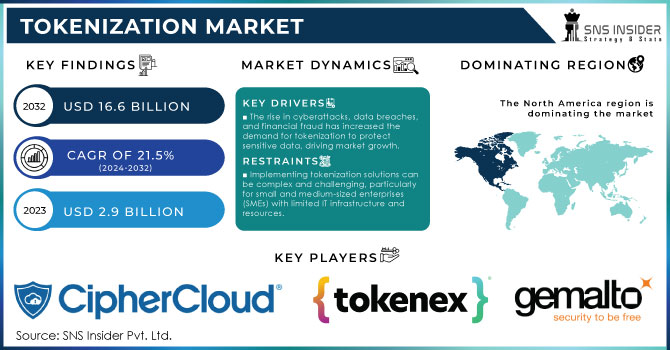

Tokenization Market Size & Overview:

To Get More Information on Tokenization Market - Request Sample Report

Tokenization Market size was valued at USD 2.9 billion in 2023 and is expected to grow to USD 16.6 billion by 2032 and grow at a CAGR of 21.5 % over the forecast period of 2024-2032.

Increasing concerns on data privacy, rising cyberattacks, and stringent government policies on data security have been the main drivers for the tokenization market. As of 2023, governments around the globe are implementing or have strengthened data policies to protect the information on digital platforms which has been boosting the market. For example, the General Data Protection Regulation by the European Union continues to create demand for secure data tools and has pushed business organizations to adopt tokenization tools to comply with the strict stringent data protection laws. The U.S. government has implemented similar measures as the National Institute of Standards and Technology developed new guidelines for secure data which emphasized the use of stronger protection measures such as tokenization to protect privately identifiable information and payment information. According to U.S. Government Accountability Office, in 2022, the economy lost over $6 trillion through cybercrimes, and better data security policies have been implemented as a measure. To manage this, organizations have been adopting tokenization solutions in different sectors. For example, the number of payment data tokenization vendors has been growing as the technology safeguards sensitive customer data leading to businesses maintaining positive reputations by securing their transaction data and reducing the risk of fraud.

Overall, the necessity for fraud protection has been a security challenge for organizations with a demand for payment gateways that are more widely used alongside governments implementing tighter regulations on private data protection. Data breaches have affected many companies, and as of 2023, the Baymard Institute had reported that 18% of online carts were abandoned because customers did not trust the safety of the web page. Hence, the continued reliance on credit and debit cards while seeking safer payment methods has been growing with significant adoption of the tokenization process.

Tokenization Market Dynamics

Drivers

- The rise in cyberattacks, data breaches, and financial fraud has increased the demand for tokenization to protect sensitive data, driving market growth.

As cyberattacks and data breaches become increasingly sophisticated and frequent, organizations are turning to tokenization as a robust solution to secure sensitive data. In the last couple of years, the number of cybersecurity challenges has been unprecedented, with numerous ransomware attacks, phishing attempts, and data breaches. According to the latest data from a recent report in 2023, the average global cost of a data breach has reached $4.45 million, up from $4.35 million in 2022. Thus, the financial risks to the companies only continue growing, marking one of the reasons for numerous organizations to urgently search for different ways of improving and strengthening the protection of their data. As a solution, the technology of tokenization allows replacing sensitive information with non-sensitive data that would be practically useless if intercepted by an unauthorized third party. For example, many companies in the payments industry rely on tokenization as an effective means of protecting their users’ data when processing payments. Payment processors, including Visa and Mastercard, use the technology to replace sensitive credit card information and pass the data to merchants. As the eCommerce and the banking industry often deal with vast payment processing volumes, the technology has become highly beneficial for these sectors.

Furthermore, the healthcare sector is also moving towards using tokenization. As dictated by the HIPAA laws in the United States, sensitive patient information must be protected, and thus tokenization has become one of the preferred solutions for protecting electronic health records. The companies will likely continue moving towards tokenization due to the ever-growing threats of cyberattacks and data breaches and the increasing need for data protection observed in the last couple of years.

-

Growing regulations like GDPR, PCI-DSS, and other data privacy laws globally are pushing organizations to adopt tokenization to ensure compliance with stringent data protection standards.

-

The increasing adoption of digital payments and e-commerce platforms has made tokenization essential for securing payment data, driving its widespread adoption across industries.

-

The rise in cloud-based tokenization solutions allows businesses to scale and manage tokenization efforts more efficiently, fueling market growth.

Restraints:

- Implementing tokenization solutions can be complex and challenging, particularly for small and medium-sized enterprises (SMEs) with limited IT infrastructure and resources.

The major restraint in the tokenization market is the difficulty of tokenization solutions’ integration, especially for SMEs. Tokenization implies huge changes in the already existent IT infrastructure, requiring the implementation of new security protocols in some businesses. Installation and maintenance of tokenization technology create complexities for those companies that need to add security to their preexisting systems. A lot of small and medium-sized enterprises do not have the necessary technical knowledge or technical teams to support such changes. As soon as tokenization gets implemented, the challenge of ensuring its compatibility and interoperability with the payment processing platform, in the case of payments tokenization, with various databases, or other applications, emerges. If the solution is not compatible with these systems, it can create traffic, slow down the process, or provide the generated token with an incorrect value. This complexity slows down the adoption rate and impacts market growth, especially for smaller organizations.

-

The upfront investment required for tokenization technologies can be high, especially for large-scale deployments, which can be a barrier to adoption in cost-sensitive sectors.

-

Many smaller organizations lack awareness of tokenization benefits and available solutions, which hampers broader market penetration, particularly in emerging economies.

Tokenization Market Segment analysis

By Component

In 2023, the solution component segment dominated the tokenization market, with a share of 79%. This development is largely attributed to the high deployment of these solutions in various industries to guard against sensitive data and minimize security risks. Tokenization solutions are being widely adopted for their ability to replace sensitive information, such as credit card numbers, with non-sensitive tokens, rendering data unusable if intercepted by cybercriminals. According to government reports, such as those from the U.S. Department of Commerce, there is a growing demand for digital payment security solutions as online transactions and digital payments surged by 24% in 2023. In addition, the growth of the tokenization solution market can also be attributed to measures imposed by the government to ensure the protection of the tokens when handling personal information.

By Technology

In 2023, the application programming interface-based segment had over 53% of the revenue share and was the largest. One of the benefits of API-based tokenization is its flexibility and simple integration with already existing company systems. Businesses can take advantage of API solutions to seamlessly integrate with different applications and platforms without changing the existing infrastructure. Moreover, according to the United States, Federal Trade Commission report of 2023, API solutions are vital in the e-commerce and financial technology sectors, where there has been a 35% increase in API usage for secure payment processing and identity verification. The increment can largely be attributed to the surge of online and mobile transactions, where APIs help protect data in real-time and remain compliant with global regulations like the General Data Protection Regulation and the California Consumer Privacy Act. Government data suggests that API adoption will continue to expand, given the increasing reliance on digital services and the pressing need for enhanced cybersecurity measures in sectors like finance and healthcare.

By Industry Vertical

In 2023, the banking, financial services, and insurance industry was the largest revenue shareholder of over 19.0% in the tokenization market. This high market share is attributed to the high exposure of the BFSI industry’s sensitive financial data and the high level of stringent regulations over data security. In line with this, the BFSI sector also accounted for over 60% of global financial transactions in 2023 and with cyberattacks becoming more frequent, the demand for tokenization as a preventive security measure has surged. Subsequently, regulatory bodies such as the Financial Conduct Authority in the UK and the Monetary Authority of Singapore now enforce adherence to stricter compliance regulations, especially with the usage of the Payment Services Act and the stringent e-payment act. Thus, data protection technologies such as tokenization are in high demand to comply with the advanced data privacy laws. Thus, most BFSI institutions are adopting tokenization technology to heighten their payment security and reduce the incidences of fraud to comply with the new data privacy laws.

Regional Analysis

In 2023, North America accounted for the largest share of the tokenization market. This is because digital payment systems are rapidly adopted in the region, and there are stringent data security guidelines. The government has to put in place strict regulations in data protection as is done through the Federal Trade Commission. Moreover, the region is involved in a significant amount of e-commerce transactions, and it has advanced financial systems hence will continue to hold the largest market share. Additionally, market trends in North America, such as the emergence of buy now pay later options for cryptocurrencies, have greatly influenced the regional market's growth.

Asia Pacific region will experience the highest Compound Annual Growth rate during the forecast period 2024-2032. Several industries in the region are going through a digital transformation, and governments in some countries such as India are investing in securing online transactions. The Reserve Bank of India has mandated the payment card e-commerce token to protect the data of the customer and reduce fraud. In addition to that, the market will grow as more people gain access to the internet and more people in the regions own a smartphone which they use to carry out transactions. The governments in the region are also investing in cybersecurity solutions and implementing policies to enforce data protection hence creating a more favorable environment for the market to grow.

Do You Need any Customization Research on Tokenization Market - Enquire Now

Key Players

Key Service Providers/Manufacturers:

-

Gemalto (Thales Group) – (SafeNet Tokenization, Vormetric Data Security Platform)

-

TokenEx – (Cloud Tokenization, PCI Compliance Solutions)

-

Hewlett Packard Enterprise (HPE) – (SecureData Enterprise, Atalla HSM)

-

F5 Networks – (BIG-IP Advanced Firewall Manager, BIG-IP Application Security Manager)

-

CipherCloud – (Cloud Security Gateway, Tokenization-as-a-Service)

-

Symantec Corporation – (Data Loss Prevention, Symantec Encryption)

-

Protegrity USA, Inc. – (Protegrity Cloud, Protegrity Vaultless Tokenization)

-

Broadcom Inc. (CA Technologies) – (Layer7 API Gateway, Payment Security Suite)

-

Micro Focus – (Voltage SecureData, Security ArcSight)

-

Wipro Limited – (Data Discovery and Protection, Cloud Tokenization Service)

Key Users of Tokenization Services/Products:

-

JPMorgan Chase & Co.

-

Bank of America

-

Amazon Web Services (AWS)

-

PayPal Holdings, Inc.

-

Mastercard Inc.

-

Visa Inc.

-

Walmart Inc.

-

American Express Company

-

Stripe, Inc.

-

Microsoft Corporation

Recent Developments

-

In January 2024, the BIS Innovation Hub, which is owned by the Bank for International Settlements, launched a CBDC-related initiative. The company’s blockchain-based tokenization project was announced, along with the expansion of its privacy testing program for the issuance of central bank digital currencies.

-

In March 2023, the U.S. Department of the Treasury announced a number of guidelines that would have an impact on the digital payments market. The measures proposed the use of tokenization for the safe handling of financial data in order to resolve the issue of endless amounts of data being leaked throughout the financial industry.

-

In December 2023, Akemona, Inc., a U.S. SEC-based asset tokenization platform, disclosed new contracts with previously unidentified issuers. The latter was seen as providing equity tokens by Akemona, Inc., which launched a new security token offering. The issuers’ new instruments included global equity token offerings, or GETOs, smart bonds, and digital stocks issued under bicameral shareholder acts.

-

April 2023: Imperva, Inc. partnered with Fortanix to enhance multi-cloud data protection, focusing on data privacy and compliance through their joint cybersecurity solutions.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.9 billion |

| Market Size by 2032 | USD 16.6 billion |

| CAGR | CAGR of 21.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment (Cloud, On-premises) • By Application Area (Payment Security, User Authentication, Compliance Management, Others) • By Services (Professional Services, Managed Services) • By Technology (Application Programming Interface-based, Gateway-based) • By Industry Vertical (BFSI, Healthcare, IT, Government, Retail and E-Commerce, Energy & Utilities, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Gemalto (Thales Group), TokenEx, Hewlett Packard Enterprise (HPE), F5 Networks, CipherCloud, Symantec Corporation, Protegrity USA, Inc., Broadcom Inc. (CA Technologies), Micro Focus, Wipro Limited |

| Key Drivers | •The rise in cyberattacks, data breaches, and financial fraud has increased the demand for tokenization to protect sensitive data, driving market growth. •Growing regulations like GDPR, PCI-DSS, and other data privacy laws globally are pushing organizations to adopt tokenization to ensure compliance with stringent data protection standards. •The increasing adoption of digital payments and e-commerce platforms has made tokenization essential for securing payment data, driving its widespread adoption across industries. •The rise in cloud-based tokenization solutions allows businesses to scale and manage tokenization efforts more efficiently, fueling market growth. |

| Market Restraints | •Implementing tokenization solutions can be complex and challenging, particularly for small and medium-sized enterprises (SMEs) with limited IT infrastructure and resources. •The upfront investment required for tokenization technologies can be high, especially for large-scale deployments, which can be a barrier to adoption in cost-sensitive sectors. •Many smaller organizations lack awareness of tokenization benefits and available solutions, which hampers broader market penetration, particularly in emerging economies |