Specialty Enzymes Market Size:

Get More Information on Specialty Enzymes Market - Request Sample Report

The Specialty Enzymes Market size was valued at USD 5.6 Billion in 2023. It is expected to grow to USD 10.7 Billion by 2032 and grow at a CAGR of 7.5% over the forecast period of 2024-2032.

The cosmetic and personal care industry is gradually taking onboard specialty enzymes due to their simultaneous gentle and effective action. Special enzymes, papain, aromatic amine, and bromelain, are good exfoliating agents since they can safely dissolve dead skin cells that need to be removed. Thus, they are ideal for sensitive skin types because they reduce irritation risks while making the skin cleaner and brighter. Moreover, specialty enzymes contribute to skin conditioning by increasing hydration and enhancing skin elasticity. For this reason, they are commonly used in anti-aging products.

According to a report by the U.S. Food and Drug Administration (FDA), the demand for natural ingredients in personal care products has grown significantly, with a 25% increase in consumer preference for natural and organic skincare products over the past five years.

Specialty enzymes are becoming more popular in the food and beverage sector. Such a category of enzymes is primarily used to improve the overall taste and texture of different products, such as dairy or baked goods. The use of specialty enzymes is likely to continue growing based on the ever-increasing demand observed among customers. As substitutes for artificial components, specialty enzymes are now actively incorporated in a wide variety of products, including beverages or plant-based alternatives.

In 2022, Novozymes, a global leader in biological solutions, launched a new line of specialty enzymes specifically designed for the beverage industry called “Novozymes Zymabrew.” This product line aims to improve the efficiency of brewing processes and enhance the flavor profiles of various beverages.

Specialty Enzymes Market Dynamics

Drivers

-

Rising demand for natural and organic products

-

Rising demand in pharmaceuticals and biotechnology drives the market growth.

The increasing consumption of specialty enzymes within the pharmaceutical and biotechnology industries is mainly facilitated by the unique advantages of their catalytic properties as compared to conventional chemical reactions. These enzymes are actively utilized in both drug formulation and diagnostics. They promote the synthesis of several elaborate biologics and active pharmaceutical ingredients. An application within enzyme supplement therapies should be singled out since they can be used to treat various inherited conditions. This trend aligns with the broader shift towards biologically-based solutions in healthcare, making specialty enzymes a crucial component in advancing pharmaceutical innovation and improving patient outcomes.

According to a report from the U.S. Department of Health and Human Services (HHS), the global enzyme market in the pharmaceutical sector was valued at approximately $9.6 billion in 2022.

In 2023, Thermo Fisher Scientific announced the launch of its new line of Thermo Scientific Enzyme Replacement Therapies” designed to enhance the efficiency of drug development and manufacturing processes. These specialty enzymes are tailored to support the production of biologics, enabling faster and more cost-effective drug formulation.

Restraint

-

Competition from synthetic alternatives hamper market growth.

Competition from synthetic alternatives poses a significant challenge to the growth of the specialty enzymes market. Many industries, including pharmaceuticals and food processing, have traditionally relied on synthetic chemicals and catalysts due to their established performance, cost-effectiveness, and ease of use. These synthetic alternatives often provide immediate results and can be produced in large quantities, making them appealing for manufacturers looking to optimize production efficiency. As a result, companies may hesitate to transition to specialty enzymes, which, despite their benefits, may come with higher production costs and require more intricate formulation processes.

Specialty Enzymes Market Segmentation

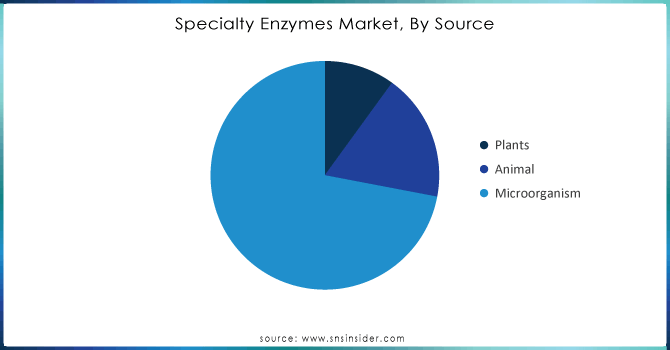

By Source

Microorganisms held the largest market share around 72% in 2023. The method uses microbial enzymes that serve as biological catalysts to produce enzymes that can operate equally well at differences in temperature and pH levels. This adjustability enables their efficacious implementation in pharmaceuticals, food processing, and biotechnology Moreover, the increasing consumer interest in natural and sustainable products has helped fuel demand for microbial enzymes as eco-friendly substitutes to synthetic chemicals. In addition, biotechnology advances have facilitated the identification and production of new microbial enzymes, increasing their effectiveness and applications. Therefore, the exceptional properties and advantages of microbial enzymes determine that they are key players in all new industrial developments alternatives to known success market.

Need Any Customization Research On Specialty Enzymes Market - Inquiry Now

By Product

The carbohydrases segment held the highest market share around 38% in 2023. This may be due to the rise in the use of dietary supplements, and digestive enzymes. Applications for specialty enzymes research & biotechnology increasing R&D activity to enhance enzyme yield by reducing specificity, increasing stability, and fermentations has led to more widespread use of specialty enzymes in research & biotechnology applications.

Furthermore, polymerase and nuclease are other revenue-generating segments, which will find lucrative development due to the heavy adoption of enzymes in molecular biology such as recombinant DNA and polymerase chain reactions. Thus, the growth of this segment also increases with the rise in the prevalence of cancer.

By Application

The pharmaceutical segment contributed more than 42.6% of the total market revenue. In the United States, in particular, many of the top-of-the-line biopharmaceutical companies and research institutions are investing a huge chunk in enzyme research projects. This rich environment creates a culture of innovation among food, diagnostics and pharmaceutical manufacturers, which has also created the need for specialty enzymes in all these applications. Moreover, the strict regulatory guidelines regarding product safety and efficacy in the region promote the use of specialty enzymes as a safe and effective alternative to harmful synthetic chemicals.

In 2022, Novozymes, a leading global player in the specialty enzymes market, announced a significant partnership with Cargill to develop innovative enzyme solutions aimed at improving the efficiency of food and beverage production processes.

This further contributes to the growth of the market as consumers focus more on natural and organic products, forcing manufacturers to improve their product offerings with enzyme-based solutions. Furthermore, the established supply chain infrastructure in North America combined with better technology penetration into the market allows faster production and distribution of specialty enzymes thereby contributing towards making North America one of the prime regional markets across the globe.

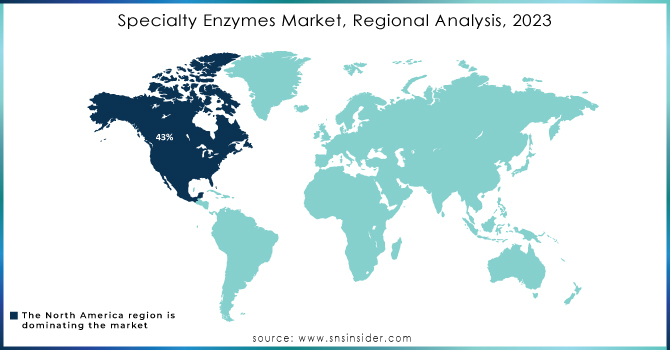

Specialty Enzymes Market Regional Analysis

North America held the largest market share around 43% in 2023. One of the reasons for the fact is that in this region there is an increase in highly advanced biotechnology and pharmaceutical sectors. Additionally, the USA has big biopharmaceutical companies and a significant number of scientific-research organizations with high knowledge and resources for investments in studies of enzymes, including specialty. One another reason is the severity of controlling the safety and quality of the products. Since its creation, the FDA and USDA have monitored the safety of consumers, therefore companies use specialty enzymes instead of chemicals because the first is much safer and more effective. Also, such attitude of customers like the pursuit of organic products and unwillingness to consume non-organic products, dictates a trend to replace chemical additives with some specialty enzymes. The fifth reason is the very fast development and modernization of its own country. The industrial supply chain of all of the USA is out on an advanced level. In 2022, Novozymes, a leading global player in the specialty enzymes market, announced a significant partnership with Cargill to develop innovative enzyme solutions aimed at improving the efficiency of food and beverage production processes. This collaboration focuses on creating specialized enzyme formulations that enhance product quality and reduce waste in the food supply chain.

Key Players

Key Manufacturers

-

BASF SE

-

DSM Nutritional Products

-

DuPont de Nemours, Inc.

-

Advanced Enzyme Technologies Ltd.

-

Codexis, Inc.

-

Roche Holding AG

-

Kerry Group plc

-

Biocatalysts Ltd

Key Users

-

Pfizer Inc. (Pharmaceutical)

-

GlaxoSmithKline plc (Pharmaceutical)

-

Bayer AG (Pharmaceutical)

-

Abbott Laboratories (Diagnostics)

-

Nestlé S.A. (Food & Beverage)

-

Roche Diagnostics (Diagnostics)

-

Merck & Co., Inc. (Research & Biotechnology)

-

Danone S.A. (Food & Beverage)

-

Thermo Fisher Scientific Inc. (Research & Biotechnology)

Recent Development:

-

In 2023, Novozymes launched a new line of enzymes specifically designed to enhance the efficiency of biocatalysis in pharmaceutical manufacturing, focusing on sustainability and reduced waste production.

-

In 2023, DuPont expanded its enzyme production capabilities by opening a new facility in the U.S. dedicated to the development of high-performance enzymes for industrial applications, including biofuels and textiles.

-

In 2022, DSM introduced a new enzyme solution for the food and beverage industry aimed at improving the shelf-life and quality of plant-based products, catering to the growing demand for vegan and vegetarian foods.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.6 Billion |

| Market Size by 2032 | USD 10.7 Billion |

| CAGR | CAGR of 7.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Plants, Animals, Microorganisms), • By Product (Carbohydrase, Proteases, Lipases, Polymerases & Nucleases, Other), • By Application (Pharmaceutical, Research & Biotechnology, Diagnostics, Biocatalyst) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novozymes A/S, BASF SE, DSM Nutritional Products, DuPont de Nemours, Inc., Amano Enzyme Inc., Advanced Enzyme Technologies Ltd., Codexis, Inc., Roche Holding AG, Kerry Group plc, Biocatalysts Ltd. Topsoe, and Others |

| Key Drivers | • Rising Demand for Natural and Organic Products • Rising demand in pharmaceuticals and biotechnology drives the market growth. |

| Restraints | • Competition from synthetic alternatives hamper market growth. |