API Management Market Report Scope & Overview:

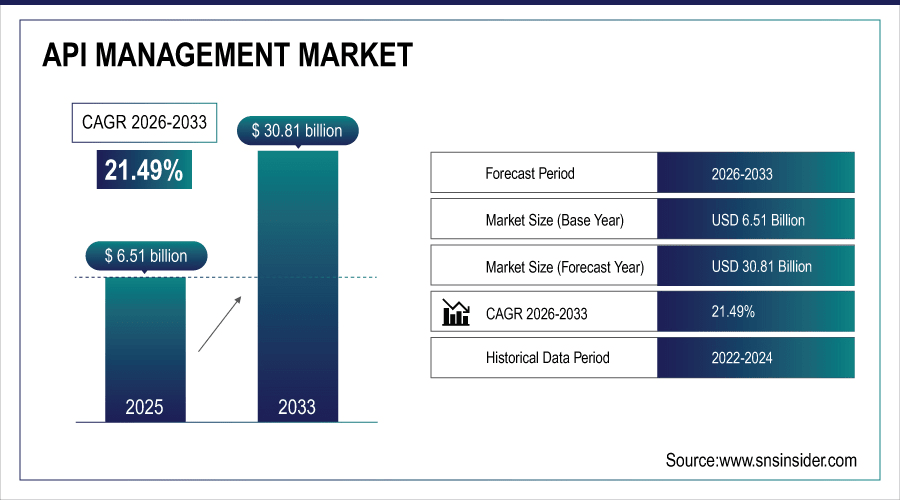

The API Management Market Size was valued at USD 6.51 Billion in 2025E and is expected to reach USD 30.81 Billion by 2033 and grow at a CAGR of 21.49% over the forecast period 2026-2033.

The increasing adoption of digital transformation and cloud-based services among enterprises of all sizes has remained a key factor influencing the growth of the API Management Market. APIs have become the backbone of modern digital business, with organizations rapidly adopting APIs to integrate with hybrid legacy systems with microservices, mobile applications and third-party platforms creating an ever-increasing demand for secure, scalable and efficient API management solutions. This trend is further driven by increasing awareness towards cloud-native architectures and SaaS platforms as they help facilitate a reduced operational burden while enhancing agility and performance which leads to high demand. According to study, APIs Secured with OAuth/JWT: ~65–70% of enterprise APIs in 2024 are secured with standard protocols.

To Get More Information On API Management Market - Request Free Sample Report

API Management Market Trends

-

Rapid cloud adoption fuels scalable, flexible, and efficient API deployments globally.

-

Enterprises increasingly integrate APIs across legacy systems, microservices, and platforms.

-

IoT and AI/ML applications significantly boost API usage and traffic.

-

Growing demand for secure API access protects enterprises against cyber threats.

-

Rising adoption of API analytics optimizes performance and operational efficiency.

-

Automated API lifecycle management streamlines workflows, reducing time-to-market drastically.

-

Expansion of external-facing APIs enables new partnerships, services, and revenue streams.

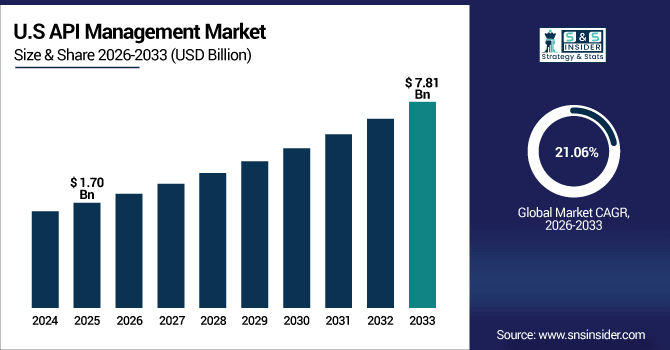

The U.S. API Management Market size was USD 1.70 Billion in 2025E and is expected to reach USD 7.81 Billion by 2033, growing at a CAGR of 21.06% over the forecast period of 2026-2033, driven by widespread smartphone and console adoption, advanced broadband and 5G networks, and strong engagement in esports and multiplayer games.

API Management Market Growth Drivers:

-

Cloud Adoption and Digital Transformation Fuel Rapid API Market Growth

The rapid shift towards cloud computing along with the increasing demand for SaaS platforms and rapid digital transformation across various enterprises globally is the first major factor fuelling the API Management Market. More and more organizations are shifting workloads and applications to cloud environments to take advantage of improved scalability, flexibility, and operational efficiency. APIs are the foundation of all cloud-based integration, facilitating integration across legacy systems, mobile apps, microservices, and third-party platforms. Another area where businesses are utilizing APIs is to speed up application development, encourage collaboration among internal and external teams, and enhance the time-to-market. With the increasing popularity of IoT devices and the need for AI/ML applications and data-driven services, the need for comprehensive API management platforms capable of high-volume traffic is even greater, maintaining security and reliability.

Active Developer Engagement: ~70–80% of registered developers actively use enterprise APIs.

API Management Market Restraints:

-

Integration Complexity and Legacy Systems Challenge API Management Adoption

The key factor acting as a restraint in the API Management Market is the complexity of implementation and management of APIs across multiple IT environments. Integrating APIs with legacy systems, microservices, and multi-cloud architectures is challenging for many enterprises. Moreover, the process of implementing API security, performance monitoring, and compliance with multiple regulatory standards like GDPR, HIPAA, or PCI-DSS is going to eat up resources as well. Even smaller organizations may struggle when they lack sufficient technical expertise, have budget constraints, or lack specialist tools to check API health, lifecycle and performance. The truth is that such integration and operational complexities are a hurdle in the adoption and also build potential operational risk if not done properly.

API Management Market Opportunities:

-

Rising API Security, Governance, Analytics Demand Presents Major Market Opportunity

The API Management Market is the largest opportunity along the security management curve as the market necessity to meet ever-increasing needs for more secure, well-governed, and well-analyzed API functionality. With organizations now exposing APIs to external partners, customers, and developers, ensuring security and controlled access to their APIs from breaches, and monitoring their performance is of paramount importance. High-level security features like OAuth/JWT, throttling, encryption, and anomaly detection all need API management platforms. Apart from that enterprises are looking out for programmable insights to enhance API performance, boost operational efficiency and enable data-driven decisions. Those vendors offering end-to-end API lifecycle management, real-time monitoring, and automated governance solution are next in line to capture this growing opportunity.

External-Facing API Growth: ~40% of enterprise APIs are available to customers.

API Management Market Segmentation Analysis:

-

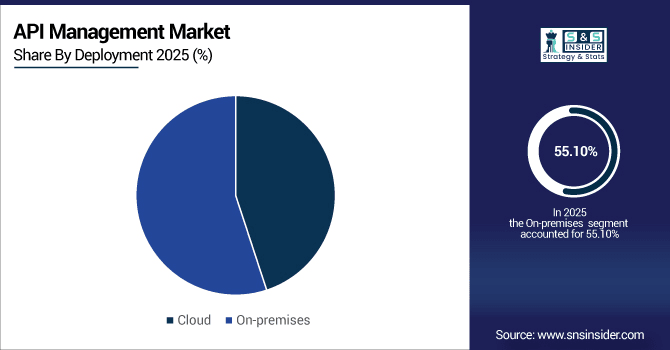

By Deployment: In 2024, On-premises led the market with share 55.10%, while Cloud are the fastest-growing segment with a CAGR 30.02%.

-

By Enterprise Type: In 2024, Large Enterprises the market 65.08%, while Small & Medium Enterprises fastest-growing segment with a CAGR 26.08%.

-

By Application: In 2024, Security led the market with share 30.20%, while Performance Analytics the fastest-growing segment with a CAGR 22.36%.

-

By End-user: In 2024, IT & Telecom led the market with share 28.10%, while Retail is the fastest-growing segment with a CAGR 23.20%.

By Deployment, On-premises Leads Market While Cloud Fastest Growth

In 2024, the On-premises deployment segment is estimated to account for the largest share of the API Management Market owing to large enterprises separating their network infrastructure and offering complete control over IT environment, better security, and compliance of the IT infrastructure with the policies of the internal IT departments. For many organizations where data is sensitive like BFSI, Healthcare, Government, an on-premise solution continues to be indispensable. On the other hand, the fastest-growing segment is Cloud Deployment, which is being boosted by rising adoption of cloud-native architectures, SaaS platforms and digital transformation projects. The flexibility, scalability, low operation costs, and fast integration capabilities offered by cloud APIs make it highly attractive solution among SME and emerging enterprise worldwide.

By Enterprise Type, Large Enterprises Lead Market While Small & Medium Enterprises Fastest Growth

Large Enterprises dominate the API Management Market in 2024 due to large IT infrastructure, significant API usage for legacy system integration, and strong digital transformation initiatives in large organizations. Mature API management platforms are heavily used by large organizations focused on security, governance, and performance analytics. On the other hand, SMEs are the fastest-growing segment, propelled by soaring cloud adoption, scalable API solutions, and cost-efficient platform solutions that provide fast integration, increased operational efficiency, and better digital service delivery functions across all sectors.

By Application, Security Leads Market While Performance Analytics Fastest Growth

In 2024, the Security application segment will hold the leading share in the API Management Market for Security Applications, as enterprises put more emphasis on protecting APIs from cyber threats, meeting regulatory compliance, and allowing for secure data exchange between systems. Security-related functionality like OAuth/JWT, encryption and threat detection across data pipeline still is a must-have for large scale enterprises. On the other hand, Performance Analytics is expected to register the highest growth rate among all application segments as organizations across verticals need ways to gain visibility into API usage, optimize API response time, enhance operational efficiency, and drive actionable insights that facilitate digital transformation and business growth initiatives.

By End-User, IT & Telecom Leads Market While Retail Fastest Growth

the IT & Telecom segment accounts for the largest share of the API Management Market in 2024, which is due to the high adoption of the use of APIs for cloud services, and network management, and growing requirements for digital solutions to improve operational effectiveness and connectivity. Such enterprises require API management platforms that are highly scalable, secure and high performing to cater to their large-scale infrastructure and complex integrations. On the other hand, the Retail segment is both the largest and fastest end-user, with a notable surge attributed to the proliferation of e-commerce platforms, the emergence of digital payment solutions, the development of customer engagement APIs, and data-driven analytics solutions that facilitate omnichannel experiences and determination of associations within the retail domain, enabling rapid digital transformation across retail businesses globally.

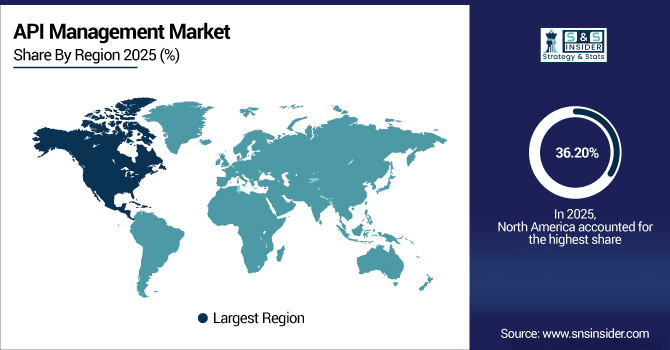

API Management Market Region Analysis:

North America API Management Market Insights

North America accounted for the largest share 36.20% of the API Management Market in 2024 due to high initial adoption of advanced IT infrastructure and services, and cloud computing and digital transformation between enterprises in the region. Major API management vendors Google (Apigee), Microsoft, IBM, and MuleSoft promote innovation, high level security and scalable solutions. Integration, process automation, and performance analytics are becoming paramount in large enterprises of BFSI, healthcare, and IT & telecom sectors which are adopting APIs at a rapid pace. Robust regulation, a greater adoption rate of APIs and quicker migration to cloud solidifies North America in its top position in the market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates API Management Market with Advanced Technological Adoption

The U.S. leads the API Management Market, driven by advanced cloud adoption, robust IT infrastructure, high API integration, strong security focus, and rapid digital transformation across enterprises.

Asia-Pacific API Management Market Insights

In 2024, Asia-Pacific is the fastest-growing API Management market with a CAGR 23.61%, driven by rapid digital transformation, increasing cloud adoption, and expanding IT infrastructure in countries like China, India, and Japan. SMEs and large enterprises are adopting APIs to integrate mobile applications, microservices, and third-party platforms. The region’s growing e-commerce, BFSI, and healthcare sectors are fuelling demand for secure, scalable, and performance-driven API management solutions, while government initiatives supporting digitalization further accelerate market growth across Asia-Pacific.

China and India Propel Rapid Growth in API Management Market

China and India lead growth via government digital initiatives, rising IoT adoption, mobile-first enterprises, cloud-native API platforms, microservices integration, and increasing demand for secure, scalable, and data-driven enterprise solutions.

Europe API Management Market Insights

Europe accounts for high revenue in the API Management Market in 2024, due to the advanced digital transformation initiatives, regulatory compliance, and the trend of cloud adoption by enterprises. BFSI, healthcare, and IT sectors are experiencing high API integration growth in Germany, the UK, and France. Enterprises are exploring GDPR-compliant solutions for optimized working models and customer engagement by choosing secure, scalable, and performant API management solutions that will further boost Europe as a major regional market.

Germany and U.K. Lead API Management Market Expansion Across Europe

Germany and the U.K. drive Europe’s API Management growth through strong digital transformation, cloud adoption, GDPR compliance, and rising enterprise demand for secure, scalable, and integrated API solutions.

Latin America (LATAM) and Middle East & Africa (MEA) API Management Market Insights

In 2024, The API Management Market in Latin America & Middle East & Africa is introducing the most recent rising market with our analysis covering this sector which is poised for steady growth driven by increasing digital transformation initiatives, cloud platform adoption, and growing fintech and telecom ecosystems. Enterprises in LATAM are adopting APIs to improve e-commerce, BFSI, and customer engagement, while SMEs are looking for affordable cloud-native solutions to achieve scale. Recent investments in digital infrastructure, smart technologies, and innovation programs driven by governments in MEA are accelerating demand for secure, scalable API management platforms, further establishing both continents as fruitful frontiers for future market growth.

API Management Market Competitive Landscape

Microsoft’s Azure API Management platform delivers end-to-end capabilities for API lifecycle management, including security, analytics, and developer engagement. Deeply integrated with Azure cloud, DevOps, and AI services, it empowers businesses to modernize applications, enhance scalability, and securely manage digital ecosystems, making Microsoft a key leader in API management adoption.

-

In March 2025, Microsoft introduced Azure Integrated HSM Security Chip, a custom FIPS 140-3 Level 3 ASIC deployed across all Azure servers for cryptographic security.

AWS provides robust API management through Amazon API Gateway, enabling developers to create, secure, and scale APIs for applications. Its integration with serverless computing, IAM security, and cloud-native services makes it a preferred choice for enterprises. AWS drives efficiency, flexibility, and innovation across industries, supporting global API-driven ecosystems.

-

In June 2025, Amazon Web Services (AWS) introduced routing rules for REST APIs, enabling header and path-based dynamic routing for backend workloads.

MuleSoft is a leading player in the API management market, offering its Anypoint Platform for API design, deployment, governance, and integration. It enables enterprises to connect applications, data, and devices seamlessly. With strong AI-driven automation and hybrid deployment support, MuleSoft empowers organizations to accelerate digital transformation initiatives effectively.

-

In February 2025, MuleSoft, a Salesforce company, released significant upgrades to Anypoint Code Builder. These enhancements aimed to streamline API development and integration processes.

API Management Market Key Players

Some of the API Management Market Companies are:

-

Google (Apigee)

-

Microsoft

-

Amazon Web Services (AWS)

-

IBM

-

MuleSoft (Salesforce)

-

Oracle

-

Axway

-

Red Hat

-

SAP

-

Software AG

-

TIBCO Software

-

Postman

-

Kong Inc.

-

WSO2

-

Akamai Technologies

-

Broadcom (CA Technologies)

-

Dell Boomi

-

RapidAPI

-

Gravitee.io

-

KrakenD

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.51 Billion |

| Market Size by 2033 | USD 30.81 Billion |

| CAGR | CAGR of 21.49% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Cloud, On-premises) • By Enterprise Type (Large Enterprises, Small & Medium Enterprises) • By Application (Security, Performance Analytics, Governance, Gateway, Others (API catalog, and others)) • By End-User (IT & Telecom, Government, Retail, Healthcare, BFSI, Transport & Logistics, Others (Manufacturing, and others)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Google (Apigee), Microsoft, Amazon Web Services (AWS), IBM, MuleSoft (Salesforce), Oracle, Axway, Red Hat, SAP, Software AG, TIBCO Software, Postman, Kong Inc., WSO2, Akamai Technologies, Broadcom (CA Technologies), Dell Boomi, RapidAPI, Gravitee.io, KrakenD, and Others. |