Metagenomics Market Size Analysis:

The Metagenomics Market size was valued at USD 2.11 Billion in 2023 and is expected to reach USD 6.70 Billion by 2032, growing at a CAGR of 13.69% over the forecast period of 2024-2032.

To Get More Information on Metagenomics Market - Request Sample Report

The Metagenomics Market is rapidly evolving, driven by breakthroughs in sequencing and bioinformatics. Government and private funding initiatives are accelerating microbiome research, while investment and venture capital trends reflect growing interest in metagenomics-driven innovations. Unlike traditional culture-based methods, metagenomics offers a more precise and comprehensive microbial analysis, revolutionizing applications in healthcare, agriculture, and environmental science. The rise of emerging startups in metagenomics is introducing novel solutions, fostering competition and innovation. Additionally, advancements in sample preparation techniques are streamlining workflows, reducing costs, and improving sequencing efficiency. Our report delves into these market-driving forces, providing exclusive insights into funding, technological advancements, and competitive landscapes shaping the future of metagenomics.

The US Metagenomics Market Size was valued at USD 0.57 Billion in 2023 and is expected to reach USD 1.70 Billion by 2032, growing at a CAGR of 12.91% over the forecast period of 2024-2032.

The US Metagenomics Market is witnessing rapid growth, driven by advancements in sequencing technologies, increasing research funding, and expanding applications in healthcare, agriculture, and environmental science. Organizations like the National Institutes of Health (NIH) and the U.S. Department of Agriculture (USDA) are actively funding microbiome research, enhancing its role in disease diagnostics and sustainable farming. Companies such as Illumina and Thermo Fisher Scientific are leading innovations in sequencing and bioinformatics, further accelerating market expansion. Additionally, initiatives like the Human Microbiome Project are strengthening the country’s position as a global leader in metagenomics research and applications.

Metagenomics Market Dynamics:

Drivers

-

Increasing Adoption of Metagenomics in Bioremediation and Waste Management Enhances Market Expansion

The adoption of metagenomics in bioremediation and waste management is significantly contributing to market expansion as industries seek sustainable environmental solutions. Metagenomics-based technologies are revolutionizing how pollutants, including heavy metals, hydrocarbons, and industrial waste, are identified and degraded. With growing environmental concerns, industries and regulatory bodies are emphasizing the need for advanced microbial approaches to clean up contaminated sites. Metagenomics enables the discovery of microbial communities that naturally break down toxic substances, leading to the development of tailored bioremediation strategies. This approach is particularly gaining traction in the oil and gas sector, where microbial consortia are being used to remediate oil spills. Additionally, wastewater treatment plants are utilizing metagenomics to monitor microbial populations and enhance the efficiency of biological treatment processes. Government agencies, such as the United States Environmental Protection Agency (EPA), are actively supporting research on microbial applications in environmental cleanup, further fueling the demand for metagenomics solutions. This driver is expected to strengthen as industries increasingly shift toward eco-friendly waste management solutions, ensuring compliance with stringent environmental regulations.

Restraints

-

Data Privacy and Security Concerns Pose Regulatory and Ethical Challenges in Metagenomics Research

With the rise of human microbiome research and metagenomics-based diagnostics, concerns regarding data privacy and security are intensifying. Metagenomics studies often involve sequencing vast amounts of genetic material from human, environmental, and clinical samples, raising ethical questions about data ownership and the potential for misuse. Personal health data extracted from microbiome sequencing could reveal sensitive medical conditions, genetic predispositions, and even geographical origins, leading to possible privacy violations if not adequately protected. Regulatory agencies such as the National Institutes of Health (NIH) and Federal Trade Commission (FTC) emphasize the need for stringent data security measures, but the lack of standardized global frameworks complicates compliance. Cybersecurity threats and unauthorized access to genomic databases further escalate risks, making secure data storage and ethical governance crucial for the metagenomics market’s sustainable growth. Without clear regulatory guidelines and secure data management practices, concerns over ethical violations and patient privacy will continue to impede the widespread adoption of metagenomics.

Opportunities

-

Metagenomics-Based Environmental Surveillance for Early Disease Outbreak Detection Gains Government and Public Health Interest

The potential of metagenomics in environmental surveillance is being increasingly recognized as governments and public health agencies explore its use in detecting disease outbreaks before they escalate. By analyzing wastewater, air, and soil samples, metagenomics can identify pathogens and antimicrobial resistance genes, allowing for early intervention strategies. The COVID-19 pandemic underscored the importance of wastewater-based epidemiology, where metagenomic sequencing was utilized to track SARS-CoV-2 variants and predict infection trends. Public health organizations, including the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO), are investing in metagenomic-based disease surveillance systems to monitor the emergence of novel infectious diseases such as avian influenza, antibiotic-resistant bacteria, and zoonotic viruses. The ability of metagenomics to detect microbial threats in real time and inform policy decisions presents a massive opportunity for governments, biotech firms, and research institutions to expand the scope of disease surveillance and preventive healthcare solutions.

Challenge

-

Interdisciplinary Skill Gap in Metagenomics Research Limits Efficient Data Interpretation and Innovation

One of the critical challenges in the metagenomics market is the interdisciplinary skill gap required to effectively analyze and interpret sequencing data. Unlike traditional microbiology, metagenomics requires expertise in multiple domains, including genomics, bioinformatics, computational biology, and data science. Many laboratories and research institutions struggle to find professionals with the necessary skill set to handle large-scale sequencing data, perform taxonomic classification, and apply machine learning models for predictive analytics. The complexity of metagenomics datasets—often comprising billions of genetic sequences—requires advanced statistical modeling, which many traditional microbiologists lack experience in. Additionally, bioinformatics tools used in metagenomics, such as QIIME, MG-RAST, and Kraken, require significant computational proficiency, further widening the knowledge gap. Academic institutions and companies are investing in training programs and AI-driven automation tools to bridge this skill shortage, but the rapid advancements in sequencing technology make it difficult for professionals to keep pace with evolving analytical methods. Without an adequately trained workforce, the full potential of metagenomics in healthcare, agriculture, and environmental sciences remains underutilized.

Metagenomics Market Segmentation Analysis:

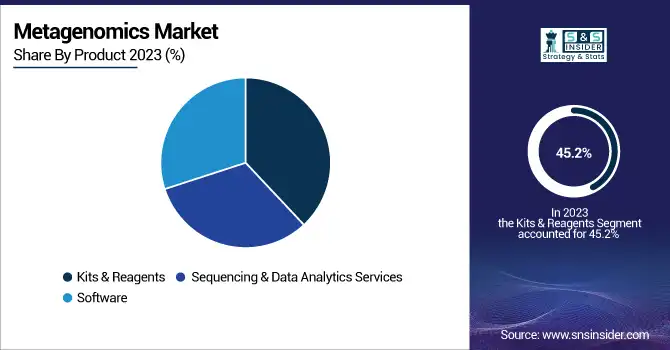

By Product

Kits & Reagents dominated the metagenomics market in 2023, holding a market share of 45.2%. The widespread use of metagenomics kits and reagents is driven by their essential role in DNA and RNA extraction, sample preparation, and sequencing workflows. Government agencies like the National Institutes of Health (NIH) and private research initiatives have increased funding for microbiome research, boosting demand for high-quality reagents. The COVID-19 pandemic further accelerated metagenomics-based diagnostics, requiring advanced sample preparation kits. Additionally, companies such as QIAGEN, Illumina, and Thermo Fisher Scientific have expanded their metagenomics reagent portfolios to cater to growing applications in clinical and environmental microbiome research. The ease of use, cost-effectiveness, and continuous product innovations, such as single-tube metagenomics kits and automation-friendly reagents, have further solidified the segment’s dominance.

By Workflow

Sequencing workflow dominated the metagenomics market in 2023, with a market share of 50.5%. The increasing affordability of next-generation sequencing (NGS) technologies and the availability of high-throughput platforms have driven the adoption of sequencing in metagenomics. The U.S. government, through the Human Microbiome Project (HMP), has emphasized large-scale sequencing initiatives, propelling market growth. Companies such as Illumina, Oxford Nanopore Technologies, and PacBio have introduced high-accuracy sequencing platforms specifically designed for metagenomics applications. Furthermore, advancements in sequencing technologies, such as long-read sequencing and error correction algorithms, have enhanced data quality, making sequencing the most critical step in metagenomics workflows. The rising adoption of clinical metagenomics for infectious disease diagnostics and personalized medicine has also contributed to the segment’s leadership.

By Technology

Shotgun Sequencing dominated the metagenomics market in 2023, capturing a 58.7% market share. This dominance is due to its ability to provide comprehensive microbial community analysis, offering high-resolution insights into functional genes and species diversity. Unlike 16S sequencing, which is limited to bacterial identification, shotgun sequencing enables complete genome reconstruction, facilitating precise functional annotation. The Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA) have increasingly relied on shotgun metagenomics for outbreak surveillance and antimicrobial resistance tracking. Companies such as Illumina and PacBio continue to develop high-throughput shotgun sequencing platforms, reducing costs and increasing accessibility. Its application in clinical diagnostics, environmental surveillance, and microbiome research ensures continued market dominance.

By Application

Ecology and Environmental applications dominated the metagenomics market in 2023, holding a 40.8% market share. The increasing focus on biodiversity conservation, climate change impact assessment, and bioremediation has driven demand for metagenomics in environmental research. Government programs such as the U.S. Environmental Protection Agency’s (EPA) microbial monitoring initiatives and the European Union’s Horizon 2020 research programs have fueled growth. Metagenomics is widely used to analyze microbial diversity in soil, oceans, and wastewater treatment plants, aiding in pollution control and ecosystem monitoring. Companies such as Eurofins Microbiome Genomics and CosmosID have developed metagenomics-based environmental testing services. The rising adoption of metagenomics in industrial wastewater treatment and oil spill remediation further strengthens its position as the leading application.

By End User

Pharmaceutical Industries dominated the metagenomics market in 2023, accounting for a 32.3% market share. The growing interest in microbiome-based therapeutics, drug discovery, and antimicrobial resistance research has propelled demand for metagenomics solutions in the pharmaceutical sector. The U.S. Food and Drug Administration (FDA) has encouraged microbiome-based drug development, resulting in increased investment in metagenomics-driven research. Pharmaceutical giants like Johnson & Johnson and Pfizer are actively leveraging metagenomics for probiotic drug development, gut microbiome modulation, and personalized medicine approaches. Additionally, clinical trial advancements in microbiome-based therapies for conditions like inflammatory bowel disease (IBD) and metabolic disorders have boosted adoption among pharmaceutical firms. The rise of biopharmaceutical startups focusing on metagenomics-driven drug discovery, such as Vedanta Biosciences and Seres Therapeutics, further reinforces the segment’s dominance.

Metagenomics Market Regional Insights:

North America dominated the metagenomics market in 2023, with an estimated market share of 41.3%. The region’s leadership is attributed to strong government support, high research funding, and the presence of leading genomics companies. The National Institutes of Health (NIH), the Centers for Disease Control and Prevention (CDC), and the Food and Drug Administration (FDA) have actively promoted metagenomics research through large-scale funding initiatives. The United States leads the market, driven by investments in human microbiome research, clinical diagnostics, and environmental metagenomics. Companies like Illumina, Thermo Fisher Scientific, and Zymo Research are headquartered in the U.S., further boosting market dominance. Additionally, metagenomics applications in disease surveillance, including COVID-19 wastewater monitoring and antimicrobial resistance tracking, have expanded in the U.S. Canada also contributes significantly, with government-backed projects on climate change impact assessment and agricultural microbiome studies. The presence of world-class research institutions and a well-established regulatory framework supports continued market leadership in North America.

Moreover, Asia Pacific emerged as the fastest-growing region in the metagenomics market, with a significant growth rate during the forecast period of 2024 to 2032. The rising adoption of metagenomics in clinical diagnostics, agriculture, and environmental monitoring is fueling growth across the region. China, Japan, and India are emerging as key markets due to government investments in genomics research and increasing demand for precision medicine. In China, initiatives such as the China Precision Medicine Initiative and projects backed by the Chinese Academy of Sciences are accelerating metagenomics adoption. Japan’s RIKEN Institute and National Institute of Infectious Diseases are utilizing metagenomics for infectious disease surveillance and gut microbiome research. India is rapidly advancing in agricultural metagenomics, with institutions like the Indian Council of Agricultural Research (ICAR) focusing on soil microbiome studies to enhance crop productivity. The region is also witnessing increasing collaborations between academic institutions and biotech firms, further driving the rapid expansion of metagenomics applications.

Do You Need any Customization Research on Metagenomics Market - Enquire Now

Metagenomics Market Key Players

-

Arc Bio, LLC (Galileo ONE, Galileo Pathogen Detection, Metagenomic Data Analysis)

-

BaseClear (Shotgun Metagenomics, 16S/18S/ITS Amplicon Sequencing, Functional Microbiome Analysis)

-

Biomcare (Microbiome Data Analysis, Metagenomics Research Services, Multi-Omics Integration)

-

CosmosID (CosmosID-HUB, Microbiome Profiling, Pathogen Detection in Metagenomics)

-

Computomics GmbH (AI-Driven Microbiome Analysis, Metagenomics Data Interpretation, Genome Reconstruction)

-

Clinical Microbiomics (Strain-Level Microbiome Profiling, Microbiome Biomarker Discovery, Metagenomics Data Science)

-

Diversigen (Shotgun Metagenomics, 16S/ITS/18S Sequencing, Microbiome Functional Analysis)

-

Eurofins Microbiome Genomics (Microbiome Sequencing, Shotgun Metagenomics, Whole Genome Sequencing)

-

GenoScreen (MetaBiote, 16S/18S/ITS Sequencing, Metagenomics Functional Analysis)

-

Luminous Bioinformatics (Metagenomic Workflow Solutions, Microbiome Data Interpretation, AI-Driven Genomic Analysis)

-

Macrogen (16S/18S/ITS Sequencing, Whole Metagenome Sequencing, Microbiome Analysis Services)

-

Microsynth AG (Microbiome Profiling, 16S/ITS Amplicon Sequencing, Whole Genome Metagenomics)

-

MR DNA (Molecular Research LP) (Microbiome Sequencing, 16S/ITS Metagenomics, Shotgun Metagenomics)

-

Molzym GmbH & Co. KG (Ultra-Deep Microbiome Profiling, DNA-Free Metagenomics Kits, Pathogen Detection in Metagenomics)

-

Omega Bioservices (Shotgun Metagenomics, 16S/ITS Sequencing, Whole Genome Metagenomics)

-

One Codex (Microbiome Data Interpretation, Metagenomics Cloud Platform, Pathogen Detection in Metagenomics)

-

SeqBiome (Microbiome Profiling, Shotgun & Amplicon Sequencing, Bioinformatics Analysis)

-

Shivom (Genomic Data Interpretation, Blockchain-Backed Genomic Analysis, AI-Driven Metagenomics Insights)

-

uBiome Inc. (now part of Psomagen) (Gut Microbiome Testing, Shotgun Metagenomics, Human Microbiome Analysis)

-

Zymo Research (ZymoBIOMICS Microbiome Kits, DNA/RNA Extraction Solutions, Microbiome Standards)

Recent Developments in the Metagenomics Market:

-

January 2025: UKHSA introduced a metagenomic surveillance program to enhance pathogen detection and antimicrobial resistance monitoring using next-generation sequencing. The initiative aimed to improve outbreak preparedness through global collaborations.

-

October 2024: Delve Bio partnered with Broad Clinical Labs to expand metagenomic next-generation sequencing (mNGS) for infectious disease diagnostics, improving detection speed and clinical adoption in hospitals.

-

August 2024: MGI Tech launched high-throughput sequencing platforms to enhance metagenomics research, focusing on cost-effective and scalable solutions for microbiome analysis and genomic surveillance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.11 Billion |

| Market Size by 2032 | USD 6.70 Billion |

| CAGR | CAGR of 13.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Kits & Reagents, Sequencing & Data Analytics Services, Software) •By Workflow (Pre-sequencing, Sequencing, Data Analysis) •By Technology (Shotgun Sequencing, 16S Sequencing, Whole Genome Sequencing, Others) •By Application (Ecology and Environmental, Clinical Diagnostics, Drug Discovery, Biotechnology, Food & Nutrition, Others) •By End User (Pharmaceutical Industries, Research Laboratories, Biotechnology Companies, Pathology Laboratories, Academic and Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zymo Research, Computomics GmbH, Microsynth AG, Arc Bio, LLC, CosmosID, BaseClear, SeqBiome, MR DNA (Molecular Research LP), Macrogen, GenoScreen and other key players |