Recombinant Vaccines Market Report Scope & Overview:

Get More Information on Recombinant Vaccines Market - Request Sample Report

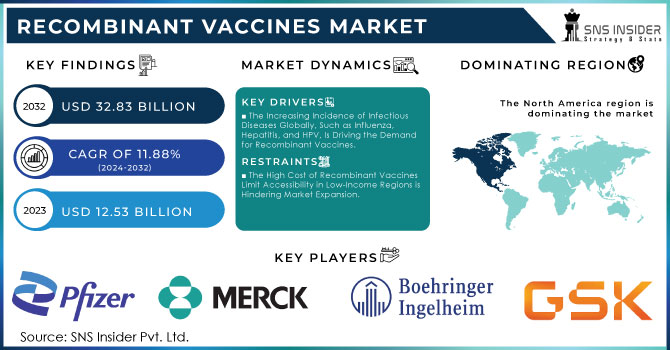

The Recombinant Vaccines Market Size was valued at USD 12.53 Billion in 2023, and is expected to reach USD 32.83 Billion by 2032, and grow at a CAGR of 11.88%.

The driving force behind the substantial growth of the recombinant vaccine market is the increasing prevalence of infectious diseases on a global scale. As a result, vaccinations have become a highly important practice across the globe. Governmental initiatives also fuel this trend. Specifically, as reported by WHO, over 2.5 million deaths were associated with vaccine-preventable diseases in 2023. In the U.S., the rate of vaccination as reported by the CDC showed a 12 percent increase, or approximately 20.3 million additional vaccinations delivered. The effect was particularly pronounced in the cases of hepatitis B and HPV, which represent contagions addressed by recombinant vaccines.

Additionally, as reflected by ECDC, the European Union saw substantial growth in the rate of immunization, reaching 14 percent in 2023. Specifically, a major driver of the trend was the government-sponsored initiative to increase population access to the HPV vaccines implemented across the union. As a result of the aggregate of these key factors, and their reflection in statistical data, throughout the global context, the recombinant vaccines reflect their universal importance, and the global aspect of their rising dominance is a major cause of the new market changes.

MARKET DYNAMICS:

Key Drivers:

-

The Increasing Incidence of Infectious Diseases Globally, Such as Influenza, Hepatitis, and HPV, Is Driving the Demand for Recombinant Vaccines.

-

Technological Innovations in Genetic Engineering and Biotechnology are Leading to the Creation of Safer and More Effective Recombinant Vaccines.

Restraints:

-

The High Cost of Recombinant Vaccines Limit Accessibility in Low-Income Regions is Hindering Market Expansion.

-

The Stringent Regulatory Environment Poses Challenges to the Growth of the Market.

Opportunity:

-

The Growing Demand for Vaccines in Emerging Markets Presents Significant Opportunities for the Recombinant Vaccines Market.

-

The Trend Towards Personalized Medicine is Opening New Avenues in the Creation of Personalized Recombinant Vaccines Tailored to Individual Genetic Profiles.

KEY MARKET SEGMENTATION:

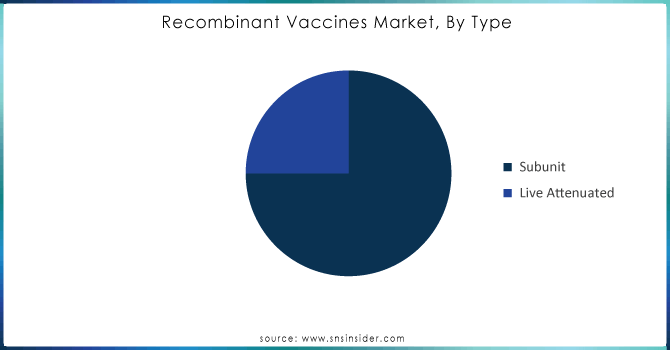

By Type

In 2023, the subunit vaccines segment was the largest, representing 75% of the share. Subunit vaccines were also the most popular vaccine type from 2017 – 2023 for the same reasons discussed above, in addition to the safety of these vaccines. Subunit vaccines only contain specific antigens of the pathogenic virus, which reduces the likelihood of an adverse reaction. Therefore, subunit vaccines can be safely given to vulnerable populations, such as infants, the elderly, and immunocompromised people. The CDC reported that in 2023, more than 70% of routine annual vaccination schedules made use of subunit vaccines in the United States.

The WHO reports that there was a 15% rise in subunit vaccines distributed worldwide in 2023, which was mainly attributed to international vaccination campaigns in low and middle-income countries and International Vaccination Agency collaborations. Demand for subunit vaccines will continue to rise because they offer a safer alternative to live attenuated vaccines. Although live vaccines have proven to be more effective, they also have a higher risk of side effects, particularly in the case of those who have a weakened immune system.

Need any customization research on Recombinant Vaccines Market - Enquiry Now

By Indication

The vaccine currently contributing to the disease indication segment, which had the highest share of the market in 2023, is HPV with a total percentage of 25% share, and is projected to be the fastest-growing segment. This dominance is owed to the more sales of vaccines across the world as a result of its higher demand and procurement volume. In addition, the market value is projected to increase in the coming years, attributed to the pipeline of candidates for the HPV vaccines. Besides, the HPB vaccine and rotavirus also play a role in the growth of the market since HPV is more prevalent in emerging and underdeveloped states. For example, VAXELIS was approved by the USFDA for MSD and Sanofi to treat different diseases, including hepatitis B. Most states are expected to adopt the policies for the hepatitis B vaccine for babies. It is likely to increase the demand and sales for the hepatitis B vaccine globally.

Despite the lower CAGR and revenue generation, the herpes zoster, meningococcal B, and other vaccine segments are projected to record numerous R&D in the forecast period. This is attributed to the numerous trials currently using recombinant technology and resources. Currently, in a phase 3 clinical trial, GlaxoSmithKline had a pipeline candidate for reducing the risk of herpes zoster among the population. The primary factor that will impact the sales and demand of vaccines is the increasing awareness among individuals regarding the advantages of immunization.

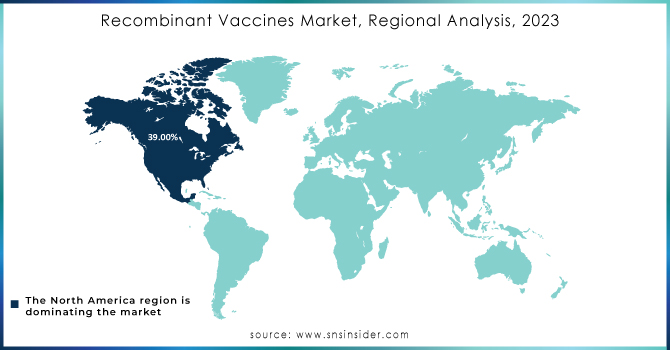

REGIONAL ANALYSIS:

The market for recombinant vaccines was dominated by North America in 2023, with a market share of 39%. The performance was due to the demand for efficient vaccines and R&D investments by major industry players. In addition, R&D is due to the availability of advanced molecular & genetic engineering equipment. The government of North America is amending vaccine immunization programs to cover the entire region. Therefore, the availability of new recombinant vaccines is expected to drive growth in the region.

However, Asia-Pacific is expected to exhibit the greatest growth in the market. The amendment to immunization programs in Asia-Pacific by governments is leading to a rising demand for effective vaccines in the region. Further, the increasing incidence of diseases like human papillomavirus and hepatitis B is driving the criterion for vaccine supply in the Asia-Pacific region.

KEY PLAYERS:

The key market players are GlaxoSmithKline plc., C.H. Boehringer Sohn AG & Co.KG, Merck & Co., Inc, Sanofi, Pfizer Inc., LG Chem, Dynavax Technologies, Serum Institute of India Pvt. Ltd, Novartis AG, Sinovac Biotech Ltd & other players.

RECENT DEVELOPMENTS

-

In April 2023, Pfizer Inc. announced the completion of phase III clinical trials and the subsequent approval of a new recombinant pneumococcal vaccine, Prevnar 20™ by the U.S. FDA. The vaccine is an immunization vaccine that is intended for the prevention of diseases that are caused by Streptococcus pneumoniae.

-

In June 2021, GlaxoSmithKline plc. announced the approval of its new recombinant shingles vaccine, Shingrix™, and launched it into the market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.53 Billion |

| Market Size by 2032 | US$ 32.83 Billion |

| CAGR | CAGR of 11.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Subunit and Live Attenuated) •By Route of Administration (Parenteral and Oral) •By Disease Indication (Human Papillomavirus (HPV), Hepatitis B, Rotavirus, Herpes Zoster, Meningococcal B, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GlaxoSmithKline plc., C.H. Boehringer Sohn AG & Co.KG, Merck & Co., Inc, Sanofi, Pfizer Inc., LG Chem, Dynavax Technologies, Serum Institute of India Pvt. Ltd, Novartis AG, Sinovac Biotech Ltd & other players |

| Key Drivers | •The Increasing Incidence of Infectious Diseases Globally, Such as Influenza, Hepatitis, and HPV, Is Driving the Demand for Recombinant Vaccines. •Technological Innovations in Genetic Engineering and Biotechnology are Leading to the Creation of Safer and More Effective Recombinant Vaccines. |

| RESTRAINTS | •The High Cost of Recombinant Vaccines Limit Accessibility in Low-Income Regions is Hindering Market Expansion. •The Stringent Regulatory Environment Poses Challenges to the Growth of the Market. |