Protein Expression Market Report Scope & Overview:

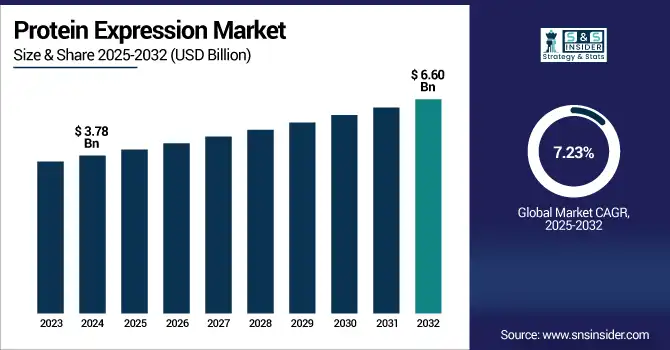

The protein expression market size was valued at USD 3.78 billion in 2024 and is expected to reach USD 6.60 billion by 2032, growing at a CAGR of 7.23% over 2025-2032.

To Get more information on Protein Expression Market - Request Free Sample Report

The protein expression market is gaining momentum owing to the increased demand for biologics, personalized medicine, and advanced therapeutics. The growing production of recombinant proteins for pharmaceutical, academic, and biotechnological applications has also had a significant impact on the global protein expression market. The level of R&D investment in proteomics and genomics is rising, which is expediting the cell-free, bacterial, and mammalian expression systems by biopharma companies and research institutions.

For instance, the investment fund for genetics and protein study surpassed USD 10 billion in 2024, ultimately favoring innovation in protein production techniques, according to the NIH. Furthermore, the growing prevalence of chronic diseases and infectious diseases, the higher demand for better biologics and vaccines have led to a surge in demand for U.S. vaccine and protein expression.

In June 2025, Ginkgo Bioworks and Pfizer entered a collaboration to develop new recombinant protein expression platforms using AI and synthetic biology, marking a key innovation in protein expression market trends and reshaping future protein expression market analysis.

Furthermore, the rapid biologic approval bodies and relaxed guidelines set by the FDA and EMA are also contributing favourably to the protein expression market trends. The expanded capability provided by CDMOs and important partnerships between protein expression vendors and universities are also closing technology gaps and simplifying processes. One of the remarkable trends is that mammalian expression systems are witnessing an increased demand for expressing complex proteins with correct post-translational modifications, which is strengthening the protein expression market analysis.

In 2024, Thermo Fisher Scientific expanded its St. Louis biologics site with a USD 150 million investment to enhance cell culture and protein expression capabilities, signaling long-term confidence in the protein expression market.

Table: Supply Chain Analysis – Key Suppliers of Reagents and Expression Vectors (2025)

|

Supplier/Company |

Product Supplied |

Region |

Key Clients/Partners |

|

New England BioLabs |

Enzymes & Vectors |

North America |

Harvard Medical School, GenScript |

|

Merck Millipore |

Expression Media |

Europe |

Roche, Boehringer Ingelheim |

|

Lucigen Corporation |

Competent Cells |

North America |

NIH, Promega |

|

QIAGEN |

Expression Vectors |

Global |

Pfizer, Thermo Fisher |

|

Oxford Expression Tech. |

Baculovirus Systems |

UK |

Oxford University, Novavax |

Market Dynamics:

Drivers:

-

Advancements in Biotechnology, Rising Biologics Demand, and Increased R&D Funding are Accelerating the Growth of the Protein Expression Market

Protein expression market growth is majorly driven by the increasing demand for recombinant proteins in applications such as drug discovery, life sciences, and proteomics, owing to the functional properties offered by recombinant proteins, technological advancements in protein expression products, and the increasing funding for protein-based research. Rising prevalence of chronic diseases (such as cancer and autoimmune diseases) at the global level has been stimulating the demand for biologics that are predominantly dependent on sophisticated protein expression techniques.

Reported by the Pharmaceutical Research and Manufacturers of America (PhRMA), the biopharmaceutical sector contributed more than USD 102 billion in R&D in 2023, a significant portion of which was spent on protein drugs. Furthermore, these services are supported by an expanded network of CROs and CDMOs having access to novel “next generation” expression platforms, which makes the supply chain more efficient as well as scalable.

Regulatory assistance by the FDA and EMA providing accelerated biologics approval pathways and promoting the development of biosimilars, is also helping in expediting time to market. Rise in new advances in synthetic biology and AI in protein design are offering precision in protein synthesis and structural optimization are further contributing to the growth of the protein expression market. Demand surges are also fueled by the use of CRISPR and mRNA technologies for vaccine and therapeutic proteins. Such a rise in partnerships between protein expression firms and academic institutes to simplify discovery pipelines, which in turn are anticipated to fuel the global protein expression market.

Restraints:

-

Technical Complexity, High Production Costs, and Regulatory Stringency Pose Significant Challenges to Market Expansion

There are significant barriers to the market due to limitations in cost and complexity of the process, despite the strong positive trends regarding the market of protein expression market. High capital expenditures on bioreactors, purification facilities, and technology to ensure quality make entry difficult for small players. Technical constraints of expression platforms, including low expression in mammalian systems or incorrect folding in bacterial systems, prevent scale-up.

For instance, in a report of Biotechnology Advances (2024), it was pointed out that the variation of yields in E. coli expression systems was the original cause of the failure of a protein-based drug development trial at a rate of 25–30%.

In addition, the regulation of protein-based biologics is strict, especially for the safety, immunogenicity, and batch-to-batch consistency of the product. Protein misfolding or contamination during expression and purification resulted in 18% of biologic products not being approved or being delayed, based on the FDA biologics report 2024. Disruption of supply chains, particularly for critical reagents, expression vectors, and specialty enzymes, creates additional bottlenecks. Problems associated with IP concerning new protein expression technologies also hinder the commercialisation. Together, these drawbacks hinder the protein expression market growth in the presence of strong demand potential. There is a need to address these challenges with continued innovation and standardization to grow the protein expression market share sustainably.

Segmentation Analysis:

By Systems

In 2024, the mammalian cell expression system was widely used in the production of proteins, accounting for 37.59% of the protein expression market due to its ability to express complex proteins with appropriate post-translational modification necessary for therapeutic purposes. Mammalian cells, including CHO and HEK293, are commonly used to produce biologics because they are most likely to fold proteins correctly, and the glycans are more human-like than other systems, which is particularly important for monoclonal antibodies and vaccines. Meanwhile, the prokaryotic expression system will be growing with the highest CAGR, including E. coli that is expected to grow at the highest CAGR (both in value and volume) during the forecast period, owing to its cost effectivity, fast protein production, and genetic manipulations, including gene knockout, increasingly used in basic research study and industrial production of enzymes.

By Product

Reagents were the leading product segment with a market share of 44.22% in 2024, owing to the relevance of reagents across all the stages of the protein expression workflow, including cell lysis and purification and detection, and analysis. This domination has been further strengthened by the tremendous requirement of antibodies, enzymes, and kits in proteomic research and biologics manufacture. The services segment is projected to have the highest growth as a result of the increasing outsourcing of recombinant protein production and the demand for custom protein manufacturing, particularly by small- and mid-sized biotech companies with no in-house capabilities.

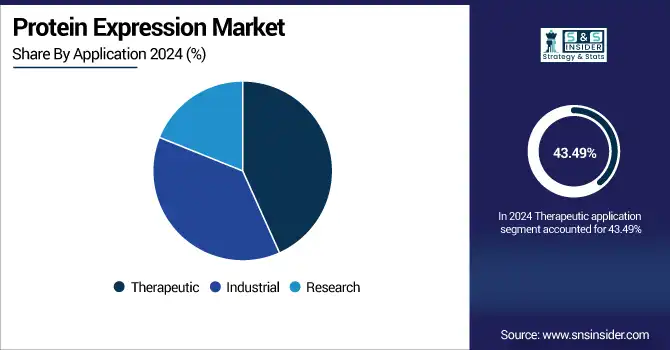

By Application

The largest share of the market was owned by the therapeutic application segment, which share was 43.49% in the year 2024. The increasing application of recombinant proteins in the treatment of diseases, such as chronic diseases like cancer, diabetes, and autoimmune disease, will contribute to the growth of the market. The approval of protein-derived drugs and increasing investment in biopharmaceutical R&D further add to this dominance. The industrial segment is forecasted to account for the fastest growth due to rising adoption of protein expression for enzyme production/biocatalysis and agricultural biotechnology, and the demand for high productivity and scalability.

By End Use

In 2024, pharmaceutical and biotech companies held the largest share of the global protein expression market, accounting for 43.49%, due to large pipelines for biologics development, high volume requirements for protein production, and significant ongoing investment in new expression technologies. The contract research organizations (CROs) market is also projected to grow the fastest as more and more biopharma firms outsource early discovery, expression optimization, and process development to speed up time-to-market and reduce the research and development (R&D) expenses.

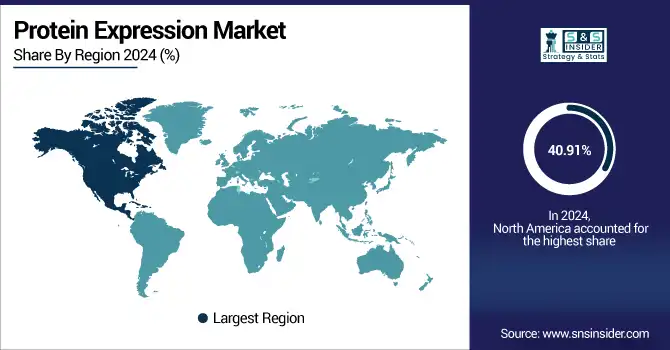

Regional Analysis:

North America was the leading region for the protein expression market in 2024, capturing more than 40.91% of the total market share. This dominance is driven by a strong pharmaceutical industry, rising demand for biologics, and ongoing investment in R&D.

The U.S. protein expression market size was valued at USD 1.17 billion in 2024 and is expected to reach USD 1.86 billion by 2032, growing at a CAGR of 6.07% over 2025-2032. The U.S. held the largest portion within the region, with major industry players like Thermo Fisher Scientific and Bio-Rad Laboratories. The increasing adoption of advanced expression technologies in both academic and commercial labs also contributed. Additionally, the U.S. benefits from substantial support from NIH, which allocated over USD 45 billion for biomedical research in 2024. Canada is gradually advancing through investments in cell and gene therapy, while Mexico is expanding its biotech manufacturing capacity. The region's mature regulatory environment and quicker biologic approval process by the FDA have also supported its market leadership.

The protein expression market has high potential in Europe due to a strong biotechnology industry and government support for the development of protein-based drugs. Germany and the UK are the leading countries in the region, with Germany in protein purification and analytical instrumentation technology. Proteomics and structural biology are in high demand, and both are heavily supported by Germany’s established pharmaceutical giants and academic institutions. France and Italy are doggedly pursuing recombinant protein research with some success due to EU-funded innovation programmes. Prospects in the region are encouraging, with joint research programs taking off under Horizon Europe, which will increase its protein expression market share.

Asia Pacific is expected to be the fastest-growing region in the protein expression market, which is expected to witness the growth of government expenditure in the healthcare sector, a continual increase in clinical trials studies, and the blooming market for biologics. China powers the field with huge government backing of biotechnology (more than USD 35billion in biotech commitments by 2025) and the continued growth of in-country CDMOs. The market in India is also showing robust development, with the country’s expanding pharma export industry and increasing academic research on recombinant proteins being a key factor. Japan’s leadership in protein engineering is complemented by South Korea’s focus on biosimilar production, which also fuels regional momentum. Growing demand for cost-efficient production services with augmented foreign investments represents the key drivers of the rapidly growing protein expression market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Table: Recent Product Launches and Innovations by Leading Protein Expression Companies (2023–2025)

|

Company |

Product/Platform Launched |

Technology Focus |

Launch Date |

Key Feature |

|

Thermo Fisher |

GenEx Cell-Free Plus |

Cell-Free Expression |

Jan 2024 |

2.1× increase in membrane protein yield |

|

GenScript |

TurboCHO |

Mammalian Cell Expression |

Apr 2024 |

44% higher productivity |

|

Agilent Technologies |

SureVector System Upgrade |

Vector Design |

Aug 2023 |

Streamlined plasmid assembly |

|

Promega Corporation |

PureYield Protein Kit |

Rapid Purification |

Nov 2024 |

25% faster than standard protocols |

|

Takara Bio |

Smart mRNA Expression System |

mRNA-Based Expression |

Feb 2025 |

Higher fidelity in protein synthesis |

Key Players:

Leading protein expression companies operating in the market comprise Thermo Fisher Scientific, Merck Millipore, Bio-Rad Laboratories, Agilent Technologies, QIAGEN, Promega Corporation, Takara Bio Inc., New England BioLabs, Oxford Expression Technologies, and Lucigen Corporation.

Recent Developments:

-

In June 2025, DeepMind launched AlphaGenome, a deep‑learning model that predicts gene-regulatory effects to inform gene and protein expression, enabling more precise design of expression systems, paving the way for smarter, faster protein expression engineering.

-

In May 2025, Thermo Fisher Scientific collaborated with GenNext Technologies, integrating GenNext’s AutoFox protein footprinting with Thermo’s Orbitrap mass spectrometry tools. This created an end-to-end structural proteomics workflow enhancing high-resolution protein characterization for accelerated biologics development.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.78 billion |

| Market Size by 2032 | USD 6.60 billion |

| CAGR | CAGR of 7.23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Systems (Prokaryotic, Mammalian cell, Insect cell, Yeast, and Others) • By Product (Reagents, Competent cells, Expression vectors, Services, and Instruments) • By Application (Therapeutic, Industrial, and Research) • By End Use (Pharmaceutical and biotechnological companies, Academic research, Contract research organizations, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Merck Millipore, Bio-Rad Laboratories, Agilent Technologies, QIAGEN, Promega Corporation, Takara Bio Inc., New England BioLabs, Oxford Expression Technologies, and Lucigen Corporation. |