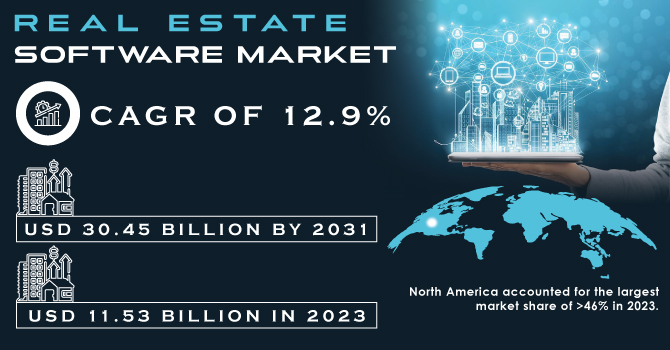

The Real Estate Software Market size was USD 11.53 billion in 2023 and is expected to Reach USD 30.45 billion by 2031 and grow at a CAGR of 12.9% over the forecast period of 2024-2031.

Get More Information on Real Estate Software Market - Request Sample Report

The real estate sector is crucial, impacting individuals and businesses alike. Real estate software helps companies to streamline tasks through social media, online marketing, and website creation. The market is seeing advancements in overcoming data and process transparency issues. Blockchain offers solutions it encrypts records and secures ledgers, even enabling instant payments. Businesses also need software for better data management and customer retention. The residential market involves buying, selling, and renting properties. Factors like population growth and interest rates influence this market. Real estate can be an investment option for individuals and institutions seeking long-term growth and rental income. Real estate investment trusts (REITs) are a popular way to invest in real estate without owning properties.

Software providers are adopting new technologies to meet customer needs. Virtualization and Virtual Reality (VR) are expected to grow the market, allowing remote purchases and saving time. Additionally, Artificial Intelligence (AI) and machine learning (ML) are helping businesses automate tasks and improve ROI. Real estate software streamlines operations across departments. Sales & marketing, finance, and management can gain insights into the customer journey by monitoring software modules, tracking leads, managing dashboards, and monitoring financial data.

KEY DRIVERS

Real estate professionals manage a lot of data and processes. Software automates tasks, improves data management, and streamlines workflows, boosting efficiency.

Blockchain technology offers solutions for data security and transparency in real estate transactions.

Competition necessitates better customer service. Real estate software helps manage leads, personalize communication, and improve the overall customer experience.

RESTRAIN

Implementing and maintaining real estate software can be expensive for smaller companies.

Smaller firms may be hesitant to adopt new technologies due to budget constraints or lack of technical expertise.

Real estate software solutions can be complex to implement and use. This can be a barrier to adoption for businesses that do not have the technical expertise to implement and use real estate software solutions.

OPPORTUNITY

Virtual tours and VR experiences can help close deals remotely and enhance the customer journey.

AI and ML can automate tasks, predict market trends, and optimize property valuations, leading to improved ROI.

The adoption of VR and AI technologies is gaining traction in the real estate market, with businesses looking for ways to improve property management

As companies explore for methods to simplify operations like rent collection, repair requests, and lease administration. This gives software companies the chance to produce effective and user-friendly property management systems.

CHALLENGES

Real estate software stores sensitive data, so robust security measures are crucial to prevent breaches.

Integrating new software with existing systems can be complex and expensive.

Shifting from traditional methods to software-driven processes might require overcoming resistance from some real estate professionals.

On the internet, open-source software is publicly accessible and simple to download. Instead of purchasing software, users might choose open-source alternatives. In addition to being transparent since the source code is available, open-source software has cost advantages and is scalable, both of which are profitable for end users.

The war in Russia-Ukraine presents a complex situation for the real estate software market. Economic uncertainty caused by the war discourages investment, potentially leading to a decrease in demand for software used in property management and analysis. Disruptions in supply chains further complicate matters by making it harder for software companies to acquire necessary materials.

However, the war also creates potential growth avenues. The influx of refugees in neighboring countries drives up housing demand, which could translate to increased demand for property management software to streamline rentals. Additionally, the war's emphasis on remote work benefits real estate software companies offering virtual tours, online leasing, and other tools that facilitate remote interaction. In essence, the war's impact on the real estate software market is multifaceted. While challenges exist, the market has the potential to adapt and find new opportunities in this evolving landscape.

For Example: Realogy, the parent company of Century 21 and Coldwell Banker, has seen its stock price decline by 30% since the start of the war. Redfin, a real estate brokerage company, has seen its revenue decline by 15% since the start of the war.

IMPACT OF ONGOING RECESSION

The housing slump triggered by the recession is creating a ripple effect in the real estate software industry. These tools, crucial for agents and brokers to market and sell homes, see a drop in demand as fewer properties move. Furthermore, rising unemployment during a recession translates to less people buying houses, diminishing the need for such software. This is exemplified by Prop Tiger and Magic Bricks, real estate portals, experiencing revenue dips of 10% and 5% respectively since the recession began. The financial strain expands beyond software. HDFC Housing Finance, a mortgage lender, has witnessed a 15% plunge in stock price as defaults on mortgages rise, impacting their profitability.

By Type

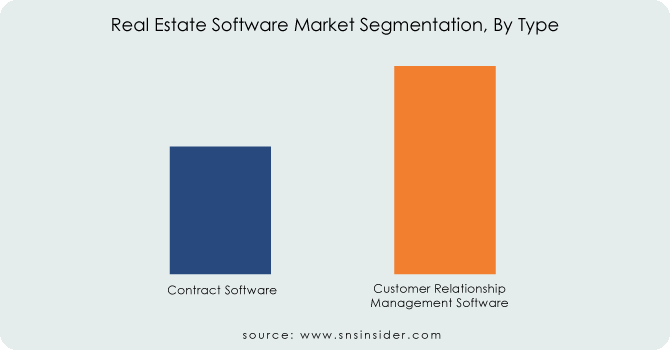

Contract Software

Customer Relationship Management Software

Customer Relationship Management (CRM) Software this segment holds the largest market share in 2023, due to its vital role for real estate agents. CRM software streamlines client communication, tracks lead, and manages deals, boosting productivity and efficiency.

Do You Need any Customization Research on Real Estate Software Market - Enquire Now

By Application

Commercial

Residential

By Deployment

Cloud

On-premise

Cloud-based solutions hold the largest market share of 58% in 2023, and are rapidly gaining traction. Cloud software offers easier access, scalability, and cost-effectiveness compared to on-premise solutions, making it a preferred choice for many businesses.

By End-Use

Architects

Engineers

Project Managers

Real Estate Agents

REGIONAL ANALYSIS

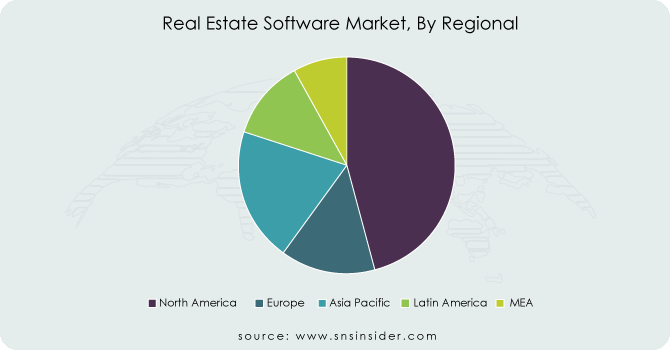

North America accounted for the largest market share of 46% in 2023. The adoption of innovative technologies for a variety of commercial and residential applications, as well as increased urbanization and infrastructure construction activities, are all contributing to the market growth in this area. The United States is the largest real estate market in North America. The real estate market in Canada is also growing, but at a slower pace than the real estate market in the United States. The real estate market in Mexico is growing, but it is still smaller than the real estate markets in the United States and Canada. The interest rates in North America are at a record low, which is making it more affordable to buy a home.

Asia Pacific is anticipated to grow as the fastest-developing regional market. Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. China is the largest real estate market in APAC. The real estate markets in other APAC countries, such as Japan, South Korea, and Australia, are also growing, but at a slower pace than the real estate markets in China and India. The APAC region is urbanizing at a rapid pace, and this is driving the demand for housing. The middle class in APAC is growing rapidly, and this is creating more demand for housing. There is a significant investment in infrastructure in APAC, and this is creating more demand for commercial real estate.

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major players are Accruent, Altus Group Ltd., Autodesk Inc., CoStar Realty Information Inc., Microsoft Corporation, MRI Software LLC, Oracle Corporation, RealPage Inc., SAP SE, SMR Group, Trimble Inc., Yardi Systems Inc. and other players.

In January 2023: RealPage Inc. acquired Arrived Homes, a proptech company that provides a platform for homeowners to rent out their homes. The acquisition will allow RealPage to expand its offerings to homeowners and property managers.

In February 2023: SAP SE announced the development of a new product called SAP Real Estate Cloud. SAP Real Estate Cloud is a cloud-based platform that provides real estate companies with a single view of their properties and tenants. The platform also includes features for managing maintenance requests, leasing, and accounting.

In January 2023: SAP SE acquired Taulia, a cloud-based supplier financing company. The acquisition will allow SAP to expand its offerings to businesses by providing them with a way to finance their purchases from suppliers.

| Report Attributes | Details |

| Market Size in 2023 | US$ 11.53 Bn |

| Market Size by 2031 | US$ 30.45 Bn |

| CAGR | CAGR of 12.9% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Contract Software, Customer Relationship Management Software) • By Type (Commercial, Residential) • By Deployment (Cloud, On-premise) • By End-use (Architects, Engineers, Project Managers, Real Estate Agents) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accruent, Altus Group Ltd., Autodesk Inc., CoStar Realty Information Inc., Microsoft Corporation, MRI Software LLC, Oracle Corporation, RealPage Inc., SAP SE, SMR Group, Trimble Inc., Yardi Systems Inc. |

| Key Drivers |

• Real estate professionals manage a lot of data and processes. Software automates tasks, improves data management, and streamlines workflows, boosting efficiency. • Blockchain technology offers solutions for data security and transparency in real estate transactions. |

| Market Restraints | • Implementing and maintaining real estate software can be expensive for smaller companies. |

The Real Estate Software Market was valued at USD 11.53 billion in 2023.

The expected CAGR of the global Real Estate Software Market during the forecast period is 12.9%.

The Asia-Pacific region is anticipated to record the Fastest Growing in the Real Estate Software Market.

The Customer Relationship Management Software segment is leading in the market revenue share in 2023.

The North America region with the largest revenue share in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Real Estate Software MarketSegmentation, By Type

9.1 Introduction

9.2 Trend Analysis

9.3 Contract Software

9.4 Customer Relationship Management Software

10. Real Estate Software MarketSegmentation, By Application

10.1 Introduction

10.2 Trend Analysis

10.3 Commercial

10.4 Residential

11. Real Estate Software MarketSegmentation, By Deployment

11.1 Introduction

11.2 Trend Analysis

11.3 Cloud

11.4 On-premise

12. Real Estate Software MarketSegmentation, By End Use

12.1 Introduction

12.2 Trend Analysis

12.3 Architects

12.4 Engineers

12.5 Project Managers

12.6 Real Estate Agents

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 Trend Analysis

13.2.2 North America Real Estate Software Market by Country

13.2.3 North America Real Estate Software Market, By Type

13.2.4 North America Real Estate Software Market, By Application

13.2.5 North America Real Estate Software Market, By Deployment

13.2.6 North America Real Estate Software Market, By End-Use

13.2.7 USA

13.2.7.1 USA Real Estate Software Market, By Type

13.2.7.2 USA Real Estate Software Market, By Application

13.2.7.3 USA Real Estate Software Market, By Deployment

13.2.7.4 USA Real Estate Software Market, By End-Use

13.2.8 Canada

13.2.8.1 Canada Real Estate Software Market, By Type

13.2.8.2 Canada Real Estate Software Market, By Application

13.2.8.3 Canada Real Estate Software Market, By Deployment

13.2.8.4 Canada Real Estate Software Market, By End-Use

13.2.9 Mexico

13.2.9.1 Mexico Real Estate Software Market, By Type

13.2.9.2 Mexico Real Estate Software Market, By Application

13.2.9.3 Mexico Real Estate Software Market, By Deployment

13.2.9.4 Mexico Real Estate Software Market, By End-Use

13.3 Europe

13.3.1 Trend Analysis

13.3.2 Eastern Europe

13.3.2.1 Eastern Europe Real Estate Software Marketby Country

13.3.2.2 Eastern Europe Real Estate Software Market, By Type

13.3.2.3 Eastern Europe Real Estate Software Market, By Application

13.3.2.4 Eastern Europe Real Estate Software Market, By Deployment

13.3.2.5 Eastern Europe Real Estate Software Market, By End-Use

13.3.2.6 Poland

13.3.2.6.1 Poland Real Estate Software Market, By Type

13.3.2.6.2 Poland Real Estate Software Market, By Application

13.3.2.6.3 Poland Real Estate Software Market, By Deployment

13.3.2.6.4 Poland Real Estate Software Market, By End-Use

13.3.2.7 Romania

13.3.2.7.1 Romania Real Estate Software Market, By Type

13.3.2.7.2 Romania Real Estate Software Market, By Application

13.3.2.7.3 Romania Real Estate Software Market, By Deployment

13.3.2.7.4 Romania Real Estate Software Market, By End-Use

13.3.2.8 Hungary

13.3.2.8.1 Hungary Real Estate Software Market, By Type

13.3.2.8.2 Hungary Real Estate Software Market, By Application

13.3.2.8.3 Hungary Real Estate Software Market, By Deployment

13.3.2.8.4 Hungary Real Estate Software Market, By End-Use

13.3.2.9 Turkey

13.3.2.9.1 Turkey Real Estate Software Market, By Type

13.3.2.9.2 Turkey Real Estate Software Market, By Application

13.3.2.9.3 Turkey Real Estate Software Market, By Deployment

13.3.2.9.4 Turkey Real Estate Software Market, By End-Use

13.3.2.10 Rest of Eastern Europe

13.3.2.10.1 Rest of Eastern Europe Real Estate Software Market, By Type

13.3.2.10.2 Rest of Eastern Europe Real Estate Software Market, By Application

13.3.2.10.3 Rest of Eastern Europe Real Estate Software Market, By Deployment

13.3.2.10.4 Rest of Eastern Europe Real Estate Software Market, By End-Use

13.3.3 Western Europe

13.3.3.1 Western Europe Real Estate Software Marketby Country

13.3.3.2 Western Europe Real Estate Software Market, By Type

13.3.3.3 Western Europe Real Estate Software Market, By Application

13.3.3.4 Western Europe Real Estate Software Market, By Deployment

13.3.3.5 Western Europe Real Estate Software Market, By End-Use

13.3.3.6 Germany

13.3.3.6.1 Germany Real Estate Software Market, By Type

13.3.3.6.2 Germany Real Estate Software Market, By Application

13.3.3.6.3 Germany Real Estate Software Market, By Deployment

13.3.3.6.4 Germany Real Estate Software Market, By End-Use

13.3.3.7 France

13.3.3.7.1 France Real Estate Software Market, By Type

13.3.3.7.2 France Real Estate Software Market, By Application

13.3.3.7.3 France Real Estate Software Market, By Deployment

13.3.3.7.4 France Real Estate Software Market, By End-Use

13.3.3.8 UK

13.3.3.8.1 UK Real Estate Software Market, By Type

13.3.3.8.2 UK Real Estate Software Market, By Application

13.3.3.8.3 UK Real Estate Software Market, By Deployment

13.3.3.8.4 UK Real Estate Software Market, By End-Use

13.3.3.9 Italy

13.3.3.9.1 Italy Real Estate Software Market, By Type

13.3.3.9.2 Italy Real Estate Software Market, By Application

13.3.3.9.3 Italy Real Estate Software Market, By Deployment

13.3.3.9.4 Italy Real Estate Software Market, By End-Use

13.3.3.10 Spain

13.3.3.10.1 Spain Real Estate Software Market, By Type

13.3.3.10.2 Spain Real Estate Software Market, By Application

13.3.3.10.3 Spain Real Estate Software Market, By Deployment

13.3.3.10.4 Spain Real Estate Software Market, By End-Use

13.3.3.11 Netherlands

13.3.3.11.1 Netherlands Real Estate Software Market, By Type

13.3.3.11.2 Netherlands Real Estate Software Market, By Application

13.3.3.11.3 Netherlands Real Estate Software Market, By Deployment

13.3.3.11.4 Netherlands Real Estate Software Market, By End-Use

13.3.3.12 Switzerland

13.3.3.12.1 Switzerland Real Estate Software Market, By Type

13.3.3.12.2 Switzerland Real Estate Software Market, By Application

13.3.3.12.3 Switzerland Real Estate Software Market, By Deployment

13.3.3.12.4 Switzerland Real Estate Software Market, By End-Use

13.3.3.13 Austria

13.3.3.13.1 Austria Real Estate Software Market, By Type

13.3.3.13.2 Austria Real Estate Software Market, By Application

13.3.3.13.3 Austria Real Estate Software Market, By Deployment

13.3.3.13.4 Austria Real Estate Software Market, By End-Use

13.3.3.14 Rest of Western Europe

13.3.3.14.1 Rest of Western Europe Real Estate Software Market, By Type

13.3.3.14.2 Rest of Western Europe Real Estate Software Market, By Application

13.3.3.14.3 Rest of Western Europe Real Estate Software Market, By Deployment

13.3.3.14.4 Rest of Western Europe Real Estate Software Market, By End-Use

13.4 Asia-Pacific

13.4.1 Trend Analysis

13.4.2 Asia-Pacific Real Estate Software Marketby Country

13.4.3 Asia-Pacific Real Estate Software Market, By Type

13.4.4 Asia-Pacific Real Estate Software Market, By Application

13.4.5 Asia-Pacific Real Estate Software Market, By Deployment

13.4.6 Asia-Pacific Real Estate Software Market, By End-Use

13.4.7 China

13.4.7.1 China Real Estate Software Market, By Type

13.4.7.2 China Real Estate Software Market, By Application

13.4.7.3 China Real Estate Software Market, By Deployment

13.4.7.4 China Real Estate Software Market, By End-Use

13.4.8 India

13.4.8.1 India Real Estate Software Market, By Type

13.4.8.2 India Real Estate Software Market, By Application

13.4.8.3 India Real Estate Software Market, By Deployment

13.4.8.4 India Real Estate Software Market, By End-Use

13.4.9 Japan

13.4.9.1 Japan Real Estate Software Market, By Type

13.4.9.2 Japan Real Estate Software Market, By Application

13.4.9.3 Japan Real Estate Software Market, By Deployment

13.4.9.4 Japan Real Estate Software Market, By End-Use

13.4.10 South Korea

13.4.10.1 South Korea Real Estate Software Market, By Type

13.4.10.2 South Korea Real Estate Software Market, By Application

13.4.10.3 South Korea Real Estate Software Market, By Deployment

13.4.10.4 South Korea Real Estate Software Market, By End-Use

13.4.11 Vietnam

13.4.11.1 Vietnam Real Estate Software Market, By Type

13.4.11.2 Vietnam Real Estate Software Market, By Application

13.4.11.3 Vietnam Real Estate Software Market, By Deployment

13.4.11.4 Vietnam Real Estate Software Market, By End-Use

13.4.12 Singapore

13.4.12.1 Singapore Real Estate Software Market, By Type

13.4.12.2 Singapore Real Estate Software Market, By Application

13.4.12.3 Singapore Real Estate Software Market, By Deployment

13.4.12.4 Singapore Real Estate Software Market, By End-Use

13.4.13 Australia

13.4.13.1 Australia Real Estate Software Market, By Type

13.4.13.2 Australia Real Estate Software Market, By Application

13.4.13.3 Australia Real Estate Software Market, By Deployment

13.4.13.4 Australia Real Estate Software Market, By End-Use

13.4.14 Rest of Asia-Pacific

13.4.14.1 Rest of Asia-Pacific Real Estate Software Market, By Type

13.4.14.2 Rest of Asia-Pacific Real Estate Software Market, By Application

13.4.14.3 Rest of Asia-Pacific Real Estate Software Market, By Deployment

13.4.14.4 Rest of Asia-Pacific Real Estate Software Market, By End-Use

13.5 Middle East & Africa

13.5.1 Trend Analysis

13.5.2 Middle East

13.5.2.1 Middle East Real Estate Software Marketby Country

13.5.2.2 Middle East Real Estate Software Market, By Type

13.5.2.3 Middle East Real Estate Software Market, By Application

13.5.2.4 Middle East Real Estate Software Market, By Deployment

13.5.2.5 Middle East Real Estate Software Market, By End-Use

13.5.2.6 UAE

13.5.2.6.1 UAE Real Estate Software Market, By Type

13.5.2.6.2 UAE Real Estate Software Market, By Application

13.5.2.6.3 UAE Real Estate Software Market, By Deployment

13.5.2.6.4 UAE Real Estate Software Market, By End-Use

13.5.2.7 Egypt

13.5.2.7.1 Egypt Real Estate Software Market, By Type

13.5.2.7.2 Egypt Real Estate Software Market, By Application

13.5.2.7.3 Egypt Real Estate Software Market, By Deployment

13.5.2.7.4 Egypt Real Estate Software Market, By End-Use

13.5.2.8 Saudi Arabia

13.5.2.8.1 Saudi Arabia Real Estate Software Market, By Type

13.5.2.8.2 Saudi Arabia Real Estate Software Market, By Application

13.5.2.8.3 Saudi Arabia Real Estate Software Market, By Deployment

13.5.2.8.4 Saudi Arabia Real Estate Software Market, By End-Use

13.5.2.9 Qatar

13.5.2.9.1 Qatar Real Estate Software Market, By Type

13.5.2.9.2 Qatar Real Estate Software Market, By Application

13.5.2.9.3 Qatar Real Estate Software Market, By Deployment

13.5.2.9.4 Qatar Real Estate Software Market, By End-Use

13.5.2.10 Rest of Middle East

13.5.2.10.1 Rest of Middle East Real Estate Software Market, By Type

13.5.2.10.2 Rest of Middle East Real Estate Software Market, By Application

13.5.2.10.3 Rest of Middle East Real Estate Software Market, By Deployment

13.5.2.10.4 Rest of Middle East Real Estate Software Market, By End-Use

13.5.3 Africa

13.5.3.1 Africa Real Estate Software Marketby Country

13.5.3.2 Africa Real Estate Software Market, By Type

13.5.3.3 Africa Real Estate Software Market, By Application

13.5.3.4 Africa Real Estate Software Market, By Deployment

13.5.3.5 Africa Real Estate Software Market, By End-Use

13.5.3.6 Nigeria

13.5.3.6.1 Nigeria Real Estate Software Market, By Type

13.5.3.6.2 Nigeria Real Estate Software Market, By Application

13.5.3.6.3 Nigeria Real Estate Software Market, By Deployment

13.5.3.6.4 Nigeria Real Estate Software Market, By End-Use

13.5.3.7 South Africa

13.5.3.7.1 South Africa Real Estate Software Market, By Type

13.5.3.7.2 South Africa Real Estate Software Market, By Application

13.5.3.7.3 South Africa Real Estate Software Market, By Deployment

13.5.3.7.4 South Africa Real Estate Software Market, By End-Use

13.5.3.8 Rest of Africa

13.5.3.8.1 Rest of Africa Real Estate Software Market, By Type

13.5.3.8.2 Rest of Africa Real Estate Software Market, By Application

13.5.3.8.3 Rest of Africa Real Estate Software Market, By Deployment

13.5.3.8.4 Rest of Africa Real Estate Software Market, By End-Use

13.6 Latin America

13.6.1 Trend Analysis

13.6.2 Latin America Real Estate Software Marketby country

13.6.3 Latin America Real Estate Software Market, By Type

13.6.4 Latin America Real Estate Software Market, By Application

13.6.5 Latin America Real Estate Software Market, By Deployment

13.6.6 Latin America Real Estate Software Market, By End-Use

13.6.7 Brazil

13.6.7.1 Brazil Real Estate Software Market, By Type

13.6.7.2 Brazil Real Estate Software Market, By Application

13.6.7.3 Brazil Real Estate Software Market, By Deployment

13.6.7.4 Brazil Real Estate Software Market, By End-Use

13.6.8 Argentina

13.6.8.1 Argentina Real Estate Software Market, By Type

13.6.8.2 Argentina Real Estate Software Market, By Application

13.6.8.3 Argentina Real Estate Software Market, By Deployment

13.6.8.4 Argentina Real Estate Software Market, By End-Use

13.6.9 Colombia

13.6.9.1 Colombia Real Estate Software Market, By Type

13.6.9.2 Colombia Real Estate Software Market, By Application

13.6.9.3 Colombia Real Estate Software Market, By Deployment

13.6.9.4 Colombia Real Estate Software Market, By End-Use

13.6.10 Rest of Latin America

13.6.10.1 Rest of Latin America Real Estate Software Market, By Type

13.6.10.2 Rest of Latin America Real Estate Software Market, By Application

13.6.10.3 Rest of Latin America Real Estate Software Market, By Deployment

13.6.10.4 Rest of Latin America Real Estate Software Market, By End-Use

14. Company Profiles

14.1 Accruent

14.1.1 Company Overview

14.1.2 Financial

14.1.3 Products/ Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Altus Group Ltd.

14.2.1 Company Overview

14.2.2 Financial

14.2.3 Products/ Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Autodesk Inc.

14.3.1 Company Overview

14.3.2 Financial

14.3.3 Products/ Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 CoStar Realty Information Inc.

14.4.1 Company Overview

14.4.2 Financial

14.4.3 Products/ Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 Microsoft Corporation

14.5.1 Company Overview

14.5.2 Financial

14.5.3 Products/ Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 MRI Software LLC

14.6.1 Company Overview

14.6.2 Financial

14.6.3 Products/ Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 Oracle Corporation

14.7.1 Company Overview

14.7.2 Financial

14.7.3 Products/ Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 RealPage Inc.

14.8.1 Company Overview

14.8.2 Financial

14.8.3 Products/ Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 SAP SE

14.9.1 Company Overview

14.9.2 Financial

14.9.3 Products/ Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 SMR Group

14.10.1 Company Overview

14.10.2 Financial

14.10.3 Products/ Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

14.11 Trimble Inc.

14.11.1 Company Overview

14.11.2 Financial

14.11.3 Products/ Services Offered

14.11.4 SWOT Analysis

14.11.5 The SNS View

14.12 Yardi Systems Inc.

14.12.1 Company Overview

14.12.2 Financial

14.12.3 Products/ Services Offered

14.12.4 SWOT Analysis

14.12.5 The SNS View

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. Use Case and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Video Streaming Software Market size was USD 9.8 billion in 2022 and is expected to Reach USD 38.1 billion by 2030 and grow at a CAGR of 18.5 % over the forecast period of 2023-2030.

The Travel and Expense Management Software Market size was valued at USD 2.91 billion in 2022 and is expected to grow to USD 8.07 billion by 2030 and grow at a CAGR of 13.6 % over the forecast period of 2023-2030.

The Workplace Transformation Market size was valued at USD 22.91 Bn in 2023 and is expected to reach at USD 84.49 Bn by 2031, and grow at a CAGR of 17.73% over the forecast period 2024-2031.

The Facility Management Market size was valued at USD 1.50 Trillion in 2023 and is projected to reach USD 3.26 Trillion in 2031 with a growing CAGR of 10.2% Over the Forecast Period of 2024-2031.

The Augmented And Virtual Reality (AR VR) Market Size was valued at USD 24.9 Billion in 2023 and is expected to reach USD 134.01 Billion by 2031 and grow at a CAGR of 23.4 % over the forecast period 2024-2031.

The Digital Vault Market size was valued at USD 785.3 million in 2022 and is expected to grow to USD 2176.4 million By 2030 and grow at a CAGR of 13.59 % over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone