Mainframe Modernization Market Report Scope & Overview:

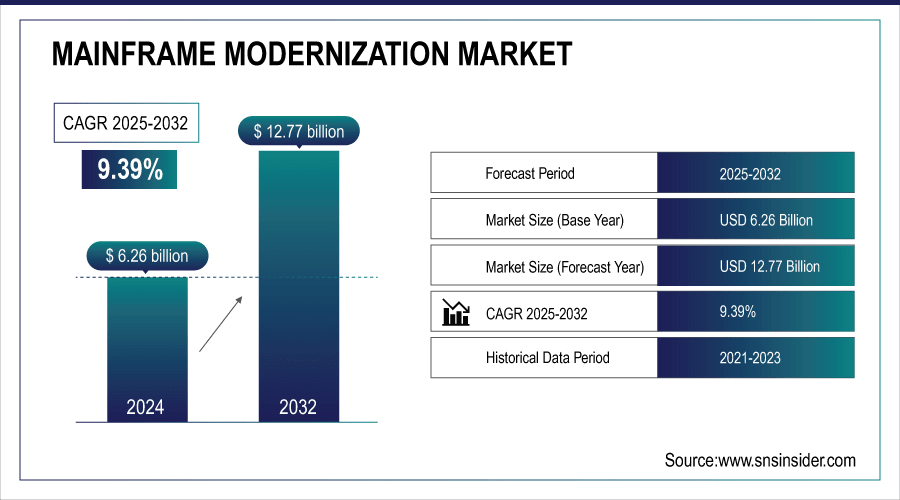

Mainframe Modernization Market was valued at USD 6.26 billion in 2024 and is expected to reach USD 12.77 billion by 2032, growing at a CAGR of 9.39% from 2025-2032.

The Mainframe Modernization Market is growing due to increasing demand for enhanced IT agility, scalability, and cost efficiency. Organizations are shifting from legacy mainframes to modern platforms to support digital transformation, cloud adoption, and real-time data processing. Rising need for improved application performance, reduced maintenance costs, and integration with emerging technologies such as AI, IoT, and analytics further drives adoption across banking, healthcare, IT, and other sectors

Fujitsu reports that more than 220 billion lines of COBOL code are still in active use globally, highlighting the massive reliance on legacy systems and the urgency for modernization.

AWS reinforces this trend through its Mainframe Modernization service, designed to migrate on-premises workloads into cloud-native managed runtimes, delivering reduced operational costs, faster testing, and improved migration management making modernization both scalable and cost-efficient.

To Get More Information On Mainframe Modernization Market - Request Free Sample Report

Mainframe Modernization Market Trends

-

Growing need to replace legacy mainframes with cloud-based, scalable architectures for cost efficiency.

-

Adoption of AI, automation, and DevOps is accelerating modernization and operational agility.

-

Rising demand for real-time processing and analytics is driving migration to modern platforms.

-

Integration with hybrid and multi-cloud environments enhances flexibility and resilience.

-

Regulatory compliance and data security requirements are motivating system upgrades.

-

Legacy application refactoring and containerization are enabling faster deployment and innovation.

-

Enterprises are prioritizing digital transformation to support omnichannel services and improved customer experiences.

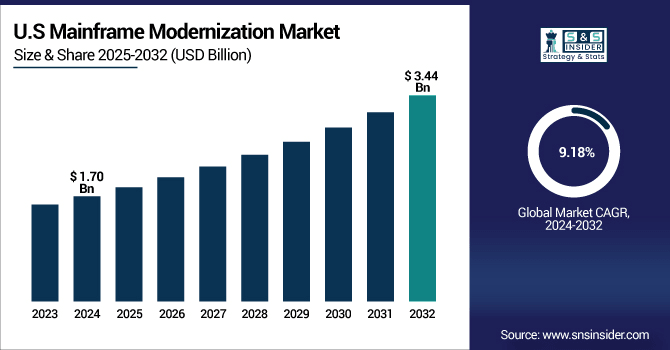

U.S. Mainframe Modernization Market was valued at USD 1.70 billion in 2024 and is expected to reach USD 3.44 billion by 2032, growing at a CAGR of 9.18% from 2025-2032.

The U.S. Mainframe Modernization Market is growing due to increasing digital transformation initiatives, cloud adoption, and demand for cost-efficient, scalable IT infrastructure, enabling organizations to modernize legacy systems and enhance performance, security, and real-time data processing.

Mainframe Modernization Market Growth Drivers:

-

Rising demand for scalable and cost-efficient IT infrastructure drives modernization initiatives for enterprises across industries globally

Rising demand for scalable and cost-efficient IT infrastructure has become a primary reason for enterprises to modernize mainframes. Traditional systems are expensive to maintain and lack the flexibility required for growing digital workloads. Organizations are migrating to cloud platforms and hybrid models that offer reduced operational costs, improved agility, and faster deployment. This transition allows companies to optimize resources, enhance customer experiences, and support innovation. Enterprises are under pressure to ensure real-time data processing and scalability, which legacy mainframes cannot deliver efficiently. Thus, modernization becomes a strategic priority to balance cost, performance, and competitive advantage.

-

AWS highlights that legacy mainframes may cost up to USD 16 million per year in public sector scenarios, while migration to AWS can cut capital and operating costs by 40–90%. Real-world examples include the UK Driver & Vehicle Standards Agency cutting costs by 50% and the U.S. Air Force saving USD 25 million annually.

-

IBM reinforces this trend, noting that 68% of IT executives see mainframes as central to hybrid cloud strategies, and organizations are 12× more likely to reuse than rebuild mainframe assets. Further, mainframes handle 72% of global transaction workloads but account for just 8% of enterprise IT costs, with 75% of IT leaders rating them equal to or more cost-effective than cloud in terms of total cost of ownership.

Mainframe Modernization Market Restraints:

-

Shortage of skilled professionals and expertise in legacy and modern systems limits smooth transition and modernization success

Shortage of skilled professionals with expertise in both legacy and modern systems has emerged as a strong restraint for mainframe modernization. Many enterprises face difficulties finding specialists who can effectively manage transitions while ensuring business continuity. Legacy mainframe experts are retiring, while modern cloud and API specialists lack sufficient knowledge of outdated systems. This talent gap complicates integration, increases project timelines, and raises modernization costs. Without proper expertise, organizations risk project failures, inefficient migrations, and vulnerabilities. The shortage of hybrid skill sets directly limits modernization speed, reducing efficiency and slowing global adoption despite rising demand.

Mainframe Modernization Market Opportunities:

-

Growing adoption of hybrid cloud models and AI-driven automation creates promising opportunities for modernization globally

Growing adoption of hybrid cloud models and AI-driven automation creates significant opportunities for mainframe modernization across industries. Hybrid models enable enterprises to balance the strengths of mainframes with the scalability of cloud environments. AI and automation simplify workload migration, reduce downtime, and optimize performance during modernization projects. Enterprises can leverage cloud-native analytics, predictive maintenance, and real-time monitoring, enhancing operational efficiency. This integration provides flexibility for scaling applications while maintaining data security. As organizations aim for agile, cost-effective, and intelligent systems, the combination of hybrid cloud and AI opens new growth avenues for modernization providers.

-

According to a survey, 99% of businesses are already pursuing a hybrid approach to mainframe modernization, with 95% planning to move some workloads to the cloud. On average, 37% of application portfolios are expected to migrate, and projects implementing these strategies have delivered 9–11% boosts in profitability highlighting the tangible value of hybrid modernization.

Mainframe Modernization Market Segment Analysis

-

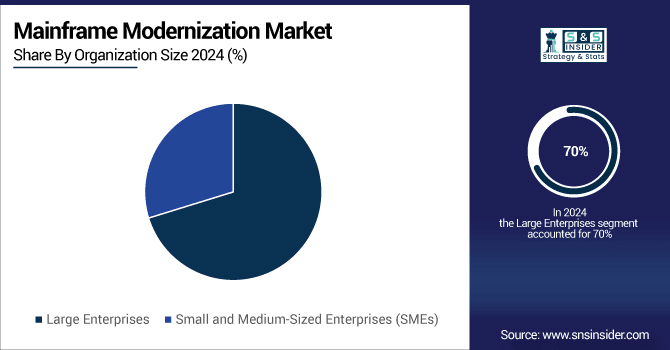

By Organization Size, Large Enterprises dominated with ~70% share in 2024; Small and Medium-Sized Enterprises (SMEs) fastest growing (CAGR 11.50%).

-

By Component, Software dominated with ~59% share in 2024; Services fastest growing (CAGR 10.64%).

-

By Vertical, Banking, Financial Services, & Insurance (BFSI) dominated with ~32% share in 2024; Healthcare fastest growing (CAGR 12.09%).

-

By Modernization Type, Rehosting dominated with ~30% share in 2024; Rearchitecting fastest growing (CAGR 11.15%).

-

By Tool Type, Cloud Migration Tools dominated with ~32% share in 2024; Application Development Tools fastest growing (CAGR 11.19%).

Mainframe Modernization Market Segment Analysis

By Organization Size, Large Enterprises led while SMEs are projected to grow rapidly

Large enterprises held the largest share in 2024 due to their reliance on legacy systems for mission-critical operations across industries like banking, insurance, and government. Their significant IT budgets, large-scale digital transformation initiatives, and focus on maintaining operational efficiency while ensuring compliance drive demand for modernization. Established enterprises prioritize scalable modernization strategies to enhance agility and competitiveness.

Small and medium-sized enterprises are expected to grow rapidly from 2025 to 2032 as they increasingly adopt cost-effective modernization solutions to compete with larger players. Cloud-based platforms, flexible deployment models, and reduced upfront investments make modernization accessible. SMEs seek agility, faster time-to-market, and improved customer engagement, fueling their demand for scalable modernization tools and services.

By Offering, Software dominated while Services are expected to expand fastest

The software segment dominated in 2024 as enterprises prioritize modernization platforms offering migration, integration, and application reengineering capabilities. Businesses increasingly adopt automation, AI-driven analytics, and cloud-native tools for optimizing legacy workloads. Software solutions reduce dependency on outdated infrastructure, streamline operations, and enhance scalability, making them central to modernization initiatives aimed at achieving cost efficiency and flexibility.

The services segment is projected to grow quickly from 2025 to 2032 as enterprises demand consulting, implementation, and managed services to minimize migration risks. Expertise in system integration, compliance management, and hybrid cloud deployment drives this demand. With growing complexity in modernization, organizations increasingly depend on service providers for seamless transitions, operational continuity, and ongoing support tailored to industry needs.

By Vertical, BFSI held the largest share while Healthcare is expected to grow fastest

The banking, financial services, and insurance sector led the market in 2024 as it heavily relies on mainframes for core banking, transaction processing, and regulatory compliance. Large-scale digital banking adoption, increasing online transactions, and the need for real-time processing drive modernization demand. Institutions modernize to reduce costs, ensure cybersecurity, and provide customers with faster and more secure services.

Healthcare is expected to witness rapid growth from 2025 to 2032 as providers modernize legacy systems to enhance patient data management, digital records, and telemedicine platforms. Regulatory compliance, real-time access to clinical information, and demand for advanced analytics drive modernization investments. Modernized systems enable interoperability, improve patient care, and support innovative digital healthcare delivery models, fueling significant adoption across the sector.

By Type of Modernization, Rehosting dominated while Rearchitecting is expected to grow fastest

Rehosting dominated in 2024 as enterprises prefer cost-effective modernization approaches that migrate workloads to cloud or modern environments without major code changes. It minimizes downtime, ensures business continuity, and accelerates transformation compared to complete reengineering. Organizations adopt rehosting to achieve scalability, reduce infrastructure costs, and modernize quickly while preserving critical legacy applications and minimizing risks.

Rearchitecting is expected to expand significantly from 2025 to 2032 as enterprises increasingly focus on redesigning legacy applications for long-term flexibility and cloud-native integration. Unlike rehosting, rearchitecting enables deeper modernization by restructuring systems into microservices and APIs. This approach supports innovation, agility, and advanced analytics, making it a strategic choice for future-proofing operations and achieving sustainable competitive advantage.

By Technology, Cloud Migration Tools led while Application Development Tools are projected to expand fastest

Cloud migration tools dominated in 2024 as enterprises prioritize seamless workload migration to hybrid and multi-cloud environments for scalability and cost efficiency. These tools enable automation, minimize downtime, and ensure secure data transfer. With growing adoption of cloud-first strategies, enterprises rely on advanced migration tools to accelerate transformation while maintaining business continuity and regulatory compliance.

Application development tools are set to grow fastest from 2025 to 2032 as organizations invest in modernizing legacy applications into cloud-native, agile environments. These tools enable rapid coding, deployment, and integration of APIs, microservices, and advanced analytics. Rising demand for innovation, faster delivery cycles, and customer-centric applications positions development tools as vital for enhancing agility, competitiveness, and digital transformation success.

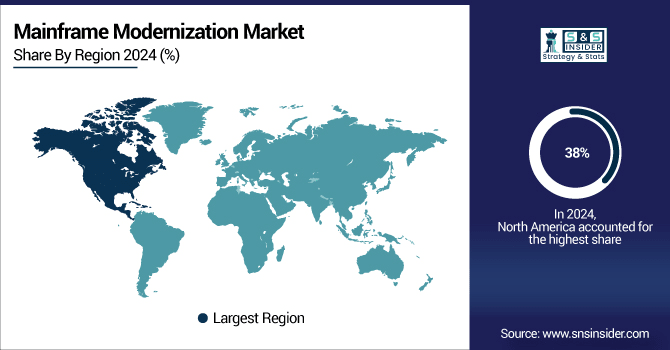

North America Mainframe Modernization Market Insights

North America dominated the market in 2024 with 38% share due to its strong base of large enterprises relying on legacy mainframes, particularly in banking, insurance, and government sectors. High adoption of cloud technologies, advanced IT infrastructure, and early investments in digital transformation drive modernization. The region also benefits from strong vendor presence, skilled workforce, and strict regulatory compliance needs, which accelerate modernization initiatives and maintain its leadership position in the global market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Mainframe Modernization Market Insights

Asia Pacific is projected to grow fastest from 2025 to 2032 at 11.27% CAGR, driven by rapid digitalization, cloud adoption, and expanding IT investments across developing economies like India and China. SMEs and large enterprises alike are modernizing systems to improve scalability, agility, and competitiveness. Rising demand for digital banking, e-commerce, and healthcare modernization, combined with government-driven digital initiatives, fuels modernization adoption, positioning the region as the fastest-growing market globally.

Europe Mainframe Modernization Market Insights

Europe is witnessing steady growth in the mainframe modernization market driven by rising demand for digital transformation, cloud integration, and compliance with stringent data protection regulations. Enterprises in banking, insurance, and manufacturing are modernizing legacy systems to enhance agility, reduce operational costs, and ensure security. Strong government support for digital initiatives further strengthens modernization adoption across the region.

Middle East & Africa and Latin America Mainframe Modernization Market Insights

Middle East & Africa show gradual growth in mainframe modernization driven by increasing digital adoption, cloud investments, and modernization in banking and government sectors. Latin America is experiencing rising demand as enterprises modernize legacy systems to support digital banking, e-commerce, and healthcare. Cost efficiency, scalability, and regulatory compliance needs are accelerating modernization initiatives across both regions.

Mainframe Modernization Market Competitive Landscape:

IBM is a leading player in the Mainframe Modernization Market, offering software, cloud integration, and consulting services to help enterprises rehost, refactor, and modernize legacy systems. Its AI-driven tools and automated workflows enhance efficiency, scalability, and security while reducing costs. Serving BFSI, healthcare, and government sectors, IBM’s strong R&D, industry expertise, and strategic partnerships make it a preferred choice for organizations pursuing digital transformation without disrupting critical legacy operations.

-

In 2025, IBM unveiled the IBM z17, integrating the Telum II processor and AI accelerators to deliver real-time AI inference, stronger cybersecurity, and hybrid-cloud scalability through z/OS 3.2, advancing mainframe modernization for enterprises.

-

In 2024, IBM confirmed acquisition of application modernization assets from Advanced, strengthening IBM Consulting’s mainframe transformation portfolio with expanded data migration, refactoring, and cloud enablement services to accelerate enterprise adoption of hybrid-cloud modernization strategies.

AWS plays a significant role in the Mainframe Modernization Market by providing cloud-based solutions that enable organizations to migrate, modernize, and optimize legacy mainframe applications. Its services, including rehosting, refactoring, and containerization, enhance scalability, flexibility, and cost-efficiency. Leveraging cloud-native tools, automation, and analytics, AWS supports enterprises across BFSI, healthcare, and retail in accelerating digital transformation, improving operational efficiency, and reducing dependency on traditional mainframe infrastructure.

-

In 2025, AWS: Published updated guidance on replatforming mainframe applications using a shared IBM Db2 for z/OS database, supporting incremental modernization, reduced disruption, and seamless integration of critical workloads into scalable AWS Cloud environments.

-

In 2024, AWS: Announced integration of AWS Mainframe Modernization service with BMC Helix Control-M, delivering unified orchestration for batch workloads, enabling enterprises to modernize legacy operations with enhanced automation across mainframe and cloud environments seamlessly.

Mainframe Modernization Market Companies are:

Some of the Mainframe Modernization Market Companies

-

IBM

-

TCS

-

Atos

-

AWS

-

Micro Focus

-

BMC Software

-

Wipro

-

HCL Tech

-

DXC Technology

-

Kyndryl

-

Rocket Software

-

Fujitsu

-

Cognizant

-

Tech Mahindra

-

Broadcom

-

TmaxSoft

-

PalmDigitalz

-

TSRI

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.26 Billion |

| Market Size by 2032 | USD 12.77 Billion |

| CAGR | CAGR of 9.39% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Software, Services) • By Type of Modernization (Rehosting, Refactoring, Rearchitecting, Replacement) • By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)) • By Vertical (Banking, Financial Services, & Insurance (BFSI), IT & ITES, Healthcare, Media & Entertainment, Retail & eCommerce, Education, Manufacturing, Other Verticals) • By Technology Used (Application Development Tools, Cloud Migration Tools, Integration Platforms, Data Management Solutions) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM, TCS, Capgemini, Atos, AWS, Micro Focus, BMC Software, Infosys, Wipro, HCL Tech, DXC Technology, Kyndryl, Rocket Software, Fujitsu, Cognizant, Tech Mahindra, Broadcom, TmaxSoft, PalmDigitalz, TSRI |