Quantum Computing-as-a-Service (QCaaS) Market Report Scope & Overview:

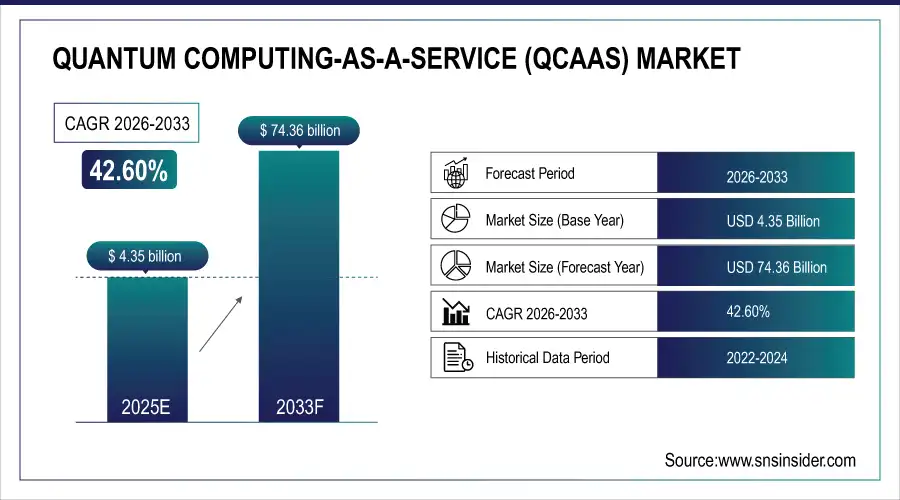

The Quantum Computing-as-a-Service (QCaaS) Market Size was valued at USD 4.35 Billion in 2025E and is projected to reach USD 74.36 Billion by 2033, growing at a CAGR of 42.60% during the forecast period 2026–2033.

The Quantum Computing-as-a-Service (QCaaS) market analysis provides insights into significant trends, regional growth patterns, and market size from the perspective of service value. The market is divided into the following segments based on deployment mode, service type, end user/industry, industry application and pricing model. Rapid development of quantum processors, growing enterprise interest, surge in demand for solving complex problems are promoting market growth worldwide.

Quantum hardware access accounted for around 45% of the QCaaS market in 2025, driven by increasing enterprise adoption and the need for high-performance computing.

Market Size and Forecast:

-

Market Size in 2025: USD 4.35 Billion

-

Market Size by 2033: USD 74.36 Billion

-

CAGR: 42.60% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Quantum Computing-as-a-Service (QCaaS) Market - Request Free Sample Report

Quantum Computing-as-a-Service (QCaaS) Market Trends:

-

Increasing number of enterprises are adopting cloud-based quantum computing which is boosting the demand for scalable QCaaS services.

-

Advanced quantum algorithms are being integrated by companies to address problems that include complex optimization, simulation and cryptography.

-

Growing emphasis on R&D in healthcare, finance, automotive applications are driving application specific QCaaS solutions.

-

No subscription or "per-use" charges are making it affordable even for startups, SMEs and academic institutions.

-

Tech providers, cloud platforms and academic partners are teaming up to drive innovation and ecosystem growth.

U.S. Quantum Computing-as-a-Service (QCaaS) Market Insights:

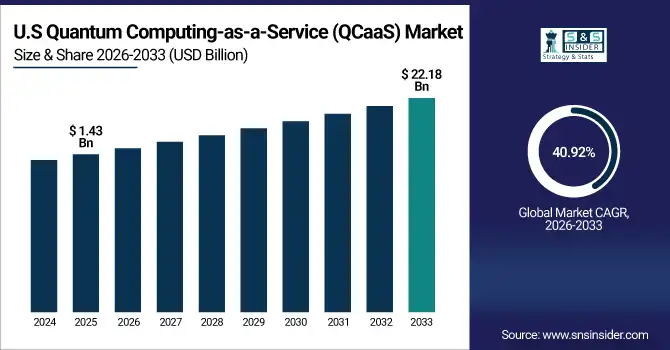

The U.S. QCaaS Market is projected to grow from USD 1.43 Billion in 2025E to USD 22.18 Billion by 2033, at a CAGR of 40.92%, driven by enterprise adoption, cloud-based deployments, and investments in quantum hardware and software, particularly across IT, finance, and healthcare sectors.

Quantum Computing-as-a-Service (QCaaS) Market Growth Drivers:

-

Surging demand for complex problem-solving and optimization across industries is fueling exponential QCaaS market growth.

The QCaaS market growth is due to rising demand for cloud-based quantum computing across enterprises and research institutions worldwide. The annual installation of QCaaS offerings will exceed 2,500 enterprise projects by 2033 as complex problem solving in finance, healthcare and manufacturing exploits these technologies. Larger investments in quantum software, algorithms, and hybrid cloud infrastructure, coupled with tech provider-academia collaboration are driving innovation and growth on a worldwide basis.

Surging enterprise adoption of cloud-based quantum computing drove nearly 40% of global QCaaS deployments in 2025, led by finance, healthcare, and manufacturing applications.

Quantum Computing-as-a-Service (QCaaS) Market Restraints:

-

High complexity and limited skilled workforce hinder adoption, restricting growth and deployment of QCaaS solutions globally.

The Challenges in the QCaaS market include high complexity and a lack of talented quantum computing professionals, affecting 35% of potential deployments worldwide. Enterprises face difficulty hiring and training staff members who can write quantum algorithms and operate quantum hardware. The dearth of this kind of talent is especially pronounced in the developing world, where adoption is stifled. Further, the slow deployment of these world-class QCaaS solutions is impeding overall growth and scaling globally due to integration with current IT infrastructure and regulatory compliance.

Quantum Computing-as-a-Service (QCaaS) Market Opportunities:

-

Growing adoption of quantum computing in drug discovery and financial modeling offers substantial global QCaaS market opportunities.

Opportunities Increasing in the QCaaS Market Opportunities are promising for the adoption of quantum cloud service in drug discovery, financial modeling, and advanced simulations. More than 1,800 enterprise projects will use the QCaaS by 2033, evidence of increasing dependence on quantum technology. Quantum software investments, hybrid cloud integration and algorithm development growth aside from collaboration with tech providers and universities are resulting in more accessibility and innovation, further sustaining worldwide market expansion during the forecast.

Adoption of QCaaS for drug discovery, financial modeling, and advanced simulations accounted for nearly 38% of new enterprise quantum projects in 2025.

Quantum Computing-as-a-Service (QCaaS) Market Segmentation Analysis:

-

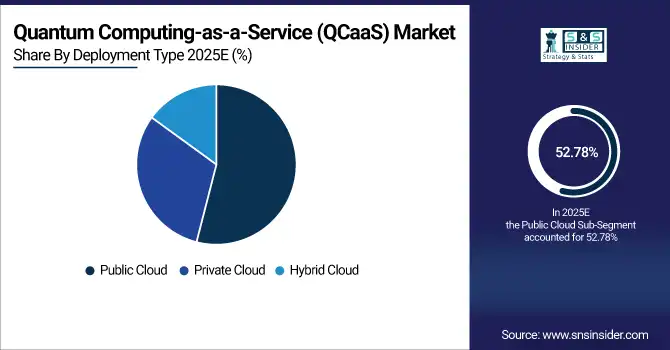

By Deployment Type, Public Cloud held the largest market share of 52.78% in 2025, while Hybrid Cloud is expected to grow at the fastest CAGR of 47.86%.

-

By Service Type, Quantum Hardware Access dominated with a 46.15% share in 2025, while Quantum Development Tools is projected to expand at the fastest CAGR of 48.09%.

-

By End User, IT & Telecom accounted for the highest market share of 38.66% in 2025, and Healthcare & Life Sciences is projected to record the fastest CAGR of 50.17%.

-

By Industry Application, Optimization held the largest share of 42.44% in 2025, while Drug Discovery is expected to grow at the fastest CAGR of 53.24%.

-

By Pricing Model, Subscription-Based dominated with a 51.22% share in 2025, and Pay-per-Use is projected to record the fastest CAGR of 48.45%.

By Deployment Type, Public Cloud Leads While Hybrid Cloud Expands Rapidly:

Public cloud dominated with more than 900 enterprise QCaaS deployments in 2025, which are led by accessibility, scalability and ease of integration with available IT hardware. It is a leader, with solid support from top cloud providers and penetration among large enterprises. Hybrid cloud with 480 deployments by 2025, but it's fast-growing area given demand from enterprises wanting secure and private access to quantum applications. The increasing desire to connect on-site resources with the cloud and use quantum technologies is driving this change.

By Service Type, Quantum Hardware Access Leads While Quantum Development Tools Expands Rapidly:

Quantum hardware dominated in 2025, a 1000 active projects driven by need for high performance computation such as for simulations, optimization and cryptography. It is maintained by active hardware development and access to quantum processors. Quantum development tools, at 500 projects in 2025, is a very fast-growing sector as enterprises and academia invest in algorithm development, software platforms and developer education. Accelerated worldwide adoption due to increasing ecosystem support and customized solution offerings.

By End User, IT & Telecom Leads While Healthcare & Life Sciences Expands Rapidly:

IT & telecom dominated the market in 2025 with more than 850 enterprise QCaaS deployments, capitalizing on cloud infrastructure knowledge and early adoption of high-performance computing innovations. Its leading position is based on current IT capabilities and deep relationships with quantum service providers. Healthcare & Life Sciences with 420 projects in 2025 is fast-growing due to demand for drug discovery, molecular simulations and personalized medicine. University and tech provider partnerships are speeding deployment in this promising space.

By Industry Application, Optimization Leads While Drug Discovery Expands Rapidly:

Optimization dominated in 2025 with more than 780 projects around logistics, manufacturing and finances modelling as large corporations aimed for efficiency and cost cutting. It is the darling of investors due to its shown results in operational efficiencies and risk reduction. The drug discovery category, although at 360 projects by 2025 and fast-growing due to pharma and biotech companies adopting QCaaS for molecular modeling, clinical trial simulations and compound profiling. Growing investments and collaborations are catalyzing global adoption at breakneck speed.

By Pricing Model, Subscription-Based Leads While Pay-per-Use Expands Rapidly:

Subscription-based models dominated in 2025 with over 950 enterprise agreements, due to cost certainty, scale and durability of quantum processing projects. Its hegemony is reinforced by the fact that larger institutions tend to prefer steady access over that which stops and starts. The pay-per-use model, projected to reach just 440 installations in 2025, is experiencing fast-growing adoption as start-ups and SMEs seek flexible access without large upfront investments. Increasing need for economical and equitable access is driving global deployment.

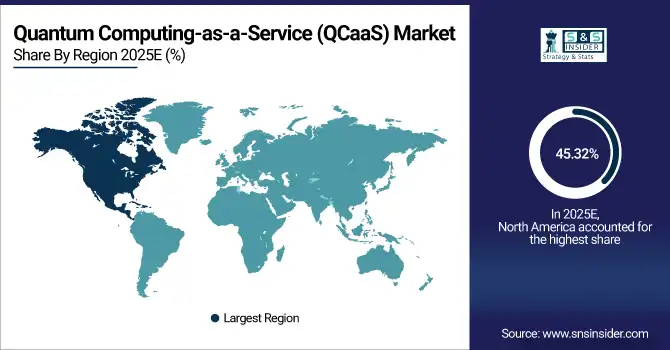

Quantum Computing-as-a-Service (QCaaS) Market Regional Analysis:

North America Quantum Computing-as-a-Service (QCaaS) Market Insights:

The North America QCaaS Market dominated with 45.32% of the share in deployment due to IT & telecom, finance, and healthcare sectors in 2025. Public cloud offerings and subscription-based models drive adoption, reinforced by mature salesforce infrastructure and talent pool as well as early enterprise implementations. Expansion is driven by rising investment in quantum hardware, new forms of algorithms, growing hybrid quantum computing ecosystem and partnerships with academic and research organizations throughout the US and Canada.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Quantum Computing-as-a-Service (QCaaS) Market Insights:

By 2025, the U.S. accounted for more than 1,200 QCaaS enterprise projects with 850 serving via public cloud and about 350 on hybrid cloud systems. Adoption is led by IT, finance & healthcare industries with enabling power of next-generation quantum hardware & algorithms through collaborations with universities & national labs.

Asia-Pacific Quantum Computing-as-a-Service (QCaaS) Market Insights:

The Asia-Pacific QCaaS market is fast-growing at a CAGR of 46.56% over the forecast period, propelled by the adoption of these services in China, Japan, and India. By 2025, the region accommodated 620+ enterprise deployments of which China accounted for about 280 projects and India over 150. Growth is being driven by investments in quantum research, cloud infrastructure, hybrid deployment models and increasing demand from the finance, healthcare and manufacturing industries.

China Quantum Computing-as-a-Service (QCaaS) Market Insights:

In 2025, the number of China’s QCaaS enterprise projects reached about 280, which were mainly public cloud; IT, finance and healthcare had great potential. Some 170 projects used a hybrid cloud approach; the others were private cloud or on-premises access. Growth is being fueled by quantum hardware and software investments, in addition to greater acceptance among enterprises nationally.

Europe Quantum Computing-as-a-Service (QCaaS) Market Insights:

In 2025 the Europe QCaaS Market would contain 420 enterprise deployments, there will be around Germany 120 projects, UK 95 and France 80. More than 260 projects used public cloud offerings, and more than 160 involved hybrid or private clouds. Growth of the market is primarily dominated by rising business investments in IT, finance and healthcare sector, increasing adoption of quantum computing in organizations to bring efficiency processing data are growing MENA Quantum Computing Market.

Germany Quantum Computing-as-a-Service (QCaaS) Market Insights:

In 2025, Germany had around 120 QCaaS enterprise projects, where 70 were implemented on public cloud and 50 on hybrid/private. Adoption was strongest among IT and finance. Market expansion is based on rising investments in quantum hardware and software, adoption by enterprises, and partnerships with institutions of research throughout the country.

Latin America Quantum Computing-as-a-Service (QCaaS) Market Insights:

In 2025, Latin America had about 75 QCaaS enterprise projects with Brazil contributing up to 35, Argentina 20 and Chile ten. Public cloud deployments were used in 50 projects and the rest were based on hybrid or private clouds. The growth is driven by the growing adoption in enterprises, investments in quantum hardware and software and demand from industries like finance, healthcare and manufacturing.

Middle East and Africa Quantum Computing-as-a-Service (QCaaS) Market Insights:

Middle East and Africa had hosted 25 QCaaS enterprise projects in 2025,13 using a public cloud approach at around 15 projects deployed whereas the hybrid or private clouds about reached ten. It is being fuelled by growing enterprise adoption, growing investments in quantum hardware and software, and increasing use cases across finance, healthcare and research industries throughout the region.

Quantum Computing-as-a-Service (QCaaS) Market Competitive Landscape:

IBM Quantum dominated the QCaaS space with access to clouds through IBM Quantum System One and System Two. IBM once in company history a year, accounting for 47% of all Quantum compute enterprise deployments at of work by across sectors IT, financial and healthcare. With its open-source Qiskit platform, collaborations with research partners, and steady progression of hardware innovation that drives algorithm discovery, IBM Quantum has positioned itself as the was an influential and trusted supplier in an expanding global QCaaS market.

-

In June 2025, IBM unveiled plans to build the world's first large-scale, fault-tolerant quantum computer at its new data center in Poughkeepsie, New York, marking a significant milestone in quantum computing development.

AWS Braket gives customers a fully managed way to access quantum computers from different hardware providers and software tools. By 2025, AWS Braket has enabled more than 250 enterprise projects in financial, IT and research institutions. Quantum circuit batch processing and AWS cloud service integration enhance scalability and utilization. Ongoing platform growth, solid developer backing, and simple deployment keep AWS Braket at the top of the quantum services provider list with an increasingly great user-base worldwide.

-

In July 2025, AWS Braket launched a 54-qubit superconducting quantum processor, named Emerald, providing customers with higher fidelity gates and full square lattice connectivity for advanced quantum computations.

Microsoft Azure Quantum offers a variety of quantum solutions, both in hardware and software, within the Azure cloud infrastructure. By 2025, at least 200 companies across Europe, North America and Asia-Pacific choose Azure Quantum to optimize, simulate and develop algorithms. Partnerships, developer tools and hybrid integration with the Azure cloud boost take-up. “Quantum-ready” enterprise focus will help Microsoft remain a front runner and strengthen its position as the market leader in the QCaaS worldwide.

-

In February 2025, Microsoft unveiled Majorana 1, the world's first quantum processor powered by topological qubits, marking a significant advancement in quantum computing technology.

Quantum Computing-as-a-Service (QCaaS) Market Key Players:

Some of the Quantum Computing-as-a-Service (QCaaS) Market Companies are:

-

IBM Quantum

-

Amazon Web Services (AWS) – Braket

-

Microsoft Azure Quantum

-

Google Quantum AI

-

D-Wave Quantum

-

IonQ

-

Rigetti Computing

-

Honeywell Quantum Solutions

-

Intel Corporation

-

Xanadu

-

PASQAL

-

PsiQuantum

-

Atos SE

-

QC Ware

-

Multiverse Computing

-

Strangeworks

-

Riverlane

-

Quantum Machines

-

Q-Ctrl

-

Qiskit (IBM’s open-source quantum software)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.35 Billion |

| Market Size by 2033 | USD 74.36 Billion |

| CAGR | CAGR of 42.60% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud) • By Service Type (Quantum Hardware Access, Quantum Software & Algorithms, Quantum Development Tools) • By End User / Industry (IT & Telecom, BFSI, Healthcare & Life Sciences, Automotive, Government & Defense, Academia & Research) • By Industry Application (Optimization, Simulation & Modeling, Cryptography & Security, Drug Discovery, Financial Modeling, Others) • By Pricing Model (Subscription-Based, Pay-per-Use, Enterprise Licensing) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM Quantum, Amazon Web Services (AWS) – Braket, Microsoft Azure Quantum, Google Quantum AI, D-Wave Quantum, IonQ, Rigetti Computing, Honeywell Quantum Solutions, Intel Corporation, Xanadu, PASQAL, PsiQuantum, Atos SE, QC Ware, Multiverse Computing, Strangeworks, Riverlane, Quantum Machines, Q-Ctrl, Qiskit (IBM’s open-source quantum software) |