Precious Metal Plating Chemicals Market Report Scope & Overview:

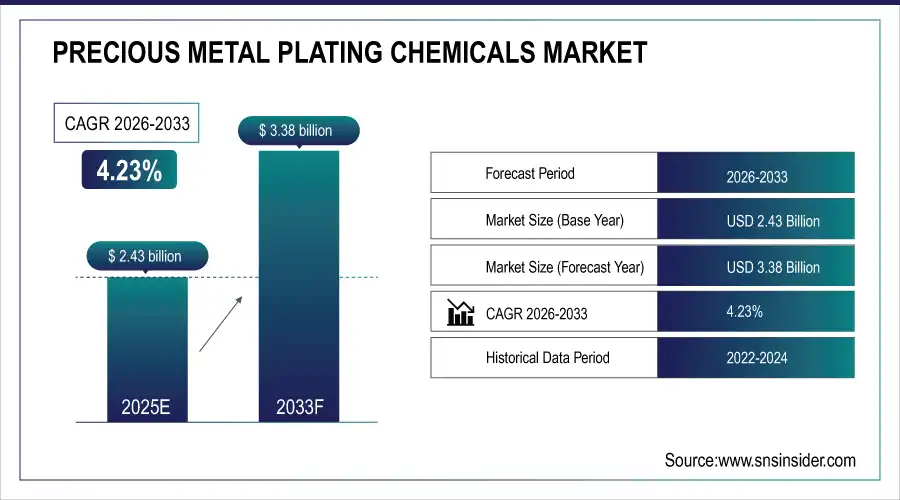

The Precious Metal Plating Chemicals Market size was valued at USD 2.43 Billion in 2025E and is projected to reach USD 3.38 Billion by 2033, growing at a CAGR of 4.23% during 2026–2033.

To Get more information On Precious Metal Plating Chemicals Market - Request Free Sample Report

The precious metal plating chemicals market is witnessing steady growth driven by increasing demand across semiconductor, automotive, medical device, aerospace, and electronics industries. Advanced plating solutions, including gold, silver, rhodium, platinum, and tin alloys, are essential for high-precision applications requiring corrosion resistance, conductivity, and durability. Technological innovations, such as hard gold, gold-tin alloy, and nickel-free finishes, are enhancing product performance, while stringent quality standards and rising adoption of electric vehicles and electronic devices further fuel market expansion. Strategic collaborations and regional expansions are also supporting market penetration and the development of specialized, high-performance plating solutions.

Tokyo-based Mitsuya Precious Metal Plating Expands to US Market – August 11, 2025, Long Beach, CA, USA – Mitsuya launches precision plating services for semiconductor, medical device, and aerospace industries in partnership with Japan USA Precision Tools.

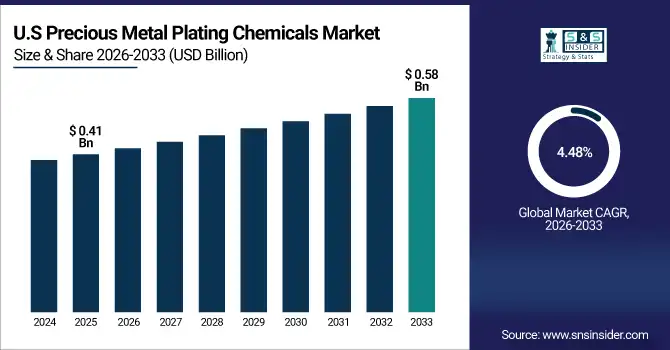

The Precious Metal Plating Chemicals Market size was valued at USD 0.41Billion in 2025E and is projected to reach USD 0.58 Billion by 2033, growing at a CAGR of 4.48% during 2026–2033, driven by increasing demand from semiconductor, automotive, aerospace, and electronics industries, alongside technological advancements and rising adoption of high-performance, corrosion-resistant, and precision plating solutions.

Precious Metal Plating Chemicals Market Size and Forecast:

-

Market Size in 2025 (USD 2.43 Billion)

-

Market Size by 2032 (USD 3.38 Billion)

-

CAGR (4.23% from 2026 to 2033)

-

Base Year (2025E)

-

Forecast Period (2026–2033)

-

Historical Data (2022–2024)

Precious Metal Plating Chemicals Market Highlights:

-

Strong demand from automotive, semiconductor, and communications industries drives growth, fueled by electric vehicles, 5G/6G, and advanced semiconductor packaging.

-

Plating solutions with high conductivity, corrosion resistance, and durability are increasingly required for harsh operating environments.

-

Focus on sustainable and cost-efficient processes, including non-cyanide and alloy-based plating, supports market expansion.

-

High raw material costs, stringent environmental regulations, and process complexity pose challenges for manufacturers.

-

Opportunities exist in advanced catalyst testing, renewable feedstock adoption, and data-driven process optimization to enhance efficiency and product quality.

-

Continuous innovation in eco-friendly plating technologies and precision alloys boosts adoption and addresses evolving industrial demands.

Precious Metal Plating Chemicals Market Drivers:

-

Rising Demand for High-Performance Electronics and Sustainable Plating Solutions

The precious metal plating chemicals market is driven by increasing demand for high-performance electronic components across automotive, semiconductor, and communications industries. Growing adoption of advanced technologies such as electric vehicles, 5G/6G networks, and sophisticated semiconductor packaging requires plating solutions with superior conductivity, corrosion resistance, and durability. The need for materials capable of withstanding harsh environments, including heat and moisture, further fuels demand. Additionally, rising focus on cost-efficient and sustainable processes, such as non-cyanide and alloy-based plating, supports market growth. Continuous innovation in plating technologies enhances performance, efficiency, and reliability, making these solutions essential for modern industrial and electronics applications.

EEJA, TANAKA’s Plating Business, Showcases Advanced Technologies at NEPCON JAPAN – January 15, 2025, Tokyo, Japan – EEJA will exhibit new high-precision and eco-friendly plating solutions for semiconductors, automotive electronics, and next-generation electronic components, highlighting innovations in precious metal alloys and non-cyanide processes to meet rising industry demands.

Precious Metal Plating Chemicals Market Restraints:

-

High Costs and Environmental Regulations Limit Precious Metal Plating Market Growth

The precious metal plating chemicals market faces challenges from high raw material costs, particularly for gold, platinum, rhodium, and other precious metals, which can increase overall production expenses. Strict environmental regulations regarding the use and disposal of hazardous chemicals, including cyanide-based and heavy metal processes, add compliance burdens for manufacturers. Additionally, the complexity of advanced plating processes and the need for skilled labor can limit adoption among smaller manufacturers. Volatility in precious metal prices and the availability of alternative surface treatment technologies also pose constraints, potentially slowing market expansion despite growing industrial demand.

Precious Metal Plating Chemicals Market Opportunities:

-

Advanced Catalyst Testing and Renewable Feedstock Adoption Fuel Market Growth

The precious metal plating and catalyst market presents significant opportunities as companies invest in advanced testing technologies and innovative R&D to optimize performance and reduce development timelines. Rising demand for high-efficiency fluid catalytic cracking (FCC) additives, coupled with the shift toward renewable and circular feedstocks, drives adoption of precision plating and catalyst solutions. Enhanced in-house benchmarking and data-driven optimization allow refiners and manufacturers to improve yields, efficiency, and product quality. Continuous innovation in plating processes, alloy compositions, and environmentally friendly techniques offers substantial growth potential for market players aiming to meet evolving industrial and sustainability requirements.

February 26, 2025,– Johnson Matthey installs state-of-the-art ACE equipment in Savannah, Georgia, boosting catalyst optimization, renewable feedstock analysis, and faster development of next-generation FCC additives.

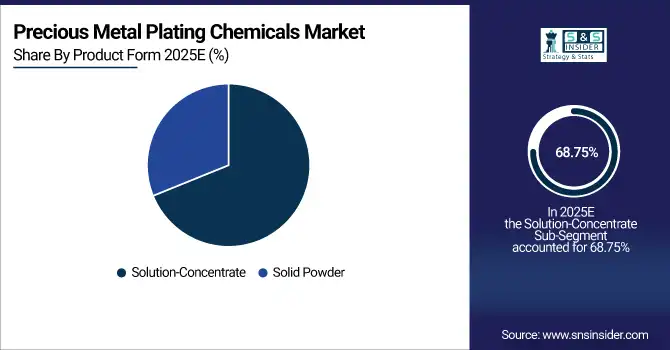

Precious Metal Plating Chemicals Market Segment Highlights:

-

By Product Form: Dominant – Solution-Concentrate: 68.75% in 2025E, growing to 73.25% in 2033; Fastest-Growing – Solution-Concentrate: 5.06% CAGR

-

By Chemical Base: Dominant – Silver: 29.75% in 2025E, declining slightly to 28.25% in 2033; Fastest-Growing – Rhodium: 6.01% CAGR, followed by Platinum: 5.60% CAGR

-

By Application: Dominant – Electrical & Electronics: 30.25% in 2025E, increasing to 31.75% in 2033; Fastest-Growing – Automotive: 5.34% CAGR, followed by Electrical & Electronics: 4.86% CAGR

-

By End-Use Industry: Dominant – Industrial: 65.38% in 2025E, increasing to 67.63% in 2033; Fastest-Growing – Industrial: 4.67% CAGR

Precious Metal Plating Chemicals Market Segment Analysis:

By Product Form, Solution-Concentrate Leads as Demand Accelerates

By Product Form, solution-concentrate dominates the market due to its versatility and efficiency in various applications, while continued industrial adoption and technological improvements drive its rapid growth, positioning it as the fastest-growing segment and a key contributor to overall market expansion.

By Chemical Base, Silver Dominates While Rhodium and Platinum See Rapid Growth

Silver remains the dominant choice due to its excellent conductivity and established industrial use, while rhodium and platinum are witnessing rapid adoption driven by increasing demand in high-performance applications and emerging technologies, positioning them as the fastest-growing segments in the market.

By Application, Electrical & Electronics Dominate as Automotive Surges

By application, the electrical and electronics sector remains the leading market for plating solutions due to its widespread use in circuits and components, while the automotive segment is experiencing rapid growth driven by increasing vehicle production and the shift toward electric and connected vehicles, making it one of the fastest-expanding application areas.

By End-Use Industry, Industrial Sector Leads and Grows Rapidly

By End-Use Industry, the industrial sector dominates the market due to its extensive use in manufacturing, machinery, and heavy equipment, while ongoing modernization, automation, and increasing production demands continue to drive its rapid growth, reinforcing its position as both the largest and fastest-expanding segment in the plating market.

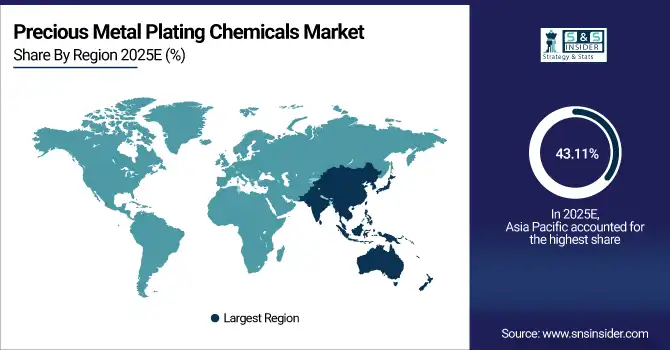

Precious Metal Plating Chemicals Market Regional Highlights:

-

By Region – Dominating: Asia-Pacific (43.11% in 2025E → 41.04% in 2033, CAGR 5.27%)

-

Fastest-Growing Region: North America (25.55% in 2025E → 27.96% in 2033, CAGR 7.12%)

-

Europe: 20.44% → 21.97% (CAGR 6.88%)

-

South America: 6.00% → 5.02% (CAGR 3.55%, declining)

-

Middle East & Africa: 4.89% → 4.02% (CAGR 3.32%, declining)

Precious Metal Plating Chemicals Market Regional Analysis:

Asia-Pacific Precious Metal Plating Chemicals Market Trends:

The Asia-Pacific Precious Metal Plating Chemicals market is dominated by strong demand from electronics, automotive, and jewelry industries. Growth is driven by advanced plating requirements in semiconductors, connectors, and decorative applications, supported by rapid industrialization, technological advancements, and increasing adoption of sustainable and high-performance plating solutions across various sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Precious Metal Plating Chemicals Market Insights:

China is the dominant country in the Precious Metal Plating Chemicals market. Its leadership is driven by a robust electronics manufacturing sector, large-scale industrial production, strong demand for semiconductors and connectors, and significant investments in automotive, jewelry, and high-tech plating applications.

North America Precious Metal Plating Chemicals Market Trends:

The North America Precious Metal Plating Chemicals market is witnessing strong expansion, emerging as one of the fastest-growing regions. Growth is fueled by increasing demand from electronics, automotive, and aerospace industries, along with advancements in plating technologies, adoption of high-performance coatings, and rising focus on sustainable and efficient metal finishing solutions.

-

U.S Precious Metal Plating Chemicals Market Insights:

The United States is the dominant country in the Precious Metal Plating Chemicals market, driven by its large electronics, automotive, and aerospace industries, high adoption of advanced plating technologies, strong R&D infrastructure, and increasing demand for high-performance and sustainable metal finishing solutions.

Europe Precious Metal Plating Chemicals Market Trends:

The Europe Precious Metal Plating Chemicals market is primarily driven by rising demand for safe and efficient brightening solutions. Growth is supported by stringent environmental regulations, increasing adoption of advanced plating technologies, and a strong presence of automotive, electronics, and decorative industries seeking high-quality, sustainable metal finishing products.

-

Germany Precious Metal Plating Chemicals Market Insights:

Germany is the leading country in the Precious Metal Plating Chemicals market, supported by its strong automotive, electronics, and industrial manufacturing sectors, advanced technological capabilities, and emphasis on high-quality, sustainable, and environmentally compliant plating solutions.

Latin America Precious Metal Plating Chemicals Market Trends:

The Latin America Precious Metal Plating Chemicals market is experiencing steady growth, driven by expanding electronics, automotive, and jewelry industries, increasing industrialization, and growing adoption of advanced and sustainable metal plating technologies across the region.

-

Brazil Precious Metal Plating Chemicals Market Insights:

Brazil is the dominant country in the Precious Metal Plating Chemicals market, supported by its large automotive, electronics, and jewelry industries, expanding industrial base, and growing demand for advanced plating solutions.

Middle East & Africa Precious Metal Plating Chemicals Market Trends:

The Middle East & Africa Precious Metal Plating Chemicals market is experiencing moderate growth, driven by rising demand from automotive, electronics, and jewelry sectors. Increasing industrialization, infrastructure development, and adoption of advanced and sustainable plating technologies are contributing to market expansion. However, growth is tempered by limited local production capabilities and reliance on imports of high-quality precious metal chemicals.

-

United Arab Emirates (UAE) Precious Metal Plating Chemicals Market Insights:

The United Arab Emirates (UAE) is the dominant country in the Precious Metal Plating Chemicals market, driven by its strong industrial base, thriving electronics and jewelry sectors, strategic trade hubs, and growing adoption of advanced and high-quality metal plating solutions.

Precious Metal Plating Chemicals Market Competitive Landscape:

Umicore, established in 1805 and headquartered in Belgium, is a global leader in materials technology and recycling. The company specializes in precious metals, catalysts, energy materials, and electroplating solutions. With strong sustainability goals, Umicore develops innovative products like cobalt- and nickel-free hard gold plating, addressing environmental and ethical challenges in metal processing.

-

In 7 February 2025 – Umicore Metal Deposition Solutions introduced AURUNA® cobalt- and nickel-free hard gold plating, combining gold and iron to deliver a sustainable, robust alternative to traditional cobalt/nickel alloys.

Atotech, established in 1993 and now part of MKS Instruments, is a global leader in surface-finishing solutions. Headquartered in Berlin, Germany, the company develops advanced plating, coating, and chemical technologies that enhance durability, corrosion resistance, and aesthetics across industries. With a strong focus on sustainability, Atotech delivers innovative, environmentally friendly solutions tailored to demanding industrial requirements worldwide.

-

05 February 2024 – Atotech, part of MKS Instruments, participated in the Indian Surface Finishing Show 2024 in Greater Noida, showcasing sustainable surface finishing solutions including Interlox® zirconium-based pretreatment and Master Remover® paint removal technologies.

Precious Metal Plating Chemicals Market Key Players:

-

Atotech Deutschland GmbH

-

Umicore Group

-

Heraeus Holding GmbH

-

Johnson Matthey Plc

-

Legor Group S.p.A.

-

Metalor Technologies International SA

-

Heimerle + Meule GmbH

-

Japan Pure Chemical Co., Ltd.

-

Shaanxi Kaida Chemical Engineering Co., Ltd.

-

American Elements

-

Matsuda Sangyo Co., Ltd.

-

Tanaka Holdings Co., Ltd.

-

Coventya Holding SAS

-

DOW Chemical Company

-

Technic, Inc.

-

Robert Chemical Co., Inc.

-

Electrochemical Products

-

Grauer & Weil (India) Limited

-

Riko Chemicals Pvt. Ltd.

-

Solar Applied Materials Technology Corporation

| Report Attributes | Details |

| Market Size in 2025 | USD 2.43 Billion |

| Market Size by 2033 | USD 3.38 Billion |

| CAGR | CAGR of 4.23% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Form (Solution-Concentrate, Solid Powder) • By Chemical Base (Silver, Palladium, Rhodium, Platinum, Gold) • By Application (Fashion Accessories & Jewelry, Electrical & Electronics, Hardware, Automotive, Aerospace, Others) • By End-Use Industry (Industrial, Commercial/Consumer) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Atotech Deutschland GmbH, Umicore Group, Heraeus Holding GmbH, Johnson Matthey Plc, Legor Group S.p.A., Metalor Technologies International SA, Heimerle + Meule GmbH, Japan Pure Chemical Co., Ltd., Shaanxi Kaida Chemical Engineering Co., Ltd., American Elements, Matsuda Sangyo Co., Ltd., Tanaka Holdings Co., Ltd., Coventya Holding SAS, DOW Chemical Company, Technic, Inc., Robert Chemical Co., Inc., Electrochemical Products, Grauer & Weil (India) Limited, Riko Chemicals Pvt. Ltd., and Solar Applied Materials Technology Corporation. |