Project Portfolio Management Market Report Scope & Overview:

Get more information on Project Portfolio Management Market - Request Free Sample Report

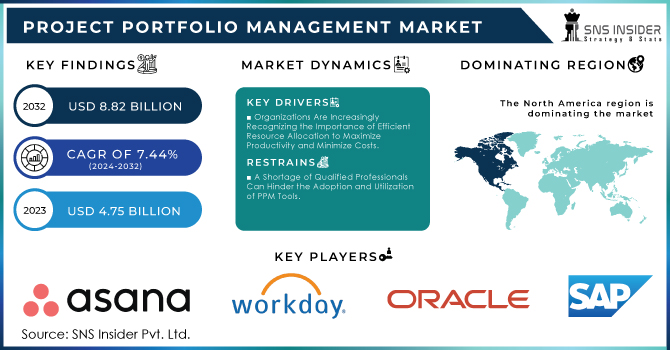

The Project Portfolio Management Market Size was valued at USD 4.75 Billion in 2023, and is expected to reach USD 8.82 Billion by 2032, and grow at a CAGR of 7.44%.

In response to the increasing complexity of projects, companies have started considering overall project management. In today's world, traditional waterfall projects don't always provide the best response for cost, equipment, activity, and resource management. As a result, companies are transforming their business into an agile business model by changing their organizational processes. Most enterprises traditionally implement two or more project management prototypes, such as Agile, Scaled Agile, or Waterfall methods. Depending on the type of programs or projects being managed, there are times when the Agile management model works best. By integrating adaptive and Agile elements into portfolio management, the delivery model evolves into a more productive one. The agile business model has become one of the most common approaches to systems as it provides highly cross-functional and collaborative project management. The primary focus of the Agile methodology as a project management type is on delivering value in the shortest terms.

The Scaled Agile Framework is becoming increasingly popular throughout the industry. Scaled Agile Framework delivers a set of workflow templates designed to guide businesses in expanding agile and lean business practices. Companies of all sizes can use this approach to maintain their abilities in the most volatile business environments. Therefore, many companies are recognizing the need for agile projects and portfolio management. It's worth noting that the application of agile principles allows managers to see the value and ROI of their projects, as well as oversee their performance and make any necessary changes. According to key market players, installing a modern solution based on agile principles saves an average of 37% on project lead time. As a result, the global market is expected to grow during the forecast period.

MARKET DYNAMICS:

Key Drivers:

-

The Growing Complexity of Projects, Especially in Industries Like Technology, Healthcare, And Construction, Has Made Effective Management Necessary.

-

Organizations Are Increasingly Recognizing the Importance of Efficient Resource Allocation to Maximize Productivity and Minimize Costs.

Restraints:

-

Implementing A PPM Solution Can Require a Significant Upfront Investment, Which May Be a Barrier for Smaller Organizations or Those with Limited Budgets.

-

A Shortage of Qualified Professionals Can Hinder the Adoption and Utilization of PPM Tools.

Opportunity:

-

The Increasing Popularity of Agile and Hybrid Project Management Methodologies Creates a Demand for PPM Tools That Support These Approaches.

-

AI Can Enhance PPM Capabilities by Automating Tasks, Providing Predictive Analytics, And Improving Risk Management.

KEY MARKET SEGMENTATION:

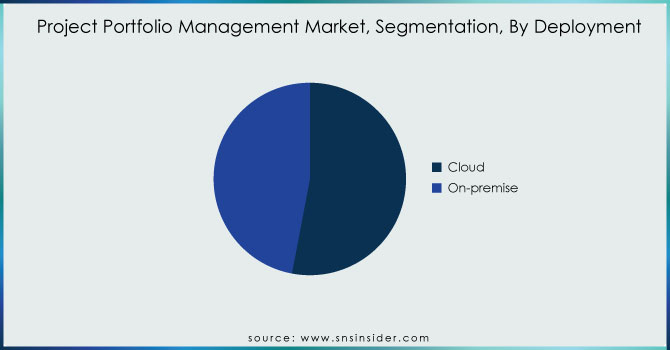

By Deployment

The cloud segment had the largest share with revenues of 60% in 2023. It is also expected to be the fastest-growing segment with a CAGR of 15.5% during the forecast period. These solutions are highly favored by users considering their cost efficiency and flexibility. Moreover, cloud systems are highly scalable, at a much lower implementation cost, and ever-evolving. The adoption of cloud-based solutions drives the ease of service delivery due to the virtual presence of the cloud, which allows organizations to access data from across multiple connected devices and at any time”. Furthermore, cloud-based PPM solutions enhance control over operations on multiple business channels. The factors are likely to improve the adoption of cloud PPM solutions across all verticals.

The on-premise segment is expected to grow at a CAGR of 10.02% during the forecast period. It is a classic approach to software adoption that has been in place since the computer was adopted. With on-premise, users have total control of the software since all of the sensitive data is stored by the company, and there are no risks of exposure to third parties. This deployment also offers numerous customization options. However, cloud solutions are being preferred by more companies today because on-premise solutions are more expensive to run. The maintenance needs are also too high because it is the company’s responsibility to upgrade and scale the system.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Type

The PPM market is split into two main categories: software and services. In 2023, the software category held a market share of 75%. As of now, PPM software has become the primary driver for the market due to multiple factors. These include the software’s multiple business applications and the constantly growing popularity of cloud solutions. The latter are often more flexible, more scalable, and have a nimbler approach to pricing; therefore, they are the preferred choice for companies and organizations of all sizes. At the same time, while not as influential on the PPM market as software, services also play a major role. This category includes implementation, training, and consulting. The role of the latter is to allow companies to optimize the utilization of previously purchased software; the combination of software and services provides a fuller and more versatile approach to project, program, and portfolio management

REGIONAL ANALYSIS:

North America dominated the project portfolio management market, with a revenue share of 43.0% in 2023. The region is projected to continue its dominance over the forecast period due to significant infrastructure developments and the growth of startup companies. Different industrial companies present in the region are adopting business intelligence & analytics solutions, and analytics-based strategies are one of the key factors driving the market growth. Moreover, companies that operate using digital infrastructure are adopting PPM solutions to enable collaborative decision-making in the region, thereby driving the project success rate of the projects. The market in the U.S. is fueled by a surge in the adoption of project portfolio magnet services by end-use companies in the healthcare, manufacturing, BFSI, and construction sectors to manage overall business operations, which is reducing extra costs. It has provided a conducive environment for market expansion in the U.S. Companies operating in the region are adopting business strategies such as mergers and acquisitions to enhance the services they provide along with their customer base. For instance, in December 2021, Tempo Software acquired ALM Works for an undisclosed amount to help its customers make better decisions for their projects in Massachusetts.

KEY PLAYERS:

The key market players are Asana Inc., Workday Inc., Oracle Corporation, Wrike (Citrix Systems Inc.), Atlassian Corporation PLC, SAP SE, Monday.com, Microsoft Corporation, Servicenow Inc., Planview Inc. (changepoint) & other players.

RECENT DEVELOPMENTS

-

In March 2023 UiPath, a provider of enterprise automation software joined Planview in integrating Planview Tasktop Hub with UiPath Business Automation Platform. The collaboration was supposed to enhance the optimization of time-intensive and repetitive tasks through better automation and expedite product delivery as well as minimize manual mistakes.

-

Also, in May 2022 Kimble Applications merged with a work management vendor Mavenlink, and combined the name KBM, forming the new project management software company – Kantata. Its brands include finances, resources, team collaboration, projects, BI, and integrations. -in-disease systemic treatment for adults suffering from severe alopecia areata (Auto-immune disorder).

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 4.75 Billion |

|

Market Size by 2032 |

US$ 8.82 Billion |

|

CAGR |

CAGR of 7.44% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Deployment (Cloud and On-Premise) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Asana Inc., Workday Inc., Oracle Corporation, Wrike (Citrix Systems Inc.), Atlassian Corporation PLC, SAP SE, Monday.com, Microsoft Corporation, Servicenow Inc., Planview Inc. (changepoint) & other players |

|

Key Drivers |

•The Growing Complexity of Projects, Especially in Industries Like Technology, Healthcare, And Construction, Has Made Effective Management Necessary. |

|

RESTRAINTS |

•Implementing A PPM Solution Can Require a Significant Upfront Investment, Which May Be a Barrier for Smaller Organizations or Those with Limited Budgets. |