Prescriptive & Predictive Analytics Market Report Scope & Overview:

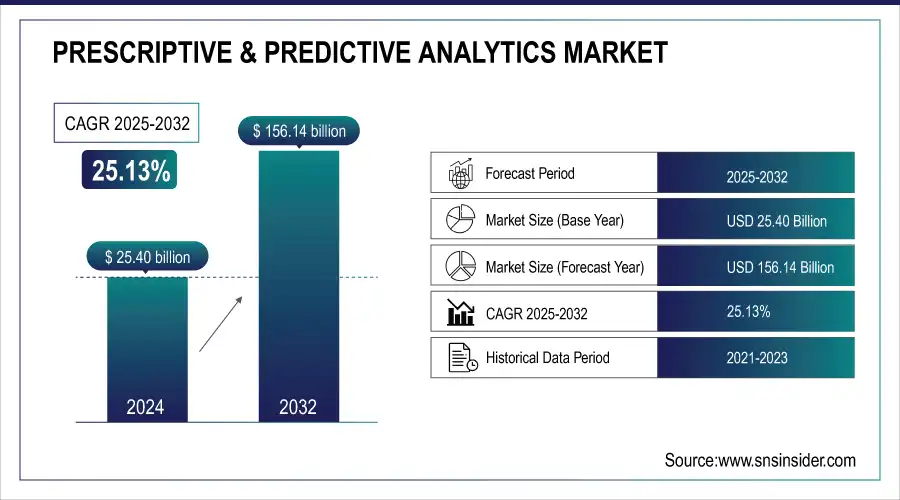

The Prescriptive & Predictive Analytics Market was valued at USD 25.40 billion in 2024 and is expected to reach USD 156.14 billion by 2032, growing at a CAGR of 25.13% over the forecast period 2025-2032.

The prescriptive and predictive analytics market is experiencing significant growth, driven by the increasing demand for data-driven decision-making across various industries. As businesses strive to gain a competitive edge, improve operational efficiency, and enhance customer experiences, the adoption of predictive analytics and prescriptive analytics has surged. In 2024, 25% of organizations base nearly all strategic decisions on data, with 90% of enterprise businesses acknowledging the growing importance of data in their operations. This transformation is especially evident in leading organizations, where 73.5% of managers and executives consistently use data to guide decision-making processes. This shift toward data-driven strategies is yielding substantial benefits, including an 8% average increase in revenue and a 10% reduction in costs, driving a rise in demand for advanced analytics tools. The prescriptive analytics market, which focuses on providing actionable recommendations, and the predictive analytics market, which leverages historical data to forecast future trends, play crucial roles in helping companies optimize operations and make informed decisions. This, in turn, is fueling the rapid growth of the market for these cutting-edge technologies.

Get more information on Prescriptive & Predictive Analytics Market - Request Sample Report

Industries such as manufacturing, logistics, retail, and healthcare are among the largest adopters of prescriptive and predictive analytics. In manufacturing, predictive maintenance powered by analytics is preventing costly equipment failures by predicting when machines are likely to break down, enabling timely repairs and reducing downtime. In logistics, predictive analytics is optimizing delivery routes, enhancing efficiency, and lowering fuel consumption. In healthcare, predictive and prescriptive analytics are revolutionizing patient care by enabling early disease detection, personalized treatment plans, and improved resource allocation.

Key Prescriptive & Predictive Analytics Trends:

-

Rising reliance on cloud computing for scalable, flexible, and cost-efficient analytics deployment.

-

Increasing use of predictive analytics for equipment maintenance, demand forecasting, and risk identification.

-

Growth of prescriptive analytics to optimize supply chains, inventory, pricing, and staffing decisions.

-

Expanding automation driven by anticipatory and advisory analytics to minimize human error.

-

Widespread adoption of cloud-based predictive and prescriptive analytics across industries like manufacturing, logistics, and retail.

Prescriptive & Predictive Analytics Growth Drivers:

-

The growth of big data and the increasing adoption of cloud computing have significantly contributed to the expansion of the prescriptive and predictive analytics market.

With the help of advanced analytics techniques, organizations can mine this vast amount of data for valuable insights. Around 2.5 quintillion bytes worth of data are generated each day. Cloud computing enables businesses to store and process this data efficiently without the need for significant capital investment in on-premise infrastructure. The cloud offers scalability, flexibility, and cost efficiency, which are critical factors for businesses of all sizes looking to implement prescriptive and predictive analytics solutions. The ability to access powerful analytics tools on demand and scale resources as needed allows organizations to harness the full potential of big data. As more companies transition to cloud-based environments, the demand for predictive and prescriptive analytics tools grows, driving market expansion.

-

The predictive and prescriptive analytics market is essential in automating decision-making processes and optimizing business operations.

Forecasting models can recognize possible problems or weaknesses, while prescriptive analysis can provide answers to tackle these obstacles, resulting in enhanced resource distribution, reduced expenses, and increased overall productivity. In sectors like manufacturing, predictive analytics can foretell breakdowns of equipment, enabling timely maintenance, decreasing downtime, and boosting productivity. Prescriptive analytics goes beyond by suggesting the most effective ways for handling production schedules, supply chains, and inventory. Automation is more and more viewed as a method to decrease human mistakes and guarantee that companies function at peak efficiency. Anticipatory and advisory analytics allow for automation by offering immediate advice and suggestions that influence operational choices without requiring human involvement. In areas such as logistics and retail, predictive analytics can predict demand and suggest optimal stock levels, while prescriptive analytics can propose pricing strategies, promotion schedules, and staffing needs.

Prescriptive & Predictive Analytics Restraints:

-

The increasing concern about data privacy and security is a significant obstacle to the expansion of the prescriptive and predictive analytics market.

Due to the use of extensive datasets containing personal, financial, and sensitive business information, analytics solutions face a growing threat of data breaches, cyberattacks, and unauthorized data usage. Organizations are required to adhere to strict data privacy regulations, like the EU's General Data Protection Regulation (GDPR) and the United States' California Consumer Privacy Act (CCPA), which set forth rigorous rules for collecting, storing, and using data. These rules hinder businesses from fully utilizing predictive and prescriptive analytics. In sectors such as healthcare and finance, where the risks are especially significant, safeguarding data privacy and security is crucial. A violation or improper use of personal or financial information may result in severe legal penalties, monetary damages, and harm to one's reputation. Therefore, businesses frequently hesitate to implement advanced analytics solutions unless strong data security measures are implemented.

Prescriptive & Predictive Analytics Regional Analysis:

By Type

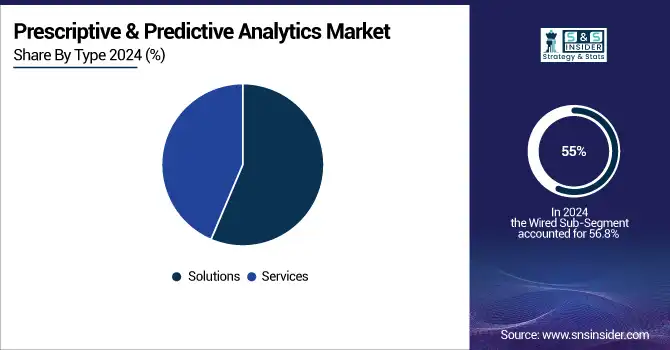

The Solutions segment dominated with a 55% market share in 2024 in the prescriptive and predictive analytics market, propelled by the increasing use of sophisticated analytics tools in various sectors. These solutions use data analysis to anticipate upcoming patterns (predictive) and suggest actions for decision-making (prescriptive). The increasing need for these solutions is driven by their capacity to boost business results, enhance operational efficiency, and mitigate risks. One instance is when IBM Watson Analytics gives companies predictive insights and prescriptive solutions to assist in making real-time strategic decisions.

The Services segment is projected to be the fastest-growing during 2025-2032 in the predictive and prescriptive analytics market. These services consist of consulting, integration, training, and maintenance, guaranteeing efficient utilization of analytics tools. This sector, although increasing, doesn't keep up with the quick growth seen in the solutions sector. An illustration is when Deloitte Analytics provides consulting services to assist organizations in incorporating prescriptive and predictive analytics into their operations.

By Deployment

The cloud segment dominated the prescriptive & predictive analytics market in 2024, accounting for over 60% of the market share. Cloud-based solutions offer unparalleled scalability, cost efficiency, and accessibility, enabling organizations to harness analytics without investing heavily in infrastructure. These solutions cater to industries like retail, healthcare, and finance, where data volumes are large, and real-time analytics are critical. For instance, Salesforce Einstein Analytics provides predictive insights for customer relationship management (CRM), while Amazon Web Services (AWS) enables machine learning-driven forecasting for supply chain optimization.

The on-premises segment is expected to experience a rapid growth rate during 2025-2032 due to its appeal in industries requiring stringent data security and compliance, such as government, defense, and banking. On-premises solutions provide total control over data and infrastructure, making them ideal for organizations with sensitive information or regulatory constraints. Examples include SAP Predictive Analytics, widely used in enterprise resource planning (ERP), and IBM SPSS Modeler, which aids in fraud detection in financial services. These deployments allow companies to customize analytics to their specific workflows while maintaining robust data protection measures.

Prescriptive & Predictive Analytics Regional Analysis:

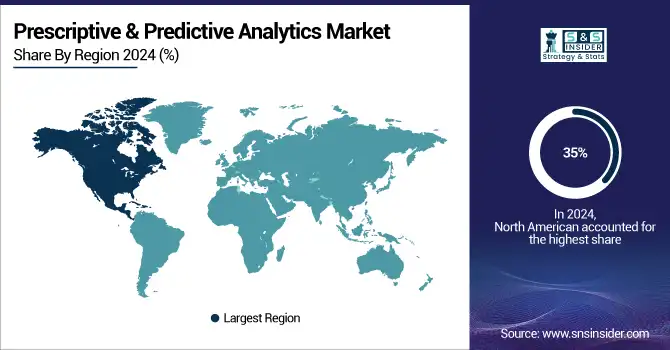

North America Prescriptive & Predictive Analytics Insights

In 2024, North America held a 35% market share, primarily due to its strong technology infrastructure, widespread use of advanced analytics, and the presence of major companies such as IBM, Microsoft, and SAS Institute. North America possesses a well-established data analytics market fueled by the demand for data-centric decision-making in industries like healthcare, finance, and retail. IBM utilizes predictive analytics tools in finance for risk management, while Microsoft offers cloud-based analytics solutions through Azure to help various industries optimize operational efficiency. The region's market sees great investments in AI, machine learning, and cloud tech, which enhance organizations' performance through trend prediction and actionable insights.

Need any custom research/data on Prescriptive & Predictive Analytics Market - Enquiry Now

Asia Pacific Prescriptive & Predictive Analytics Insights

Asia-Pacific is anticipated to become the fastest-growing region during 2025-2032, driven by heightened digital transformation initiatives in nations such as India, China, and Japan. The rise in predictive analytics applications is being fueled by the growth of cloud computing, e-commerce, and IT infrastructure in manufacturing, supply chain management, and marketing. Indian companies like Tata Consultancy Services (TCS) and Infosys are incorporating prescriptive and predictive analytics in their offerings to improve operational efficiency and elevate customer satisfaction. Furthermore, Alibaba Cloud and Huawei play a vital role in offering sophisticated analytics platforms that aid businesses in forecasting market trends and customer behavior.

Europe Prescriptive & Predictive Analytics Insights

Europe is witnessing strong growth in prescriptive and predictive analytics, fueled by digital transformation, stringent regulatory compliance, and advanced adoption across industries such as manufacturing, healthcare, and finance. With rising investments in AI, automation, and cloud platforms, European enterprises are leveraging analytics to optimize operations, enhance decision-making, and maintain competitiveness in increasingly data-driven markets.

Latin America (LATAM) and Middle East & Africa (MEA) Prescriptive & Predictive Analytics Insights

LATAM and MEA regions are steadily adopting prescriptive and predictive analytics, driven by digitalization, e-commerce expansion, and the need for improved efficiency across logistics, energy, and banking sectors. Growing cloud adoption, government-led smart initiatives, and rising awareness of big data benefits are fostering demand. Brazil, Mexico, UAE, and South Africa emerge as key markets fueling regional growth.

Prescriptive & Predictive Analytics Key Players:

Some of the Prescriptive & Predictive Analytics Companies are

-

IBM (IBM SPSS Modeler, Watson Studio)

-

Microsoft (Azure Machine Learning, Power BI)

-

SAP (SAP Analytics Cloud, SAP Predictive Analytics)

-

SAS (SAS Visual Analytics, SAS Forecasting)

-

Google Cloud (Vertex AI, BigQuery ML)

-

Amazon Web Services (AWS) (Amazon SageMaker, AWS Forecast)

-

Oracle (Oracle Analytics Cloud, Oracle DataScience)

-

TIBCO Cloud (TIBCO Spotfire, TIBCO Data Science)

-

DataRobot (DataRobot AutoML, Paxata Data Prep)

-

Alteryx (Alteryx Designer, Alteryx Analytics Hub)

-

FICO (FICO Decision Optimizer, FICO Analytic Cloud)

-

Teradata (Teradata Vantage, Teradata QueryGrid)

-

Qlik (Qlik Sense, Qlik Insight Bot)

-

RapidMiner (RapidMiner Studio, RapidMiner AI Hub)

-

H2O.ai (H2O Driverless AI, H2O Hydrogen Torch)

-

Tableau (Tableau Desktop, Tableau Prep)

-

KNIME (KNIME Analytics Platform, KNIME Server)

-

Infor (Infor Coleman AI, Infor Birst)

-

Altair (Altair Knowledge Studio, Altair SmartWorks)

-

Anaconda (Anaconda Distribution, Anaconda Enterprise)

Providers of Cloud/Platforms to Manufacturers:

-

Cloudera (Cloudera Data Platform, Cloudera Machine Learning)

-

Snowflake (Snowflake Data Cloud, Snowflake Marketplace)

-

Databricks (Databricks Lakehouse Platform, Databricks Delta)

-

Domino Data Lab (Domino Enterprise MLOps Platform, Domino Data Science Platform)

-

Trifacta (Trifacta Wrangler, Trifacta Enterprise Data Engineering Cloud)

-

Splunk (Splunk Enterprise, Splunk Machine Learning Toolkit)

-

Domo (Domo Business Cloud, Domo Data Apps)

-

MathWorks (MATLAB, Simulink)

-

MicroStrategy (MicroStrategy Analytics Platform, MicroStrategy HyperIntelligence)

-

Sisense (Sisense Fusion, Sisense Analytics Cloud)

Competitive Landscape for Prescriptive & Predictive Analytics:

IBM is a global leader in the prescriptive and predictive analytics market, offering advanced solutions like IBM SPSS Modeler and Watson Studio. The company empowers organizations with AI-driven insights, forecasting models, and decision optimization tools. Its strong cloud infrastructure and industry expertise enable businesses to improve efficiency, reduce risks, and drive innovation.

-

October 2024: IBM integrated artificial intelligence into Cognos Analytics to simplify tasks, improve data exploration, and help users uncover more profound insights with less difficulty.

SAP SE is a prominent player in the prescriptive and predictive analytics market, delivering solutions such as SAP Analytics Cloud and SAP Predictive Analytics. The company supports enterprises with real-time insights, advanced forecasting, and data-driven decision-making. Leveraging AI and cloud technologies, SAP enables businesses to optimize operations, enhance productivity, and achieve sustainable growth.

-

January 2024: SAP SE unveiled new AI-powered features to assist retailers in enhancing business operations and boosting profits and customer loyalty.

| Report Attributes | Details |

| Market Size in 2024 | USD 25.40 Billion |

| Market Size by 2032 | USD 156.14 Billion |

| CAGR | CAGR of 25.13% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Services, Solutions) • By Deployment (On-premises, Cloud) • By Application (Human resource, Sales & Marketing, Finance, Operations, Others) • By End User (Retail, Telecommunication, Mining & Energy, Manufacturing & Logistics, Healthcare, Automotive, Government & Defense, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM, Microsoft, SAP, SAS, Google Cloud, Amazon Web Services (AWS), Oracle, TIBCO Cloud, DataRobot, Alteryx, FICO, Teradata, Qlik, RapidMiner, H2O.ai, Tableau, KNIME, Infor, Altair, Anaconda. |