Molecular Quality Controls Market Report Scope & Overview:

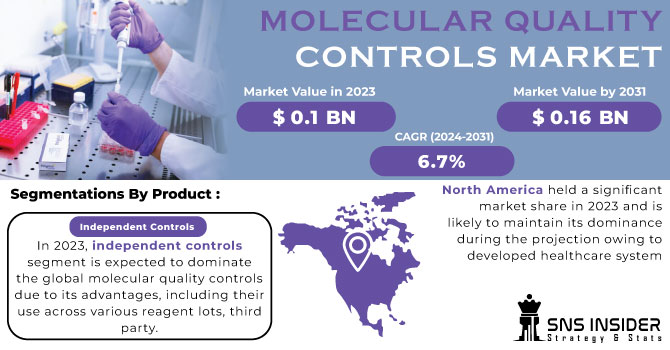

The Molecular Quality Controls Market size was estimated at USD 0.1 billion in 2023 and is expected to reach USD 0.16 billion by 2031 with a growing CAGR of 6.7% during the forecast period of 2024-2031.

The need for crucial and precise diagnostic information is growing as more hereditary and transmissible diseases come to light. Any deviation in diagnostic goods that can have an impact on decisions about laboratory product quality is tested for and reported through molecular quality control.

Get More Information on Molecular Quality Controls Market - Request Sample Report

The rise in third-party quality controls, the expansion of accredited clinical laboratories, and the expansion of government financing for genomic research are the main factors fueling the expansion of this market. Increasing demand for multi-analyte controls and growth prospects in emerging nations are anticipated to present chances for market participants throughout the anticipated timeframe. A major factor in the development of customized medicine has been genomics. For best results, personalized medicine offers treatments and preventative measures that are specifically designed for each patient's situation. The most promising method to treat illnesses that aren't known to respond well to current therapies or cures is provided by this discipline of medicine. based on the PMC (Personalized Medicine Coalition) paper on personalized medicine.

MARKET DYNAMICS

DRIVERS

-

Increasing preference for personalized medicines

-

Adoption of Third-Party Quality Controls

-

the provision of funding to researchers for the creation of innovative interventions

Numerous governmental and corporate organizations are increasing the amount of money they spend on creating cutting-edge interventions and therapies that benefit the market. The market for molecular quality controls is also positively impacted by the rise in demand for efficient treatments, surge in healthcare spending, prevalence of HIV infection, population growth, changes in lifestyle, and rise in need for external quality evaluation.

RESTRAIN

-

Financial limitations in clinical laboratories

Dental radiologists are particularly in short supply in poor areas, which will impede industry expansion.

OPPORTUNITY

-

Rising demand for multi- analyst control

As a result of technological advancements, a new range of multi-analyte and multi-instrument controllers has been produced. With the help of these innovative controls, clinical laboratories can spend less money by combining many instrument-specific controls into one control. Additionally, by using these controls, time-consuming separate QC processes for each individual analyte are avoided. Seraseq Controls (SeraCare), Introl Series (Maine Molecular Quality Controls), Amplicheck Series (BD Company), and AcroMetrix Series (Thermo Fisher Scientific) are a few examples of the multi-analyte controls that are offered on the market. With the aid of these controls, laboratories can do quality control for a variety of parameters, such as cardiac and tumor indicators, DNA/RNA of various infectious disease-causing agents, and multiple parameters simultaneously.

CHALLENGES

-

Strict regulatory requirements for IVD products

New multi-analyte and mu probes have been created as a result of technological advances. In the US and Europe, there are stricter legal and regulatory standards for IVD, including molecular diagnostics. IVD products are defined by 21 CFR 809 in the US, and they are subject to the same regulations as apply to medical devices. New FDA guidance documents were published by the FDA. Device manufacturers are required by US federal regulations to submit a 510(k) application for any further modifications to a device.

IMPACT OF RUSSIAN-UKRAINE WAR

The molecular quality control market may be affected in a number of ways by the current conflict between Russia and Ukraine. The international community's sanctions on Russia as a result of its conduct in Ukraine may result in a decline in the import and export of products and services, which may cause a disruption in the supply chain for molecular quality controls. The volatility in the area may also have an influence on company and investment confidence, which may have an effect on market expansion.

IMPACT OF ONGOING RECESSION

The recession is expected to have little of a negative effect on the market for molecular quality controls. Hospital CAPEX restrictions are anticipated to lead to a slowdown in the diagnostic imaging industry, which may prevent hospitals from making purchases of equipment. As the primary market for molecular quality controls is the medical industry, these will reduce demand for them. Given that end-use sectors are under pressure from growing raw material costs, demand-side factors may have the biggest impact on this market.

KEY MARKET SEGMENTATION

By Product

-

Independent Controls

-

Instrument-Specific Controls

In 2023, independent controls segment is expected to dominate the global molecular quality controls due to its advantages, including their use across various reagent lots, third-party independent quality controls are being used more frequently, which helps lower operating costs and accounts for the big proportion of this market.

By Analyte Type

-

Single-Analyte Controls

-

Multi-Analyte Controls

In 2023, single-analyte controls segment is expected to dominate the global molecular quality controls market due to the widespread use of singleplex assays in hospitals and the low danger of cross-reactivity, this category has a substantial market share.

By Application

-

Infectious Diseases

-

Oncology

-

Genetic Testing

-

Other Applications

By End User

-

Clinical Laboratories

-

Hospitals

-

IVD Manufacturers and Contract Research Organizations

-

Academic and Research Institutes

-

Other End Users

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSES

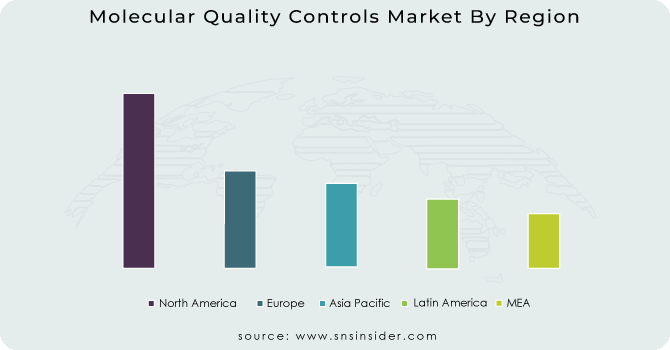

North America held a significant market share in 2023 and is likely to maintain its dominance during the projection owing to developed healthcare system in Canada and US and also the presence of many key manufacturer of molecular quality controls product.

Asia-Pacific is witness to increase at the highest rate during the forecast period. The market in the region is being driven by the increasing healthcare needs, rising focus on improving the quality of laboratory testing and strategic developments of leading key players. Also, the rapid growth in the number of accredited laboratories also helps to drive the market share of molecular quality controls product.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major players are SeraCare Life Sciences, Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Microbiologics, Inc., ZeptoMetrix Corporation, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Quidel Corporation, Qnostics, Maine Molecular Quality Controls, INC., Danaher., Helena Biosciences Europe, SERO AS, Technopath Clinical Diagnostics, and Randox Laboratories Ltd., and others.

Thermo Fisher Scientific Inc-Company Financial Analysis

RECENT DEVELOPMENTS

Thermo Fisher Scientific, in 2023, The Binding Site Group was purchased by Thermo Fisher Scientific (US) in order to add cutting-edge innovation in multiple myeloma diagnostics and monitoring to the company's current speciality diagnostics portfolio.

Microbiologics Inc., in 2022, Cryologics was purchased by Microbiologics Inc. in order to increase the company's ability to provide quality control microbiologists who are committed to the security of pharmaceutical and personal care products with more resources.

| Report Attributes | Details |

| Market Size in 2023 | US$ 0.1 Billion |

| Market Size by 2031 | US$ 0.16 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Independent Controls, Instrument-Specific Controls) • By Analyte Type (Single-Analyte Controls, Multi-Analyte Controls) • By Application (Infectious Diseases, Oncology, Genetic Testing, Other Applications) • By End User (Clinical Laboratories, Hospitals, IVD Manufacturers and Contract Research Organizations, Academic and Research Institutes, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SeraCare Life Sciences, Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Microbiologics, Inc., ZeptoMetrix Corporation, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Quidel Corporation, Qnostics, Maine Molecular Quality Controls, INC., Danaher., Helena Biosciences Europe, SERO AS, Technopath Clinical Diagnostics, and Randox Laboratories Ltd. |

| Key Drivers | • Increasing preference for personalized medicines • Adoption of Third-Party Quality Controls • the provision of funding to researchers for the creation of innovative interventions |

| Market Opportunity | • Rising demand for multi- analyst control |