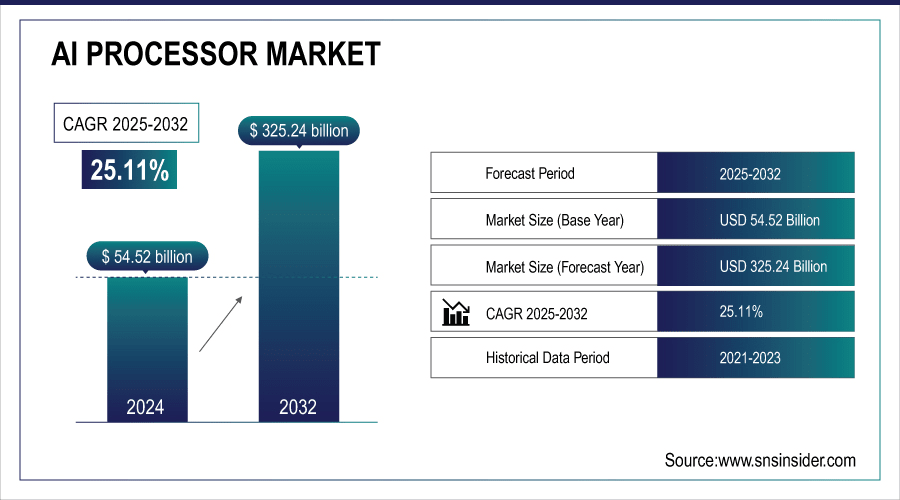

AI Processor Market Size Insights:

The AI Processor Market size was valued at USD 54.52 billion in 2024 and is expected to reach USD 325.24 billion by 2032 and grow at a CAGR of 25.11% over the forecast period of 2025-2032.

The global market report includes comprehensive AI processor market analysis in terms of type, application, technology, end-user and region. The rise of AI across consumer electronics, automotive, finance, and healthcare sectors is creating demand for high-efficiency, energy-efficient processors. Cloud-based inference, custom chipsets, and edge AI are all experiencing rapid market growth. These investments in autonomous systems and natural language processing accelerate market expansion in the context of both enterprise and consumer-level AI applications.

For instance, over 60% of enterprises in automotive and healthcare sectors have adopted AI processors.

To Get more information on AI processor market - Request Free Sample Report

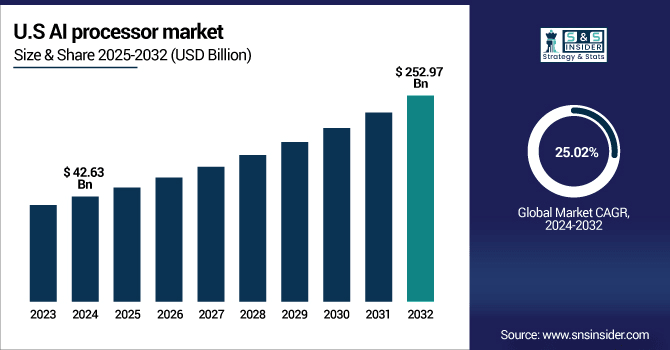

The U.S. AI processor market size was USD 42.63 billion in 2024 and is expected to reach USD 252.97 billion by 2032, growing at a CAGR of 25.02% over the forecast period of 2025–2032.

The U.S. market is primarily fueled by the presence of capital-intensive AI chip makers, escalating governmental budget allocations towards AI research, and fast adoption across autonomous cars, defense, and business software. Domestic demand continues to be driven by advances in large language models (LLMs) and edge computing and by the strength of the U.S.-based hyperscalers. Together, these factors have firmly placed the U.S. at the forefront of AI processor invention and large-scale deployment. Key AI processor market trends highlight innovation, investment, and rapid technology adoption.

For instance, more than 70% of autonomous vehicles in the U.S. now integrate advanced AI processors for real-time decision-making.

AI Processor Market Dynamics:

Key Drivers:

-

Rising Demand for AI Applications Across Industries Accelerates the Adoption of High-Performance AI Processors Globally

The demand for real-time, intelligent decision-making has led to the adoption of AI processors across industries, such as automotive, healthcare, finance, and retail. AI processors provide systems that are rapid and efficient in processing data which is essential in applications such as autonomous driving, robotic surgeries, algorithmic trading and fraud detection. This has also fueled demand given that AI has become a common part of consumer devices, such as smartphones, wearables, and smart assistants. This dramatic trajectory in deployment is driving enterprises to expend on high-performing and domain-specific processors for instances that will help AI workloads from cloud to edge.

For instance, AI processors have reduced data processing latency by up to 40%, critical for real-time applications such as autonomous driving.

Restraints:

-

Supply Chain Disruptions and Chip Shortages Create Bottlenecks in AI Processor Availability

Semiconductor components have been one of the most significantly affected parts by everything from international manufacturers crimped by geopolitical tensions and trade restrictions to lockdown-induced manufacturing delays. This is especially true for AI processors that they use high-end manufacturing nodes. Need for key materials, such as silicon wafers and reliance on a handful of large foundries, TSMC and Samsung for advanced chip manufacturing compounds the challenge. Such challenges lead to delayed product launches, high overall procurement costs, and reduced scalability of AI-enabled products for OEMs, which ultimately result in an impediment to the overall AI processor market growth.

Opportunities:

-

Rapid Growth of Edge AI and IoT Devices Creates Massive Opportunities for Low-Power AI Processors

Smart homes, wearables, autonomous drones, and industrial IoT edge AI applications have created exciting new frontier domains for AI processors. They necessitate energy efficiency, miniaturization, and processing in real-time without utilizing cloud infrastructure. Responding to this, chipmakers are creating AI processors optimized for low power and high performance edge computing. The edge AI processor market has a huge opportunity for growth driven by the move toward on-device intelligence for businesses looking to lower latency, bandwidth, and privacy risks.

For instance, advances have shrunk AI processors by over 30%, allowing seamless integration into compact wearables and IoT sensors.

Challenges:

-

Rapid Evolution of AI Algorithms Requires Constant Processor Architecture Updates and Compatibility Challenges

The speed at which AI algorithms are progressing has never been faster, adding complexity to processors by making it difficult to design processors that can be used for many different AI algorithms. As these advancements continue to quicken, chipmakers will always need to deal with the inherent challenge of creating processors that do not become obsolete by the time they are ready to ship. Differing training and inference demands are still pushing the hardware for continuous innovations. This fast-paced ecosystem creates cost pressure, lengthy R&D cycles, and product obsolescence.

AI Processor Market Segmentation Analysis:

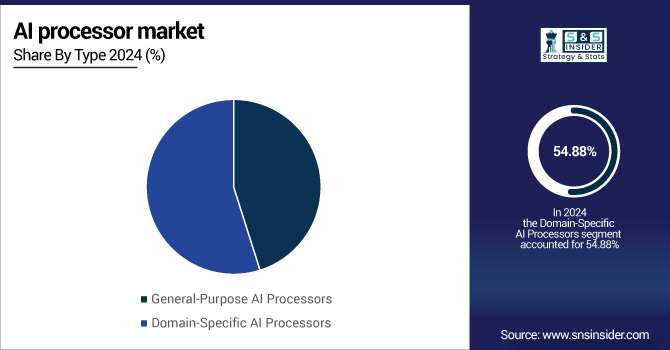

By Type

Domain-Specific AI Processors have dispersed the most revenue, holding more than 54.88% of the revenue share in 2024 and are anticipated to grow at the highest CAGR of approximately 25.28% during 2024-2032, which can be largely attributed to their workhorse nature that results in unparalleled efficiency for workloads related to AI including deep learning, computer vision, and natural language processing. They are meant for fast AI work, with kilogram-for-kilogram and watt-for-watt power at a premium versus general-purpose chips. Domain-specific processor capabilities have advanced by leaps and bounds in the last decade with its Tensor Processing Units (TPUs) making them almost a necessity for cloud level AI workloads and enterprise level AI deployments.

By Application

Image Processing and Recognition accounted for the largest share of about 32.10% in 2024 due to its key role in the automotive (ADAS and autonomous driving), healthcare (imaging diagnostics), and surveillance systems sectors. Such applications demand reliable real-time image analytics based on AI processors. As a leading player of GPUs, NVIDIA keeps excelling in this space by providing enterprise-specific hardware to enhance the speed of visual AI on both edge and cloud infrastructure.

Natural Language Processing (NLP) is projected to experience the highest CAGR over 2024-2032, at around 26.37%, supported by the rapid growth of generative AI, virtual assistants, and enterprise automation tools. NLP deals with large-scale data and sequential data, which can easily burden the chips if they lack high performance. To meet the increasing complexity and compute demands of NLP workloads converging in the cloud and in enterprise systems, companies, such as AMD are building processors designed to do just this, through its AI-optimized Instinct accelerators.

By Technology

In 2024, the GPU-based AI Processors segment held the largest revenue share at approximately 45.28% owing to their efficiency in processing a large volume of parallel computations that are crucial for training complex AI models. This is why AI developers choose them for their scalability and performance advantage. NVIDIA is not only the leader in this segment but they are also the most engaged with developers (due to the CUDA ecosystem) and customers, especially as they dominate the data center GPU with both AI training and inference.

ASIC-based AI Processors are expected to grow at the highest CAGR making over 25.79% from 2024-2032, as more companies choose custom chips designed such that they can support specific AI related work processes. The new processors deliver enhanced efficiency, low-latency, and cost benefits. For instance, Amazon Web Services (AWS) has created ASICs, such as Inferentia and Trainium that are used for its own internal AI cloud to scale unique inference workloads across its global infrastructure, doing so at peak efficiency.

By End-User

The Automotive segment led the AI Processor Market on the basis of revenue with a share of 30.20% in 2024, driven by the growing penetration of AI in autonomous driving and smart in-vehicle systems. Real-time and low-latency data processing is required for these technologies. The heart of car-type AI-processor solutions includes the programmable automotive microcontroller unit (MCU), defines its critical aspects, for instance, in the case of Tesla that designs the AI chips for the FSD systems, the industry's strong dependency on AI-hardware innovation, and custom-tailored solutions for next-level automotive solutions.

The Healthcare segment will have the highest CAGR of approximately 26.80% during the forecast period of 2024-2032, owing to the AI adoption and implementations in diagnostics, genomics, and patient monitoring. AI processors facilitate the kind of algorithms needed to analyse vast quantities of medical data quickly and accurately. Intel and others are partnering with healthcare providers to infuse AI-accelerated processors into diagnostic platforms to facilitate better outcomes, clinical efficiencies, and disruptive innovation in AI-enabled clinical environments.

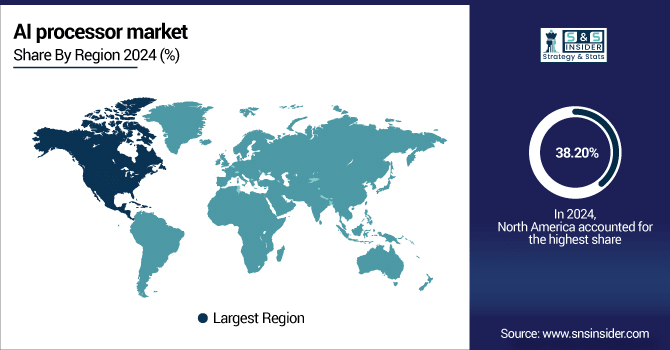

AI Processor Market Regional Overview:

In 2024, North America held the highest AI processor market share at approximately 38.20% due to the presence of a significant number of leading AI chip manufacturing companies, tech companies, and cloud service providers in the region. Early adoption is across industries in this region, such as automotive, defense, and healthcare. Cementing North America’s position as a leader in the global AI processor landscape are strong government support, mature industrial infrastructure, and advanced R&D ecosystems.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American AI processor market due to its strong presence of global tech giants, advanced semiconductor R&D, robust AI infrastructure, and early adoption across industries including defense, healthcare, autonomous vehicles, and enterprise software solutions.

The Asia Pacific is expected to be a major growth area over the entire projected period with the highest CAGR of 26.63% during 2024-2032, owing to increasing digitalization, growing industrial automation, and large government investments in AI infrastructure. China, India, South Korea, and Japan, are all witnessing aggressive pushes to build domestic chip capabilities and AI integration across the economy. With this momentum and a large population with technology experience, Asia Pacific acts as a major growth home for the AI processor industry.

-

China leads the Asia Pacific AI processor market owing to massive government investments, rapid AI integration in manufacturing and surveillance, local tech giants, such as Huawei and Alibaba, and aggressive efforts to build domestic semiconductor capabilities amid growing demand for AI applications.

Europe is proving to be a major force on the AI processor market, with abundant regulatory support, higher investments in AI research and rising adoption in automotive, industrial automation and healthcare. Germany and France are making strides in fostering innovation, and the U.K., where policy directives, and funding, are keeping pace with the rapid advances in the required hardware for AI, which is increasingly being developed through collaboration between academic institutions and a growing number of industries.

-

Germany dominates the European AI processor market due to its advanced industrial base, strong focus on automotive AI, and significant R&D investments. Government initiatives and leading tech companies further drive AI adoption in manufacturing, robotics, and smart infrastructure across the country.

The UAE is leading the AI processor market in the Middle East & Africa, due to the country providing extremely supportive government initiatives and high adoption of AI in public services. The country is the largest market in Latin America, driven by the growing use of AI in finance, agriculture, and smart cities, strongly backed by favorable government policies and global collaboration within the technology sector.

AI Processor Companies are:

Major Key Players in AI processor Market are NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Inc., Qualcomm Technologies, Inc., Apple Inc., Alphabet Inc. (Google), Samsung Electronics Co., Ltd., IBM Corporation, Microsoft Corporation, Arm Ltd., MediaTek Inc., Huawei Technologies Co., Ltd., Graphcore Ltd., Tenstorrent Inc., Cerebras Systems Inc., Alibaba Group, Baidu Inc., Amazon Web Services, Fujitsu Ltd., and Mythic AI and others.

Recent Developments:

-

In June 2025, AMD introduced the MI400 series and Helios rack-scale systems designed to outpace Nvidia in inference efficiency and rack integration.

-

In March 2025, Cerebras scaled up inference capacity across US and EU data centers, and by May 2025, they claimed more than double the performance over Nvidia’s Blackwell on Llama 4 models.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 54.52 Billion |

| Market Size by 2032 | USD 325.24 Billion |

| CAGR | CAGR of 25.11% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (General-Purpose AI Processors and Domain-Specific AI Processors) • By Application (Image Processing and Recognition, Natural Language Processing, Machine Learning, Deep Learning and Predictive Analytics) • By Technology (CPU-based AI Processors, GPU-based AI Processors, FPGA-based AI Processors and ASIC-based AI Processors) • By End-User (Automotive, Healthcare, Manufacturing, Retail and Financial Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Inc., Qualcomm Technologies, Inc., Apple Inc., Alphabet Inc. (Google), Samsung Electronics Co., Ltd., IBM Corporation, Microsoft Corporation, Arm Ltd., MediaTek Inc., Huawei Technologies Co., Ltd., Graphcore Ltd., Tenstorrent Inc., Cerebras Systems Inc., Alibaba Group , Baidu Inc., Amazon Web Services and Fujitsu Ltd. and Mythic AI. |