Biodegradable Plastics Market Report Scope & Overview:

Get more information on Biodegradable Plastics Market - Request Sample Report

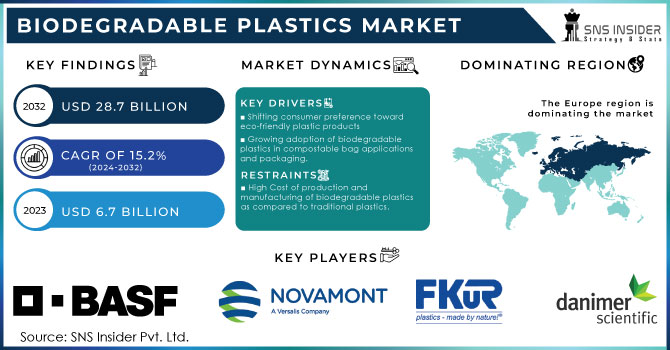

The Biodegradable Plastics Market size was valued at USD 6.7 Billion in 2023. It is expected to grow to USD 28.7 Billion by 2032 and grow at a CAGR of 15.2% over the forecast period of 2024-2032.

The biodegradable plastics market is growing significantly due to rising environmental concerns and stricter regulations on traditional plastics are driving demand for sustainable alternatives. Consumers are increasingly aware of the benefits of bioplastics, and advancements in technology are bringing down production costs. Increasing consumer demand for sustainable packaging solutions and eco-friendly alternatives to traditional plastics is a significant factor propelling market expansion. Additionally, a surge in demand for sustainable packaging solutions and the possibility of government incentives to promote bioplastic use are fueling market growth.

The EU has implemented stringent regulations under the Single-Use Plastics Directive, targeting a 50% reduction in single-use plastic by 2025 and a 90% reduction by 2030. This has significantly increased demand for biodegradable alternatives across member states, especially in the packaging and consumer goods sectors.

The packaging industry, and primarily the food service one, actively involves biodegradable plastics as a solution to the growing concern over waste management. Bags, cups, cutlery items, and food containers meant for single use are increasingly made based on bioplastics. Many quick-service restaurants and cafes prefer to use compostable or biodegradable options to meet customer expectations on the sustainability of packaging and comply with governmental policies regarding reducing carbon footprint.

Thus, in the EU members, the Single-Use Plastics Directive is expected to eliminate some plastic products from the market by 2021 and further stimulate the use of compostable substitutes. In particular, the reduction of CO₂ by around 3.4 million tons is anticipated by 2030. As a result, it is the government policy that plays a crucial role in the implementation of biodegradable solutions in food service packaging.

Government Initiatives:

|

Category |

Details |

|---|---|

|

Government Policies and Regulations |

Various governments are introducing policies to reduce single-use plastic waste and promote biodegradable alternatives. Examples include the European Union's ban on single-use plastics and India's Plastic Waste Management Rules. |

|

Tax Incentives |

Some governments offer tax benefits or subsidies for companies investing in biodegradable plastic production. For example, in China, tax incentives are provided for green manufacturing sectors, including bioplastics. |

|

Environmental Targets |

Countries are setting environmental targets for reducing plastic waste. The European Green Deal aims for the EU to become carbon neutral by 2050, with bioplastics playing a significant role in reducing plastic pollution. |

|

Legislation on Plastic Packaging |

Many countries are mandating the use of biodegradable plastics in packaging. In France, the "Anti-Waste Law" stipulates that all plastic packaging must be recyclable or biodegradable by 2025. |

|

Waste Management Regulations |

The UK has introduced the "Extended Producer Responsibility" (EPR) policy, which requires producers to cover the full cost of managing the waste they produce, encouraging the use of biodegradable plastics. |

|

Government Support for R&D |

Japan's "Green Growth Strategy" emphasizes government support for R&D in biodegradable plastics to combat plastic pollution, with a focus on advanced biopolymer technologies. |

Drivers

-

Shifting consumer preference toward eco-friendly plastic products

-

Growing adoption of biodegradable plastics in compostable bag applications and packaging.

The surge in the adoption of biodegradable plastics within compostable bag applications and packaging is pivotal for propelling the biodegradable plastics market forward. This adoption is primarily fueled by escalating environmental concerns and a burgeoning preference for sustainable alternatives to conventional plastics. With compostable bags offering an environmentally friendly solution that can decompose into natural elements, industries are increasingly embracing biodegradable plastics to meet consumer demands, thus driving market growth.

The activity of the government is a prominent factor in fostering the use of biodegradable plastics. For example, according to the California Senate Bill 54, 100% of plastic packaging in the state should be recyclable or compostable by 2032. The law also prescribed a 25% decrease in single-use plastic production in the next 10 years. As a result, the local demand for compostable products will increase in turn, it will drive the demand for compostable bag applications. Moreover, the European Union’s Circular Economy Action Plan includes making all plastic packaging in the EU reusable or recyclable by 2030, with a particular focus on compostable solutions. In this way, environmentally friendly policies of governments stimulate not only the growth of the number of compostable bag applications but also the market development, as businesses require using eco-friendly products to meet both environmental regulations requirements of customers.

Restraint

-

High Cost of production and manufacturing of biodegradable plastics as compared to traditional plastics.

The high cost of production and manufacturing is a significant barrier to the widespread adoption of biodegradable plastics when compared to traditional plastics. Biodegradable plastics often rely on complex and specialized processes, as well as raw materials derived from renewable sources like corn starch, sugarcane, and cassava, which are generally more expensive than the petrochemical-based inputs used for conventional plastics. Additionally, the production of biodegradable plastics typically requires advanced technology and dedicated facilities that can handle these materials, leading to higher operational and capital costs. These factors combine to make biodegradable plastics more costly, impacting their price competitiveness in the market.

Opportunity

-

Innovation in materials and technology

-

Regulatory support and government initiatives promoting biodegradable plastics

Market segmentation

By Type

Starch Blends dominated the type segment of the biodegradable plastic market and generated a revenue share of about 42% in 2023. This dominance is due to their excellent biodegradability, renewable sourcing, and versatility in applications ranging from packaging to consumer goods. Their eco-friendly nature and compatibility with existing manufacturing processes further propelled their adoption, making starch blends a preferred choice for industries seeking sustainable alternatives to conventional plastics. Moreover, starch blends are also highly compostable, which aligns well with rising consumer demand for sustainable products and stricter regulatory requirements on plastic waste. Furthermore, advancements in processing techniques have improved the strength and flexibility of starch-based materials, making them suitable for a broader range of applications while keeping costs relatively low.

By End-Use Industry

By End-use Industries, packaging held the largest revenue share of about 55% in 2023 owing to the escalating demand for sustainable packaging solutions. Biodegradable plastics offer an eco-friendly alternative to conventional packaging materials, aligning with increasing consumer and regulatory pressures for environmental responsibility. The versatility and compatibility of biodegradable plastics with existing packaging processes further contributed to their dominance in this sector. This trend reflects a growing industry shift towards greener packaging practices to reduce environmental impact.

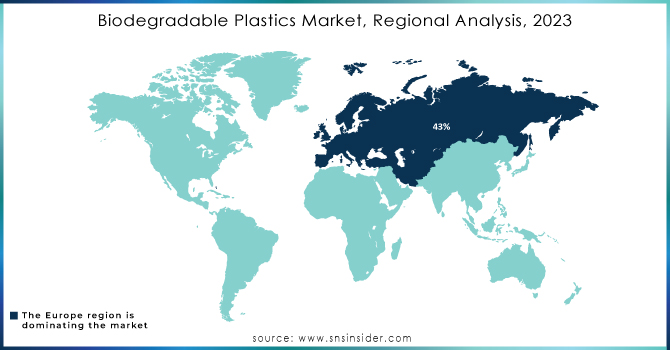

Regional Analysis

Europe dominated the Biodegradable Plastics Market with the highest revenue share of more than 43% in 2023 due to its stringent environmental regulations and proactive initiatives promoting sustainable practices. The region's commitment to reducing plastic waste and fostering a circular economy framework has driven widespread adoption of biodegradable plastics across industries. Additionally, the presence of advanced recycling infrastructure and increasing consumer preference for eco-friendly products further bolstered Europe's leadership in the biodegradable plastics market.

For instance, the European Union’s Single-Use Plastics Directive mandates that member states significantly reduce the consumption of certain single-use plastics and ensures that all plastic packaging in the EU is either reusable or recyclable by 2030.

Additionally, the European Green Deal outlines a commitment to achieving climate neutrality by 2050, which includes a comprehensive strategy to minimize plastic pollution. This has led to substantial investment in biodegradable plastics as an alternative to conventional plastics, especially in countries like Germany, France, and Italy, which have implemented national bans on single-use plastics.

Asia Pacific is expected to grow at the highest CAGR in the biodegradable plastics market during the forecast period driven by expanding industrialization, burgeoning population, and increasing awareness about environmental sustainability. Furthermore, supportive government regulations and initiatives aimed at reducing plastic waste contribute to the region's accelerated adoption of biodegradable plastics, driving its robust growth in the forecast period.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Raw Key Manufacturers

-

FKuR Kunststoff GmbH (BIO-FLEX)

-

BASF SE (ecoflex)

-

Danimer Scientific (Nodax PHA)

-

Novamont S.p.A. (Mater-Bi)

-

Biome Bioplastics (BiomeHT)

-

Toray Industries, Inc. (Ecodear)

-

NatureWorks LLC (Ingeo PLA)

-

Plantic Technologies (PLANTIC)

-

Mitsubishi Chemical Holdings Corporation (BioPBS)

-

Total Corbion PLA (Luminy PLA)

-

Kingfa Sci & Tech Co., Ltd. (Ecoworld)

-

Corbion N.V. (PURAC)

-

Kaneka Corporation (PHBH)

-

Cardia Bioplastics (Cardia Biohybrid)

-

Agrana Beteiligungs-AG (Agenacomp)

-

Clondalkin Group (FlexTop)

-

Tianan Biologic Materials Co., Ltd. (PHA-based BioMater-Bi)

-

Avantium N.V. (YXY)

-

Evonik Industries AG (VESTAMID Terra)

-

FKUR Plastics Corp. (Terramac)

Key Users in End -Use Industry

-

McDonald’s

-

Starbucks

-

Amcor

-

Tetra Pak

-

Walmart

-

Tesco

-

Procter & Gamble

-

Unilever

-

John Deere

-

Syngenta

-

Pfizer

-

Johnson & Johnson

-

Patagonia

-

Adidas

Recent Development:

-

In February 2024, the Mitsubishi Chemical Group (MCG Group) announced the development of new biodegradable biopolyester resins with a high biomass content and exceptional flexibility. The newly created SA916N and SA916F resins are biodegradable, meaning they can be broken down by microorganisms found in nature.

-

In September 2023, Chevron Phillips Chemical expanded its partnership with Georgia-based bioplastics company Danimer Scientific to further explore the development and commercialization of high-volume biodegradable plastic products. This collaboration will utilize Danimer's Rinnovo polymers through CPChem's loop slurry reactor process at its Bartlesville, Oklahoma facility.

-

In August 2022, Toray Industries, Inc. made a groundbreaking announcement regarding the development of the world's first 100% bio-based adipic acid. This acid serves as a raw material for nylon 66 (polyamide 66) and is derived from sugars found in inedible biomass.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.7 Billion |

| Market Size by 2032 | US$ 28.7 Billion |

| CAGR | CAGR of 15.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PLA, PHA, Starch Blends, Biodegradable Polyesters, and Others) • By End-use Industries (Packaging, Textile, Agriculture, Consumer Goods, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fkur Kunstsoff, BASF, Danimer Scientific, Novamont, Biome Bioplastics, Toray Industries, NatureWorks, Plantic Technologies, Mitsubishi Chemical Holding Corporation, Total Corbion |

| Drivers | • Shifting consumer preference toward eco-friendly plastic products • Growing adoption of biodegradable plastics in compostable bag applications and packaging |

| Restraints | • High Cost of production and manufacturing of biodegradable plastics as compared to traditional plastics |