Probiotic Supplements Market Report Scope & Overview:

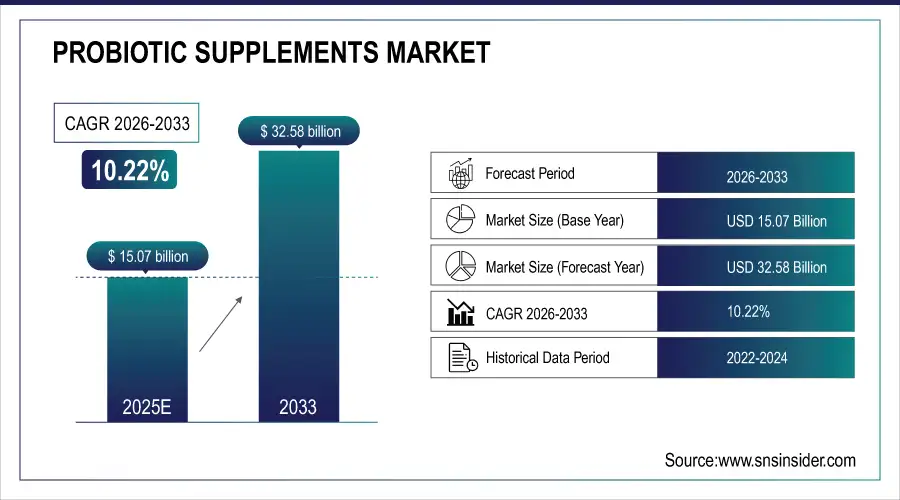

The Probiotic Supplements Market was valued at USD 15.07 billion in 2025E and is expected to reach USD 32.58 billion by 2033, growing at a CAGR of 10.22% from 2026-2033.

The Probiotic Supplements Market is growing due to increasing consumer awareness of digestive health, immunity, and overall wellness. Rising adoption of functional foods, preventive healthcare trends, and aging populations are boosting demand. Innovations in formulation, delivery formats, and high-CFU products enhance efficacy and convenience. Expansion of e-commerce, urbanization, and higher disposable incomes further support widespread accessibility, while rising interest in personalized nutrition and gut-health-focused products drives consistent market growth globally.

Market Size and Forecast

-

Market Size in 2025: USD 15.07 Billion

-

Market Size by 2033: USD 32.58 Billion

-

CAGR: 10.22% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Probiotic Supplements Market - Request Free Sample Report

Market Trends

-

Rising health awareness and focus on gut health are driving the probiotic supplements market.

-

Growing adoption among adults, children, and seniors is boosting market growth.

-

Expansion of functional foods, dietary supplements, and nutraceuticals is enhancing consumption.

-

Increasing use of Lactobacillus, Bifidobacterium, and other beneficial strains is shaping product trends.

-

Advancements in CFU formulation, delivery systems, and stability are improving efficacy.

-

Rising prevalence of digestive, metabolic, and immune-related disorders is fueling demand.

-

Collaborations between supplement manufacturers, research institutions, and healthcare providers are accelerating innovation and market penetration.

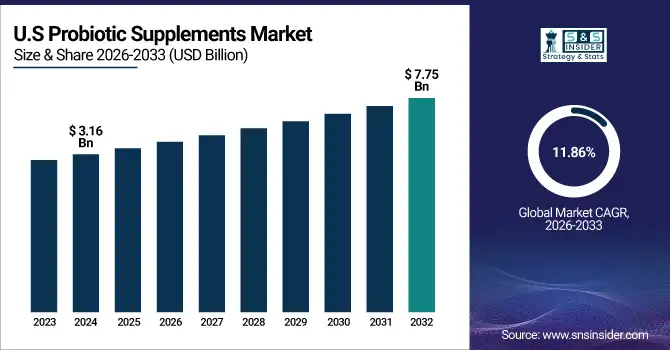

U.S. Probiotic Supplements Market was valued at USD 3.16 billion in 2025E and is expected to reach USD 7.75 billion by 2032, growing at a CAGR of 11.86% from 2026-2033.

The U.S. Probiotic Supplements Market is growing due to rising consumer focus on digestive and immune health, increasing preventive healthcare adoption, innovative product formats, and growing awareness of gut microbiome benefits driving higher demand across age groups.

Probiotic Supplements Market Growth Drivers:

-

Rapidly increasing consumer awareness of gut health and digestive wellness driving global demand for Probiotic Supplements Market growth significantly

The rising awareness among consumers about gut health, digestive wellness, and immunity enhancement is fueling demand for probiotic supplements worldwide. Increasing health consciousness, coupled with the adoption of preventive healthcare measures, has encouraged consumers to incorporate probiotics into daily diets. Growing research on the benefits of probiotics for overall well-being, immunity, and metabolic health has boosted consumer confidence. Additionally, rising disposable incomes and the trend toward functional foods and nutraceuticals support widespread adoption. This awareness has prompted manufacturers to launch diverse formulations targeting different age groups, driving consistent market growth.

Probiotic Supplements Market Restraints:

-

Limited shelf life and stability of probiotic strains restraining the global Probiotic Supplements Market expansion

Probiotic strains are highly sensitive to temperature, moisture, and oxygen, affecting their viability and shelf life. Maintaining stability during processing, storage, and transportation requires advanced technologies such as microencapsulation or cold-chain logistics. Inadequate storage conditions can degrade bacterial activity, reducing efficacy and consumer trust. This instability also complicates product formulation, packaging, and distribution, particularly in regions with hot and humid climates. Manufacturers face challenges in ensuring consistent potency until consumption, leading to potential dissatisfaction and returns. Such limitations impact scalability and restrict widespread adoption, serving as a key restraint for the global probiotic supplements market.

Probiotic Supplements Market Opportunities:

-

Growing demand for personalized nutrition and gut-health-focused products presenting opportunities in Probiotic Supplements Market

Increasing consumer interest in personalized nutrition and microbiome-targeted wellness presents lucrative opportunities for probiotic supplements. Advances in gut microbiome research allow manufacturers to develop tailored formulations addressing specific digestive, metabolic, and immune health needs. Collaborations with healthcare professionals, dietitians, and wellness platforms enable personalized recommendations, enhancing consumer engagement. Rising trends in functional foods, fortified beverages, and lifestyle supplements provide additional avenues for product innovation. These developments cater to health-conscious consumers seeking targeted benefits, enabling companies to differentiate offerings, charge premium prices, and capture higher market share, thus expanding opportunities in the probiotic supplements sector.

Probiotic Supplements Market Segment Highlights

-

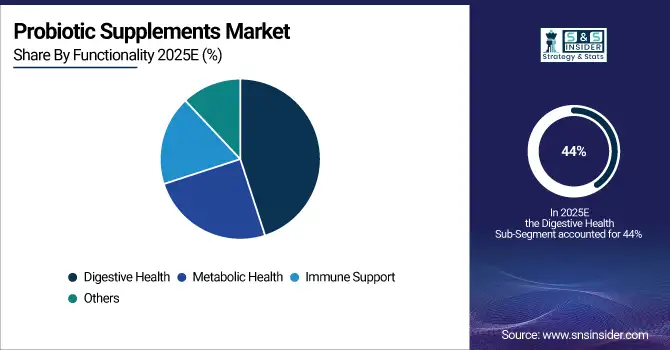

By Functionality, Digestive Health dominated with ~44% share in 2025; Immune Support fastest growing (CAGR).

-

By Customer Orientation, Unisex dominated with ~61% share in 2025; Women fastest growing (CAGR).

-

By Bacteria Type, Lactobacillus dominated with ~37% share in 2025; Bacillus coagulans fastest growing (CAGR).

-

By CFU Count, 5 Billion to 10 Billion dominated with ~28% share in 2025; 10 Billion to 20 Billion fastest growing (CAGR).

-

By Form, Tablets/Pills dominated with ~33% share in 2025; Gummies/Chewable fastest growing (CAGR).

Probiotic Supplements Market Segment Analysis

By Functionality, Digestive health dominated in 2025; immune support expected fastest growth 2026–2033 due to rising immunity focus.

Digestive Health segment dominated the Probiotic Supplements Market in 2025 due to rising digestive disorders and increasing consumer awareness about gut health. Probiotics targeting digestion are widely recommended by healthcare professionals, and their proven effectiveness in improving bowel regularity and nutrient absorption ensures strong demand, maintaining the segment’s leading market position.

Immune Support segment is expected to grow at the fastest CAGR from 2026-2033 owing to increasing focus on immunity, especially post-pandemic. Rising health consciousness, preventive healthcare trends, and growing preference for supplements that enhance immune function are driving rapid adoption, making this segment a key growth opportunity in the probiotic market.

By Customer Orientation, Unisex led in 2025; women segment projected fastest growth 2026–2033 from targeted health awareness.

Unisex segment dominated the Probiotic Supplements Market in 2025 as products are widely formulated for general consumption without gender-specific variations. Broad applicability across all age groups, convenience, and established product availability contribute to strong sales, ensuring market leadership and sustained demand among diverse consumer groups.

Women segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing awareness of women-specific health needs, including reproductive and urinary tract health. Targeted formulations, marketing initiatives, and rising female health consciousness are driving demand, accelerating growth in probiotics designed specifically for women.

By Bacteria Type, Lactobacillus dominated in 2025; Bacillus coagulans expected fastest growth 2026–2033 with stability and broad health benefits.

Lactobacillus segment dominated the Probiotic Supplements Market in 2025 because of its well-established efficacy in improving gut flora, digestion, and overall health. Extensive research, widespread use in commercial products, and strong consumer trust make Lactobacillus the most preferred probiotic strain, sustaining its dominance in the market.

Bacillus coagulans segment is expected to grow at the fastest CAGR from 2026-2033 due to its stability, heat resistance, and broad health benefits. Increasing inclusion in functional foods and supplements, along with rising consumer awareness of its effectiveness for digestion and immunity, is driving rapid adoption and market growth.

By CFU Count, 5–10 billion dominated in 2025; 10–20 billion projected fastest growth 2026–2033 due to higher-potency demand.

5 Billion to 10 Billion segment dominated the Probiotic Supplements Market in 2025 as it offers effective dosage levels for general health benefits without causing side effects. Widely recommended by healthcare professionals and available across multiple product formats, this dosage range ensures consistent consumer preference and steady market demand.

10 Billion to 20 Billion segment is expected to grow at the fastest CAGR from 2026-2033 owing to increasing demand for higher-potency probiotics. Rising health awareness, focus on enhanced efficacy, and preference for stronger formulations to support gut and immune health are driving rapid adoption of these higher CFU products.

By Form, Tablets/pills led in 2025; gummies/chewables expected fastest growth 2026–2033 from palatability and convenience trends.

Tablets/Pills segment dominated the Probiotic Supplements Market in 2025 due to convenience, precise dosage, long shelf life, and widespread availability. Familiarity among consumers and ease of integration into daily routines make tablets the preferred delivery format, ensuring strong adoption and steady revenue generation for manufacturers.

Gummies/Chewable segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for palatable, easy-to-consume probiotic products. Increasing preference among children and adults, combined with attractive flavors and functional benefits, is driving rapid growth, making gummies a fast-emerging format in the probiotic supplements market.

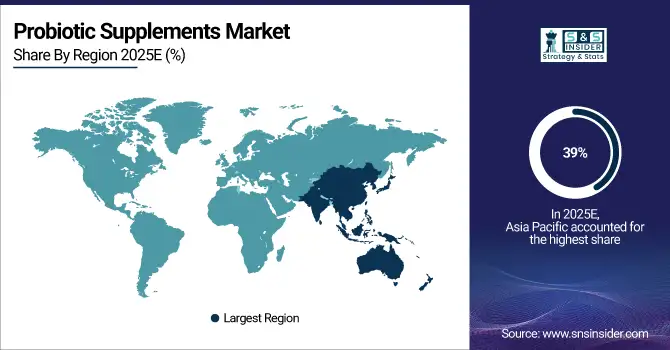

Probiotic Supplements Market Regional Analysis

Asia Pacific Probiotic Supplements Market Insights

Asia Pacific dominated the Probiotic Supplements Market in 2025 with a 39% revenue share due to rising health awareness, increasing disposable incomes, and expanding e-commerce channels. High prevalence of digestive and lifestyle-related health issues, coupled with strong adoption of dietary supplements in countries like China, Japan, and Australia, drives demand. Additionally, growing investments by manufacturers in product innovation and regional distribution networks further strengthen market dominance and sustained growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Probiotic Supplements Market Insights

North America is expected to grow at the fastest CAGR of 11.98% from 2026-2033 due to increasing consumer preference for preventive healthcare and functional foods. Rising awareness of gut health, high adoption of dietary supplements, and presence of major market players driving innovation and distribution are key factors. Additionally, strong regulatory frameworks and widespread e-commerce adoption facilitate rapid market expansion across the region.

Europe Probiotic Supplements Market Insights

Europe held a significant share in the Probiotic Supplements Market due to rising health consciousness, growing demand for digestive and immune support products, and widespread adoption of dietary supplements. Strong presence of established manufacturers, strict regulatory standards ensuring product quality, and increasing functional food integration are driving growth. Additionally, expanding e-commerce channels, aging population, and rising lifestyle-related health concerns further support market expansion across the region during the forecast period.

Middle East & Africa and Latin America Probiotic Supplements Market Insights

Middle East & Africa and Latin America are witnessing steady growth in the Probiotic Supplements Market due to rising health awareness, increasing disposable income, and growing adoption of dietary supplements. Expanding retail and e-commerce channels, coupled with a young population seeking preventive healthcare solutions, are driving demand. Additionally, government initiatives promoting nutrition and wellness, along with the introduction of innovative probiotic formulations, support market expansion in these regions.

Probiotic Supplements Market Competitive Landscape:

BioGaia

BioGaia develops evidence-based probiotic solutions targeting all age groups, from infants to adults. The company emphasizes scientific research, product efficacy, and market expansion through direct distribution channels. BioGaia focuses on strengthening its presence in Europe while showcasing innovations that promote digestive and overall health.

-

May 2025: Showcased evidence-based probiotic solutions at The Primary Care Show 2025, highlighting products for infants, children, and adults.

-

September 2025: Established its own distribution channels in Germany and Austria to strengthen European market presence.

Chr. Hansen Holding A/S

Chr. Hansen is a bioscience company specializing in microbial and fermentation technologies. With a focus on Health & Nutrition, the company emphasizes innovation, sustainable solutions, and differentiated products that leverage its microbial expertise. Chr. Hansen aims to expand its global footprint while advancing bioscience-based health solutions.

-

September 2025: Launched the "2025 Strategy," focusing on creating a differentiated bioscience company with microbial and fermentation technology platforms, emphasizing Health & Nutrition.

VSL Pharmaceuticals, Inc.

VSL Pharmaceuticals develops high-potency probiotic formulations to support digestive health and overall wellness. The company focuses on innovation, product accessibility, and shelf-stable solutions to enhance consumer convenience. VSL emphasizes evidence-based formulations and market-responsive product development.

-

August 2024: Actial Nutrition, U.S. distributor of VSL#3, launched VSL4 Gut, a shelf-stable daily probiotic supplement to support digestion and regularity.

Culturelle

Culturelle offers consumer-focused probiotic supplements known for effectiveness, quality, and affordability. The brand emphasizes clinical validation, ease of use, and broad accessibility, aiming to establish trust with consumers seeking digestive and immune health support.

-

May 2025: Recognized in a Forbes Health panel as one of the best probiotic supplements of 2025 for effectiveness and affordability.

Florastor

Florastor produces probiotic products designed to promote gut health and overall wellness. The brand emphasizes consumer engagement, product refreshes, and accessibility, aiming to broaden its audience and maintain relevance in a competitive market.

-

August 2024: Unveiled a refreshed brand look for its probiotics to enhance appeal and reach a wider audience.

Metagenics

Metagenics develops integrated health solutions combining probiotics with vitamins and nutraceuticals. The company focuses on whole-body wellness, energy, and vitality, with a strong emphasis on product innovation, user-friendly labeling, and consumer experience.

-

July 2025: Launched UltraFlora® Probiotic + Multivitamin, a 2-in-1 supplement for overall health and vitality.

-

July 2025: Introduced a new label design to simplify product navigation and highlight core benefits, improving the consumer experience.

Key Players

Some of the Probiotic Supplements Market Companies

-

BioGaia

-

Chr. Hansen Holding A/S

-

VSL Pharmaceuticals, Inc.

-

Culturelle

-

Florastor

-

Metagenics

-

SCD Probiotics

-

Unique Biotech

-

Omni-Biotic

-

NutraScience Labs

-

Probi USA Inc.

-

Protexin (Archer-Daniels-Midland Company)

-

Reckitt Benckiser Group plc

-

Yakult Honsha Co.

-

Koninklijke DSM N.V.

-

Dietary Pro Labs

-

Custom Probiotics Inc.

-

Bio-Kult

-

Jarrow Formulas

-

Garden of Life

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 15.06 Billion |

| Market Size by 2033 | USD 32.07 Billion |

| CAGR | CAGR of 10.22% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Functionality (Digestive Health, Metabolic Health, Immune Support, Others) • By Customer Orientation (Baby, Women, Men, Unisex) • By Bacteria Type (Lactobacillus, Streptococcus, Bifidobacterium, Bacillus coagulans, Saccharomyces, Lactococcus lactis) • By CFU Count (Less than 1 Billion, 1 Billion to 5 Billion, 5 Billion to 10 Billion, 10 Billion to 20 Billion, 20 Billion to 30 Billion, 30 Billion to 50 Billion, More than 50 Billion) • By Form (Tablets/Pills, Capsules, Liquid, Powder, Gummies/Chewable, Lozenges, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BioGaia, Chr. Hansen Holding A/S, VSL Pharmaceuticals, Inc., Culturelle, Florastor, Metagenics, SCD Probiotics, Unique Biotech, Omni-Biotic, NutraScience Labs, Probi USA Inc., Protexin (Archer-Daniels-Midland Company), Reckitt Benckiser Group plc, Yakult Honsha Co., Koninklijke DSM N.V., Dietary Pro Labs, Custom Probiotics Inc., Bio-Kult, Jarrow Formulas, Garden of Life |