Fusion Splicer Market Size & Trends:

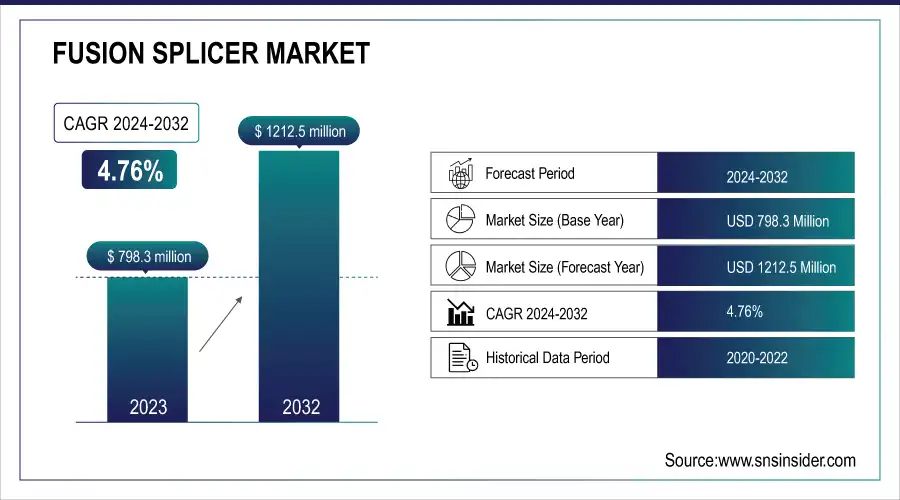

The Fusion Splicer Market was valued at USD 798.3 Million in 2023 and is projected to reach USD 1212.5 Million by 2032, growing at a CAGR of 4.76% from 2024 to 2032. A key driver for this growth is the rapid adoption of 5G networks, which is accelerating the demand for fiber optic infrastructure, boosting the need for fusion splicing technology.

In addition, sustainability trends are driving the development of eco-friendly splicing solutions, emphasizing energy efficiency and the use of recyclable materials. Cost-efficiency is another important factor, with advancements in fusion splicing technology leading to lower operational costs and greater affordability for businesses. Furthermore, the demand for skilled professionals in fusion splicing is rising as the workforce adapts to the growing complexity of fiber optic installations.

To Get more information on Fusion Splicer Market - Request Free Sample Report

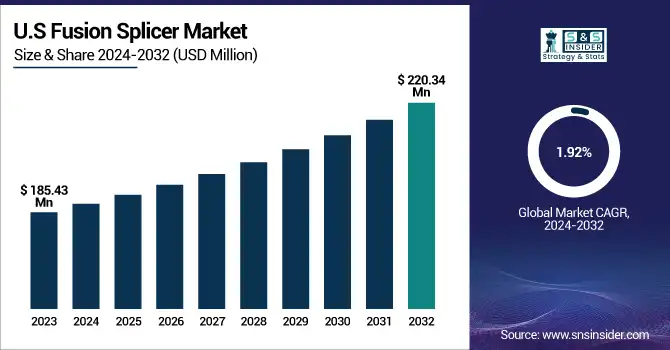

In the U.S., the market was valued at USD 185.43 million in 2023 and is expected to reach USD 220.34 million by 2032, growing at a CAGR of 1.92%. These trends reflect a strong and steady demand for fusion splicing solutions across industries, driven by technological advancements, infrastructure growth, and workforce development.

Fusion Splicer Market Dynamics:

Drivers:

-

Expansion of Fiber Optic Networks and Advancements in Splicing Technology Driving Fusion Splicer Market Growth

The fusion splicer market is expanding due to increased government funding for fiber optic networks, especially in developing regions, which has fueled the demand for high-speed broadband and telecommunication services. The rise in fiber-to-the-home (FTTH) deployments has further supported this growth, providing more opportunities for the widespread use of fusion splicers. The telecommunication sector plays a major role in advancing fiber optic technologies, while a shift from mechanical splicing to fusion splicing has accelerated the market's development. Despite challenges like high equipment costs and the need for a continuous power supply, these obstacles present opportunities for new market players to introduce competitively-priced products. Additionally, the growing demand for minimal splice loss, especially in the cable TV industry, has led to innovations in core alignment splicers to meet industry standards.

Restraints:

-

Impact of Maintenance and Calibration Costs on Fusion Splicer Market Adoption

Maintenance and calibration costs are significant restraints for the fusion splicer market. Fusion splicing equipment requires regular maintenance to ensure optimal performance and extend its lifespan. Over time, components such as electrodes, fiber holders, and other parts may wear out or lose precision, requiring replacement or adjustment. Additionally, the calibration of the splicer is crucial to maintain splice quality and minimize losses, which requires periodic checks by skilled professionals. These recurring costs can add up over time and increase the overall cost of ownership for business, and especially small business with limited budgets. This can be a potential deterrent for some users from employing fusion splicing technology, especially in those regions with limited financial resources, as companies have to include a budget for maintenance and calibration.

Opportunities:

-

Expansion of Telecommunications Infrastructure Increasing Demand for Fusion Splicing Technology

The continued global expansion of telecommunications networks, particularly in emerging markets, presents a significant opportunity for the fusion splicer market. As countries invest in modernizing and expanding their telecom infrastructures, the demand for fiber optic networks and high-speed connectivity is growing. In these regions, the deployment of fiber optics is essential to support advancements in mobile networks, broadband services, and 5G rollout. As this expansion continues to accelerate, efficient and effective fusion splicing technology will be critical in guaranteeing maximum network performance across a minimum of signal loss. The growing adoption of fiber optics for building strong and scalable infrastructure is also driving up demand for fusion splicing equipment, as telecommunications companies upgrade their networks to meet market demands for better capabilities. The rapid development of smart technologies in emerging markets, either the update of telecom infrastructure or building from scratch, is creating a potential customer base for fusion splicing technology.

Challenges:

-

Dependency on Stable Power Supply Challenges Fusion Splicer Adoption in Remote Areas.

Fusion splicers rely on a stable power supply to function effectively, making them less suitable for areas with unreliable or inconsistent electricity infrastructure. In remote or underdeveloped regions, where power outages or fluctuations are common, this dependency becomes a significant challenge. Users in these areas may experience operational delays or equipment malfunction, reducing the overall efficiency of fiber optic installation and maintenance projects. The need for a continuous power source can also drive up costs for users who must invest in backup power solutions, such as generators or uninterruptible power supplies (UPS). This limitation can deter potential customers in regions where the power grid is not reliable, affecting the market penetration of fusion splicing technology in these areas.

Fusion Splicer Market Segment Analysis:

By Offering

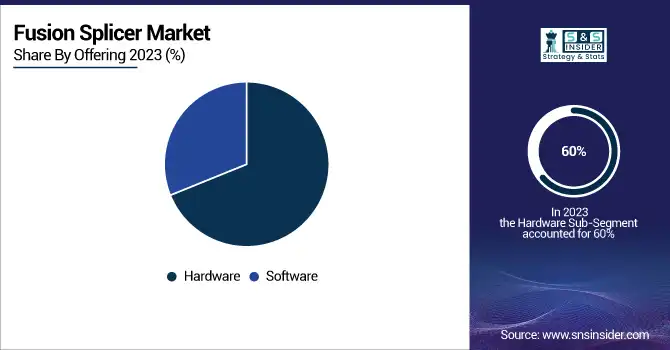

The hardware segment holds the largest share in the fusion splicer market, accounting for approximately 60% of the total market in 2023. This dominance is driven by the continued demand for high-performance fusion splicing machines that are essential for fiber optic network installation and maintenance. Hardware, which includes the actual splicing equipment and related components such as electrodes, fiber holders, and splicing machines, forms the backbone of the industry. These machines are designed for precision and reliability, ensuring minimal splice loss and high-speed connectivity, which are crucial for the expanding telecommunications and broadband infrastructure. As the need for fiber optic networks grows, especially with the rise of 5G and FTTH deployments, the demand for advanced hardware solutions in the fusion splicer market is expected to remain robust, sustaining its dominant position throughout the forecast period.

The software segment in the fusion splicer market is expected to experience significant growth over the period from 2024 to 2032. Growth in the market persists as fusion splicing equipment is incorporating more software solutions to provide improved performance, efficiency, and automation. More sophisticated software functions that include real-time monitoring, error detection, splice loss analysis, and data management are also rapidly becoming the norm if the splicing process is to be optimized. Advancement of fusion splicing technology, as well as the application of software ensures that operation is easier, precision is optimized and integration with other network systems is seamless. The growing need for smart and automated solutions in telecom and broadband network deployments is driving the adoption of software-driven fusion splicers, which will help drive the segment’s robust growth during the forecast period.

By Alignment Type

The core alignment segment dominated the fusion splicer market with a substantial share of approximately 69% in 2023. This dominance is primarily due to the superior precision and minimal splice loss offered by core alignment splicers, making them the preferred choice for high-performance applications. Core alignment technology ensures that the fiber cores are precisely aligned, which is crucial for achieving low splice loss, especially in demanding industries such as telecommunications and cable TV. These splicers are essential for applications requiring high-quality connections and are widely used in the installation and maintenance of fiber optic networks. As the demand for reliable, high-speed fiber optic communication continues to grow, particularly with the expansion of 5G networks and FTTH deployments, the core alignment segment is expected to maintain its dominant position in the market.

The cladding alignment segment is expected to experience the fastest revenue growth from 2024 to 2032 in the fusion splicer market. This growth is being fueled by the rising need for affordable solutions in less intricate splicing tasks, whereby ultra-low splice loss is not as important. Cladding alignment splicers thus align the cladding of the fiber and are the more cost-effective solution in comparison to core alignment splicers. They are QUITE popular in applications NOT needing the precision required by high-bandwidth telecommunication networks. Cladding alignment splicers, which are viewed in many circles as more efficient and lower cost splicing options, are seeing their adoption numbers rise with the expansion of fiber optic networks, especially inizing markets, as they become the splicer of choice in designs where prices are less available. This will augur well for segment which is projected to witness strong market growth during the coming years.

By Application

The Telecommunications segment dominated the fusion splicer market, accounting for around 41% of the total revenue in 2023. This predominance is fueled by the rising need for high-speed internet and the proliferation of fiber optic infrastructure worldwide, particularly with 5G technology and fiber-to-the-home (FTTH) rollouts. Fusion splicing is essential to the proper operation of these networks, providing low-loss, high-performance fiber joints. Telecom companies are rapidly investing billions of dollars in expanding bulk fiber optic infrastructure to meet growing bandwidth requirements of different consumers and businesses, which will bolster the demand for fusion splicing in telecommunications industry over the forecast period.

The Cable TV and Enterprise segments are expected to experience significant growth over the period from 2024 to 2032 in the fusion splicer market. This growth is fueled by the contemporary demand for superior, dependable fiber optic connections to facilitate the development of cable TV networks and business-grade communications. With the increasing number of high-definition and ultra-high-definition content available at Cable TV, it has become more urgent to develop low-loss splicing technology. Likewise, when it comes to enterprises, they make use of fiber networks for improved communication, speed, reliable data transfer and various, additional benefits. Core alignment splicing through fusion splicing, in particular, is critical when it comes to maintaining high-quality connections in these industries. Cable TV and enterprise networking are also adopting fibre optics at a increasingly high rate, fuelling these segments with strong demand for fusion splicing solutions over Forecast period.

Fusion Splicer Market Regional Outlook:

North America dominated the fusion splicer market with a share of around 40% in 2023. This leadership is attributed to the region's advanced telecommunication infrastructure and the rapid adoption of fiber optic networks, particularly with the expansion of 5G and fiber-to-the-home (FTTH) services. The strong demand for high-speed internet and reliable connectivity across industries, coupled with significant investments in telecom and broadband sectors, fuels the growth of fusion splicing solutions. Additionally, North America's technological advancements and established market players contribute to its dominant position in the market. As the region continues to lead in the development of cutting-edge fiber optic networks, the demand for fusion splicers is expected to remain robust throughout the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia-Pacific region is projected to be the fastest-growing market for fusion splicers from 2024 to 2032. This growth is driven by increasing telecommunications infrastructure in developing regions like China, India, and Southeast Asia. As the demand for high-speed internet continues to rise, alongside the rollout of 5G networks and the increasing deployment of fiber-to-the-home (FTTH) connections, the importance of effective fusion splicing technology is also being recognized. Market growth is attributed to end-user investments in telecom and broadband services in the region and the increasing adoption of fiber optics to meet consumer demand for reliable connectivity. The growth will keep on over the few years due to the emerging opportunities in the fusion splicer market as the digital infrastructure expands across Asia-Pacific region.

Major Players in Fusion Splicer Market along with their Products:

-

Fujikura (Japan) – Fusion splicers, optical fiber cables, test equipment.

-

Sumitomo Electric (Japan) – Fusion splicers, fiber optic components, cables.

-

Tektronix (USA) – Optical test and measurement equipment, fusion splicer testing tools.

-

Huawei (China) – Optical fiber equipment, fusion splicers, networking hardware.

-

Fiberhome (China) – Optical fiber solutions, fusion splicers, network equipment.

-

Ribbon Communications (USA) – Telecom equipment, fiber optic networking solutions.

-

Corning (USA) – Optical fiber, fusion splicers, telecommunications equipment.

-

Yokogawa Electric (Japan) – Test equipment for fiber optics, splicing tools.

-

Optotec (Italy) – Optical splicing solutions, fiber optic components.

-

Nokia (Finland) – Telecommunications hardware, fusion splicers, networking solutions.

-

Nexans (France) – Fiber optic cables, splicing tools, networking infrastructure.

-

3M (USA) – Optical fiber splice closures, fiber optic tools, adhesives.

-

Northrop Grumman (USA) – Fiber optic technology for defense applications, splicing equipment.

-

INNO Instrument (South Korea) – Core alignment fusion splicers, OTDRs, optical fiber testing equipment.

-

Furukawa Electric Co. Ltd. (Japan) – Fiber optic cables, fusion splicers, splicing tools.

-

Fiberfox (China) – Fusion splicers, testing equipment, fiber optic tools.

-

Comway Technology LLC (USA) – Fusion splicing solutions, telecom tools.

-

Multicom Inc. (USA) – Fiber optic splicing tools, cables, connectors.

-

Emerson Electric Co. (USA) – Fusion splicing equipment, fiber optic testing tools.

-

China Electronic Technology Instruments Co. Ltd. (China) – Fusion splicing and test equipment for optical fibers.

List of suppliers for raw materials and components for the Fusion Splicer Market:

-

Corning Inc.

-

Fujikura Ltd.

-

Sumitomo Electric Industries Ltd.

-

The Prysmian Group

-

Nexans

-

3M

-

Emerson Electric Co.

-

Rohde & Schwarz

-

Yokogawa Electric Corporation

-

Fiberhome

-

OFS Fitel

-

Inno Instrument

-

TE Connectivity

-

Broadcom

-

Amphenol

Recent Development:

-

01 Aug 2024 , Fujikura 45S Fusion Splicer – Pioneering Precision, Efficiency in Fibre-Optic Technology, IC Logistix proudly announces the launch of the Fujikura 45S Fusion Splicer, designed to revolutionize fibre-optic splicing with faster heating, simultaneous fibre preparation, and advanced AI-powered management for increased operational efficiency.

-

01, Jun 2024, Huawei introduces ODN 3.0, leveraging uneven optical splitters and pre-connection technologies to enhance fiber network coverage, reduce costs, and improve efficiency for FTTH deployments, revolutionizing optical distribution networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 798.3 Billion |

| Market Size by 2032 | USD 1212.5 Billion |

| CAGR | CAGR of 4.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software & Services) • By Alignment Type (Core Alignment, Cladding Alignment) • By Application (Telecommunication, Cable TV, Enterprise, Aerospace & Defense, Specialty) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fujikura (Japan), Sumitomo Electric (Japan), Tektronix (USA), Huawei (China), Fiberhome (China), Ribbon Communications (USA), Corning (USA), Yokogawa Electric (Japan), Optotec (Italy), Nokia (Finland), Nexans (France), 3M (USA), Northrop Grumman (USA), INNO Instrument (South Korea), Furukawa Electric Co. Ltd. (Japan), Fiberfox (China), Comway Technology LLC (USA), Multicom Inc. (USA), Emerson Electric Co. (USA), China Electronic Technology Instruments Co. Ltd. (China). |