Rare Earth Recycling Market Report Scope & Overview:

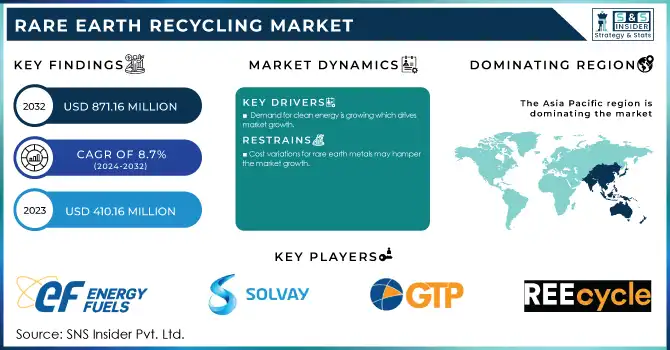

The Rare Earth Recycling Market size was USD 410.16 Million in 2023 and is expected to reach USD 871.16 Million by 2032 and grow at a CAGR of 8.7% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Rare Earth Recycling Market - Request Sample Report

The growing need for rare earth metals comes from their fundamental importance in high-tech projects that are the key to modern industries and green technologies. REEs are crucial in the production of EVs, inside the magnets used in electric motors, batteries, and other components. Likewise, rare earths play an integral role in many facets of renewable energy, most notably in wind turbines due to their use in permanent magnet high-efficiency generators. The electronics industry also uses rare earth gadgets such as smartphones, laptops, and high-performance communications. And while the global need for these technologies expands, so too does the requirement for rare earths. Yet the mining-related problems such as environmental destruction or geopolitical dependencies have also now shifted attention toward rare earth metal recycling as a truly sustainable and stable alternative supply chain. Not only does this increase the supply of metals needed to meet the rising demand, but it also reduces the need for primary mining, making recycling a vital tool to support the transition to cleaner and more sustainable technologies.

According to the U.S. Department of Energy (DOE), the demand for rare earths in electric vehicles is growing rapidly. The U.S. DOE estimates that by 2030, electric vehicles will require approximately 1.5 million tons of lithium, cobalt, and nickel annually, all of which depend on rare earth elements like neodymium and dysprosium for the production of permanent magnets.

The continuously increasing demand for rare earth elements (REEs), the secondary resource has become a sustainable way out for governments and enterprises to ensure the supply of REEs. Secondary resource utilization, on the other hand, is the utilization of rare earths from industrial and electronic, rather than exclusively procuring them from primary mines, which are resource-intensive and ecologically destructive. This method is becoming increasingly popular because of the burgeoning global electronic waste (e-waste) which is made up of precious rare earth metals. Consumer electronics such as old smartphones, laptops and other devices could be a source of neodymium, dysprosium, and terbium, which are critical elements necessary to manufacture high-tech products like permanent magnets. According to the U.S. Environmental Protection Agency (EPA), the world generates an estimated 53 million metric tons of e-waste each year, a number that is only expected to grow, making it an excellent source for rare earth recycling. And governments are aware of this potential, trying to implement regulations in the area of recycling, like the recent adoption of the European Union Directive on Waste Electrical and

Electronic Equipment (WEEE), which requires the collection and recycling of e-waste. Moreover, the new recycling technologies make the separation of rare earths from such disposal streams more effective in economic and environmental aspects. Countries can also reduce their reliance on primary mining, lower the environmental burden, and create a more secure supply of these critical materials by using these secondary sources.

Rare Earth Recycling Market Dynamics:

Drivers

-

Demand for clean energy is growing which drives market growth.

The market for rare earth metals and the recycling market is the increasing demand in the area of clean energy. With the world shifting to more sustainable energy systems to fight climate change, there is an even bigger dependency on renewable energy made from wind and solar. These technologies, especially in the case of wind generation and electric vehicle operations, are at the heart of clean energy strategies, with rare earth elements (REEs) needed for their production. In wind turbines, for example, higher efficiency requires permanent magnets made from rare earths such as neodymium and dysprosium and the same applies to EV motors using those elements for their performance. In line with these IRENA figures, world renewable energy capacity is set for substantial growth, with wind and solar combined making up greater than half of the global mix by 2050. The rapid increase in installations in renewable energy sectors is feeding the demand for rare earths and has begun creating an urgent demand for sustainable sourcing solutions, of which recycling can play a role in meeting these ever-growing requirements. In addition, this clear push towards clean energy responds to the rapid requirement for minimizing carbon footprints and improving energy efficiency, which in turn drives the rare earth metals market and positively bolsters their demand spectrum.

Restraint

-

Cost variations for rare earth metals may hamper the market growth.

Many cost fluctuations of rare earth metals around the globe have a detrimental impact on the growth of the market as the wide volatility in prices of rare earth metals is primarily due to supply-demand imbalance and geopolitical factors. China's dominance in terms of worldwide rare earth production has been known for quite some time and will continue to be a huge portion of the overall picture, with the U.S. Geological Survey (USGS) estimating over 70% of all the rare earth metals produced worldwide come from just a few countries. A small number of suppliers dominate the market this way, exposing it to price rises from export controls, trade disputes, or an in-and-out production capacity. Example: previous years of rare earth proclamations have found spikes in rare earth costs, impacting industries reliant on such components to manufacture. Moreover, the intricate and expensive methods of mining, refining, and recycling of rare earths make their prices highly volatile. These cost discrepancies create supply chain disruptions, disincentivize investment in rare-earth-based technologies, and drive up the cost associated with the transition to renewable electricity and high technology.

Rare Earth Recycling Market Segmentation

By Application

Permanent magnets held the largest market share around 28% in 2023These strong permanent magnets, consisting of rare earth elements (lanthanide metals), mainly neodymium, praseodymium, and dysprosium, are essential to providing small lightweight, durable magnets for advanced technologies. Powerful demand comes from the automotive industry where permanent magnets are irreplaceable component of electric vehicle (EV) motors, with their inherent characteristic of high energy efficiency and small size that is a must for automotive applications to enhance vehicle performance and range. The renewable energy sector also relies heavily on them for wind turbine generators, where they are vital for enhancing energy conversion efficiency. These magnets are used not only beyond energy and automotive, but also in electronics, robotics and medical devices, which rely on their high strength and unmatched reliability. In some emerging sectors, their proliferation ensures their firm hold of an ever-larger portion of the rare earth market.

By Source

Magnets held the largest market share around 32% in 2023. This is due to the wide deployment of rare-earth permanent magnets, especially Neodymium-Iron-Boron (NdFeB) in the high-tech and green energy industries. They are also critical parts of EV motors, wind turbine generators, and many electronic devices providing improved strength and durability with efficiency as compared to ceramic magnets. Unsurprisingly, this is being primarily driven by the rise of EV adoption, with global sales of EVs exceeding 10 million units in 2022 according to the International Energy Agency (IEA). The growing need for high-efficiency magnets in wind turbines also spurs demand in the renewable energy sector. In addition to these, there are robotics, medical devices, and aerospace applications that are very rapidly developing. This high-value and widely critical application in many industries ranks magnets as the largest segment in the rare earth market by share.

By Technology

Pyrometallurgical held the largest market share around 68% in 2023. It is owing to their efficiency and cost-effectiveness, extracting rare earth elements (REEs) from secondary sources. The process is essentially a high-temperature method of smelting, roasting, or calcination, and is particularly effective for treating complex waste streams such as industrial slags, magnets, and electronic materials to recover rare earth metals. This is the most common recycling method due to high recovery rates of critical elements such as neodymium, praseodymium and dysprosium, as well as high waste handling capacity of pyrometallurgical processes. Added to that, with the existing infrastructure and scalability of the technology to take it quickly to bigger operations, it is a more economical option than other processes such as hydrometallurgy. Increased demand for the recycling of rare earth elements used in old electric vehicle (EV) motors and wind turbines, along with their industrial by-products, is based on the reports from mineral recycling you might find in industry publications, pushing the pyrometallurgical processes in its place. They are the best method to recycle rare earths due to their ability to process a large variety of materials and access to energy efficient designs.

Rare Earth Recycling Market Regional Analysis

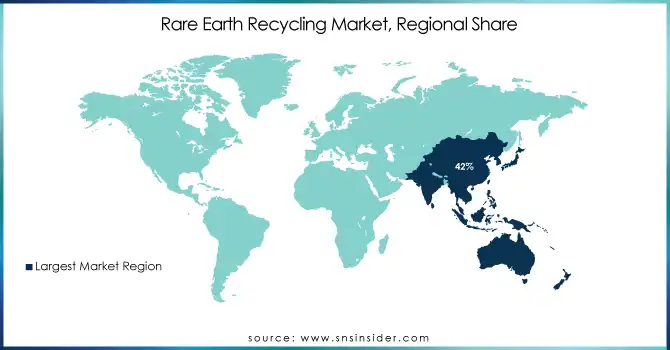

Asia Pacific held the largest market share around 42% in 2023. The Asia Pacific region is the largest market for rare earth market, as market dominates in the production, processing and consumption of rare earth elements (REEs) China holds more than 70% of global rare earth production, the US Geological Survey (USGS) notes, as do so-called rare-earth-producing regions of the world with China at their helm. China is already the leading world power in the rare earth industry due to its extensive supply chain infrastructure covering mining, refining and manufacturing capabilities. Moreover, rising penetration of advanced technologies in Japan, South Korea, and India, particularly electric vehicles (EVs), renewable energy systems, and consumer electronics, has helped to create robust regional demand for rare earths. Dirty Permanent Magnets For instance, the big market for electric vehicles (EVs) in China, which sold greater than 6 million devices in 2022 based on China Association of Automobile Manufacturers (CAAM), is closely efficacious reliance on permanent magnets based on uncommon earth elements. Moreover, its relentless focus on enhancing wind power capacity coupled with aggressive government policies promoting local plants ensures continued demand. Strategic investments in rare earth recycling and innovation solidify the region's leadership position and guarantee a long-term secure and sustainable supply of these essential materials for high-growth industries.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Energy Fuels, Inc. (Rare Earth Carbonate, Thorium)

-

Solvay SA (Cerium Oxide, Lanthanum Compounds)

-

Global Tungsten & Powders Corp. (Tungsten Powders, Tungsten Carbides)

-

REEcycle Inc. (Recycled Neodymium, Recycled Dysprosium)

-

Umicore (Rare Earth Catalysts, Cobalt-Free Battery Materials)

-

Osram Licht AG (Phosphors, Fluorescent Lamp Materials)

-

Hitachi Metals, Ltd. (NdFeB Magnets, Ferrite Magnets)

-

Lynas Rare Earths Ltd. (Rare Earth Oxides, Rare Earth Metals)

-

MP Materials (Praseodymium-Nd Oxide, Cerium Concentrates)

-

Arafura Resources (NdPr Oxide, Phosphoric Acid)

-

Avalon Advanced Materials (Rare Earth Concentrates, Lithium-Tantalum Products)

-

Iluka Resources (Monazite, Zircon-Rich Concentrates)

-

Neo Performance Materials (Magnet Powders, Cerium Polishing Powders)

-

Rainbow Rare Earths (Mixed Rare Earth Carbonate, NdPr Oxide)

-

China Northern Rare Earth Group (Rare-Earth Alloys, Rare-Earth Magnets)

-

Shenghe Resources Holding Co., Ltd. (Lanthanum Compounds, Yttrium Oxides)

-

Molycorp (Lanthanum Oxide, Cerium Oxide)

-

Iljin Materials (Rare Earth Alloys, Magnet Materials)

-

Jiangxi Ganfeng Lithium Co. (Rare Earth Compounds, Battery-Grade Materials)

-

Zhongke Sanhuan High-Tech (Magnetic Materials, Rare Earth Permanent Magnets)

Recent Development:

-

In 2023, Energy Fuels began producing rare earth carbonate from monazite sand at its White Mesa Mill in Utah, positioning itself as a significant U.S. supplier of rare earth materials.

-

In 2023, Global Tungsten & Powders Corp. announced advancements in recycling technologies for tungsten and rare earth powders to enhance sustainability in the supply chain.

-

In 2023, REEcycle launched a new recycling facility for extracting neodymium and dysprosium from electronic waste to support the circular economy in rare earth materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 410.16 Million |

| Market Size by 2032 | USD 871.16 Million |

| CAGR | CAGR of 8.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Alloy, Catalyst, Permanent magnets, Glass, Ceramics, Phosphor, Polishing materials, Hydrogen storage alloys) • By Source (FCC, Fluorescent lamps, Magnets, Batteries, Industrial process) • By Technology (Hydrometallurgical, Pyrometallurgical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America)a) |

| Company Profiles | Energy Fuels, Inc. (US), Solvay SA (Belgium), Global Tungsten & Powders Corp. (US), REEcycle Inc.(US), Umicore (Belgium), Osram Licht AG (Germany) and Hitachi Metals, Ltd. (Japan) |

| Key Drivers | • Demand for clean energy is growing which drives market growth. |

| Restraints | • Cost variations for rare earth metals may hamper the market growth. |