Reclaimed Rubber Market Report Scope & Overview:

Get E-PDF Sample Report on Reclaimed Rubber Market - Request Sample Report

The Reclaimed Rubber Market Size was valued at USD 1.2 Billion in 2023 and is expected to reach USD 3.1 Billion by 2032 and grow at a CAGR of 11.2% over the forecast period 2024-2032.

The reclaimed rubber market has witnessed substantial growth due to the increasing demand for eco-friendly products and the rising awareness about the adverse environmental impacts of rubber waste. The growth of the reclaimed rubber market is driven by a growing emphasis on sustainable practices and the need to reduce carbon footprint has propelled the demand for reclaimed rubber. Additionally, the rising costs of raw materials, such as natural rubber, have further boosted the market growth. Reclaimed rubber offers a cost-effective solution without compromising on quality, making it an attractive option for various industries.

The technological developments in rubber recycling, have revolutionized the reclaimed rubber market and improved the quality of recycled materials. But advancements in techniques, like devulcanization which entails severing the sulfur cross-links within vulcanized rubber to unvulcanize it so that it regains its initial rubbery properties for reuse have resulted in increased sustainability and improved likely circularity of the material. In addition, modern chemical recycling can transform scrap rubber back into primary raw materials that can be used to reconfigure high-grade reclaimed rubber products.

These methods improve the original characteristics of compound rubber resulting in competitive performance against virgin rubber, and enable also recycling of many types of rubbers with very low recycling rates so far that were mostly considered as non-recyclable. Consequently, being used in different industries such as automotive, construction, and consumer goods these technological advancements are leading market growth of reclaimed rubber by providing sustainability and environmental reduction.

The National Asphalt Pavement Association (NAPA) states that using recycled rubber in asphalt mixtures can reduce greenhouse gas emissions by approximately 10-20%, highlighting the environmental benefits of improved recycling processes.

In 2023, TSA launched an initiative to promote advanced recycling technologies among Australian rubber recycling companies. This initiative focuses on supporting research into devulcanization processes and chemical recycling techniques to improve the quality of reclaimed rubber.

Reclaimed Rubber Market Dynamics

Drivers

-

Scarcity of Natural Rubber Resources for the Automotive Industry.

-

Stringent government regulations promoting the use of reclaimed rubber

The lack of degradability in conventional virgin rubber has led to the emergence of a significant global concern: end-of-life tire recycling. To address this issue, various regions including the European Union, Asia Pacific, the Middle East, and North American countries have initiated programs to encourage tire recycling. The aim is to produce reclaimed rubber from tire waste, serving as a viable alternative to conventional rubber. One notable example is the California Tire Recycling Management Fund, which was established under the California Recycling Tire Act of 1989. This fund supports tire recycling initiatives and the utilization of recycled tire rubber products. The California Tire Recycling Management Fund, established under the California Recycling Tire Act of 1989, has raised over USD 180 million since its inception to support tire recycling initiatives. As of 2021, California recycles around 95% of its used tires, significantly reducing waste and promoting the use of recycled tire rubber in various applications.

In 2022, Goodyear announced its partnership with the U.S. Department of Energy to enhance tire recycling methods through advanced technologies. They are focusing on developing processes that convert scrap tires into valuable materials, including reclaimed rubber, to improve sustainability in their manufacturing processes.

Restraint

-

Limited availability of raw materials for reclaimed rubber production

-

High initial investment required for setting up reclaimed rubber manufacturing units

-

Limitations on the importation of tire waste scrap

Opportunities

-

Rising adoption of reclaimed rubber in various industries, such as automotive, construction, and footwear

-

Potential for cost savings and reduced carbon footprint through the use of reclaimed rubber

Reclaimed Rubber Market Segmentation Overview:

By Product

Whole Tire Reclaim Rubber held the largest market share around 38.23% in 2023. It is because of the growing trend for sustainable and green solutions, reclaiming rubber from end-of-life tires has become incredibly popular. Whole Tire Reclaim Rubber is a natural raw material derived from end-of-life tires, therefore providing a reliable and consistent source of raw material. The performance of this reclaimed rubber is very close to virgin first grade rubber as such this material is being used extensively in so many industries, especially in automotive sector, footwear industry and also it will be well accepted supplier for replacement of virgin rubbers due to its durability etc.

By Application

Tire segment dominated the reclaimed rubber market with a revenue share of about 68% in 2023. The growth is attributed because tires contain a large amount of recyclable rubber they are made out of intricate chemicals from the following materials; rubber, textiles and metals. The expansion in the automotive industry and environmental sustainability awareness will boost the need of recycled tire rubber in new tire manufacturing, as a replacement to virgin rubber

By End-Use

The Automotive and aircraft Tires subsegment dominated the Reclaimed Rubber Market with a revenue share of more than 50% in 2023 due to the rapid expansion of the international logistics industry and the gradual relaxation of travel restrictions at both regional and national levels. In order to mitigate the substantial costs associated with purchasing new tires, many aviation companies have opted for contractual agreements with tire manufacturing companies. Consequently, retreading has emerged as a prevalent practice for aircraft tires, given their exorbitant price tags.

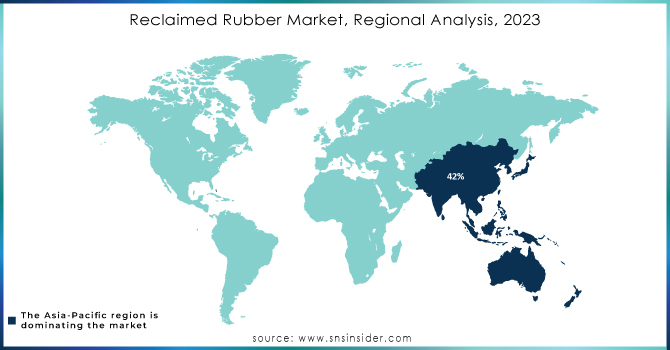

Reclaimed Rubber Market Regional Analysis

Asia Pacific held a significant share around 42% in 2023. It is owing to the presence of major rubber-producing countries like India, China, and Thailand. The region's rapid industrialization and increasing demand for sustainable products have contributed to its dominance in the market. North America and Europe also exhibit substantial growth potential due to the stringent regulations regarding waste management and the adoption of eco-friendly practices.

North America held the significant share of the global reclaimed rubber market and is projected to experience a Compound Annual Growth Rate of 11.5% during the forecast period. This region is also the leading importer of rubber tires and a significant importer of rubber overall, driven by the high demand from the automotive, aviation, construction, and electrical sectors. North America’s automotive industry is particularly influenced by the rising popularity of electric vehicles and the establishment of manufacturing bases by global automobile manufacturers in Mexico. These factors are expected to boost the market for rubber tires and have a direct impact on the growth of the reclaimed rubber industry.

Furthermore, the global market is driven by the introduction of new products by various industry players. For example, in January 2020, the Goodyear Tire & Rubber Corporation, an American tire manufacturer, partnered with Rubber-Cal, a producer of rubber flooring and mats, to launch a new range of rubber flooring and mats. The ReUz rubber flooring rolls and tiles are made from used Goodyear tires, requiring less energy during production and offering the flexibility to be easily colored. As a result, these floors have appealing textures that are suitable for use in fitness facilities. With the increasing interest of consumers in physical fitness, the demand for rubber floor mats is predicted to rise, directly influencing the expansion of the reclaimed rubber market.

Europe is projected to experience a Compound Annual Growth Rate (CAGR) of 11.7% throughout the forecast period. The reclaimed rubber market in Europe is anticipated to witness significant growth due to various initiatives, including the Black Cycle project implemented in the region. The Black Cycle project, which commenced in May 2020 and is supported by the European Union's Horizon 2020 program, aims to establish and optimize a complete value chain for reclaimed rubber production. This involves transforming end-of-life tire waste into secondary raw materials (SRM) to manufacture a new range of tires for trucks and passenger vehicles. These tires will be made available for commercial sale in both European and international markets.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Continental AG (Continental Tire)

-

Fishfa Rubbers Ltd.

-

Michelin (Michelin Eco-Concept Tires)

-

Goodyear Tire & Rubber Company (Goodyear Assurance WeatherReady)

-

Bridgestone Corporation (Bridgestone Ecopia)

-

Pirelli & C. S.p.A. (Pirelli Cinturato P7)

-

Bolder Industries (BolderBlack)

-

GRP Ltd.

-

J.Allcock & Sons Ltd.

-

HUXAR

-

Minar Reclamation Pvt. Ltd.

-

SRI Impex Pvt. Ltd.

-

Star Polymers Inc.

-

High Tech Reclaim Pvt.Ltd.

-

Balaji Rubber Industries (P) Ltd.

-

Ecore International

-

Liberty Tire Recycling (Liberty Reclaimed Rubber Products)

-

Tire Recycling Management Fund (California Reclaimed Rubber)

-

Enviro Systems (EnviroRubber)

Recent Development:

-

In April 2023- Ecore International, the largest recycler of reclaimed tire rubber in North America, made a significant move by acquiring 360 Tire Recycling Group, a leading tire recycling management company. This strategic alliance not only solidifies Ecore's position in tire collection and buffings but also streamlines the procurement of raw materials for its innovative flooring and surfacing products.

-

In September 2022- Ecore International, a rubber recycling company headquartered in Lancaster, Pennsylvania, unveiled its ambitious plan to invest a staggering USD 25.5 million in establishing a manufacturing and recycling facility in Ozark, Alabama. This facility will be dedicated to producing top-quality flooring and surfacing products using reclaimed rubber sourced from used vehicle tires.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.2 Billion |

| Market Size by 2032 | US$ 3.1 Billion |

| CAGR | CAGR of 11.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Whole Tire Reclaim Rubber, EPDM Reclaimed Rubber, Butyl Reclaim Rubber, and Others) • By Application (Tire and Non-Tire) • By End-use (Automotive & Aircraft Tires, Belts & Hoses, Retreading, Molded Rubber Goods, Footwear, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Rolex Reclaim Pvt. Ltd., Fishfa Rubbers Ltd., GRP Ltd., J. Allcock & Sons Ltd., Swani Rubber Industries, HUXAR, Minar Reclamation Pvt. Ltd., SRI Impex Pvt. Ltd., Star Polymers Inc., SNR Reclamations Pvt. Ltd., High Tech Reclaim Pvt. Ltd., Balaji Rubber Industries (P) Ltd., Tianyu (Shandong) Rubber & Plastic Products Co. Ltd., Ecore International |

| Key Drivers | • Scarcity of Natural Rubber Resources for the Automotive Sector • Stringent government regulations promoting the use of reclaimed rubber |

| Market Restraints | • Limited availability of raw materials for reclaimed rubber production • High initial investment required for setting up reclaimed rubber manufacturing units • Limitations on the importation of tire waste scrap |