Artificial Tears Market Size & Overview:

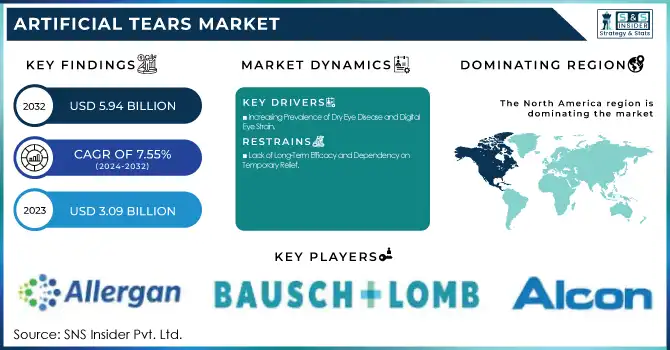

The Artificial Tears Market size was USD 3.09 Billion in 2023 and is expected to reach USD 5.94 Billion by 2032 and grow at a CAGR of 7.55% over the forecast period of 2024-2032. This study discusses prescription and OTC trends with the rise in demand for convenient eye care remedies amid rising dry eye condition awareness. Trends and innovations in products are explained in terms of the introduction of novel formulations and the inclusion of high-end ingredients designed to enhance extended relief and comfort. Consumer awareness and purchasing behavior trends show an increasing move towards convenience products, specifically highlighting preservative-free and eco-friendly products. The report also factors in the role of digitalization and screen use, where the increased screen use leads to a rise in digital eye strain incidents, thereby driving the demand for artificial tear products.

Get More Information on Artificial Tears Market - Request Sample Report

Artificial Tears Market Dynamics:

Drivers

-

Increasing Prevalence of Dry Eye Disease and Digital Eye Strain.

The increasing incidence of dry eye disease, especially because of lifestyle factors, is a major growth driver for the artificial tears market. Approximately 16 million Americans have dry eye disease, and more cases are being diagnosed every year worldwide. Contributing factors like increased screen time, aging populations, and environmental toxins worsen the condition. Digital eye strain, or "computer vision syndrome," has resulted in increased use of artificial tears as individuals spend more and more hours on digital devices. In a 2022 study, more than 60% of the global workforce indicated symptoms of eye strain related to the overuse of screens. Moreover, increased awareness of dry eye disease, fueled by medical campaigns and ease of access to treatment products, has encouraged consumers to opt for artificial tear solutions. Increased use of preservative-free and natural products, and the rise in self-medication, have further contributed to the growth of the market, particularly for over-the-counter (OTC) solutions.

Restraints

-

Lack of Long-Term Efficacy and Dependency on Temporary Relief.

Although artificial tears are a temporary solution for dry eye disease, they do not treat the underlying causes of the condition, like inflammation or meibomian gland dysfunction. This reliance on symptomatic relief over curative interventions has resulted in skepticism regarding their long-term efficacy. In a study appearing in the Journal of Ophthalmology, approximately 40% of patients claim that artificial tears do not yield long-term relief, and they are not satisfied. Additionally, excessive use of preservatives in certain products causes ocular toxicity and irritation. This problem creates a dilemma for the formulation of long-term treatments and has caused many patients to turn to alternative options, like punctal plugs or anti-inflammatory medications. The inability to devise a universally satisfactory remedy restricts the total market potential of artificial tears, causing companies to face the challenge of consistent customer retention.

Opportunities

-

Technological Advancements in Formulations and Natural Alternatives.

There is a high potential for innovation in the artificial tears market based on developments in product formulation and technology. The introduction of preservative-free and longer-duration eye drops has generated consumer interest. The demand for preservative-free artificial tears has increased by 25% over the past five years, as per a report. In addition, advances like liposomal-based artificial tears, which simulate the natural lipid layer of the eye, present the possibility for more efficient and longer-lasting products. In addition, with a move toward organic and natural products, there is the potential to bring plant-derived and bioengineered products into the market. Products containing ingredients such as hyaluronic acid and aloe vera are becoming more in demand, answering the increasing interest in "clean label" solutions. The growing emphasis on sustainability also opens up the opportunity for businesses to launch green packaging and manufacturing methods. Businesses riding these waves can cater to consumer needs and expand market share.

Challenges

-

High Cost of Innovative Formulations and Limited Access in Emerging Markets.

High-end products like liposomal-based or preservative-free artificial tears tend to be more expensive than conventional products, which may be a deterrent for price-conscious consumers, especially in developing countries. According to a World Health Organization (WHO) report, it was discovered that almost 40% of the population in low-income countries does not have access to basic medicines, including eye care products. In the emerging economies of India and Brazil, the penetration of sophisticated artificial tear products is sluggish because of high prices and low awareness about dry eye disease. Moreover, the increasing prevalence of spurious and substandard products in these markets further hinders the market. Regulatory barriers and distribution issues also restrict the availability of high-end eye care solutions. Breaking these barriers will involve reducing costs of production, raising awareness, and enhancing access to ensure innovative artificial tears can reach more consumers across the world.

Key Segmentation:

By Type

In 2023, the Glycerin segment captured the largest market share in the Artificial Tears Market with 35% of total market revenue. Artificial tears based on glycerin are most popular because they have excellent moisture retention and long-term hydration, which is required to relieve dry eye symptoms. Glycerin is a humectant that attracts water towards the eye to retain moisture and avoid irritation. This makes it a good and popular ingredient in artificial tear preparations, especially for those who have moderate to severe dry eye discomfort. The increased demand for preservative-free, safe, and moisturizing products has played a major role in glycerin's market supremacy. Moreover, its efficacy in treating dry eye syndrome as well as giving temporary relief from irritation due to environmental factors has rendered glycerin-based products the most popular choice among consumers. With increasing demand for treatments for diseases such as digital eye strain, worsened by excessive screen time, the demand for effective, moisture-holding products is anticipated to propel persistent growth in the glycerin segment. With improvements in product composition and growing awareness among consumers about its advantages, the Glycerin segment will continue to lead the market during the forecast period.

By Delivery Mode

The Eye Drops category led the way in 2023 with a commanding 45% market share. Eye drops represent the most convenient and easiest form of artificial tear delivery. They are convenient, portable, and offer fast relief to those who have dry eyes or computer eye strain. As awareness for eye care, particularly following the growth of screen time and environmental factors leading to eye strain, the market for eye drops has boomed in recent years. Their effectiveness in delivering instant moisture to the eyes is also the reason behind their popularity, particularly for individuals who suffer from sudden dry eye irritation caused by reasons like air conditioning, pollution, or excessive reading and screen use. Additionally, improvements in eye drop formulations, including preservative-free products and those with extended relief action, have consolidated their market leadership. In the future, the Eye Drops segment will be the most rapidly growing category in the market, as it is fueled by growing awareness of dry eye disorders, digital eye fatigue, and the ease of over-the-counter medications. With more individuals acknowledging the advantages of eye drops in maintaining their eye health, the segment is likely to grow during the forecast period.

By Application

The Dry Eye Syndrome segment of the market was leading in 2023, with 53.2% of the overall market share. Dry Eye Syndrome is among the most common eye diseases in the world, with millions of patients suffering from it owing to different reasons like aging, external conditions, and long-duration screen exposure. Increased usage of digital devices has caused the incidence of digital eye strain, which is one of the primary causes of dry eye symptoms. As individuals are glued to computers, smartphones, and other electronic gadgets, blinking occurs less often, causing improper lubrication and wetness on the surface of the eye. Dry eye comfort has become the priority for many consumers because of this. The Dry Eye Syndrome segment is likely to maintain its leadership because of the increasing awareness of the condition and the rising availability of over-the-counter and prescription products. In addition, improvements in eye care products, including preservative-free artificial tears and advances in eye drops, have assisted in addressing the varied needs of patients with dry eye syndrome. This category is expected to continue as the most rapidly growing area of application for artificial tears, as more individuals look for relief from the discomfort of dry eyes, especially following contemporary digital lifestyles and environmental causes.

By Distribution Channel

Hospital Pharmacies held a 40% market share in the artificial tears market in 2023. Hospital pharmacies are also very important for the distribution of prescription eye care products like artificial tears, particularly for patients who are struggling with severe or chronic eye problems like dry eye syndrome, glaucoma, or post-surgery recovery. Such pharmacies are staffed with the know-how to dispense specialized eye care products that are usually prescribed by ophthalmologists or other medical practitioners. Hospital pharmacies have a more customized service, with patients being treated with the proper medication for their individual needs. Additionally, they tend to offer useful advice to consumers on the proper use of eye drops or ointments, which leads to better treatment outcomes. As the market for artificial tears keeps developing, Online Pharmacies are surfacing as the most rapidly increasing distribution channel. The ease of buying products in the comfort of one's own home, and the convenience of being able to access a full line of artificial tear products by different brands, have made online pharmacies increasingly popular. As e-commerce grows globally, consumers are becoming increasingly more inclined to buy eye care products through online platforms, which is expected to drive segment growth over the forecast period.

Regional Analysis:

In 2023, the artificial tears market was dominated by North America due to strong consumer awareness of eye care and the widespread availability of prescription and over-the-counter artificial tear products. The region is supported by sophisticated healthcare infrastructure and a strong distribution network that involves hospital and retail pharmacies and online channels, providing easy access to a range of eye care solutions.

In Europe, the market is growing as a result of growing environmental and lifestyle factors that lead to dry eye conditions. There is a growing demand for preservative-free artificial tear formulations that mirror the increased demand for safer, more natural products. Germany, the UK, and France are at the forefront with a concentration on technological developments and better treatments for dry eye syndrome.

The Asia-Pacific market is projected to witness the fastest growth in the coming years, fueled by a fast-growing aging population, increased awareness of eye health, and growing digital eye strain. The major markets of Japan, China, and India are at the core of this growth. While in Latin America and the Middle East & Africa, the market is increasing steadily driven by enhancements in healthcare access and the increasing prevalence of dry eye conditions associated with environmental factors and lifestyle changes.

Need any customization research on Artificial Tears Market - Enquiry Now

Key Players:

-

Johnson and Johnson Vision Care - Blink Contacts, Blink Tears

-

Allergan plc - Refresh Tears, Refresh Optive

-

Alcon Plc - Systane Ultra, Systane Balance

-

Bausch & Lomb Incorporated - Renu, Bausch & Lomb Advanced Eye Relief

-

Santen, Inc - Thealoz Duo, Sante FX

-

URSAPHARM Arzneimittel GmbH - Thealoz, Artelac

-

ROHTO Pharmaceutical CO., LTD - Rohto Dry-Aid, Rohto Z!

-

Similasan Corporation - Similasan Dry Eye Relief

-

Ocusoft - Retaine MGD, Ocusoft Lid Scrub

-

Nicox - NCX 470

-

Abbott - Blink Gel Tears

-

LUMECARE - LumeCare Dry Eye Drops

-

Menicon - Menicon Tears

-

Thea Pharmaceuticals - Thealoz Duo

-

SEED Co. Ltd. - Seed Dry Eye Relief

-

Hikma Pharmaceuticals - Hikma Dry Eye Drops

Recent Developments:

-

In April 2023, Sun Pharmaceutical Industries Limited launched CEQUA, a novel treatment for Dry Eye Disease (DED) with inflammation in India. This is the first dry eye therapy in the country utilizing nano micellar (NCELL) technology, offering a new solution for patients suffering from this common condition.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 3.09 billion |

|

Market Size by 2032 |

USD 5.94 billion |

|

CAGR |

CAGR of 7.55% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type [Polyethylene Glycol, Propylene Glycol, Cellulose, Glycerin, Others] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Johnson and Johnson Vision Care, Allergan plc, Alcon Plc, Bausch & Lomb Incorporated, Santen, Inc, URSAPHARM Arzneimittel GmbH, ROHTO Pharmaceutical CO., LTD, Similasan Corporation, Ocusoft, Nicox, Abbott, LUMECARE, Menicon, Thea Pharmaceuticals, SEED Co. Ltd., Hikma Pharmaceuticals. |