Medical Equipment Maintenance Market Key Insights:

Get More Information on Medical Equipment Maintenance Market - Request Sample Report

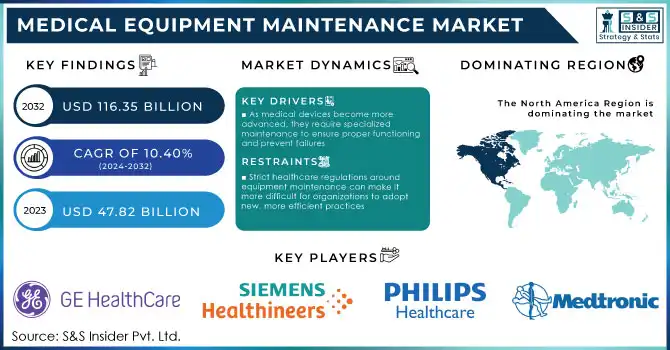

The Medical Equipment Maintenance Market Size was valued at USD 47.82 billion in 2023 and is expected to reach USD 116.35 Billion by 2032, growing at a CAGR of 10.40% over the forecast period of 2024-2032.

The medical equipment maintenance market is experiencing rapid growth, driven by the increasing complexity of medical devices that require specialized maintenance to ensure seamless operation without interruptions. As healthcare technologies advance, the need for expert servicing and upkeep becomes critical to maintaining device performance and reliability. With healthcare facilities becoming increasingly dependent on state-of-the-art technologies ranging from imaging devices and surgical tools to life-support systems, demand for routine and preventive maintenance services has risen dramatically. Especially those like MRIs, CT scanners, and endoscopic devices; all of the expensive, essential diagnostic and treatment equipment. Their upkeep extends longevity as well as provides for safe as well as trustworthy medical techniques. Another key factor driving market growth is the increasing focus on preventive maintenance, as healthcare providers aim to reduce the risk of unexpected equipment failures. This approach helps minimize costly downtimes and ensures continuous, reliable operation of critical medical devices. The preventive maintenance strategy includes regular inspection and minor servicing to foresee possible problems in the future. This shift is occurring gradually due to growing recognition that taking a proactive approach can significantly reduce repair costs and prevent operational disruptions by addressing potential issues before they escalate into major breakdowns. This preventative strategy not only enhances equipment reliability but also improves overall cost-efficiency. Furthermore, regulatory standards are pushing healthcare organizations to maintain a stricter protocol when it comes to upkeep to meet industry standards and safeguard patient safety.

In addition, the emergence of technology-oriented maintenance services such as the acceptance of predictive analytics and IoT-driven devices is changing the face of the market. Such innovation enable monitoring of the stand for the equipment in real time, predicting failure of the product before it occurs, allowing for more effective management of maintenance schedule. This combination brings improved cost efficiency, and helps maintain the reliability of medical equipment. In summary, the medical equipment maintenance industry boom is focused on the increasing demand for medical equipment reliability and patient safety, coupled with the need for cost-efficient management of sophisticated medical technology.

| Medical Equipment | 1-Year Maintenance Cost (%) | 2-Year Maintenance Cost (%) | 5-Year Maintenance Cost (%) |

|---|---|---|---|

| MRI Machine | 5% | 10% | 25% |

| CT Scanner | 8% | 16% | 32% |

| Ultrasound Machine | 10% | 20% | 50% |

| Ventilator | 17% | 33% | 67% |

Market Dynamics

Drivers

-

As medical devices become more advanced, they require specialized maintenance to ensure proper functioning and prevent failures

-

Healthcare providers are increasingly adopting preventive maintenance strategies to avoid unplanned downtimes and reduce repair costs

-

The use of IoT and predictive analytics in monitoring equipment health is enabling more efficient and proactive maintenance

The implementation of IoT (Internet of Things) and predictive analytics in the medical equipment maintenance market are fueling maintenance operations to become more efficient and proactive. In addition, the video demonstrates how IoT technology allows medical devices to be continuously monitored, providing real-time data on things like temperature, pressure, usage cycles, and device state and performance. Predictive analytics algorithms then analyze these data, find patterns, and prevent possible issues before the equipment fails. Predictive analytics offers early warnings of malfunctions or wear and tear on equipment, so maintenance teams can perform repairs or replacements just in time, preventing unexpected downtimes, and ultimately reducing operational costs. More than just active maintenance method where actions that mitigate problems happening are considered after failure occurs On the other hand, IoT-based predictive maintenance enables healthcare providers to predict and prevent equipment failure, resulting in better equipment reliability and performance. This also makes maintenance checks more specific; resources can be deployed only when needed, reducing the costs related to redundant maintenance inspections.

In addition, predictive analytics aids data-driven decision-making which allows healthcare facilities to plan maintenance during non-peak hours or alongside other operational activity leading to minimal disruption. Such an approach to equipment maintenance is a part of the ongoing demand for cost-efficient, safe, and streamlined operations in healthcare. The usage of IoT and predictive analytics for medical equipment maintenance improves the reliability of medical devices, optimises the maintenance schedules, reduces the costs and enhances patient safety. These technologies are moving the healthcare sector towards predictive and preventative maintenance, which is not only ensuring long term usability of equipment but also smooth operations.

| Factor | Impact on Medical Equipment Maintenance |

|---|---|

| IoT Integration | Enables real-time monitoring and data collection of equipment health. |

| Predictive Analytics | Identifies potential failures before they occur, allowing proactive action. |

| Reduced Downtime | Predictive insights allow for scheduled repairs, minimizing disruptions. |

| Cost Efficiency | Reduces unnecessary maintenance and repairs, optimizing resource allocation. |

| Improved Equipment Lifespan | Proactive maintenance extends the operational life of expensive medical devices. |

Restraints

-

Integrating advanced technologies like IoT and predictive analytics requires significant upfront investment and training, which can be a barrier for some organizations

-

Strict healthcare regulations around equipment maintenance can make it more difficult for organizations to adopt new, more efficient practices

-

The cost of specialized maintenance services, particularly for complex medical devices, can be prohibitive for smaller healthcare facilities

As medical equipment becomes more complex and pricey, complex healthcare facilities are making it more difficult for smaller organizations to provide holistic healthcare with high-cost specialized maintenance services. Luxurious and high-tech medical equipment, like MRI devices, CT scanners, and robotic surgical instruments, require routine maintenance and service from expert experts, at a significant price. These devices not only require high capital costs, the service often needs specialized knowledge and equipment which can add up to expensive service costs too. These charges soon become unmanageable for smaller healthcare establishments who may not have the finances to periodically maintain their devices or affording advanced maintenance technology like predictive analytics and IoT-based monitoring systems. This means many smaller facilities instead have no choice but to turn to third-party service providers, or independent service organizations (ISOs) that do not always have access to the latest tools—or albeit OEM-level expertise and/or know-how—ultimately harming the quality of maintenance and repair. Not being able to fund preventative maintenance programs or undertake timely repairs may result in increased equipment breakdowns, which will then lead to unplanned downtimes and service interruptions that will stress already tight budgets. Failing to properly maintain costly medical devices reduces their operational life, which results in frequent replacements and higher lifetime costs. Moreover, larger hospitals with more volume and financial flexibilities can afford specialty maintenance services, but smaller facilities must often choose whether to budget for equipment or other critical operational functions. This financial burden could hinder them from being able to meet the same standards of care that comes with the newer equipment.

Due to high demand for specialized maintenance, the increase in the required means can be problematic; smaller healthcare stakeholders will not have the means to afford this service, and this will augment the gap in health services quality between large and smaller companies.

Medical Equipment Maintenance Market Segmentation Analysis

By Service

In 2023, the corrective maintenance segment held the largest revenue share of more than 49.28%. This gives advantage to fix gear in the event that they breaks or disappointing equipment for breakdowns of instruments. Replacement and restoration of systems with the goal of restoring the equipment to its original operational state. This segment is likely to achieve rapid growth owing to increasing incidences of failure in equipment due to continuous and wearisome application in contemporary healthcare establishments.

Preventive maintenance is expected to be the fastest-growing segment 2024 to 2032, With CAGR of 12.21%. It will lead to increased longevity of your assets and equipment by keeping them properly maintained, and an increase in efficiency by optimizing the performance and reliability of your assets. Facilities and healthcare institutes frequently perform these preventive maintenance drives once or twice in a year to ensure quality services and smooth process operations which in turn is expected to create a larger base of demand for the market in future years.

By Service Providers

In 2023, the OEM segment dominated the market and generated the highest revenue share of more than 70.89%. OEM spare parts are the most specialized and tailored maintenance solutions based on the individualized needs for certain products or equipment. After the warranty has expired, OEMs also stand to profit from offering maintenance, repair, and other services. This helps to nurture lasting relationships with customers and encourage loyalty. It is knowledgeable about its equipment: Design (including component-specific design), Functions, Physical Characteristics, and Operating Characteristics.

The small/third-party providers segment is projected to grow at the highest CAGR of 10.93% during the forecast period. There are many small/third-parties that specialize in the service of specific types of medical equipment; so even they have a depth of knowledge in the area. Able to adopt new Technologies and maintenance requirement. Smaller providers have a better understanding of the local regulations, infrastructure, and market dynamics. Proximity of health services ensures quick response in case of emergencies.

By End-Use

The hospitals segment held the largest revenue share in 2023. A surge in the world's senior population is causing an increase in diabetes, heart disease, and cancer, requiring increasingly sophisticated diagnostic and therapeutic equipment. Private health care institutions are also investing into better technology to provide better treatment for patients to attract more patients. In addition, increasing government spend on health infrastructure and services is creating the demand for advanced medical devices.

During the forecast period, this segment of ambulatory surgical centres is expected to achieve the highest CAGR. Patients can book procedures during times that are more accessible and face minimal waiting times in ASCs. Minimally invasive surgery is being used for more and more methods, many of which can be done on an outpatient basis. Newer technologies like robotic surgery units and advanced imaging methods have increased the capabilities of ASCs.

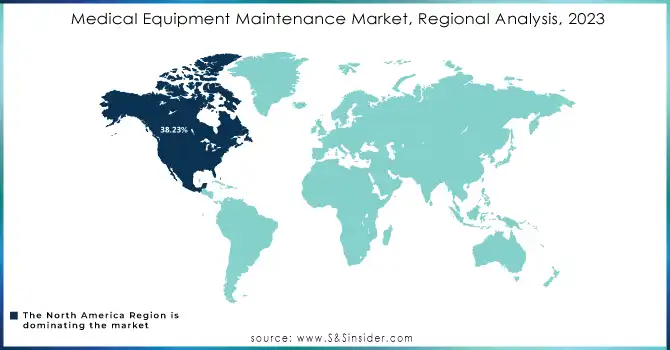

Medical Equipment Maintenance Market Regional Overview

In 2023, the North America dominated the medical equipment maintenance market with revenue share of 38.23%. Providing quality healthcare, coupled with growing instances of chronic diseases, becoming more expensive to treat, combined with the availability of ambulatory surgical centers in the region, are factors expected to boost growth for the market. The past 13-15 years have seen notable growth in a developed market for the health industry and medical tourism in the North American region. This has created a continuous need for round-the-clock works of medical devices.

From 2024 to 2034, the fastest growing CAGR in the medical equipment maintenance market is anticipated in the Asia Pacific region. The region has very populated countries like China and India, with more than half of the world population living here. As the demographics shifts to more elderly and fewer young, working people, demand for healthcare services in the region will grow significantly over the years. Now, access to care, cost and quality remain major healthcare problems across the region. Such elements are expected to grow exponentially for the medical equipment maintenance market.

Need Any Customization Research On Medical Equipment Maintenance Market - Inquiry Now

Key Players

The major key players are

-

Siemens Healthineers - CT Scanners

-

Philips Healthcare - Ultrasound Machines

-

Medtronic - Ventilators

-

Johnson & Johnson - Surgical Instruments

-

B. Braun - Infusion Pumps

-

Stryker - Endoscopic Equipment

-

Canon Medical Systems - X-ray Equipment

-

Honeywell - Thermometers and Patient Monitoring Equipment

-

Mindray - Patient Monitoring Systems

-

Fujifilm - Digital X-ray Systems

-

Toshiba Medical Systems - MRI Systems

-

Hitachi Medical Corporation - MRI Equipment

-

Becton Dickinson - Insulin Infusion Pumps

-

Zimmer Biomet - Surgical Equipment

-

Thermo Fisher Scientific - Laboratory Equipment

-

Invacare Corporation - Home Care Equipment

-

ReNew Biomedical Services - Defibrillators

-

Varex Imaging - X-ray Tubes and Detectors

-

MedeAnalytics - Healthcare Analytics Software for Maintenance Optimization

Recent Developments

In February 2024, GE Healthcare partnered with reLink Medical to launch a new asset management platform that aims to simplify equipment monitoring and maintenance. This solution helps healthcare providers track their medical assets in real time, ensuring timely maintenance and reducing operational costs

In January 2024, Siemens Healthineers announced the expansion of its digital offerings in medical equipment maintenance. Their new service leverages AI and predictive analytics to reduce downtime and improve the operational efficiency of medical equipment in hospitals. This move is aimed at enhancing customer experience and optimizing preventive maintenance schedules.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 47.82 Billion |

| Market Size by 2032 | USD 116.35 Billion |

| CAGR | CAGR of 10.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Imaging Equipment) • By Service (Preventive Maintenance, Corrective Maintenance, Operational Maintenance) •By Service Provider (OEM, Small/Third Party Providers) • By End-Use (Hospitals, Diagnostic Imaging Centers, Dialysis Centers, Ambulatory Surgical Centers, Dental Clinics & Speciality Clinics,Other End Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Siemens Healthineers, Philips Healthcare, Medtronic, Johnson & Johnson, B. Braun, Stryker, Canon Medical Systems, Honeywell, Mindray, Fujifilm, Toshiba Medical Systems. |

| Key Drivers | • As medical devices become more advanced, they require specialized maintenance to ensure proper functioning and prevent failures • Healthcare providers are increasingly adopting preventive maintenance strategies to avoid unplanned downtimes and reduce repair costs |

| Restraints | • Integrating advanced technologies like IoT and predictive analytics requires significant upfront investment and training, which can be a barrier for some organizations • Strict healthcare regulations around equipment maintenance can make it more difficult for organizations to adopt new, more efficient practices |