Access Control as a Service (ACaaS) Market Size Analysis:

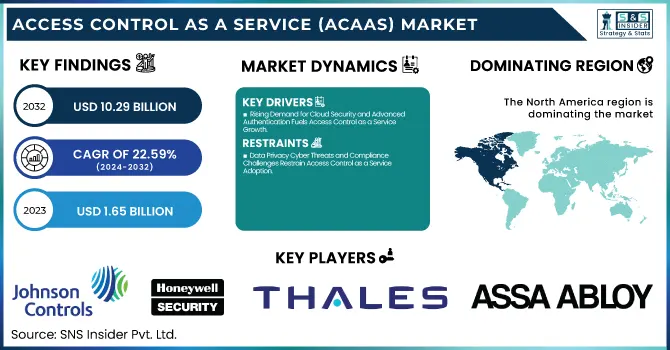

The Access Control as a Service (ACaaS) Market was valued at USD 1.65 billion in 2023 and is expected to reach USD 10.29 billion by 2032, growing at a CAGR of 22.59% over the forecast period 2024-2032. The Access Control as a Service (ACaaS) market is shaping up to adopt AI & machine learning, which will help with real-time threat detection and the automation of security responses. For instance, Biometric, mobile access, and Multi-Factor Authentication (MFA) solutions will be used to improve security.

To Get more information on Access Control as a Service (ACaaS) Market - Request Free Sample Report

Due to the expanded form of ACaaS, this form is connected with video surveillance, intrusion detection, and IoT systems to have full protection. The emergence of smart city initiatives is another factor fuelling the adoption of cloud-based access control it helps improve urban security and efficiency through centralized, scalable, and remote-access security management solutions. The U.S. Access Control as a Service (ACaaS) market has grown considerably due to the growing implementation of IoT-based security systems and the rising acceptance of cloud computing platforms. Far West especially high-tech states such as California. The commercial sector was also identified as the largest end-user of ACaaS solutions as there was an increased emphasis on protecting commercial buildings, office, and retail facilities.

The U.S. Access Control as a Service (ACaaS) Market is estimated to be USD 0.43 Billion in 2023 and is projected to grow at a CAGR of 22.38%. The U.S. Access control as a service market is being driven by the increasing requirement for cloud security solutions, the growing utilization of IoT and AI-based access control, high demand for strict regulatory compliance (HIPAA, and GDPR), rising concern about cybersecurity threats, and the rise of smart buildings and commercial real estate application security infrastructure.

ACaaS (Access Control as a Service) Market Dynamics

Key Drivers:

-

Rising Demand for Cloud Security and Advanced Authentication Fuels Access Control as a Service Growth

Various factors such as the increasing need for cloud-based security solutions, increasing adoption of IoT, and stringent government regulations associated with data privacy and security, are responsible for driving the growth of the ACaaS market. With their scalability, low-cost structures, and excellent management, organizations from every line of business are migrating away from on-prem access control systems to cloud-based systems. In addition to that, the surge in demand for real-time access monitoring, multi-factor authentication, and biometric integrations is accelerating the market growth. Moreover, increasing cyber threats and data breaches are driving enterprises towards the adoption of high levels of access control systems, particularly in industries such as BFSI, healthcare, and government among others. Similarly, hybrid workforce models and remote workforce management have elevated growth opportunities for ACaaS solutions, forcing businesses to acquire flexible and secure authentication methods.

Restrain:

-

Data Privacy Cyber Threats and Compliance Challenges Restrain Access Control as a Service Adoption

Data privacy and security issues related to cloud-based access control systems are some of the key challenges restraining the growth of the access control as a service (ACaaS) market. Most organizations dealing with sensitive information like government bodies, BFSI, and healthcare institutions are afraid to adopt complete cloud-based solutions fearing cyber breaches, unauthorized access, and data loss. Deploying its process also has to deal with region-specific regulations such as GDPR, HIPAA, and other data protection regulations, requiring the vendor to deliver a secure and compliant solution. Furthermore, legacy security infrastructure is fraught with interoperability issues when on the cloud, and it becomes hard for businesses to migrate without ripping out entire systems.

Opportunity:

-

AI Smart Cities and Hybrid Models Drive New Growth Opportunities in Access Control as a Service

There are great opportunities in digital transformation, especially across emerging economies, with the Asia-Pacific leading the way. This concept of applying AI and machine learning in access control systems can create new avenues for enhanced threat detection and automated security responses. Smart homes, smart cities, and connected infrastructure are also entering the UAE market, driving the demand, and, consequently, ACaaS providers stand to gain. In addition to this, the increasing adoption of Hybrid Cloud and Hybrid Access Control models opens an avenue for the vendors to address the need for enterprises looking for both the flexibility of the cloud and the ability to control security on premises.

Challenges:

-

Internet Dependency and SME Resistance Hinder Widespread Adoption of Access Control as a Service

Another disadvantage is that its reliability and performance are dependent on Internet connectivity. As ACaaS functions over cloud-based platforms, any loss of network connection can bring about a standstill in access control operations, causing security weaknesses. If your country has an unstable and/or limited internet connection, you might be struggling with the seamless adoption aspect of it. The other limitation is the resistance to change and awareness towards AI by the small and medium-sized enterprises (SMEs) that prevent mass adoption of this technology. Not wanting to disrupt a perfectly functioning operation, organizations opt for traditional on-prem lock and key in hopes that the threat of cyberattack can be kept at bay but at a high price.

Access Control as a Service Industry Segmentation Overview

By Service

Hosted access control as a service (ACaaS) maintained the lead in the access control market in 2023 with a 41.6% share, primarily due to its cost-effective solutions, rapid deployment, and minimized requirement for on-premises infrastructure. With remote management, real-time monitoring, as well as automatic software updates, hosted solutions free up businesses from having to maintain high-level IT expertise. Hosted services were the most predominant as the commercial office, BFSI, and government institutions are rapidly adopting cloud-based security to meet their requirements.

The segment of Managed Services is projected to expand at the highest growth rate from 2024 to 2032, due to businesses increasingly favoring outsourcing their security functions, which not only offers enhanced support but also provides a higher level of customization. Managed ACaaS providers are a compelling option, as they can manage security from end-to-end including advanced authentication, AI-driven analytics, and compliance. This demand for integrated security solutions and remote workforce management will likely drive the market for managed services and cause it to increase in the years to come.

By Deployment

In 2023, Public Cloud accounted for the largest market share of 47.5% attributed to its scalability, cost-effectiveness, and quick deployment. Public cloud solutions enable enterprises to adopt access control systems without heavy investment in on-premise infrastructure which is beneficial for small and medium enterprises, commercial offices, and retail sectors. Public cloud adoption accelerated thanks to the increasing accessibility of cloud service providers, and the adoption of AI-enabled security solutions.

Private Cloud is anticipated to log the fastest CAGR between 2024 and 2032. An increasing number of industries including BFSI, healthcare, and government are developing private cloud solutions to gain better control over sensitive access data and ensure more security. In the coming years, the continued need for bespoke, high-performance access control systems will drive demand for its advanced, fully-compliant, encryption platforms as private cloud-based ACaaS will continue to grow in popularity.

By Application

The Commercial sector held a 25.5% Access Control as a Service (ACaaS) market share in 2023, due to the growing adoption of cloud-based security solutions across office buildings, retail facilities, and corporate enterprises. Companies are continually relying on ACaaS for real-time access control, biometric access authentication, and remote access monitoring to keep their work environment safe and smooth. In the commercial sector, the massive evolution of hybrid work models and flexible office spaces has created a further need for scalable and centralized access control to support such surroundings.

The healthcare segment is anticipated to witness the highest CAGR during the forecast period (from 2024 to 2032) as hospitals, clinics, & pharmaceutical companies need such advanced & hi-tech security solutions to protect patient data and restricted areas. Growing cybersecurity threats, evolving regulations (e.g., HIPAA compliance), and the rise of IoT-enabled medical devices are expected to increase the need for secure access control systems. This, along with the increasing integration of biometric authentication, AI-driven monitoring, and cloud-based identity management will drive ACaaS adoption in the healthcare industry.

ACaaS Market Regional Outlook

North America led the Access Control as a Service (ACaaS) market with a 36.6% share in 2023, attributed to the presence of several security technology providers, early adoption of cloud-based solutions, stringent regulatory requirements, and enterprise demands for secure premises. Organizations across the region of BFSI and healthcare to government sectors leverage ACaaS for advanced authentication, biometric access, as well as compliance and data protection laws such as GDPR and HIPAA. For instance, the US-based leading security solutions provider Johnson Controls offers a cloud-based access control integrated with AI-driven threat detection. Likewise, in the U.S. and Canada, an increasing number of financial institutions and corporate enterprises are rolling out ACaaS, to control secure access across a hybrid working environment.

Asia Pacific is anticipated to register the highest CAGR growth between 2024 and 2032. China, India, and Japan are heavily investing in cloud-based security solutions to strengthen both public and private infrastructure. Expansion of Cloud-based Access Control Portfolios to Meet Growing Demand for Security Chinese Hikvision and Indian ZKTeco. Moreover, the increasing IoT-based smart access systems adoption in commercial buildings and residential complexes across the APAC will significantly drive the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Access Control as a Service (ACaaS) Market are:

-

Johnson Controls (Metasys)

-

Honeywell Security (Pro-Watch)

-

Thales (SafeNet Trusted Access)

-

ASSA Abloy AB (Aperio)

-

dormakaba Holding AG (exivo)

-

Identiv, Inc. (Hirsch Velocity Software)

-

Kastle Systems (KastleAccess)

-

AMAG Technology, Inc. (Symmetry Access Control)

-

Brivo Inc. (Brivo Access)

-

Cloudastructure Inc. (Cloud Video Surveillance)

-

STANLEY Security (Securitas Technology) (PACOM GMS)

-

Datawatch Systems (Building Security Solutions)

-

Okta Inc. (Okta Identity Cloud)

-

Netskope (Netskope Security Cloud)

-

Verkada (Verkada Access Control)

Access Control as a Service Market Recent Trends

-

In April 2024, Johnson Controls launched Security Lifecycle Management under its OpenBlue Services, offering proactive security monitoring, zero-trust cybersecurity, and remote device management to enhance building safety and compliance.

-

In November 2024, Thales enhanced its CipherTrust Data Security Platform with CipherTrust Transparent Encryption, enabling seamless data protection without modifying existing applications or infrastructure.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.65 Billion |

| Market Size by 2032 | USD 10.29 Billion |

| CAGR | CAGR of 22.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Hosted, Managed, Hybrid) • By Deployment (Public Cloud, Private Cloud, Hybrid Cloud) • By Application (Commercial, BFSI, Manufacturing & Industrial, Government Bodies, Residential, Transportation, Healthcare, Education, Utilities, Retail) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Johnson Controls, Honeywell Security, Thales, ASSA Abloy AB, dormakaba Holding AG, Identiv Inc., Kastle Systems, AMAG Technology Inc., Brivo Inc., Cloudastructure Inc., STANLEY Security (Securitas Technology), Datawatch Systems, Okta Inc., Netskope, Verkada. |