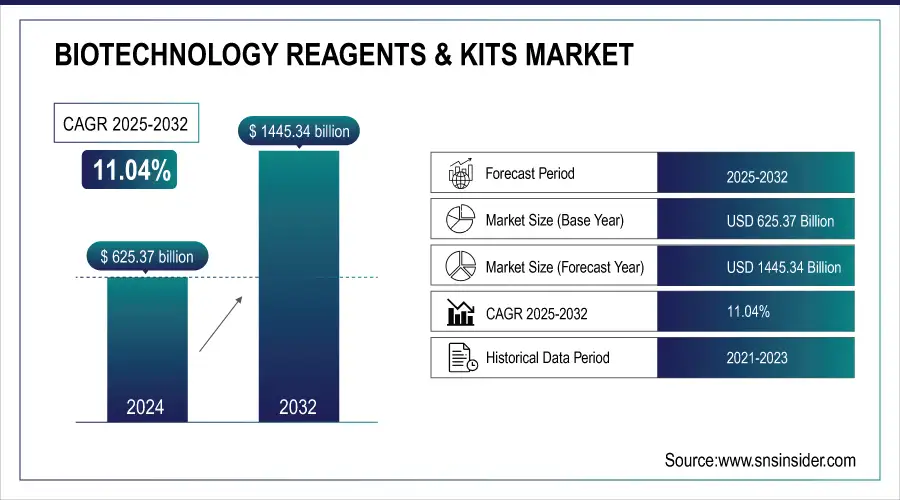

Biotechnology Reagents & Kits Market Size:

The Biotechnology Reagents & Kits Market was valued at USD 625.37 billion in 2024 and is expected to reach USD 1445.34 billion by 2032, growing at a CAGR of 11.04% from 2025-2032.

The biotechnology reagents and kits market is expanding rapidly, driven by advances in molecular biology, personalized medicine, and laboratory automation. Cutting-edge technologies, including AI integration, next-generation sequencing (NGS), and CRISPR-Cas9 gene editing, are enhancing research efficiency, improving diagnostic accuracy, and lowering development costs. The biopharmaceutical sector further fuels demand, as innovations in monoclonal antibodies and immunotherapies rely heavily on high-quality reagents. Automated high-throughput systems enable large-scale, precise testing, reducing errors and accelerating workflows. Together, these factors are creating a dynamic market landscape characterized by continuous technological innovation, growing adoption in clinical and research applications, and strong long-term growth potential.

To Get More Information on Biotechnology Reagents & Kits Market - Request Sample Report

Biotechnology Reagents & Kits Market Size and Forecast:

-

Market Size in 2024: USD 625.37 Billion

-

Market Size by 2032: USD 1,445.34 Billion

-

CAGR: 11.04% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2022

Biotechnology Reagents & Kits Market Trends

-

Rising demand for molecular biology, genomics, and proteomics research is driving reagent and kit adoption.

-

Advancements in high-throughput screening and automated workflows are boosting laboratory efficiency.

-

Increasing R&D investments in pharmaceuticals, diagnostics, and personalized medicine are fueling market growth.

-

Growth of academic and contract research organizations is expanding product usage.

-

Introduction of specialized kits for CRISPR, PCR, and next-generation sequencing is enhancing research capabilities.

-

E-commerce and distribution partnerships are improving product accessibility globally.

-

Collaborations between biotech companies and research institutions are accelerating innovation and application development.

Biotechnology Reagents & Kits Market Growth Drivers:

-

Rising Demand for Personalized Medicine and Biotechnology Research Driving Growth in Reagents and Kits Market

As biotechnology continues to advance, there is a rising need for more precise and tailored treatments. This trend has been supported by advancements in genomics, where targeted therapies based on individual genetic profiles are becoming more common. The global focus on personalized treatments for diseases like cancer, diabetes, and genetic disorders is directly increasing the demand for reagents and kits used in diagnostic testing and therapeutic development. For example, the growing adoption of liquid biopsy, a method used for detecting cancer-related mutations, has led to increased demand for reagents that can accurately detect specific biomarkers in patient samples. According to the World Health Organization (WHO), cancer is the second leading cause of death globally, with approximately 19.3 million new cancer cases and nearly 10 million cancer-related deaths recorded in 2020. This rising incidence of cancer is contributing to the increased demand for diagnostic reagents, particularly those used in precision oncology. The adoption of liquid biopsy, which is gaining traction for its non-invasive approach to detecting cancer biomarkers, is expected to play a significant role in the demand for biotechnology reagents and kits in the oncology space.

Additionally, the growing number of research activities in molecular biology, genomics, and proteomics has resulted in a higher demand for high-quality reagents and kits. Research in areas like gene editing, next-generation sequencing (NGS), and proteomics requires specialized reagents to ensure the accuracy and reproducibility of experiments. The rise in scientific studies using technologies like CRISPR-Cas9 and NGS has created a consistent need for reagents that support these advanced molecular techniques. The increasing use of genomic and proteomic technologies across research institutions and laboratories is driving the demand for innovative reagents.

Biotechnology Reagents & Kits Market Restraints:

-

Regulatory Complexities and Extended Approval Timelines Impeding Market Expansion

The biotechnology reagents and kits market faces significant restraints due to stringent regulatory frameworks and prolonged approval processes, especially in oncology and genetic testing segments. Diagnostic reagents and kits must comply with rigorous safety, efficacy, and quality standards set by regulatory authorities, which often involve extensive clinical trials and documentation. These time-consuming procedures can delay product launches, restrict timely market access, and increase development costs for manufacturers. Consequently, companies may experience slower revenue generation and hindered innovation cycles. Such regulatory complexities remain a critical barrier, limiting the speed at which new and advanced diagnostic solutions reach the global market.

Biotechnology Reagents & Kits Market Segment Analysis

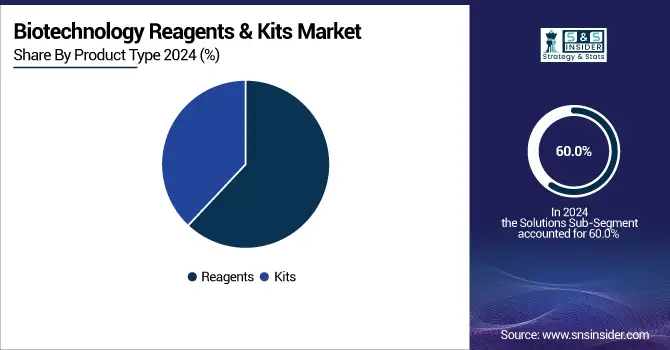

By Product Type Reagents dominated while Kits are expected to grow fastest

In 2024, Reagents held the largest share of the biotechnology reagents and kits market, dominating with an estimated market share of approximately 60.0%. The widespread adoption of reagents in a variety of applications such as molecular biology, genomics, and diagnostics is a key factor driving their dominance. Reagents are essential for a broad range of biotechnology experiments and are used across various research fields, including proteomics, genomics, and cell biology. Their application in diagnostic tests, particularly in oncology and genetic disorder diagnostics, has further fueled demand.

While reagents dominate the market, kits are the fastest-growing product segment. The demand for biotechnology kits is expected to grow at a CAGR of 10% over the next several years. This growth is largely attributed to the increasing demand for complete and standardized solutions for research and clinical diagnostics. Kits offer convenience, ease of use, and reliability, making them especially popular in diagnostic laboratories and research institutions. Their ability to provide comprehensive solutions for complex diagnostic tests, including molecular diagnostics and personalized medicine, is driving this accelerated growth.

By Technology PCR led while Flow Cytometry is projected to grow fastest

Polymerase Chain Reaction (PCR) dominated the biotechnology reagents and kits market in 2024, holding a market share of approximately 35.0%. PCR is widely regarded as one of the most important technologies in molecular biology and diagnostics, enabling the amplification of small amounts of DNA. The continued demand for PCR-based diagnostic tests, especially in areas such as infectious disease detection (e.g., COVID-19), genetic testing, and cancer diagnostics, has contributed significantly to the dominance of this technology. PCR’s ability to provide quick and highly accurate results in clinical and research settings ensures its sustained market leadership.

Flow Cytometry technology is the fastest-growing segment in the biotechnology reagents and kits market, with a projected CAGR of around 14% over the next few years. Flow cytometry is increasingly used in immunology, cell biology, and oncology research, enabling rapid and precise analysis of cell properties such as size, shape, and protein expression. The growing applications of flow cytometry in areas like cancer immunotherapy, stem cell research, and drug development are driving its rapid adoption. Moreover, advancements in multi-parameter flow cytometry are contributing to its accelerated growth, allowing for more detailed and reliable analysis of complex biological samples.

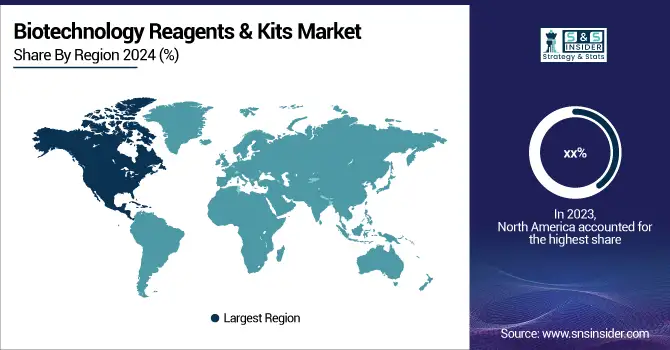

Biotechnology Reagents & Kits Market Regional Analysis

North America Market Insights

North America dominated the biotechnology reagents and kits market in 2024, primarily due to the presence of major players like Thermo Fisher Scientific, Merck, and Illumina. The region benefits from advanced healthcare infrastructure, substantial government investment in research, and a growing demand for diagnostic and therapeutic solutions, especially in oncology and genomics. In 2022, the United States allocated approximately USD 47 billion toward health research, with a significant portion directed at cancer and genomics. The market is further bolstered by the widespread adoption of personalized medicine, with over 10,000 active clinical trials focused on precision medicine across the U.S.

Do You Need any Customization Research on Biotechnology Reagents & Kits Market - Enquire Now

Europe Market Insights

Europe followed closely as a key market, driven by strong collaborations between research institutions and biotechnology companies. Nations like Germany, the UK, and France are making significant strides in genomics, proteomics, and molecular diagnostics. For instance, the UK government committed USD 250 million to advance genomics research through the Genomics England initiative. Europe also enjoys favorable regulatory support for biotechnology and substantial research funding from both government and private sectors. The European Commission’s Horizon 2020 program, with a budget of USD 80 billion, continues to accelerate advancements in biotechnology research.

Asia Pacific Market Insights

Asia-Pacific is the fastest-growing region, fueled by the increasing number of research initiatives, rising healthcare demands, and an expanding biotechnology sector in countries such as China, Japan, and India. In China, the biotechnology reagents market is expected to grow at a CAGR of 10% from 2024 to 2032, driven by the government's "Made in China 2025" initiative, which aims to enhance biotechnology research and innovation. The region’s growth is also supported by expanding healthcare infrastructure, government-backed research programs, and the rising adoption of cutting-edge biotechnology techniques like CRISPR and next-generation sequencing (NGS).

Middle East & Africa and Latin America Market Insights

The biotechnology reagents and kits market in the Middle East & Africa and Latin America is gradually expanding, driven by growing investments in healthcare infrastructure, rising adoption of molecular diagnostics, and increasing awareness of personalized medicine. Governments are supporting biotechnology initiatives, while academic and research institutions contribute to demand for reagents and kits. However, market growth is moderated by limited funding, regulatory hurdles, and slower technology adoption compared to North America and Europe, presenting both challenges and opportunities for targeted market expansion in these regions.

Biotechnology Reagents & Kits Market Competitive Landscape:

Thermo Fisher Scientific

Thermo Fisher Scientific is a leading player in the biotechnology reagents and kits market, offering a broad portfolio including PCR reagents, DNA/RNA extraction kits, antibodies, protein assays, qPCR reagents, and next-generation sequencing (NGS) kits. The company focuses on enabling high-quality research and clinical diagnostics through innovative solutions that enhance efficiency, accuracy, and reproducibility. Its reagents and kits are widely adopted in molecular biology, genomics, proteomics, and personalized medicine, supporting both academic and industrial research.

-

In 2025, Thermo Fisher’s Orbitrap Astral mass spectrometer now supports EasyPep™ Sample Prep Kits and Tandem Mass Tag reagents, enhancing high-sensitivity proteomic workflows for faster, more reliable protein discovery.

QIAGEN

QIAGEN is a leading provider in the biotechnology reagents and kits market, offering DNA/RNA extraction kits, PCR reagents, NGS kits, and gene expression profiling solutions. Its products support molecular diagnostics, genomics, and personalized medicine with reliable, high-throughput workflows. Focusing on innovation, automation, and sustainability, QIAGEN enhances sample preparation, reproducibility, and multi-omic analyses, serving both academic and industrial research and reinforcing its position as a trusted partner in biotechnology and clinical applications globally.

-

In 2024, QIAGEN Introduced the QIAseq Multimodal DNA/RNA Library Kit, enabling simultaneous preparation of DNA and RNA libraries from a single sample, boosting multi-omic sequencing efficiency (GlobeNewswire).

-

In 2024, QIAGEN Launched automated QIAsymphony DSP Circulating DNA Kits for high-volume cfDNA isolation from blood or urine, supporting non-invasive liquid biopsy workflows in oncology and prenatal care (GlobeNewswire).

-

In 2024, QIAGEN Debuted eco-friendly QIAwave DNA/RNA extraction kits, earning ACT Environmental Impact Label and My Green Lab Platinum certification for up to 27% lower environmental footprint.

Merck KGaA

Merck KGaA is a leading provider in the biotechnology reagents and kits market, offering PCR reagents, enzymes, cell culture reagents, antibodies, proteomics reagents, and DNA/RNA extraction kits. Its products support molecular biology, genomics, proteomics, and personalized medicine research, enabling high-throughput, accurate, and reproducible workflows. With a focus on innovation, automation, and integrated solutions, Merck KGaA accelerates drug discovery, biomarker identification, and diagnostics, solidifying its position as a trusted global biotechnology partner.

-

In 2024, Acquired HUB Organoids, expanding its offerings in cell culture tools with advanced 3D organoid models to accelerate drug discovery in academia and pharma.

Key Players in the Biotechnology Reagents & Kits Market

Some of the Biotechnology Reagents & Kits Market Companies

-

Thermo Fisher Scientific (PCR reagents and kits, DNA/RNA extraction kits, Antibodies and protein assays, Next-generation sequencing (NGS) kits, qPCR reagents)

-

Merck KGaA (PCR reagents and enzymes, Cell culture reagents, Antibodies and reagents for proteomics, Genomic DNA and RNA extraction kits)

-

Danaher Corporation (Beckman Coulter) (Flow cytometry reagents, Immunoassay kits, PCR reagents, Hematology and clinical chemistry reagents)

-

Agilent Technologies (PCR reagents, NGS libraries and reagents, Gene expression analysis kits, Proteomics reagents)

-

Roche Diagnostics (PCR and qPCR reagents, NGS reagents, Diagnostic reagents for cancer and infectious diseases, Antibodies for diagnostic use)

-

Abbott Laboratories (Molecular diagnostic reagents, Immunoassays for diagnostics, HIV, Hepatitis, and Covid-19 diagnostic kits, Blood testing reagents)

-

Illumina (NGS reagents and kits, DNA/RNA extraction kits, Genomic sequencing kits, Gene expression analysis reagents)

-

PerkinElmer (PCR reagents, Protein assays and reagents, Genetic testing kits, Cell biology reagents)

-

GE Healthcare (Protein and antibody reagents, PCR and NGS reagents, Cell culture media and reagents, Diagnostic kits)

-

Promega Corporation (PCR reagents and kits, Genomic DNA extraction kits, Cell-based assay reagents, Protein analysis kits)

-

QIAGEN (DNA/RNA extraction kits, PCR reagents, NGS reagents, Gene expression profiling kits)

-

New England Biolabs (PCR and qPCR reagents, DNA modification reagents, Restriction enzymes, Cloning reagents)

-

Bio-Rad Laboratories (PCR reagents, Protein expression and purification kits, Gene expression analysis kits, Antibody reagents)

-

F. Hoffmann-La Roche Ltd. (PCR reagents and kits, Diagnostic kits for oncology and infectious diseases, Antibodies and assays for diagnostic use)

-

Takara Bio, Inc. (PCR reagents, Next-generation sequencing kits, Gene editing tools (e.g., CRISPR-Cas9 reagents), DNA/RNA extraction kits)

-

LGC Ltd. (Genomic analysis reagents, DNA/RNA extraction kits, PCR reagents, Protein assays)

-

Toyobo Co. Ltd. (PCR reagents, DNA/RNA extraction kits, Next-generation sequencing kits, Protein expression reagents)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 625.37 Billion |

| Market Size by 2032 | US$ 1445.34 Billion |

| CAGR | CAGR of 11.04% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Reagents, Kits) • By Technology (Polymerase Chain Reaction (PCR), Cell Culture, In-vitro Diagnostics (IVD), Chromatography, Electrophoresis, Flow Cytometry) • By Application (Genomics, Proteomics, Cell Biology, Molecular Biology, Diagnostics, Drug Discovery, Forensics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Merck KGaA, Danaher Corporation (Beckman Coulter), Agilent Technologies, Roche Diagnostics, Abbott Laboratories, Illumina, PerkinElmer, GE Healthcare, Promega Corporation, QIAGEN, New England Biolabs, Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd., Takara Bio, Inc., LGC Ltd., Toyobo Co. Ltd., Becton, Dickinson and Company (BD), Lonza Group AG, Promega Corporation |