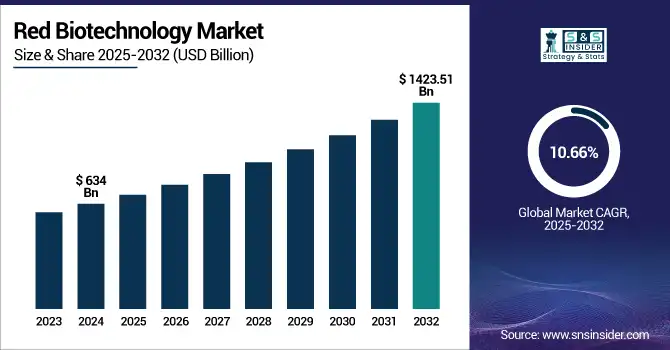

Red Biotechnology Market Size Analysis:

The Red Biotechnology Market size was valued at USD 634 billion in 2024 and is expected to reach USD 1423.51 billion by 2032, growing at a CAGR of 10.66% over the forecast period of 2025-2032.

Increased demand for personalized medicine, biologics, and new drugs propels the red biotechnology sector. Fast-moving technologies to be applied in healthcare consist of quick advancements in recombinant DNA technology, along with fresh advancements in cell and gene therapy, and expansion in the monoclonal antibody. With approximately 60% of clinical trials targeting biologics and gene therapies (ASCO, 2024), government-funded projects and R&D investments are booming.

To Get more information on Red Biotechnology Market - Request Free Sample Report

The U.S. red biotechnology market stood at USD 215.08 billion in 2024 and is anticipated to reach USD 443.51 billion by 2032, with a CAGR of 9.49% during the forecast period of 2025–2032. With ease in FDA policies and increasing funding levels, such as the USD 5 billion given by NIH in 2023 for biomedical discovery, the U.S. market particularly gets a boost.

In addition, strengthening the growth of red biotechnology market share in the field of medical biotechnology and the development of biotech vaccines demands greater regulatory support and public-private collaboration in such areas. For instance, over 60 biotechnology medicines were approved by the EMA in 2023, indicating an increased demand for global red biotechnology market products. In addition, even as overall biopharma venture capital decreased, more than 300 biotech start-ups were financed at an early stage during 2023, showing persistent investor confidence.

For instance, ASCO's 2024 report indicates that 75% of ongoing cancer research studies are employing immunotherapies and gene-editing technologies, reflecting the expansion of personalized medicine via biotechnology and targeted therapies in cancer treatment.

France's recent effort to suspend some EU regulatory red tape reflects a positive red-biotechnology market trend, seeking to spur biopharmaceutical market activity and lower barriers for red-biotechnology firms innovating in the EU.

Red Biotechnology Market Dynamics:

Drivers:

-

Rising Demand for Targeted Therapies and Growing Investment in Biotech R&D Drives Market Expansion

Biotechnology drug innovations, targeted therapies, and long-term R&D investments propel the biotechnology industry. Global R&D expenditure on biotechnology was more than USD 240 billion in 2023, with over 45% spent on medical biotechnology market innovations, such as gene editing, mRNA platforms, and monoclonal antibodies. Importantly, Gilead Sciences broadened its R&D pipeline in 2024 to include CRISPR-based HIV therapies, reflecting the depth of cell and gene therapy innovations.

In addition, more than 90 new biologics and biosimilars have been approved by the European Medicines Agency in 2023 alone, showing positive regulatory momentum. Personalized therapy through biotech is also being facilitated by improved public-private collaborations, including NIH's USD 2.5 billion precision medicine initiative.

With more than 120 potential vaccines for uncommon and infectious diseases in clinical testing, governments are also accelerating biotech vaccine development in expectation of post-continuation biothreats. Moreover, increased demand for successful cancer therapies has boosted the recombinant DNA technology innovation, providing scalable production platforms that enhance drug availability and shorten lead time. The intersection of innovation, demand, and regulation is hence powerfully driving the red biotechnology market trends expansion.

Restraints:

-

High Development Costs, IP Complexities, and Supply Chain Limitations Impede Red Biotechnology Market Growth

The cost of developing a biotech medicine currently averages more than USD 2.6 billion, with over 30% going to the clinical trial phases. Such costs, with lengthy approval processes, create entry barriers for smaller red biotech firms. Additionally, complicated IP regulations and patent cliffs discourage innovation, particularly in the case of biosimilars, thus restricting competition and affordability. Latest statistics from the U.S. GAO demonstrate that more than 50% of biotech companies slowed the advancement of clinical trials due to insufficient funding and extended regulatory approval.

On the demand side, global shortages of essential raw materials, such as enzymes and cell lines, in 2024 resulted in longer production cycles, especially in highly demanded biopharmaceutical market segments. Moreover, variations in regulations globally pose problems, whereas the U.S. has FDA fast-track procedures for gene therapies. However, most development regions lack analogous processes, an issue that compromises the red biotechnology market analysis and timing of goods in the market of red biotechnology. Limited biomanufacturing facilities and inconsistencies in the quality control environment are quelling the scale-up of advanced technologies in the biotechnology health market.

Red Biotechnology Market Segmentation Analysis:

By Product

With a market share of 48.3%, monoclonal antibodies ranked as the top product segment in the red biotechnology market in 2024. The key factor behind market share arises from its extensive use in treating long-term disorders, including cancer, autoimmune diseases, and infectious diseases. Due to their high selectivity, minimal side effects, and increasing regulatory approval, monoclonal antibodies have garnered attention.

The fact that market giants, including Roche, Amgen, and AbbVie, continue to invest in next-generation antibody treatment attests to the market's predominance. Moreover, their commercialization and scaling capacity make them a pillar of industry for biopharmaceutical pipelines all around.

Gene therapy segment is the fastest-growing product class driven by developments in viral vector and CRISPR technology, along with authorized drugs including Zolgensma and Luxturna. Pharmaceutical companies and researchers are highly interested in such treatments since they show therapeutic possibilities for genetic diseases. With more than 2,000 gene therapy trials in progress globally, this market is expected to rise gradually due to its transforming medical importance.

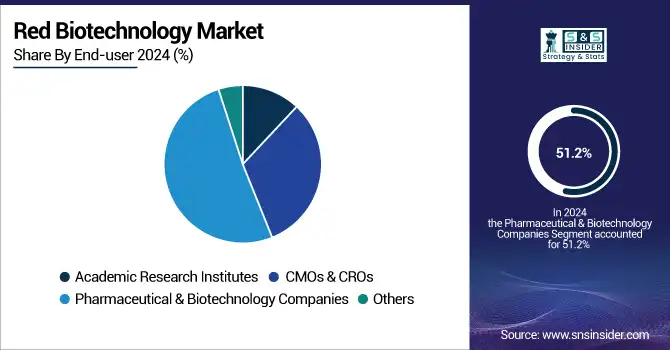

By End-user

Pharma and biotech companies led with 51.2% market share in 2024, fueled by strong R&D pipelines, strategic partnerships, and increasing demand for biologics. Heavily investing in discovery and clinical-stage research, they are the leaders in cell and gene therapy innovation.

Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) are the most rapidly expanding end-users that are leveraging increased pharma company outsourcing to cut costs and streamline development timelines. Increasing demand for compliant, scalable manufacturing solutions and growing volume of clinical trials are fueling the segment’s expansion in the market.

Regional Insights:

North America led the market in 2024, fueled by huge investment in R&D, strong biopharma infrastructure, and a supportive legal environment. With more than USD 3.5 billion in NIH funds for cell and gene therapy projects and the FDA's expedited approval programs for monoclonal antibodies and gene therapies, the U.S. held the largest share in the region. Large corporations, such as Amgen, Biogen, and Pfizer, reside in the country, and over 60% of the global gene therapy clinical trials are conducted here. With additional funds from its strategic innovation fund and increasing numbers of biotechnology clusters in Toronto and Vancouver, Canada is also quickly emerging. As a leader in contract manufacturing, Mexico is fueling regional red biotechnology market growth.

Europe holds the second-leading position in the red biotechnology market. Robust academic research, public-private collaborations, and well-established legal frameworks underpin the region. Germany dominates the region with its robust pharma industry, and companies such as Bayer and BioNTech dominate research in recombinant drugs and biotech vaccine production. France and the U.K. are other key contributors to the region’s growth. France has boosted funding for gene therapies, while the U.K.'s MHRA implemented quicker approval routes after Brexit. Growing investments in CMOs and CROs are assisting Eastern European nations, such as Poland and Turkey, to gain momentum. With advancing clinical trial activity and an accommodating environment for biotechnology-based personalized medicine, Europe is the second fastest-growing continent.

Asia Pacific is the fastest-growing region in the market throughout the forecast period, driven by government initiatives for innovative concepts, along with the growing need for novel treatments, and growing healthcare expenditure. China dominates the region under the "Made in China 2025" initiative with substantial government funding. It also comprises 1,000 biotech companies focused on gene therapy, biologics, and stem cell science. Nearing around 45 biotech drugs in 2023 alone, the country has enhanced its regulatory effectiveness. India is growing at a fast pace with its expanding biotechnology parks and increased government support under the Biotechnology Industry Research Assistance Council (BIRAC). Adding to the growth chances of the region are investments in cutting-edge regenerative medicine platforms and cell-based immunotherapies by Japan and South Korea.

The LAMEA market is increasingly gaining momentum in the red biotechnology industry, driven by increasing healthcare modernization and biotechnology infrastructure investment. Brazil is the leader in Latin America with government initiatives supporting biologic production and public-private partnerships for oncology and infectious disease. Specifically in stem cell and gene therapy, the visibility of clinical research for Argentina is growing. Saudi Arabia is investing proactively under its Vision 2030 plan to localize the production of biotech in the Middle East region. The UAE is becoming a regional center for medical research. With EU biotech companies in partnership, South Africa is advancing in molecular diagnostics and animal model studies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Red Biotechnology Market Key Players:

Red biotechnology companies operating in the market comprise Merck KGaA, Roche, Pfizer, Regeneron, AstraZeneca, Takeda, Gilead Sciences, Biogen, Amgen, and Celgene.

Recent Developmentsin the Red Biotechnology Market:

-

In March 2025, Debut Biotechnology launched a platform using precision fermentation to produce animal-free collagen and hyaluronic acid for biotech and cosmetic applications.

-

In February 2025, Bambusa Biotech raised USD 90 million in funding to develop next-gen bispecific antibodies for cancer treatment.

-

In August 2024, Red Queen Therapeutics, a biotech startup launched with support from Apple Tree Partners, focuses on small-molecule drugs for infectious diseases.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 634 Billion |

| Market Size by 2032 | USD 1423.51 Billion |

| CAGR | CAGR of 10.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Monoclonal Antibodies, Polyclonal Antibodies, Recombinant Proteins, Vaccines, Cell-Based Immunotherapy Products, Gene Therapy Products, Cell Therapy Products, Tissue-Engineered Products, Stem Cells, Cell Culture, Viral Vector, Enzymes, Kits And Reagents, Animal Models, Molecular Diagnostics, and Others) • By End-user (Academic Research Institutes, CMOs & CROs, Pharmaceutical & Biotechnology Companies, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Merck KGaA, Roche, Pfizer, Regeneron, AstraZeneca, Takeda, Gilead Sciences, Biogen, Amgen, and Celgene. |