Tuberculosis (TB) Diagnostics Market Size & Overview:

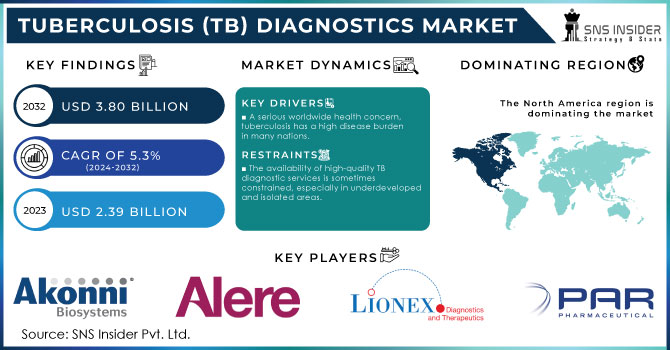

The tuberculosis (TB) diagnostics market size was worth USD 2.39 Billion in 2023 and is expected to reach USD 3.80 Billion by 2032 and grow at a CAGR of 5.29% over the forecast period of 2024-2032.

The report includes a comprehensive analysis of healthcare facility loan distribution and its impact on diagnostic infrastructure, especially in low- and middle-income countries. The report covers the adoption of advanced diagnostic technologies and provides equipment lifecycle data relevant to TB testing systems. The report also studies recent mergers and acquisitions, which are shaping landscape of medical diagnostics financing. In addition, as of 2023, the report highlights the surge in the demand for tailored financing solutions to boost access to TB diagnostics and innovative trends in research and development across various diagnostic types globally. Tuberculosis (TB) diagnostics shows how the technological, financial, and strategic dynamics are propelling the market expansion globally.

Get More Information on Tuberculosis (TB) Diagnostics Market - Request Sample Report

The market expansion in the U.S. was valued at USD 309 Million in 2023 and is projected to be valued at USD 526 Million by 2032, expanding at a CAGR of 6.09% during the forecast period.

In 2023, the U.S. held the largest tuberculosis (TB) diagnostics market share due to its advanced diagnostic technologies, strong government commitments, and robust healthcare infrastructure for surveillance and controlling TB. In the U.S., the tuberculosis (TB) diagnostics market growth is driven by the large implementation of nucleic acid amplification tests (NAATs), strong investments in public health programs via agencies including the NIH and CDC, and availability of TB test kits approved by the U.S.-FDA. In addition, the growth of the market is also propelling owing to the presence of the leading diagnostic players and ongoing research collaborations with academic institutions, further boosting innovation and the adoption of faster and more accurate TB diagnostic tools.

MARKET DYNAMICS

Drivers:

-

Rising Government Funding and Public Health Initiatives to Accelerate Market Growth

The surging government funding and synchronized public health efforts, particularly targeting the eradication of tuberculosis (TB) is driving the tuberculosis (TB) diagnostics market growth. The high adoption of different national TB programs and international initiatives, such as End TB Strategy by WHO has increased the implementation of TB screening campaigns and upgrades in diagnostics infrastructure on a large scale. In the U.S., agencies including the NIH and CDC have substantially raised investments to control TB spread, further allowing broader access to advanced diagnostics, such as interferon-gamma release assays (IGRAs) and nucleic acid amplification tests (NAATs). The developing nations are also receiving both technical and financial support from global organizations to tackle the spread of tuberculosis (TB), improving early detection and treatment outcomes. These strategic efforts are raising the demand for effective and rapid tuberculosis (TB) diagnostic tools, which makes the involvement of public-sector companies a major driver of the market growth globally.

Restraints:

-

High Advanced TB Diagnostic Tools Costs is Hampering their Accessibility in Low-resource Healthcare Settings

As advanced technologies have substantially amended the speed and accuracy and accuracy of tuberculosis TB diagnostics, the high cost of these diagnostic tools act as a major restraint hampering market growth, specifically in the low- and middle-income countries. Techniques, such as line probe assays, NAATs, and next-generation sequencing offer superior diagnostic performance but they have high maintenance costs, skilled professionals, and expensive instruments. This creates a discrepancy in TB detection capabilities between resource-limited regions having high burden of TB and high-income nations. Furthermore, the lack of reimbursement policies for latest diagnostic procedures in several healthcare systems also limits the adoption of these diagnostic tools. Regardless of the support from the government and donor in several areas, the deployment of these advanced diagnostic tools is still challenging due to limited funds in the underfunded healthcare settings, raising a critical challenge to reach the goal of global TB control and hindering market growth in the underdeveloped regions.

Opportunities:

-

Emerging Point-of-Care TB Diagnostic Solutions Present Lucrative Opportunities in Remote and Rural Areas

The development of affordable and portable point-of-care (POC) diagnostic solutions offers a major opportunity in the TB diagnostics market, especially for regions with limited laboratory infrastructure. These tools can be deployed directly at community health centers, further allowing for immediate treatment decisions and early detection of the disease even in remote regions. The high adoption of innovations, such as microfluidic devices, smart-phone integrated diagnostics, and paper-based biosensors for tuberculosis (TB) detection, with many products are already in the development stages. Different organizations, including the Bill & Melinda Gates Foundation and FIND are funding research to propel the launch of low-cost and scalable TB POC technologies globally. The demand for POC diagnostics is projected to increase as the global health policies are emphasizing the decentralized care and equitable access, further driving the market expansion.

Challenges:

-

Infrastructure Challenges and Lack of Skilled Laboratory Professionals are Limiting the Accuracy of TB diagnostic in Developing Nations

The lack of trained or skilled laboratory professionals and inadequate diagnostic infrastructure in several high-TB-burden regions are some of the major challenges affecting the market expansion globally. Complex tests, including molecular assays and culture-based detection significantly require skilled personnel and sophisticated laboratory settings, which are mainly absent in the rural and underdeveloped regions. In addition, poor maintenance of diagnostic equipment, inconsistent sample collection practices, and lack of high-quality reagents, negatively affects the test results, further decreasing the disease control efforts. The inability to safeguard the quality and standardization across multiple testing sites severely impedes the patient outcomes and diagnostic accuracy, even with the availability of advanced technologies. To overcome this challenge, a systemic investment in building the healthcare capacity, enhanced logistics for ensuring reliable TB detection, and continuous training programs across all the healthcare ecosystem levels.

SEGMENTATION ANALYSIS:

By Type

Based on type, the market is classified into detection of latent infection (skin test & IGRA), phage assay, detection of drug resistance (DST), nucleic acid testing, radiographic method, cytokine detection assay, and others. In 2023, the market is being dominated by the latent infection detection segment with a share at around 43%. The segment’s growth is attributed to its growing use in addressing critical need for asymptomatic carriers’ identification that can later provide active disease. The interferon-gamma release assays (IGRAs) and tuberculin skin tests (TSTs) are majorly used owing to their proven sensitivity and specificity in mycobacterium tuberculosis infection detection before symptoms arise. Public health programs in both high‑ and low‑burden nations are prioritizing the latent TB screening process among the high‑risk groups, including immunocompromised patients, healthcare workers, and people having close contacts with active TB patients to prevent TB transmission and decrease disease incidence.

By End-Use

On the basis of end-use, the market is trifurcated into diagnostic laboratories, hospitals & clinics, and others. The hospitals & clinics segment dominated the market in terms of share at around 47% in 2023. The segment’s growth is driven by the vital role of hospitals in administering vaccinations for Hepatitis B during birth and during postnatal care and regular medical services. Hospitals, as the first service contact point for newborns, routinely administer hepatitis B birth dose as part of national immunization programs especially in countries with very high birth rates and good institutional delivery coverage. Likewise, hospitals have the facilities and staff to store and administer vaccines and monitor for any post-vaccination adverse events and must abide by safety protocols set by the government. Increased awareness about nosocomial infections and preventive healthcare, in addition to adults and healthcare workers, are now choosing to be vaccinated for hepatitis B during routine hospital visits or pre-employment screenings. This, coupled with greater patient confidence for hospital-based care has cemented hospitals as the preferred center to the distribution and administration, thereby capturing the leading share of the market globally.

REGIONAL ANALYSIS

In 2023, Asia Pacific held the largest market share in the tuberculosis (tb) diagnostics market around 39%. The growth is driven by its high disease burden, growing healthcare investments, and rapid adoption of diagnostic technologies across emerging economies. Countries, such as India, China, Indonesia, and the Philippines account for a significant portion of global TB cases, prompting strong governmental and international efforts to scale up early detection and treatment. National programs such as India’s National TB Elimination Programme (NTEP) and China's expanded public health strategies have accelerated the deployment of advanced diagnostic tools, including GeneXpert systems and digital chest X-rays. Additionally, Asia Pacific benefits from an expanding network of public-private partnerships and support from global agencies such as WHO and the Global Fund. The region’s large population base, rising awareness, and ongoing healthcare infrastructure development collectively make it the dominant contributor to the global TB diagnostics market.

For instance, Indonesia reported over 1 million TB cases in 2023, an increase from approximately 820,000 cases in 2020, with TB-related deaths reaching around 134,000 in 2022, the second highest globally after India. Similarly, the Philippines' Department of Health recorded 446,478 TB cases as of September 30, 2023.

North America held a significant share in the tuberculosis (TB) diagnostics market owing its advanced healthcare infrastructure, high awareness levels, and strong government-led TB control programs. The U.S. and Canada have established comprehensive public health surveillance systems and prioritize early detection, routine screening, and preventive strategies for high-risk populations, such as immigrants, immunocompromised individuals, and healthcare workers. The U.S. Centers for Disease Control and Prevention (CDC) actively funds TB control efforts, including the use of advanced diagnostic methods, such as nucleic acid amplification tests (NAATs) and interferon-gamma release assays (IGRAs). Additionally, the presence of major diagnostic technology providers and consistent investments in research and development enhance regional capabilities. Furthermore, stringent regulatory guidelines and reimbursement policies ensure the adoption of quality diagnostic tools, making North America a key contributor to the global tuberculosis (TB) diagnostics market expansion.

List of Key Players in the Market:

-

Akonni Biosystems Inc. (TruTip Sample Prep, TB Multi-Drug Resistance Panel)

-

Alere Inc. (Alere Determine TB LAM Ag, Alere qTB)

-

Par Pharmaceutical (Isoniazid Tablets, Rifampin Capsules)

-

Lionex GmbH (LIONEX TB LAM Rapid Test, TB IgG ELISA)

-

Creative Diagnostics (TB Ag85 ELISA Kit, TB ESAT-6 Recombinant Protein)

-

Abbott Laboratories (RealTime MTB, m2000 System)

-

BioMerieux SA (VIDAS TB IGRA, BacT/ALERT 3D)

-

Cepheid (GeneXpert MTB/RIF, GeneXpert MTB/XDR)

-

Hologic Inc. (Panther Fusion System, Aptima MTB Assay)

-

F. Hoffmann-La Roche Ltd. (COBAS MTB, COBAS TaqMan MTB-RIF)

-

Qiagen (QuantiFERON-TB Gold Plus, QIAstat-Dx Analyzer)

-

BD (Becton, Dickinson and Company) (BD MAX MDR-TB, BD MGIT 960)

-

Siemens Healthineers (CLINITEK Status+, Dimension EXL)

-

Thermo Fisher Scientific (TaqMan TB Detection Kit, Ion Torrent NGS)

-

Bio-Rad Laboratories Inc. (Platelia TB ELISA, BioPlex 2200 System)

-

Luminex Corporation (xMAP Technology, ARIES System)

-

PerkinElmer Inc. (DELFI Diagnostics, TB PCR Detection Kit)

-

Zhejiang Orient Gene Biotech Co. Ltd. (TB Rapid Test Cassette, TB Antigen Detection Kit)

-

Tosoh Corporation (AIA-900 Analyzer, Enzyme Immunoassay Kit for TB)

-

Oxford Immunotec (T-SPOT.TB, T-Cell Select Kit)

Recent Developments:

-

In 2024, QIAGEN launched the QIAseq xHYB Mycobacterium Tuberculosis Panel, a culture-independent solution for whole genome sequencing directly from patient samples, which significantly accelerates diagnostic timelines and enhances real-time tracking of tuberculosis outbreaks.

-

In 2023, Siemens Healthineers and Global Fund partnered to promote the integration of artificial intelligence into chest X-ray screening for tuberculosis to enhance diagnostic accuracy and operational efficiency in TB detection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.39 Billion |

| Market Size by 2032 | USD3.80Billion |

| CAGR | CAGR of5.29 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Detection of Latent Infection (Skin Test & IGRA), Phage Assay, Detection of Drug Resistance (DST), Nucleic Acid Testing, Radiographic Method, Cytokine Detection Assay, Others) • By End Use (Diagnostic Laboratories, Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Akonni Biosystems Inc., Alere Inc., Par Pharmaceutical, Lionex GmbH, Creative Diagnostics, Abbott Laboratories, BioMerieux SA, Cepheid, Hologic Inc., F. Hoffmann-La Roche Ltd., Qiagen, BD (Becton, Dickinson and Company), Siemens Healthineers, Thermo Fisher Scientific, Bio-Rad Laboratories Inc., Luminex Corporation, PerkinElmer Inc., Zhejiang Orient Gene Biotech Co. Ltd., Tosoh Corporation, Oxford Immunotec |