Radiation Dose Optimization Software Market Report Scope & Overview:

Get More Information on Radiation Dose Optimization Software Market - Request Sample Report

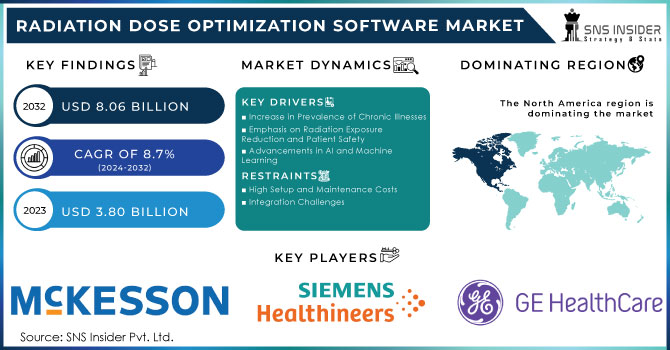

The Radiation Dose Optimization Software Market was valued at USD 3.80 Billion in 2023 and will reach USD 8.06 Billion by 2032, with a growing CAGR of 8.7% during the forecast period of 2024-2032.

The Radiation Dose Optimization Software market is experiencing notable growth due to a heightened focus on patient safety and regulatory compliance in diagnostic imaging and therapeutic procedures. This growth is driven by increased awareness of radiation risks and the push for precise dose management to reduce adverse effects while maximizing diagnostic accuracy. One of the drivers is the growing emphasis on radiation safety and patient protection, as medical professionals aim to minimize radiation exposure during diagnostic procedures. The increasing prevalence of chronic illnesses, such as cancer, cardiovascular diseases, and respiratory conditions, is significantly driving the demand for radiation dose optimization technologies. Chronic diseases often necessitate frequent imaging procedures to monitor disease progression, evaluate treatment efficacy, and guide medical interventions. Patients undergoing treatment for cancer frequently require imaging to assess tumor size, response to therapy, and disease spread. According to the World Health Organization (WHO), cancer incidence is expected to rise, leading to an increased need for imaging technologies. Optimization software helps manage the radiation dose during these frequent scans, minimizing risks while ensuring accurate diagnostic results. Advances in artificial intelligence (AI) and machine learning are enhancing the precision and efficacy of these software solutions, enabling improved dose management and real-time analytics. Additionally, stringent regulatory standards and guidelines for radiation dose monitoring are compelling healthcare facilities to adopt advanced optimization software to ensure compliance and enhance patient outcomes. For example, a June 2022 study in the Children's Journal explored AI, specifically deep convolutional neural networks (CNNs), to reduce radiation doses in pediatric CT scans. The study found AI could cut radiation by 36-70% while maintaining diagnostic image quality.

The Radiation Dose Optimization Software market benefits significantly from early detection capabilities, enabling timely identification of excessive radiation exposure and adjustment needs. By integrating advanced analytics and real-time monitoring, these software solutions enhance the early detection of dose deviations, which helps in mitigating risks and ensuring patient safety. This proactive approach supports adherence to regulatory standards and improves overall diagnostic accuracy and efficiency.

On the supply side, key players are investing significantly in research and development to enhance their radiation dose optimization software. Innovations are centered on integrating AI and machine learning to improve dose accuracy, streamline workflows, and provide actionable insights for clinicians. Companies are expanding their product offerings to include features like real-time dose tracking, automatic dose adjustment, and comprehensive reporting tools. The competitive supply landscape includes both established players and emerging startups contributing to advanced solutions.

Governments worldwide are enforcing stringent regulations and guidelines for radiation exposure management. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Commission, and various national health agencies have set standards for radiation dose limits and reporting requirements. These regulations drive healthcare providers to adopt dose optimization software to ensure compliance and enhance patient safety. Additionally, initiatives like the Image Gently Alliance and the Radiological Society of North America (RSNA) promote best practices in radiation dose management and encourage the adoption of advanced software solutions.

Market Dynamics

Drivers:

-

Increase in Prevalence of Chronic Illnesses

The rising incidence of chronic diseases such as cancer and cardiovascular conditions is driving the demand for diagnostic imaging tests. This increase in imaging procedures necessitates sophisticated dose optimization tools to manage and monitor radiation levels effectively. With cardiovascular diseases being a leading cause of mortality worldwide, regular imaging such as CT angiography or cardiac MRI is essential for patient management. The American Heart Association highlights the growing number of cardiovascular cases i.e. About 1 in 3 adults in the United States, which equates to approximately 85 million people, are affected by cardiovascular diseases (CVD) including heart disease, stroke, and high blood pressure., driving the need for effective dose management solutions to balance diagnostic accuracy and radiation safety.

Chronic respiratory diseases, such as chronic obstructive pulmonary disease (COPD), necessitate regular imaging to assess lung function and track disease progression. According to the National Institutes of Health (NIH), COPD affects approximately 16 million adults in the United States. This high prevalence underscores the growing need for advanced radiation dose optimization software to ensure patient safety during frequent imaging procedures. As COPD and similar conditions become more common, the demand for technologies that can manage and reduce radiation exposure while maintaining diagnostic accuracy is intensifying. This trend highlights the critical role of dose optimization software in protecting patients during routine imaging and managing the burden of chronic respiratory diseases. The integration of radiation dose optimization technologies in response to the growing incidence of these chronic conditions ensures that imaging procedures are performed safely and effectively, maintaining high diagnostic quality while minimizing patient exposure to harmful radiation.

-

Emphasis on Radiation Exposure Reduction and Patient Safety

There is a growing focus on minimizing radiation exposure and enhancing patient safety in medical imaging. This has heightened the demand for advanced software solutions that ensure precise dose management, reducing the risk of radiation-induced complications.

-

Advancements in AI and Machine Learning

Developments in artificial intelligence (AI) and machine learning are significantly enhancing the capabilities of dose optimization software. These technologies enable real-time dose adjustments, predictive analytics, and improved accuracy, thereby increasing the effectiveness and efficiency of radiation dose management.

-

Strict Legal Restrictions and Regulations

Regulatory requirements mandating efficient radiation dosage monitoring are pushing healthcare providers to adopt advanced software solutions. Compliance with stringent guidelines ensures patient safety and avoids potential legal repercussions.

|

Disease Category |

Specific Disease |

Imaging Techniques |

Purpose of Imaging |

|

Cancer |

|

Mammograms, CT scans, MRIs |

Monitor tumor progression and response to treatment |

|

|

|

CT scans, PET scans |

Assess tumor size and metastasis |

|

|

|

CT scans, MRIs |

Track disease status and detect recurrence |

|

Cardiovascular Diseases |

Coronary Artery Disease (CAD) |

CT angiography, Cardiac MRIs |

Evaluate coronary artery blockages and heart function |

|

|

|

Echocardiograms, Cardiac MRIs |

Monitor heart function and structure |

|

Chronic Respiratory Diseases |

Chronic Obstructive Pulmonary Disease (COPD) |

Chest X-rays, CT scans |

Monitor lung damage and disease progression |

|

|

|

Imaging to assess airway inflammation and structural changes |

Assess airway inflammation and structural changes |

|

Autoimmune Diseases |

Rheumatoid Arthritis |

X-rays, MRIs |

Monitor joint damage and disease progression |

|

|

|

Imaging studies to assess internal organ involvement |

Assess internal organ involvement and damage |

|

Neurological Disorders |

Multiple Sclerosis (MS) |

MRIs |

Track lesion development and disease progression |

|

|

|

Brain MRIs, PET scans |

Identify focal abnormalities and assess treatment efficacy |

The above table outlines the key diseases that require frequent imaging, the specific techniques used, and the purpose of these imaging procedures, which are crucial for optimizing radiation dose and ensuring patient safety.

Market Restraints:

-

High Setup and Maintenance Costs

The initial investment and ongoing maintenance expenses associated with sophisticated dose optimization software can be prohibitively high. This cost barrier may deter smaller healthcare facilities from adopting these advanced solutions.

-

Integration Challenges

-

Limited Knowledge and Training

-

Data Security and Privacy Concerns

Key Segmentation:

By Components

In the Radiation Dose Optimization Software Market, the Software segment commanded a leading 29.0% share in 2023. This dominance can be attributed to the widespread implementation of automated dose tracking and optimization tools within healthcare facilities. These software solutions are highly valued for their precision in monitoring and adjusting radiation doses, thereby ensuring both patient safety and adherence to stringent regulatory standards. Automated systems offer real-time analytics and accurate dose management, which are crucial for minimizing radiation exposure while enhancing diagnostic accuracy. As healthcare providers increasingly recognize the importance of effective dose management, the adoption of advanced software solutions continues to rise.

On the other hand, the Services segment, with a notable focus on Support services, is poised to experience the fastest growth. The complexity of modern dose optimization software necessitates ongoing technical support, system maintenance, and regular updates to ensure optimal performance and reliability. As healthcare facilities integrate more sophisticated software into their operations, the demand for comprehensive support services is expected to surge. This growth reflects the need for continuous technical assistance to manage and optimize advanced dose management systems effectively, further driving the expansion of the Services segment in the market.

By End-User

In the Radiation Dose Optimization Software Market, hospitals led with a substantial 32.9% share in 2023. This dominance is attributed to the extensive adoption of radiation dose optimization tools for both diagnostic imaging and cancer treatment within hospital settings. Hospitals are major consumers of these technologies, driven by the need to comply with rigorous regulatory standards and enhance patient safety. The large-scale implementation of dose optimization solutions helps hospitals manage radiation exposure effectively, ensuring adherence to safety protocols while delivering high-quality diagnostic and therapeutic outcomes. The significant investment in these technologies underscores hospitals' commitment to improving patient care and meeting regulatory requirements.

Conversely, Cancer Research Institutes are anticipated to witness the fastest growth in the market over the forecast period. This growth is propelled by the institutes’ focus on cutting-edge research and their commitment to minimizing radiation exposure during cancer treatments. As these institutions push the boundaries of cancer research, they increasingly adopt advanced radiation dose optimization technologies to refine treatment protocols and improve patient outcomes. The drive for innovation and precision in cancer care fuels the demand for sophisticated dose management solutions, positioning Cancer Research Institutes as key contributors to the market's rapid expansion.

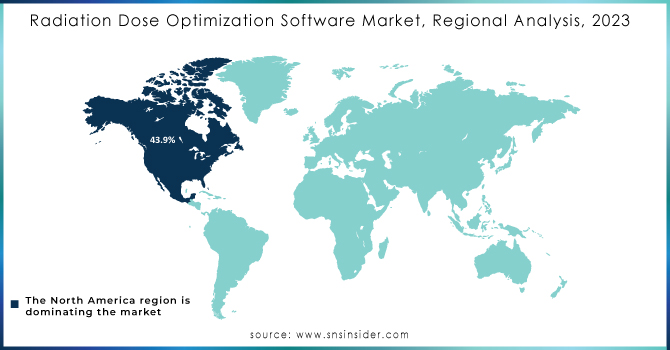

Regional Analysis

North America

In 2023, North America held a commanding 43.9% share of the radiation dose optimization software market, largely due to the region's advanced healthcare infrastructure and rigorous regulatory standards. The United States and Canada have established themselves as leaders in adopting cutting-edge healthcare technologies, including sophisticated radiation dose optimization solutions. The strong regulatory frameworks in these countries play a crucial role in driving market demand. Agencies like the U.S. Food and Drug Administration (FDA) and Health Canada enforce strict guidelines for radiation safety and dose management, compelling healthcare providers to implement advanced software to ensure compliance. This regulatory pressure, combined with the region's substantial investment in healthcare technology, has fostered an environment ripe for the growth of radiation dose optimization software. The high level of technological adoption in North America, including the integration of artificial intelligence and machine learning in medical imaging, further supports the region's dominant position in the market.

Europe

Europe is experiencing notable growth in the radiation dose optimization software market, fueled by similar regulatory pressures and technological advancements as seen in North America. European countries such as Germany, the United Kingdom, and France are at the forefront of adopting and integrating advanced dose optimization technologies. The European Union has established comprehensive guidelines and standards aimed at enhancing patient safety and minimizing radiation exposure, driving healthcare facilities across the continent to invest in sophisticated software solutions. The emphasis on compliance with these regulations, coupled with ongoing advancements in healthcare technology, contributes to Europe's significant market growth. Furthermore, European countries are engaged in continuous research and development to improve software capabilities, ensuring that healthcare providers have access to the latest innovations in dose management. This commitment to regulatory adherence and technological progress solidifies Europe’s position as a key player in the radiation dose optimization software market.

Asia-Pacific

The Asia-Pacific region is emerging as the fastest-growing market for radiation dose optimization software, driven by rapid advancements in healthcare infrastructure and increasing investments in medical technology. Countries such as China, India, and Japan are witnessing significant growth in demand for radiation dose optimization solutions due to their expanding healthcare networks and a rising prevalence of chronic diseases. The region's rapid development of healthcare facilities is enhancing access to advanced diagnostic imaging technologies, which in turn increases the need for effective dose management solutions. Additionally, government initiatives aimed at improving healthcare quality and safety are further propelling the market. The growing focus on integrating advanced software solutions into medical practices reflects the region's commitment to enhancing patient care and optimizing radiation exposure. As healthcare technology continues to advance and the burden of chronic diseases rises, the Asia-Pacific market is expected to maintain its robust growth trajectory, driven by both technological and healthcare infrastructure developments.

Need any customization research on Radiation Dose Optimization Software Market - Enquiry Now

Key Players

-

Philips Healthcare

-

Fujifilm (FUJIFILM Corporation)

-

McKesson Corporation

-

IMAGO Radiology

-

Merge Healthcare (an IBM Company)

-

Toshiba Medical Systems and others

Recent Developments

-

July 2024: GE Healthcare introduced an AI-driven dose management solution to enhance real-time dose adjustments and imaging accuracy.

-

June 2024: Siemens Healthineers launched a new dose optimization software version with improved integration capabilities for seamless data sharing.

-

April 2024: Philips Healthcare unveiled an updated radiation dose management system with advanced visualization tools and automated dose tracking.

-

March 2024: Canon Medical Systems released a software update featuring improved dose reduction algorithms and enhanced user interfaces.

-

February 2024: Varian Medical Systems introduced a new dose optimization tool focused on precision and patient-specific adjustments for radiation therapy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.80 Billion |

| Market Size by 2032 | US$ 8.06 billion |

| CAGR | CAGR of 8.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Software, Automatic, Manual, Services, Education & Training, Support) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Varian Medical Systems, McKesson Corporation, IMAGO Radiology, Sectra AB, Merge Healthcare (an IBM Company), Toshiba Medical Systems, and others. |

| Key Drivers |

• Emphasis on Radiation Exposure Reduction and Patient Safety |

| Restraints |

• High Setup and Maintenance Costs |