Portable Medical Devices Market Key Insights:

Get More Information on Portable Medical Devices Market - Request Sample Report

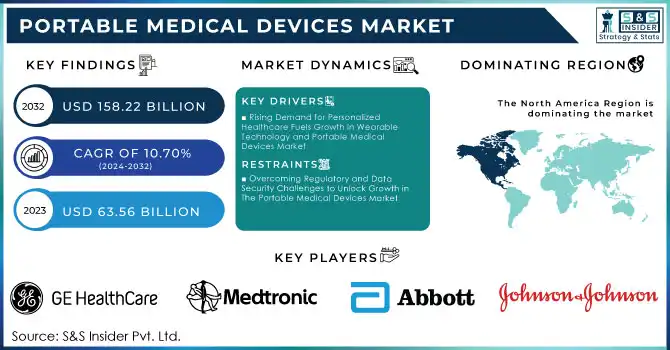

The Portable Medical Devices Market Size was valued at USD 63.56 Billion in 2023 and will reach USD 158.22 Billion by 2032 and grow at a CAGR of 10.70% over the forecast period of 2024-2032.

The portable medical devices market is experiencing rapid growth, driven by advancements in technology, rising healthcare demands, and a shift towards patient-centered care. The integration of green equipment development with cutting-edge technologies, such as miniaturization, wireless connectivity, and the Internet of Things (IoT), has enhanced patient monitoring and diagnosis. These devices enable healthcare providers to access real-time patient data, facilitating timely decision-making that improves care outcomes. The growing prevalence of chronic diseases, which account for 71% of global deaths (WHO), has intensified the demand for portable medical solutions that support at home healthcare and regular monitoring.

Telehealth and remote monitoring have become pivotal in modern healthcare, with telehealth usage increasing 38-fold and wearable health technology adoption reaching 57% among U.S. adults (CTA). Remote patient monitoring has proven to reduce hospital readmissions by 38% and emergency room visits by 60%, while saving hospitals an average of USD 2,000 per patient in hospitalization costs (AHA). The emphasis on preventive care further boosts the demand for portable devices, empowering individuals to manage their health effectively. As healthcare providers strive to reduce costs and improve care standards, portable medical devices are poised to play a crucial role in the future of healthcare delivery.

Portable Medical Devices Market Dynamics

KEY DRIVERS:

-

Rising Demand for Personalized Healthcare Fuels Growth in Wearable Technology and Portable Medical Devices Market

Increasing demand for personalized healthcare solutions is one of the primary growth factors contributing to the portable medical devices market. More and more, patients want devices designed with their specific health challenges in mind —thus the rise of customizable solutions to improve usability. An example of such a trend is the increase of wearable health technology like smartwatches with health monitoring systems. Wearables such as the Apple Watch are capable of tracking heart rate, monitoring sleep patterns, and even conducting electrocardiograms (ECGs) to help users take a more proactive approach to health management. Such customization gives individuals ownership over their well-being and also promotes compliance with health recommendations hence augmenting an active patient populace. Research in the Journal of Medical Internet Research showed a 20% improvement in patient adherence to treatment plans through wearable devices, while the American Heart Association noted a 15% increase in early diagnosis of heart conditions due to wearables like fitness trackers.

-

Remote Healthcare Demand and Advancements in Monitoring Devices Drive the Market Growth

Social distancing and other limitations on face-to-face visits ushered in a new frontier of telehealth and mobile diagnostic devices. Such as sleep apnea patients with a Philips Respironics DreamWear mask may enable continuous monitoring and transmission of data to the healthcare provider, who can make adjustments in treatment remotely. Remote healthcare solutions reduced emergency visits by 31% for chronic patients, while providers using remote monitoring saw a 40% increase in patient satisfaction during the pandemic. The move to utilize remote tracking despite allowing patients more comfort, also reduces pressure on health care systems by reducing hospital visitations. Increasing investments in portable medical devices are projected to sustain the trend even when more healthcare providers realize the advantages of remote care solutions fueling market growth

RESTRAIN:

-

Overcoming Regulatory and Data Security Challenges to Unlock Growth in the Portable Medical Devices Market

The portable medical devices market is having some challenges such as regulatory challenges and data security concerns. While safety and efficacy must be assured through stringent regulatory compliance, those rigid regulations can have the adverse effect of impeding rapid market entry for novel devices. The global distribution also opens up complications in terms of different regulations across regions, further adding steps to the regulatory process and potentially slowing market entry while increasing development timelines.

Moreover, as digital connectivity becomes more widespread for portable medical devices, the risk associated with data security and privacy gain high importance too. The cybersecurity risk associated with new products and technologies, as well as the threat of unauthorized access to sensitive health information, makes consumers and healthcare providers skeptical about technology adoption. Providing strong cybersecurity is necessary to build user trust in your system and also comply with relevant regulations, like the Health Insurance Portability and Accountability Act (HIPAA) in the United States.

Portable Medical Devices Market Segment Analysis

BY PRODUCT

The monitoring devices segment accounted for the largest share of 47% in 2023 and played an integral role in managing diseases timely, thereby driving up demand. These devices monitor vital health parameters continuously or periodically to facilitate timely interventions and proactive healthcare management. Such as heart rate monitors, glucose monitors, and blood pressure cuffs provide patients and health care providers with the ability to monitor conditions in real time a key component for managing chronic illnesses and improving patient outcomes. This segment has witnessed significant growth due to the increasing prevalence of chronic diseases and a higher need to monitor patients remotely.

The smart wearable devices segment is projected to register a rapid compound annual growth rate (CAGR) from 2024 to 2032, as improved technology and increasing interest in health and fitness monitoring have prompted the wide use of smart card devices. These smart wearables for fitness and lifestyle include advanced sensors that measure multiple health metrics like heart rate, step count, sleep quality, and even signs of stress. With the growing emphasis on health and wellness, consumers are more proactive in promoting their health they ever had, these devices are to see a rise in demand. Integration with mobile apps and cloud services offers improved user interaction, allowing for individual health notifications.

BY APPLICATION

In 2023, cardiology dominated the market with a 26% share in the portable medical devices market, driven by a need for effective management of cardiovascular diseases. From portable ECG monitors to heart rate monitors and wearable defibrillators: These devices are vital for the diagnosis and management of cardiovascular diseases, which rank among the leading causes of morbidity and mortality worldwide. High cardiac disease prevalence and the elderly population are anticipated to drive the effort for advanced cardiology devices.

The gynecology segment is estimated to be the fastest growing segment during 2024–2032 due rise in women's health awareness and the development of monitoring technologies for gynecological disorders. As more attention is given to reproductive health, fertility tracking, and menstrual health, portable medical devices that fulfill particular gynecological requirements are beginning to see greater interest. Portable ultrasound machines, fertility monitors, and at-home STI kits (as well as hormonal level testing) are easier to access and even easier to use. In addition, the changing landscape of preventive health with a focus on personalized medicine is expected to provide opportunities for growth in this segment, and as a result, gynecology is anticipated to be an emerging vertical in the portable medical devices market.

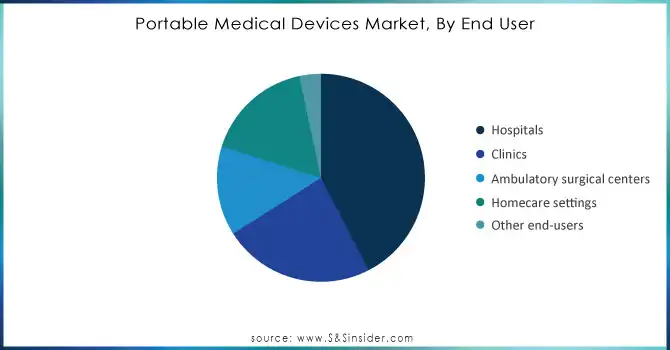

BY END USE

The hospital segment led the market in 2023, accounting for 42.4% of global revenue. This predilection is largely propelled by the hospital environment being conducive for such type of acute patient care along with a need for constant monitoring and diagnostic tools. Hospitals remotely use a variety of portable medical devices, including point-of-care testing equipment, portable imaging machines, and patient monitoring systems beyond the hospital environment to support the clinical decision-making process and patient safety. Portable medical technologies will also find increased adoption as hospitals again take a lead role in portable technologies, due to healthcare complexity and technology drivers including growing market acceptance of home-based care for chronic patients who need regular monitoring.

The homecare settings segment is anticipated to register the fastest CAGR during 2024-2032 owing to the increased geriatric population and shift to decentralized healthcare. With both patients and healthcare providers understanding that self-care in the domicile can overcome some of the chronic disease burden, this will increase the need for those wearables for remote monitoring or even potentially at-home management of health conditions. Wearable health monitors, home diagnostic kits, and telehealth solutions are helping patients take control of their health with healthier habits leading to better compliance rates and better outcomes.

Need Any Customization Research On Portable Medical Devices Market - Inquiry Now

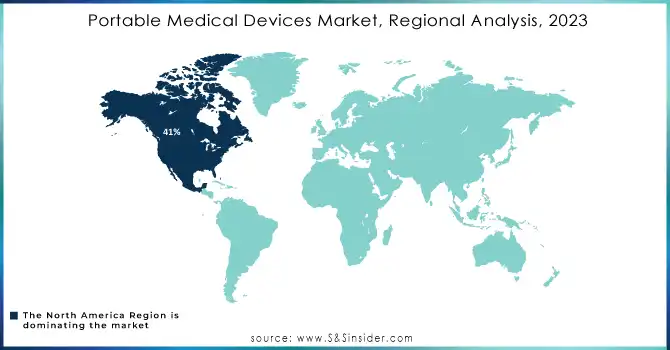

Portable Medical Devices Market Regiona Overview

North America dominated the portable medical devices market, accounting for 41% of the total share in 2023. The reasons for this stronghold include developed healthcare infrastructure, high healthcare spending, and quick adoption of innovative medical technologies in the region. High R&D Expenditure by Key Market Players: Continuous development in the medical device industry from key market players (e.g., Medtronic and Abbott Laboratories) results in continuous investments in research and development. In addition, the rising incidence of chronic diseases along with an increasing emphasis on remote patient monitoring in this region is expected to drive the market over the forecast period. To illustrate, rampant adoption of the Fitbit and Apple Watch in the U.S. signifies a more controlling approach to health and disease prevention in that region.

Asia Pacific region is likely to experience a substantial CAGR between 2024 and 2032 due to the swift population growth accompanied by improving disposal income & corresponding healthcare needs of people. Nations like India, and China are adopting better healthcare infrastructure which results in improving the accessibility of medical devices. Low-cost portable diagnostic devices are being introduced to make monitoring and management of health conditions at home easier in these markets, one example is analogical handheld ECG monitors from companies such as Philips or low-cost glucose meters made available by Roche with an initial price target keeping in line with economic standards. Telehealth services and mobile health apps are making a new standard for the treatment of patients, especially in rural areas where there are no healthcare facilities. Due to the increasing demand for portable medical devices in the Asia Pacific region as a result of improvements to sustainable healthcare accessibility and affordability, this will be one of the more lucrative segments in terms of market growth.

Key Players in Portable Medical Devices Market

Some of the major players in the Portable Medical Devices Market are:

-

Medtronic (MiniMed 770G, Guardian Connect)

-

Abbott Laboratories (FreeStyle Libre, Proclaim XR)

-

Philips Healthcare (Lifeline, HeartStart)

-

Johnson & Johnson (OneTouch Verio, Acuvue Oasys)

-

Siemens Healthineers (ACUSON P500, Mobilett Elite)

-

Roche (Accu-Chek Guide, Elecsys)

-

Becton, Dickinson and Company (BD) (BD Veritor, BD FACS)

-

Omron Healthcare (Omron 10 Series, Omron Evolv)

-

GE Healthcare (Vscan Extend, MAC 2000)

-

Boston Scientific (LUX-Dx, WATCHMAN)

-

Cochlear Limited (Nucleus 7, Baha 5)

-

Nipro Corporation (B-Braun Infusion Systems, Insulin Delivery)

-

Zoll Medical Corporation (AED Plus, R Series)

-

ConvaTec (AQUACEL, Versiva)

-

Honeywell (Draeger, LifeSignals)

-

Masimo Corporation (Rad-97, MightySat)

-

Vital Connect (VitalPatch, VitalSigns)

-

Hearing Life (Lively, Bluetooth Hearing Aids)

-

Cardinal Health (Abbott FreeStyle, Ivantage)

-

Fresenius Kabi (Infusion Systems, Injectables)

RECENT TRENDS

-

In May 2024, Omron Healthcare India partnered with AliveCor India to market AI-based handheld electrocardiography (ECG) technology and atrial fibrillation (Afib) monitoring devices in India.

-

Royal Philips has introduced the Philips Image Guided Therapy Mobile C-arm System 9000 – Zenition 90 Motorized, set to debut at the 2024 Society for Vascular Surgery Annual Meeting in Chicago.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 63.56 Billion |

| Market Size by 2032 | USD 158.22 Billion |

| CAGR | CAGR of 10.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Diagnostic Imaging, Therapeutics, Monitoring Devices, Smart Wearable, Medical Devices) • By Application (Gynecology, Cardiology, Gastrointestinal, Urology, Neurology, Respiratory, Orthopedics, Others) • By End Use (Hospitals, Clinics, Ambulatory surgical centers, Homecare settings, Other end-users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott Laboratories, Philips Healthcare, Johnson & Johnson, Siemens Healthineers, Roche, Becton, Dickinson and Company (BD), Omron Healthcare, GE Healthcare, Boston Scientific, Cochlear Limited, Nipro Corporation, Zoll Medical Corporation, ConvaTec, Honeywell, Masimo Corporation, Vital Connect, Hearing Life, Cardinal Health, Fresenius Kabi |

| Key Drivers | • Rising Demand for Personalized Healthcare Fuels Growth in Wearable Technology and Portable Medical Devices • Remote Healthcare Demand and Advancements in Monitoring Devices Drive Growth in Portable Medical Solutions |

| Restraints | • Overcoming Regulatory and Data Security Challenges to Unlock Growth in the Portable Medical Devices Market |