Export Packing Service Market Report Scope & Overview:

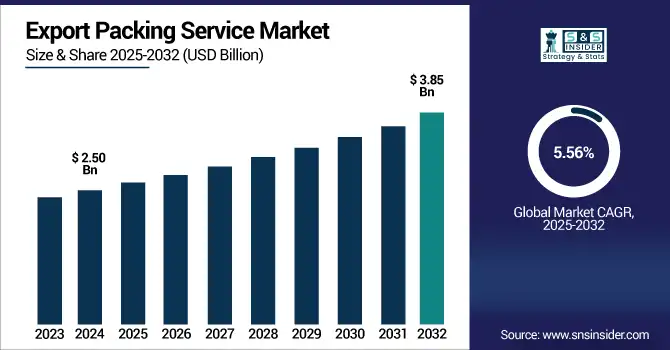

The Export Packing Service Market Size was valued at USD 2.50 billion in 2024 and is expected to reach USD 3.85 billion by 2032 and grow at a CAGR of 5.56% over the forecast period 2025-2032.

To Get more information on Export Packing Service Market - Request Free Sample Report

The market is witnessing strong growth due to the expanding global trade landscape and rising demand for customized, secure, and regulation-compliant packaging solutions. These services protect goods from damage, contamination, and regulatory issues during international transit. Key segments include box, crate, and pallet packing; custom and temperature-sensitive solutions; and materials ranging from wood to cardboard. Industries such as pharmaceuticals, food & beverages, and electronics drive demand. Market players are focusing on automation, sustainable materials, and compliance with global standards, positioning export packing as a vital link in the global logistics and supply chain ecosystem.

According to a study, the rising complexity of global trade and demand for compliant shipping have led to strong growth in the export packing service market. Over 70% of exporters now seek customized solutions, while temperature-controlled packing has increased by 45% in the pharmaceuticals and food sectors. Box packing remains dominant, used in more than 65% of export shipments. Meanwhile, paper and cardboard materials are growing fastest, with usage surging by 50% due to sustainability and recyclability preferences among global shippers.

The U.S. Export Packing Service Market size was USD 0.53 billion in 2024 and is expected to reach USD 0.68 billion by 2032, growing at a CAGR of 3.02% over the forecast period of 2025–2032. A key driving factor for the U.S. Export Packing Service Market is the surge in international trade and demand for secure, regulation-compliant packaging. As a result, industries like pharmaceuticals, electronics, and food exports increasingly rely on specialized packaging solutions. The U.S. dominates in North America due to its advanced logistics infrastructure, high export volume, and strong compliance standards, accounting for over 80% of the region’s total export packing service demand.

Market Dynamics

Key Drivers:

-

Growing Demand for Eco-Friendly Export Packing Materials Drives Market Expansion with Launch of Recyclable Corrugated Solutions

Due to global industries shifting toward sustainable practices, the demand for eco-friendly export packing materials is rapidly increasing. As a result, companies across the U.S. are investing in recyclable and biodegradable packaging materials to meet both environmental expectations and shipping regulations. It also demonstrated how innovation in sustainable materials is shaping the future of the export packing service market. Clients in sectors such as food, pharmaceuticals, and consumer electronics are actively seeking these green solutions, giving service providers a strong reason to adopt sustainable alternatives. The long-term benefit includes improved brand credibility for exporters and reduced carbon emissions across international shipping channels. This growing trend is expected to push packing service companies to not only rethink materials but also redesign packaging systems for greater environmental performance. As more regulations focus on sustainability, the demand for eco-friendly packing services is likely to continue expanding, positioning it as a critical growth driver for the U.S. export packing service market.

Restraints:

-

Strict International Phytosanitary and Packaging Regulations Restrain Export Packing Service Market Expansion

The export packing services must comply with strict international regulations, particularly concerning wooden packaging and phytosanitary standards. the market faces increasing operational challenges. As a result, service providers must invest time and resources into ensuring that packaging meets international codes, such as heat-treatment stamps or fumigation certifications. These requirements raise costs and cause delays, especially for smaller or mid-sized companies that lack in-house compliance expertise. Inconsistent rules across countries further complicate logistics, often leading to rejections at borders or fines for non-compliance. This creates a heavy burden on U.S. exporters, who must either outsource compliance or risk delayed shipments and financial losses. In industries dealing with high-volume exports such as machinery and electronics, these regulatory hurdles can significantly affect turnaround times and customer satisfaction. Consequently, the need to constantly update processes, retrain personnel, and invest in compliant materials increases operational strain. Though regulation is essential for global safety and pest control, the lack of harmonization across markets acts as a barrier to efficient international trade. This restraint limits the scalability of packing operations and curbs the otherwise strong momentum of the U.S. export packing service market.

Opportunities:

-

Rapid Growth of Temperature-Sensitive Pharma Exports Presents Opportunity Following March 2025 Launch of Insulated Packing System

The pharmaceutical industry continues to expand globally, especially in the export of vaccines, biologics, and temperature-sensitive medications; the demand for specialized packaging services is growing rapidly. As a result, export packing companies are increasingly offering temperature-controlled solutions to ensure that goods maintain integrity during transit. In March 2025, a U.S.-based provider launched an advanced insulated packaging system capable of preserving internal temperatures between 2–8 °C for up to 120 hours. This innovation addressed a pressing market need for long-duration, stable shipping of pharmaceuticals. The solution not only enhanced compliance with regulatory guidelines but also attracted high-value clients from the biotech and healthcare sectors. By offering services tailored to the precise needs of pharma exporters, packing companies gained access to a premium customer segment and opened new revenue streams. As temperature-sensitive product lines continue to grow, this development represents a major opportunity for service differentiation and long-term client contracts. Additionally, it encourages other exporters to upgrade from standard packing to specialized systems, thus expanding the overall market. The shift in demand from general to high-performance export packaging signals a promising growth avenue for U.S. providers.

Challenges:

-

Fluctuating Raw Material Prices Challenge Profit Margins and Operational Stability in Export Packing Services

The export packing service industry depends heavily on raw materials like wood, cardboard, plastic, and metal; price fluctuations in these commodities pose a major challenge. As a result, packing service providers often struggle to maintain stable profit margins when market prices for these inputs swing unpredictably. This volatility makes it difficult to forecast costs and offer fixed-price contracts to clients, especially for long-term export agreements. Sudden increases in raw material costs can lead to delayed projects, re-negotiations, or reduced profitability. For example, a spike in lumber prices may force companies to switch to alternative materials, which could compromise packaging strength or compliance with certain international standards. These challenges ripple across the entire logistics chain, affecting delivery schedules and client satisfaction. Additionally, constant pricing changes place pressure on procurement teams and strain relationships with suppliers. In response, some companies are investing in supply chain diversification or material efficiency strategies to manage risk. Despite these efforts, fluctuating material costs remain one of the most persistent obstacles in the U.S. export packing service market, making it a core challenge that impacts both service performance and financial sustainability.

Segmentation Analysis:

By Packaging Type

The dominance of box packing, with a 33% revenue share in 2024, is driven by its cost-effectiveness, stackability, and compatibility with automation. Increased global trade and standardization of freight logistics have made box formats preferred for mass shipments. This has influenced product development by emphasizing modular and tamper-proof designs. Consequently, the Export Packing Service Market benefits from reduced labor costs and faster packaging times, boosting service efficiency and client satisfaction.

Crate packing is expanding at the fastest CAGR of 8.31% due to its heavy-duty protection for oversized or fragile exports like industrial machinery and electronics. The rise in international demand for precision equipment causes manufacturers to adopt stronger wooden or metal crate designs, driving innovation in reusable crate technology. In the Export Packing Service Market, this trend supports customized, high-margin services tailored to meet international safety and insurance compliance standards.

By Service Type

Holding a 34% revenue share in 2024, customized packing solutions are in demand due to the increasing diversity of goods being shipped globally. As customers seek individualized protection and branding, businesses are investing in tailored packaging methods, including foam inserts and climate resistance. This need for precision in design and material selection has transformed product development, directly enhancing the Export Packing Service Market by fostering client-specific service models that boost client retention and revenue.

Temperature-controlled packing is growing at a CAGR of 9.99%, fueled by rising exports of sensitive goods like pharmaceuticals, seafood, and chemicals. The cause is stricter international regulations and heightened product sensitivity, leading to innovation in insulation materials and phase-change cooling technologies. This evolution has catalyzed advanced packaging systems, making them indispensable in the Export Packing Service Market, which now sees an upsurge in temperature-managed logistics contracts and premium-value service offerings.

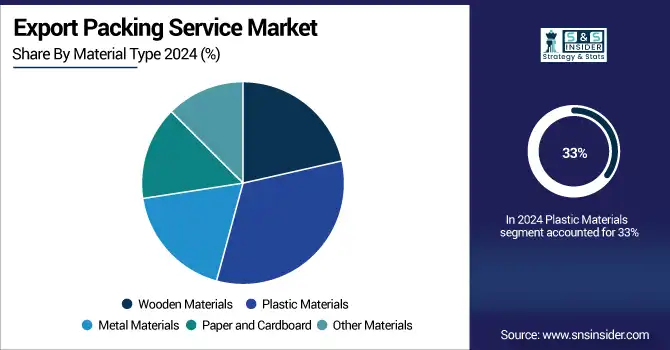

By Material Type

Plastic materials dominate with a 33% revenue share in 2024 due to their durability, moisture resistance, and lightweight profile. These properties reduce overall shipping costs and product damage, driving exporters to choose plastic for efficiency. As a result, manufacturers are advancing multi-layered and recyclable plastics. This material innovation boosts the Export Packing Service Market by enabling standardized and sustainable packaging options, aligning with global green logistics goals and enhancing service adaptability.

Paper and cardboard materials are expanding at a CAGR of 12.77% due to their eco-friendliness and cost-effectiveness. Rising environmental regulations and consumer demand for sustainable exports are pushing industries toward recyclable and biodegradable packaging. This shift drives product development of water-resistant, high-strength cardboard alternatives. The Export Packing Service Market benefits from this trend by offering greener solutions that meet compliance standards and cater to ethically-driven clients, especially in Europe and North America.

By End-User Industry

With a 28% revenue share in 2024, food and beverage packaging dominates due to the increasing global demand for perishable exports. Regulatory standards and the need for hygiene and shelf-life preservation have spurred the adoption of vacuum sealing and moisture-barrier materials. This has led to innovations in layered packaging and tamper-evidence. As a result, the Export Packing Service Market sees significant growth from food exporters needing reliable, compliant, and scalable packing services.

The pharmaceuticals and healthcare sector is growing at a CAGR of 7.99%, driven by rising exports of vaccines, biologics, and medical devices. Strict temperature and contamination controls require advanced protective and thermal packaging technologies. These demands encourage product development in smart labeling and anti-counterfeit seals. The Export Packing Service Market aligns with this trend by expanding its specialized services, ensuring compliance with global health standards and capturing high-value, time-sensitive contracts.

Regional Analysis:

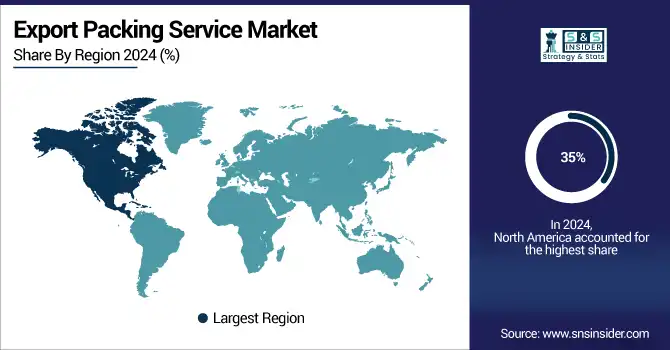

North America is the dominant region in the Export Packing Service Market in 2024 with an estimated market share of 35%. High-value industrial exports, advanced logistics infrastructure, and strict regulatory standards drive North America’s leadership in export packaging. The United States leads the region, supported by strong demand from aerospace, pharmaceuticals, and electronics sectors. In 2024, U.S. providers integrated smart tracking systems and customized climate-controlled packaging. These innovations reinforce the U.S. as a strategic hub for secure, compliant, and high-volume export packing services.

Asia Pacific is the fastest-growing region in the Export Packing Service Market in 2024 with an estimated CAGR of 9.84%. Rapid manufacturing growth, booming e-commerce exports, and rising cross-border trade are fueling packaging demand across Asia Pacific. China dominates the region due to high export volumes, automation in packaging lines, and government-backed logistics upgrades. In 2024, Chinese firms rolled out AI-enabled packing inspections and reusable crate systems. With digital transformation and global trade agreements, China is leading scalable, tech-driven growth across the regional export packing ecosystem.

Europe’s sustainability mandates and precision manufacturing boost the Export Packing Service Market in 2024. Regulated packing standards, focus on recyclability, and high-value exports support the region’s market strength. Germany leads in Europe, driven by strong automotive, machinery, and chemical export sectors that require robust and eco-friendly packaging. In 2024, German companies advanced smart packaging with QR-based traceability and biodegradable insulation. With a focus on compliance, safety, and innovation, Germany anchors Europe’s high-performance export packing services in a tightly regulated environment.

In 2024, the Export Packing Service Market in the Middle East & Africa (MEA) and Latin America shows growing traction driven by trade diversification and logistics upgrades. In MEA, the UAE leads, supported by re-export hubs, free zones, and investment in smart port technologies. Dubai’s logistics clusters are central to packaging service innovation. In Latin America, Brazil dominates due to rising agricultural and industrial exports. Providers in both regions are deploying modular packaging units and strengthening cold-chain capabilities to meet growing regional and international trade needs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The export packing service market companies are ActionPak, Bishop's Move, Epspack, Charles Kendall, UBEECO, EquipNet, International Sea & Air Shipping, IES, Advanced International Services, JK Francis & Son, HFS, Charu Packing Industries, Speedrite, NX Shoji, G&B Packing, TSI Packing, Energy Freight, Minters Of Deal, Rish Pack, World Export, and Others.

Recent Developments:

-

February 2025 – ActionPak Inc. published a blog post highlighting its single-serve packaging solutions, including stick packs, sachets, and spouted pouches. These offerings align with their contract filling and export packaging operations for powders and liquids in international shipments

-

May 2023 – Bishop’s Move Spain opened a new, significantly expanded warehouse in Algeciras, strategically located near the Port of Algeciras, to scale up its international export packing and relocation services across Europe and beyond.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.50 Billion |

| Market Size by 2032 | USD 3.85 Billion |

| CAGR | CAGR of 5.56% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Type (Box Packing, Crate Packing, Pallet Packing, Drum Packing, Other Custom Packing) • By Service Type (Standard Packing Services, Customized Packing Solutions, Temperature-Controlled Packing, Fragile Goods Packing) • By Material Type (Wooden Materials, Plastic Materials, Metal Materials, Paper and Cardboard, Other Materials) • By End-User Industry (Electronics and Electrical Equipment, Automotive and Machinery, Pharmaceuticals and Healthcare, Consumer Goods, Food and Beverages) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ActionPak, Bishop's Move, Epspack, Charles Kendall, UBEECO, EquipNet, International Sea & Air Shipping, IES, Advanced International Services, JK Francis & Son, HFS, Charu Packing Industries, Speedrite, NX Shoji, G&B Packing, TSI Packing, Energy Freight, Minters Of Deal, Rish Pack, World Export, and Others. |