Presentation Software Market Report Scope & Overview:

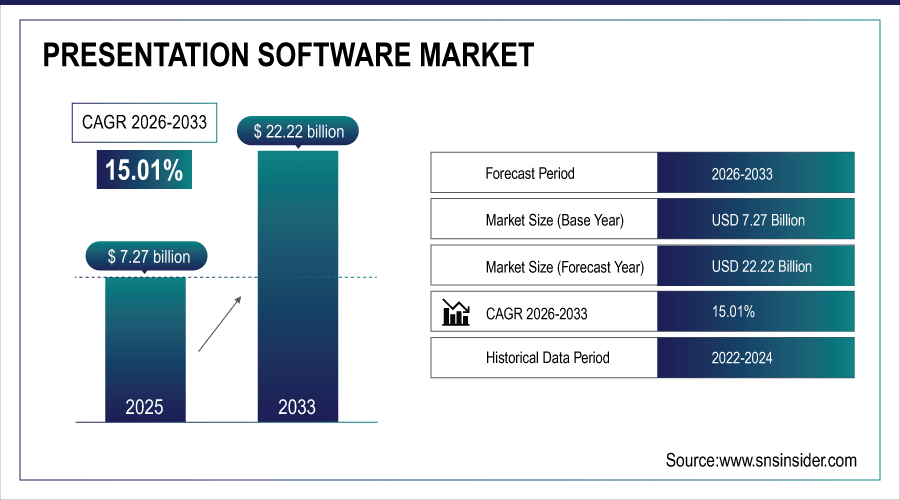

The Presentation Software Market Size was valued at USD 7.27 Billion in 2025E and is expected to reach USD 22.22 Billion by 2033 and grow at a CAGR of 15.01% over the forecast period 2026-2033.

The Presentation Software Market growth is fueled by rising digitalization of tools for various industries. The demand for cloud-based and web-enabled solutions for seamless collaboration continues to drive growth, particularly with more companies becoming remote and/or hybrid. This has led businesses, educational institutions, and media organizations to utilize presentation software to develop high-quality aesthetically pleasing, interactive, and data-oriented presentations to facilitate communication, engagement, and decision-making. AI-powered tools like automated slide design, design suggestions and analytics accelerate adoption by saving time and effort and improving presentation quality. According to study, over 30% of users leverage AI-powered features like automated slide generation and design suggestions to improve efficiency and presentation quality.

To Get More Information On Presentation Software Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 7.27 Billion

-

Market Size by 2033: USD 22.22 Billion

-

CAGR: 15.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Presentation Software Market Trends

-

Growing shift toward cloud-based presentation tools for seamless team collaboration globally.

-

Increasing demand for web-enabled solutions supporting multi-device and hybrid work environments.

-

Integration of AI-powered design suggestions and automated slide creation features.

-

AI-driven slide generation reducing time and improving professional presentation quality.

-

Predictive analytics providing insights on audience engagement and presentation performance.

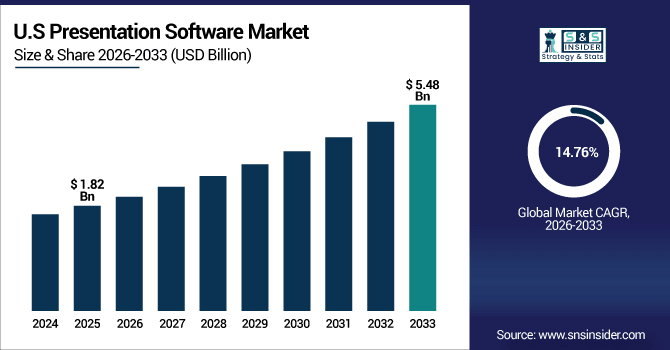

The U.S. Presentation Software Market size was USD 1.82 Billion in 2025E and is expected to reach USD 5.48 Billion by 2033, growing at a CAGR of 14.76% over the forecast period of 2026-2033, driven by advanced technological adoption, including cloud-based platforms, AI-powered tools, and real-time collaboration features.

Presentation Software Market Growth Drivers:

-

Cloud-Based Solutions Boost Collaboration, Efficiency, And Adoption Across Global Organizations

The greater demand for cloud-based and web-enabled presentation software is one of the key drivers for this market. Instead of legacy desktop-only solutions, organizations are now migrating to a new breed of platform that offers real-time collaboration, remote access, and the ability to integrate easily with other productivity tools such as Microsoft Teams, Zoom, and Google Workspace. Cloud-based solutions can help minimize infrastructure costs, provide version control features, and make it easier to use across devices, an essential aspect of hybrid work environments. Furthermore, the rise of AI-powered features built into these platforms like auto slide generation, data visualization, and design recommendations make professional presentation creation quicker, increasing adoption in enterprises, educational institutions, and media organizations as well.

Cloud-based solutions can reduce infrastructure and maintenance costs for organizations by 20–25% compared to traditional desktop setups.

Presentation Software Market Restraints:

-

Data Security Concerns Limit Adoption Of Cloud And Web Platforms

Despite the benefits, Security and privacy concerns remain big restraint for the Presentation Software Market. For this very reason most organizations are reluctant to get onboard with cloud based or better yet web enabled presentation tools leaving them under the threat of unauthorized access, data breaches, and leakage or even theft of sensitive corporate information. This is especially important for industries like finance, healthcare, and government, that are required to keep information private. It can slow down adoption rates, as compliance with regulations like EU's GDPR and USA's HIPAA resonates well with the providers, but raises the costs. Such concerns can hamper the penetration of cloud-based solutions and restrain the market over the regions with strict data protection regulations.

Presentation Software Market Opportunities:

-

AI Integration Enhances Presentations With Automation And Advanced Analytics Insights

The significant growth opportunity for presentation software providers by integrating AI, machine learning, and advanced analytics. While AI-based tools can assist with such things like automate slide generation, design, suggest layouts and visualizations, generate charts from raw data and even audience engagement prediction. Analytics Features Provides the ability to track presentation performance, user engagement, and feedback to enable organizations to measure and adjust for greater content effectiveness over time. This trend is very attractive for businesses, educators, and content creators who want to boost their time efficiency, productivity, and make better presentations. With mass adoption of AI across industries, presentation software vendors can take this opportunity to stand out from the crowd with their products and take a bigger piece of the pie.

Organizations integrating AI and analytics report 15–25% higher presentation efficiency compared to traditional methods.

Presentation Software Market Segmentation Analysis:

-

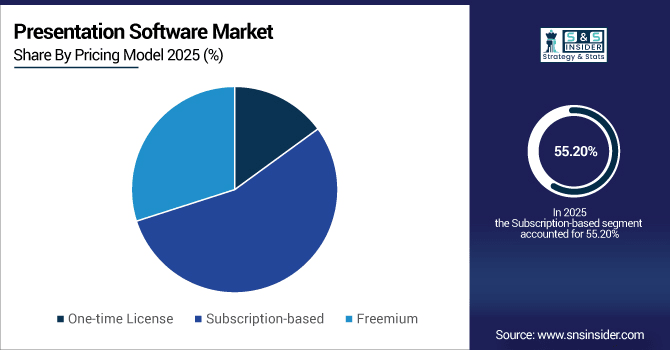

By Pricing Model: In 2025, Subscription-based led the market with share 55.20%, while Freemium is the fastest-growing segment with a CAGR 16.04%.

-

By Platform: In 2025, Web-based led the market with share 48.10%, with is the fastest-growing segment with a CAGR 15.40%.

-

By Deployment: In 2025, Cloud-based led the market with share 60.14%, while On-premise is the fastest-growing segment with a CAGR 14.80%.

-

By End User: In 2025, Business Professionals led the market with share 45.20%, while Educational Institutions is the fastest-growing segment with a CAGR 13.70%.

By Pricing Model, Subscription-based Leads Market and Freemium Fastest Growth

Based on Pricing Model, Subscription-based solutions are leading the Presentation Software Market, accounted for the highest market share in 2025. Enterprises and organizations prefer the subscription model due to consistent updates, cloud integration and constant support, as it allows users to use the latest features with minimum cost. At the same time, the freemium model has also become the fastest growing segment, due to its ability to attract SMEs, startups, and individual users who now prefer to get basic functionality for free, with options to upgrade to premium features. The visibility to flexible pricing, scalability, and accessibility is encouraging, extending the horizon for widespread adoption through subscription-based and freemium models as cornerstones of market growth catering to an expanding audience across the global.

By Platform, Web-based Leads Market and Fastest Growth

The Presentation Software Market is booming as per platform, among the four identified bases, the web-based presentation software is dominating the market due to the flexibility and accessibility it provides along with the easy connection with various cloud services. The organisations have now started operating in a more hybrid work environment, with many employees working from different locations and organisations opting for web-enabled solutions, which allows enabling multi-device access across the board. at same time Web-based solutions are fastest-growing segment, a dynamic that echoes the general trend of business-related cloud adoption and digital transformation, as well as the need for interactive accessible presentation capabilities by enterprises, educational institutions, and media organizations worldwide.

By Deployment, Cloud-based Leads Market and On-premise Fastest Growth

In 2025, the cloud based was leading to the Presentation Software Market as it provides real-time collaboration, multi-device accessibility, and seamless integration with other productivity tools. The low infrastructure cost combined with the ability to support hybrid workplace, makes it an appealing choice for enterprises, educational institutions, and media organizations too; especially, when deployed on cloud. Notably, the fastest-growing category is on-premise deployment model given the adoption of local hosting solutions by organizations that last data security, privacy and compliance requirements. This growth indicates a mix between cloud service convenience, and the need for secure and controlled environments, offering the vendors flexibility to support varied customer needs.

By End User, Business Professionals Lead Market and Educational Institutions Fastest Growth

By end user, the Presentation Software Market is largely segmented into business professionals, with the highest market share. Presentation software is used by corporates and enterprises on a large scale for meetings, pitches, training, and reporting and can help improve communication and decision-making within organizations through features such as data visualization, interactive slides, storytelling, and AI-assisted design. Meanwhile, educational institutions account for the fastest-growing segment as the adoption of e-learning, remote teaching and digital classroom solutions increase. With schools, colleges and universities adopting web-based and cloud-enabled presentation platforms for more collaborative learning, interactive content and multimedia integration.

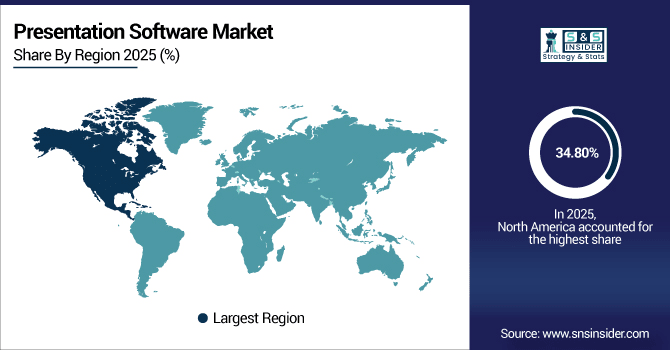

Presentation Software Market Regional Analysis:

North America Presentation Software Market Insights:

The Presentation Software Market in North America held the largest share 34.80% in 2025, due to the adoption of cloud-enabled presentation hosted applications and AI powered tools which help in designing interactive content, advanced data visualization in real-time and in collaboration. More and more enterprises, educational institutions, and media enterprises are adopting these tools to enable greater communication, productivity, and engagement. It also enjoys a strong IT infrastructure, digital transformation efforts, and remote work trend which accelerates the adoption of technology in the region. Also, subscription-based and freemium pricing plans enable both market growth and product improvement on an ongoing basis across platforms.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Presentation Software Market with Advanced Technological Adoption

The U.S. dominates the Presentation Software Market due to advanced technological adoption, including cloud-based platforms, AI-powered tools, and real-time collaboration features.

Asia-Pacific Presentation Software Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Presentation Software Market with a CAGR 16.09%, due to the increasing digital transformation, development of cloud-based and web-enabled platforms and need for interactive, collaborative, and data-driven presentations. Nurtured by the adoption of e-learning by educational institutions, hybrid work implementation by enterprises, and visually engaging content by media organizations. Rising internet penetration with increasing smartphone adoption is providing a low-cost subscription based and freemium model to presentation tools for larger audience across region. The inclusion of AI-powered functionalities such as automated slide generation, design suggestions, and analytics are contributing to improved efficiency, productivity, and engagement, thus driving strong market growth in Asia-Pacific.

China and India Propel Rapid Growth in Presentation Software Market

China and India drive rapid growth in the Presentation Software Market due to increasing digital adoption, cloud-based platform usage, AI integration, and rising demand from enterprises, educational institutions, and media organizations.

Europe Presentation Software Market Insights

The Europe Presentation Software Market is steadily gaining prominence, fueled by the growing adoption of cloud-based and AI-enabled presentation platforms among enterprises, educational institutes, and media organizations. These tools are being used for real–time collaboration, interactive content, and data-driven presentations, providing enhanced functionality for organizations. The rise of subscription model and freemium model is also fuelling the market, as it attracts more people towards advanced features. Further, digital transformation programs, remote work implementation, and the add on of analytics and multimedia functions are adding to the growth of the market.

Germany and U.K. Lead Presentation Software Market Expansion Across Europe

Germany and the U.K. lead Europe’s Presentation Software Market expansion due to widespread adoption of cloud-based, AI-powered platforms, enhanced collaboration tools, and growing demand from enterprises, educational institutions, and media organizations.

Latin America (LATAM) and Middle East & Africa (MEA) Presentation Software Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Presentation Software Market is experiencing steady growth, driven by escalating demand for cloud-based and web-enabled platforms in enterprises, educational institutions, and media organizations. Organizations in these regions are using the presentation software for interactive, data-driven, and collaborative content to improve communication and workflow. The increasing penetration of low-cost subscription-based and freemium models further augments growth by providing access to advanced features to SMEs and individual users. In addition, inclusion of artificial intelligence tools, automation of slide-making and analytics are features that are elevating efficiency and engagement of presentations. Digital Transformation initiatives and the adoption of remote work perpetuate market demand across LATAM and MEA respectively.

Presentation Software Market Competitive Landscape

Microsoft dominates the Presentation Software Market with its flagship PowerPoint platform, widely used across enterprises, educational institutions, and media organizations. The company continuously integrates cloud-based solutions, AI-powered tools, and real-time collaboration features, enhancing productivity and engagement. Its subscription-based Microsoft 365 model drives adoption, ensuring continuous updates and seamless cross-platform accessibility.

-

In October 2025, Microsoft Corporation began automatically installing the Copilot AI app alongside Microsoft 365 apps, including PowerPoint, enhancing productivity with AI-powered tools for real-time collaboration.

Apple contributes to the market through Keynote, offering intuitive, design-focused presentation tools for Mac, iPad, and iPhone users. Apple emphasizes AI-powered features, visual intelligence, and integration across devices, enabling users to create interactive, multimedia-rich presentations. Its focus on creativity, aesthetics, and seamless ecosystem integration supports adoption in both professional and educational segments.

-

In June 2024, Apple Inc. introduced Apple Intelligence, combining generative models with personal context, offering Live Translation and visual intelligence across iPhone, iPad, and Mac.

Adobe leverages its Creative Cloud suite, including tools like Adobe Express and AI-powered Firefly, to enhance presentation creation. The company focuses on generative AI, automated design, and advanced content visualization, enabling professional-grade slides and interactive content. Adobe’s innovations target enterprises, designers, and content creators seeking high-quality, visually impactful presentations.

-

In October 2024, Adobe Inc. launched over 100 AI-powered features across Creative Cloud, enhancing content creation through Firefly Gen AI models for designers.

Presentation Software Market Key Players:

Some of the Presentation Software Market Companies are:

-

Microsoft Corporation

-

Apple Inc.

-

Google LLC

-

Adobe Inc.

-

Zoho Corporation Pvt. Ltd.

-

Canva Inc.

-

Prezi Inc.

-

Vyond

-

Haiku Deck, Inc.

-

Powtoon Ltd.

-

Beautiful.ai

-

Slidebean Inc.

-

FlowVella

-

SlideDog

-

Visme

-

Tome AI

-

AhaSlides

-

Genially

-

Slides, Inc.

-

CustomShow

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 7.27 Billion |

| Market Size by 2033 | USD 22.22 Billion |

| CAGR | CAGR of 15.01% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Windows, Mac, iOS, Android, Web-based, Linux, Others) • By Pricing Model (One-time License, Subscription-based, Freemium) • By Deployment (Cloud-based, On-premise, Hybrid) • By End User (Business Professionals, Educational Institutions, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft Corporation, Apple Inc., Google LLC, Adobe Inc., Zoho Corporation Pvt. Ltd., Canva Inc., Prezi Inc., Vyond, Haiku Deck, Inc., Powtoon Ltd., Beautiful.ai, Slidebean Inc., FlowVella, SlideDog, Visme, Tome AI, AhaSlides, Genially, Slides, Inc., CustomShow, and Others. |