Programmatic Advertising Market Report Scope & Overview:

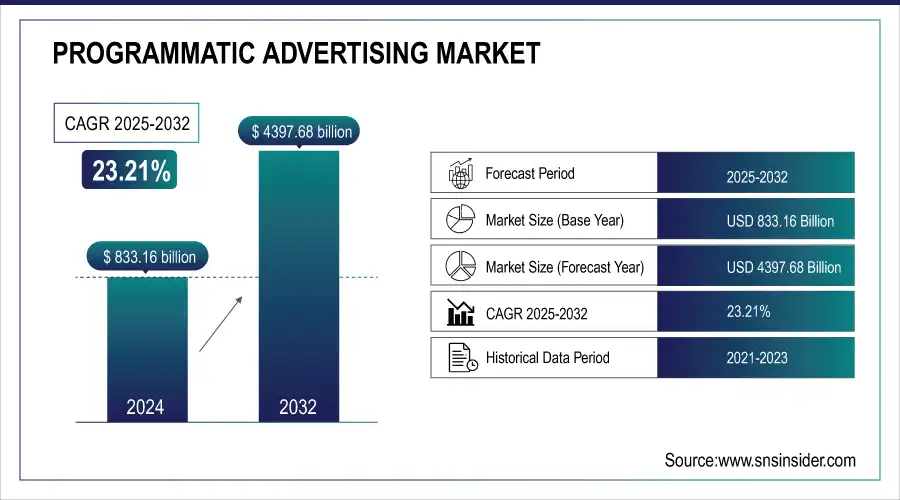

The programmatic advertising market size was valued at USD 833.16 billion in 2024 and is expected to reach USD 4397.68 billion by 2032, growing at a CAGR of 23.21% over 2025-2032.

The programmatic advertising market growth is driven by the rising trends of AI and machine learning adoption for real-time ad targeting, growing digital media consumption along with a transition toward data-driven marketing strategy. The demand for automating marketing in order to maximize reach and ROI is at an all-time high due to the increase in customer engagement through mobile and social media, and on streaming platforms, such as Netflix or Hulu, where brands have the opportunity to launch targeted campaigns. Moreover, 5G rollout and increase in penetration of connected devices is also speeding the ad delivery to consumers along with personalization. Privacy-first programmatic solutions and first-party data use will also help build advertiser trust while driving sustainable growth in the market.

To Get more information on Programmatic Advertising Market - Request Free Sample Report

-

In the U.S., 88.2% of all display ads in 2024 are expected to be purchased programmatically, highlighting the dominance of automated platforms over manual ad buying.

-

JWP Connatix, serving over 7,000 publishers, leverages AI technologies, such as Deep Contextual, which apply natural language processing and machine learning to optimize video and streaming ad targeting supporting the industry's pivot toward AI-driven, short-form content environments.

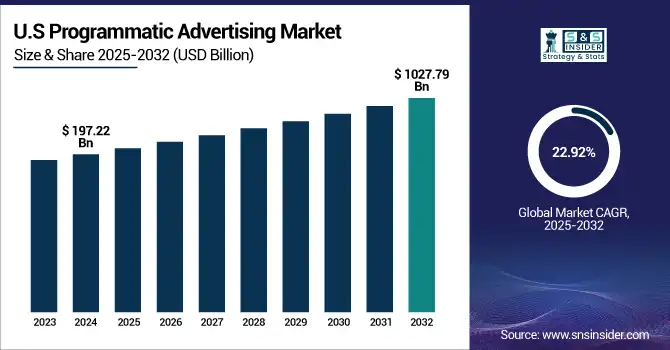

The U.S. programmatic advertising market size was valued at USD 197.22 billion in 2024 and is expected to reach USD 1027.79 billion by 2032, growing at a CAGR of 22.92% over 2025-2032.

The U.S. programmatic advertising market is growing due to the rising demand for personalized digital ads, increased mobile and video content consumption, widespread adoption of AI-driven ad platforms, and a strong focus on data-driven marketing strategies across industries.

Programmatic Advertising Market Dynamics:

Drivers:

-

Surge in Data-Driven Marketing Strategies is Enhancing Automation and Precision Across Digital Advertising Campaigns Globally

The rapid move to data-driven marketing is changing the way advertisers hit audiences. With the demand for hyper-personalization and efficiency in campaigns, brands are allocating more budgets to programmatic solutions, enabling them to automate real-time buying of advertising inventory. Extensive user data accessible to marketers enables targeting of accurate demographics, behaviors, and interests, leading to increased ROI. The transition is also driven by the continual development of AI and machine learning, which simplify the process of bidding and delivering content. With this drive for efficiency in audiences and spend, programmatic advertising becomes the clear solution to implementing broad reach and engaging, scalable and agile campaigns across digital environments.

-

WPP, one of the world’s largest ad agencies, reported in 2025 that over 50% of its 96,000 employees now use its AI-powered platform WPP Open for campaign design and optimization.

Restraints:

-

Rising Concerns over Data Privacy and Regulatory Compliance are Limiting Targeting Capabilities in Programmatic Advertising Ecosystems

As governments and consumers demand stronger privacy controls, advertisers face mounting restrictions on data usage. Programmatic apps still rely behaviorally targeted advertising via audiences, but access to third-party cookies is restricted by legislation, such as GDPR and CCPA. This change rattles the old school methods of tracking and personalization, leaving marketers with two options including adapt or see their performance suffer. The shift to privacy-first also means increased dependence on first-party data, which is usually small-scale. Advertisers' tech platforms are now forced to pour significant amounts of money into alternative identity solutions, such as contextual targeting and consent-based models, which still needed time to reform. These nuances place a sizeable burden on continuous programmatic delivery.

Opportunities:

-

Expansion of Connected Tv (Ctv) and Over-The-Top (Ott) Platforms is Unlocking High-Value Programmatic Ad Inventory Across Streaming Content

As traditional TVs move to streaming, the stage is set for programmatic ads With the ability to target precisely, Connected TV and OTT platforms deliver the impactful experience of TV. In the process, advertisers are taking advantage of CTV's premium inventory to deploy high-quality, non-skippable ads with measurable results. Programmatic CTV is valuable for the access it offers to real-time viewer data and the ability to segment audiences by viewing habits. With viewers increasingly consuming on-demand video content on devices from Roku to Hulu and Amazon Fire TV, advertisers gain a new opportunity to connect with audiences through scalable, data-driven video campaigns bought through automated systems.

-

The Roku–Amazon Ads partnership now enables reach to 80 million U.S. connected‑TV households (~80% of the market), improving performance with early tests showing 40% more unique reach and a 30% reduction in ad repetition.

-

In 2024, 95% of advertisers stated they intended to maintain or increase programmatic CTV ad spend, reflecting the growing strategic importance of CTV for both branding and performance campaigns.

Challenges:

-

Dependency on Third-Party Cookies and Identifiers is Undermining Future Scalability of Programmatic Ad Targeting and Attribution

The planned phase-out of third-party cookies by leading browsers and the increasingly strict IDFA rules on iOS will begin to undermine the bedrock of programmatic targeting. Historically, these identifiers have allowed for the cross-site tracking of users and highly detailed profiling necessary to serve personalized ads and accurately attribute performance. Without these data, advertisers cannot see user journeys, potentially resulting in lower efficiency of campaigns. While there are alternatives in the making (such as first-party data, contextual targeting, and identity graphs), they were not as mature and widely used as existing systems. This shift will bring significant scalability, reach and measurement challenges to the existing programmatic advertising ecosystem for years to come.

Programmatic Advertising Market Segmentation Analysis:

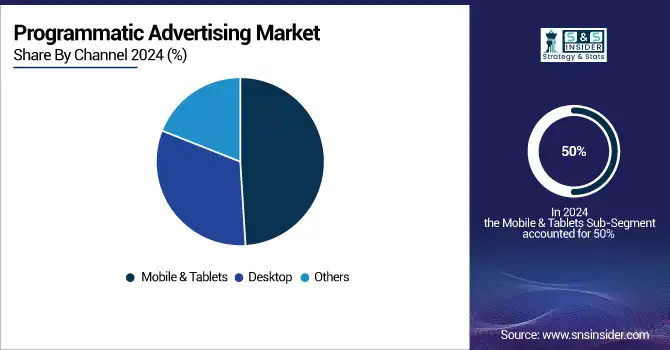

By Channel

Mobile & Tablets segment captured 50% of the Programmatic Advertising Market in 2024, driven by widespread of smartphones and growing prevalence of mobile internet activity. Consumers spend most of their time on mobile apps and mobile web pages. Programmatic tools enable marketers to deliver hyper-targeted, location-aware campaigns to users on-the-go, solidifying the segment as a leader across the e-commerce, gaming, entertainment and news media landscapes globally.

Others segment is expected to register the highest CAGR of 25.15% over 2025-2032, propelled by emerging devices, such as smart TVs, wearable devices, and voice-enabled assistants. As digital eco systems evolve further away from the dias, advertisers are looking into programmatic formats across new channels to engage customers. As more and more devices get connected, there is more inventory available that remains largely untapped for targeted advertising through automated and data-rich systems.

By End-Use

Retail & Consumer Goods segment led the Programmatic Advertising Market share in 2024 with a 34% due to high consumer engagement and purchase intent. Real-time targeting and data-driven campaigns to conversions are the main concerns for the brands in this segment. Access to rich customer databases and real-time operating advertising channels means the ecosystem has found techniques of precision marketing that lead to impactful buying behavior, creating reliably sticky demand for programmatic ads.

Media & Entertainment segment is projected to grow at the fastest CAGR of 25.95% over 2025-2032 due to accompanied extension in consumption of digital content via OTT, gaming, and streaming mediums. Personalized campaigns, unique ad formats, interactivity, and very high frequency campaigns everything that makes programmatic a perfect fit for this sector. Advertisers in media, as content consumption continues to reach new areas and breadths, are looking to better reach digital audiences in a scalable and automated way.

By Ad Format

Video segment led the Programmatic Advertising Market in 2024 with a 24% revenue share, owing to increasing consumer inclination toward video content on platforms, such as YouTube, Instagram, and CTV to drive the revenue. Video ads provide immersive storytelling, higher engagement, and better ROI. Programmatic video is a top choice for advertisers that want to maximize ad impact in the form of rich media and drive brand recall and action, especially on mobile and streaming devices, where the majority of video viewing happens.

Image segment is expected to expand at the fastest CAGR of 24.56% over 2025-2032, owing to the increasing adoption of lightweight, fast-loading advertisement formats apt for a mobile-first ecosystem. Static image ads are also inexpensive to develop and also perform well on social media networks and display networks. With brands looking at scalable visual branding and retargeting, programmatic image advertising provides an attractive summary of reach and frequency.

By Auction

Real-Time Bidding (RTB) segment dominated the Programmatic Advertising Market in 2024 with a 42% share, as a result of its ability to auction ad buying in real-time. Through RTB, advertisers can bid for impressions in real-time for cost-effectiveness and precision targeting. Its extensibility across open exchanges makes this a go-to model for readily engaging the masses. Advertisers can now control their ROI by having the capability to instantly optimize their campaigns.

Private Marketplace (PMP) segment is projected to grow at the fastest CAGR of 25.99% over 2025-2032, due to rising need for brand-safe and high-quality inventory. More Advertisers are Moving to Curated Environments with Transparency, Non-Quality Placements, and Publisher Direct. With fraud and ad misplacement concerns soaring, PMP adoption is growing as it combines the efficiency of programmatic with the trust and scarcity of direct deals.

Programmatic Advertising Market Regional Outlook:

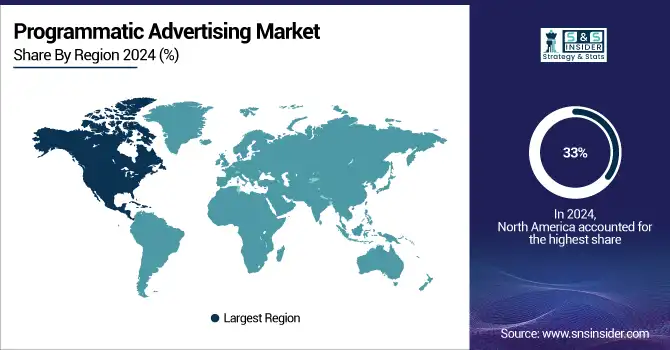

North America held the largest share of 33% in the Programmatic Advertising Market in 2024, owing to its leading digital infrastructure and high rate of ad-tech adoption. The region has a wider programmatic ecosystem, global tech major presence and early adoption of AI-based ad-platforms. North America retains significant industry penetration as it is home to mature consumer markets and high digital ad spend by major retail, media and tech sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. is dominating the programmatic advertising market due to its advanced ad-tech ecosystem, high digital ad spend, and early technology adoption.

Asia Pacific is anticipated to grow at the fastest CAGR of 25.08% over 2025-2032, owing to the growing rate of digitalization, high penetration of smartphones, and digitalization of e-commerce. The global advertisers are interested with the rising internet connectivity and increasing middle-class population in India, China, and Southeast Asian countries. With automation and localized targeting complementing programmatic strategies, the region carries an enormous potential opportunity for programmatic advertising growth across mobile, video and social.

China is dominating the programmatic advertising market in Asia Pacific, driven by massive digital user base, advanced AI integration, and strong e-commerce advertising demand.

Europe is experiencing steady growth in the programmatic advertising market, fueled by rising digital adoption, privacy-focused regulations, and increasing demand for automated, data-driven ad solutions across diverse industries and consumer segments.

The U.K. is dominating the programmatic advertising market in Europe due to strong digital infrastructure, high ad spending, and widespread adoption of automation technologies.

Programmatic Advertising Market trends in the Middle East & Africa and Latin America reflects an emerging growth trajectory fueled by increasing internet penetration, rising mobile usage, and accelerating digital transformation. Advertiser interest and expanding digital ecosystems are driving gradual adoption and market development across both regions.

Key Players:

Programmatic Advertising Market companies are Alphabet Inc. (Google LLC), Meta (Facebook), Amazon.com, Inc., Microsoft, Alibaba Group Holding Limited, Adobe, The Trade Desk, Criteo, NextRoll, Inc. (AdRoll), MediaMath, Magnite, Inc., PubMatic, Inc., Index Exchange, Sovrn Holdings, Inc., OpenX Technologies, Inc., Taboola, Outbrain Inc., InMobi, Basis Technologies (formerly Centro), and Verizon Media.

Recent Developments:

-

2025: Meta Platforms also announced plans for fully autonomous AI‑powered ad creation across Facebook and Instagram by end of 2026, set to radically streamline campaign setup with image + budget inputs.

-

2024: Google Ads launched new generative AI features and insights controls for AI‑powered campaigns at DMEXCO in September 2024, giving advertisers more oversight and customization capabilities.

-

2023: Amazon introduced Amazon Publisher Cloud (Beta), enabling publishers to securely collaborate using first‑party signals and Amazon DSP to plan and activate programmatic deals via clean room infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 833.16 Billion |

| Market Size by 2032 | USD 4397.68 Billion |

| CAGR | CAGR of 23.21% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Auction Type (Real-Time Bidding (RTB), Private Marketplace (PMP), Preferred Deals, Programmatic Direct) • By Ad Format (Image, Video, Text, Others) • By Channel (Mobile & Tablets, Desktop, Others) • By End Use (Media & Entertainment, BFSI, Education, Retail & Consumer Goods, Telecom & Communication, Healthcare, Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Alphabet Inc. (Google LLC), Meta (Facebook), Amazon.com, Inc., Microsoft, Alibaba Group Holding Limited, Adobe, The Trade Desk, Criteo, NextRoll, Inc. (AdRoll), MediaMath, Magnite, Inc., PubMatic, Inc., Index Exchange, Sovrn Holdings, Inc., OpenX Technologies, Inc., Taboola, Outbrain Inc., InMobi, Basis Technologies (formerly Centro), Verizon Media |