Refrigerated Display Cases Market Report Scope & Overview:

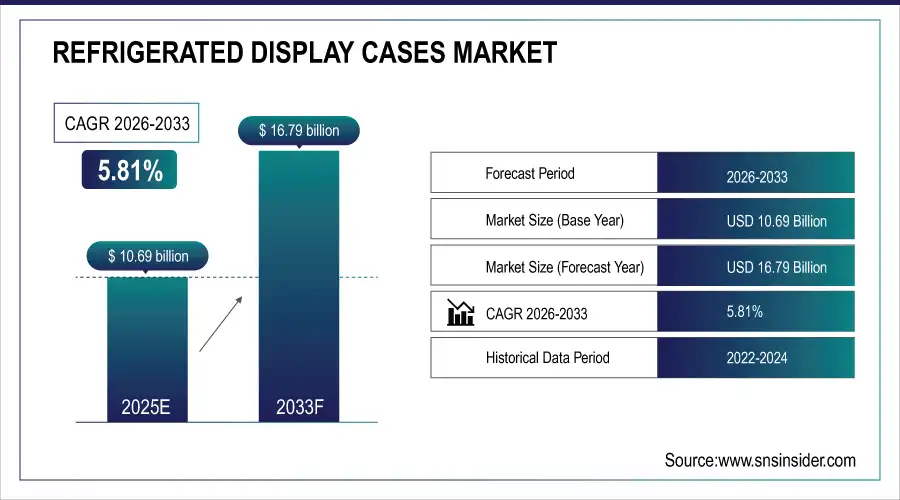

The Refrigerated Display Cases Market Size was valued at USD 10.69 billion in 2025E and is expected to reach USD 16.79 billion by 2033, growing at a CAGR of 5.81% over the forecast period of 2026-2033.

To Get more information On Refrigerated Display Cases Market - Request Free Sample Report

The Refrigerated Display Cases Market is experiencing robust growth due to a convergence of technological, regulatory, and industrial factors. A major driver is the rapid global transition toward green hydrogen, fueled by net-zero commitments and stringent carbon reduction targets in regions such as Europe, North America, and Asia-Pacific. Governments are actively supporting electrolyzer deployment through subsidies, tax incentives, and hydrogen roadmap initiatives, which de-risk investments and encourage large-scale project development. Technological innovation is also a key factor, with advancements in PEM and AEM electrolyzers improving efficiency, reducing reliance on scarce catalysts, and enabling modular, scalable solutions for industrial and mobility applications.

For instance, Investment in generative AI surged from USD 1.3 billion in 2022 to USD 17.8 billion in 2023 across OECD countries. This rapid increase reflects the growing importance of AI in driving technological innovation and economic growth

Market Size and Forecast:

-

Refrigerated Display Cases Market Size in 2025E: USD 10.69 Billion

-

Refrigerated Display Cases Market Size by 2033: USD 16.79 Billion

-

CAGR: 5.81% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Refrigerated Display Cases Market Trends

-

Rising adoption of energy-efficient and low-emission refrigerated display cases, driven by growing sustainability regulations and green building initiatives across retail and hospitality sectors.

-

Growth in deployment of advanced display cases with smart temperature controls, LED lighting, and improved insulation, enhancing product shelf life while reducing energy consumption in supermarkets, convenience stores, and restaurants.

-

Increasing government incentives, subsidies, and funding for energy-efficient refrigeration technologies in North America, Europe, and Asia-Pacific, aimed at reducing carbon footprints and promoting sustainable retail infrastructure.

-

Expansion of hybrid and modular display case designs, combining vertical, horizontal, and plug-in technologies, to meet diverse retail layouts and multi-temperature product storage requirements.

-

Rising collaboration between manufacturers, retailers, and technology providers to integrate IoT-enabled monitoring systems for remote temperature management, predictive maintenance, and energy optimization.

U.S. Refrigerated Display Cases Market Insights

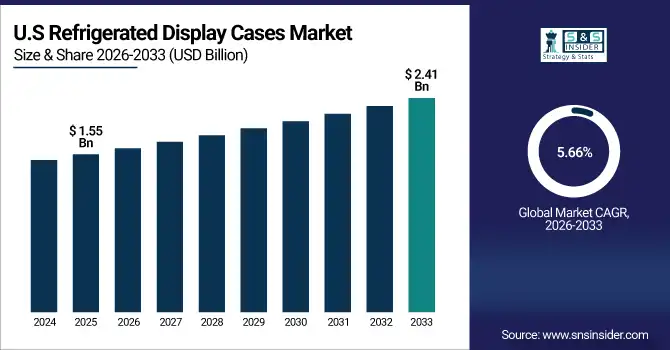

The U.S. market is valued at USD 1.55E billion in 2025 and is expected to reach USD 2.41 billion by 2033, growing at a CAGR of 5.66% over the forecast period of 2026-2033. Energy-efficiency standards, federal incentives, and private investments drive large-scale adoption of advanced plug-in, remote, and hybrid display cases across supermarkets, convenience stores, and restaurants. Modernization of retail outlets, expansion of grocery chains, and rising consumer demand for fresh and frozen foods further boost market growth.

Refrigerated Display Cases Market Growth Driver

-

Rising Demand for Energy-Efficient and Sustainable Refrigeration Solutions

Governments and regulatory bodies across regions are actively encouraging the adoption of energy-efficient refrigerated display cases through policies, subsidies, and tax incentives aimed at reducing energy consumption and greenhouse gas emissions. In Europe, under the EU Ecodesign Directive, incentives are provided to promote energy-efficient commercial refrigeration solutions. In the U.S., initiatives such as the Department of Energy’s (DOE) Energy Efficiency Programs offer grants and rebates for supermarkets and convenience stores to adopt high-efficiency refrigeration units. Similarly, in Asia-Pacific, countries like Japan and South Korea have introduced funding programs and low-interest loans to support sustainable retail refrigeration upgrades. These measures drive market growth, accelerate technology adoption, and encourage retailers to replace outdated display cases with high-efficiency, low-GWP systems.

Refrigerated Display Cases Market Restraint

-

High Capital and Operational Costs Limit Market Expansion

Advanced refrigerated display cases, particularly plug-in and remote units with IoT-enabled monitoring, require significant upfront investments, including high-performance compressors, low-GWP refrigerants, and enhanced insulation technologies. In Europe, mid-sized retail chains often delay replacement of conventional units due to high costs despite EU energy grants. In North America, supermarkets face increased operational expenses from installation and integration of remote monitoring systems, along with periodic maintenance of specialized components. In Asia, import duties on advanced refrigeration technologies and lack of skilled technicians contribute to elevated operational costs. These high capital and ongoing expenses remain key barriers to widespread adoption, especially for small retailers and emerging markets.

Refrigerated Display Cases Market Opportunity

-

Expansion into Emerging Markets and Adoption of Smart Refrigeration Technologies

Emerging economies are witnessing growing retail infrastructure, modern supermarkets, and convenience stores, creating strong demand for advanced refrigerated display cases. In India, large retail chains such as Reliance Retail and Future Group are investing in energy-efficient refrigeration systems across multiple outlets to comply with sustainability targets. In Latin America, Brazil and Mexico are modernizing supermarket chains with hybrid and vertical display units supported by government programs incentivizing low-energy refrigeration. In Europe, countries like Germany and France are integrating smart display cases with IoT-based monitoring and predictive maintenance, backed by government energy-efficiency grants. These developments provide opportunities for regional expansion, adoption of innovative display solutions, and penetration into energy-conscious retail segments globally.

Refrigerated Display Cases Market Segment Highlights:

-

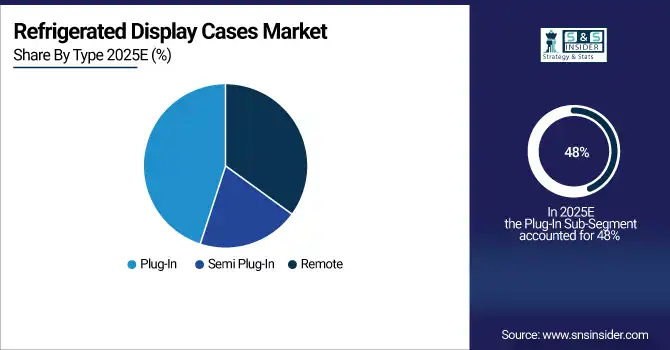

By Type: Plug-In – 48% share (largest); Remote fastest-growing at 18% CAGR, driven by centralized refrigeration adoption in large supermarkets.

-

By Design: Vertical – 42% share (largest); Hybrid fastest-growing at 20% CAGR due to versatility in retail space utilization and energy efficiency.

-

By Application: Retail Stores – 50% share (largest); Restaurants and Hotels fastest-growing at 22% CAGR, supported by expanding foodservice and hospitality sectors.

-

By End-User: Supermarkets – 55% share (largest); Convenience Stores fastest-growing at 19% CAGR due to modernization and energy-efficiency upgrades in smaller retail outlets.

Refrigerated Display Cases Market Segment Analysis

By Type

Plug-In continues to dominate the market with a 48% share in 2025, owing to its low installation cost, ease of maintenance, and suitability for small to mid-sized retail outlets. Remote display cases are the fastest-growing segment, projected at an 18% CAGR, driven by large supermarkets and hypermarkets preferring centralized refrigeration systems that reduce energy consumption and improve temperature consistency across multiple units.

By Design

Vertical display cases hold the largest share at 42% in 2025, supported by their space-efficient design, ease of product visibility, and adaptability for various grocery items. Hybrid display cases are the fastest-growing sub-segment at 20% CAGR, due to their combined features of horizontal and vertical designs, offering retailers flexibility, higher energy efficiency, and enhanced product display capabilities.

By Application

Retail stores dominate the market with a 50% share in 2025, as supermarkets, grocery stores, and hypermarkets increasingly upgrade refrigeration units to meet energy efficiency standards and improve food preservation. Restaurants and hotels represent the fastest-growing application segment at 22% CAGR, fueled by the expansion of the foodservice industry, increasing consumer demand for fresh and ready-to-eat items, and compliance with health and safety regulations.

By End-User

Supermarkets account for the largest share at 55% in 2025, driven by the adoption of energy-efficient, high-capacity display cases to maintain product quality and reduce operational costs. Convenience stores are the fastest-growing end-user segment at 19% CAGR, as smaller retailers invest in modern refrigerated units to enhance customer experience, increase product variety, and comply with evolving food storage regulations.

Refrigerated Display Cases Market Regional Analysis

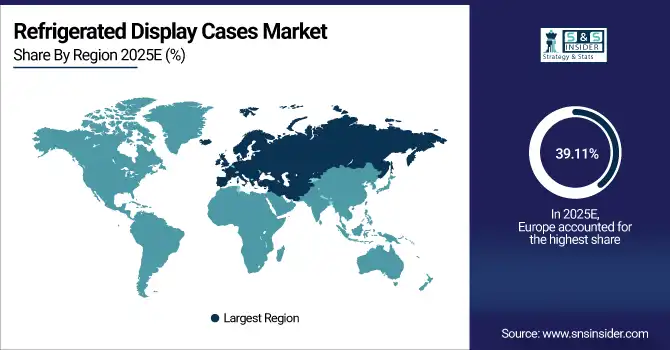

Europe Refrigerated Display Cases Market Insights

Europe dominates the global refrigerated display cases market with a 39.11% share in 2025, driven by mature retail sectors, increasing demand for energy-efficient refrigeration, and stringent energy regulations like the EU Ecodesign Directive. Germany, France, and the Netherlands lead the region, investing in modern plug-in, remote, and hybrid display cases for supermarkets, convenience stores, and foodservice outlets. Well-developed cold chain infrastructure, government incentives for energy-efficient equipment, and modernization of retail stores further drive adoption. Partnerships between retail chains and refrigeration manufacturers, as well as strategic investments in sustainable refrigeration technologies, reinforce Europe’s leadership in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Refrigerated Display Cases Market Insights

Asia-Pacific holds 24.32% of the global market in 2025 and is the fastest-growing region due to rapid urbanization, increasing retail modernization, and expansion of the foodservice and hospitality sectors. Countries such as China, Japan, India, and South Korea are investing heavily in energy-efficient and smart refrigerated display cases for supermarkets, convenience stores, and restaurants. Government initiatives promoting energy conservation and subsidies for environmentally friendly refrigeration systems encourage domestic production and private-sector investments. Rising disposable incomes, growing consumer awareness of food safety, and expansion of organized retail chains further accelerate market growth in the region.

North America Refrigerated Display Cases Market Insights

North America accounts for 19.23% of the market in 2025, with the U.S. leading regional growth. The market is driven by supermarket chains, convenience stores, and foodservice businesses upgrading to energy-efficient and modular refrigerated display solutions. Federal energy-efficiency programs, tax incentives for low-energy refrigeration, and private investments in smart retail infrastructure support market expansion. The integration of IoT-enabled and remote-monitoring display cases, combined with growing demand for frozen and fresh products, further fuels adoption.

Latin America (LATAM) and Middle East & Africa (MEA) Refrigerated Display Cases Market Insights

LATAM (6.34% share) and MEA (11% share) are emerging markets showing strong potential. In LATAM, Brazil, Chile, and Argentina are investing in modern refrigerated display units for expanding supermarket chains and convenience stores. In MEA, countries like UAE, Saudi Arabia, and South Africa are focusing on energy-efficient refrigeration in retail and hospitality sectors. Government initiatives promoting energy efficiency, growing industrial and retail infrastructure, and international collaborations drive adoption and create opportunities for market expansion.

Competitive Landscape for Refrigerated Display Cases Market:

Carrier Global Corporation

Carrier Global Corporation specializes in heating, ventilation, air conditioning, and refrigeration solutions.

-

In March 2025, Carrier launched a new line of energy-efficient plug-in and remote refrigerated display cases for supermarkets in North America and Europe, achieving up to 40% lower energy consumption compared to conventional models.

Hussmann Corporation

Hussmann is a leading provider of refrigerated display and food merchandising solutions.

-

In July 2025, Hussmann introduced hybrid vertical and horizontal display cases in Europe, combining advanced LED lighting and improved airflow management, aimed at reducing operational costs for retail chains.

Daikin Industries Ltd.

Daikin is a global leader in air conditioning and refrigeration systems.

-

In January 2025, Daikin expanded its portfolio with smart refrigerated display cases integrating IoT monitoring systems in Asia-Pacific, enhancing energy efficiency and predictive maintenance capabilities.

True Manufacturing Co., Inc.

True Manufacturing focuses on commercial refrigeration solutions for retail and foodservice sectors.

-

In June 2025, True launched modular plug-in refrigerated display units in the U.S., designed for supermarkets and convenience stores, supporting flexible store layouts and energy savings.

Foster Refrigerator (Welbilt Inc.)

Foster Refrigerator designs commercial refrigeration equipment for supermarkets and hospitality sectors.

-

In September 2025, Foster introduced a line of remote refrigerated display cases in the Middle East, targeting hotels and restaurants, with reduced refrigerant usage and compliance with new environmental regulations.

Refrigerated Display Cases Market Key Players

Some of the Refrigerated Display Cases Companies

-

Carrier Global Corporation

-

Daikin Industries Ltd.

-

Danfoss A/S

-

Haier Group Corporation

-

Hussmann Corporation

-

Epta S.p.A.

-

Arneg S.p.A.

-

Hoshizaki Corporation

-

Metalfrio Solutions S.A.

-

AHT Cooling Systems GmbH

-

Verco Limited

-

Turbo Air Inc.

-

Zero Zone Inc.

-

Frigoglass S.A.I.C.

-

Hill Phoenix Inc.

-

Fagor Professional

-

ISA S.p.A.

-

Afinox S.r.l.

-

Lennox International

-

Illinois Tool Works Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 10.69 Billion |

| Market Size by 2033 | USD 16.79 Billion |

| CAGR | CAGR of5.81% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Plug-In, Semi Plug-In, Remote) • By Design (Vertical, Horizontal, Hybrid) • By Application (Retail Stores, Restaurants and Hotels, Other Applications) • By End-User (Supermarkets, Convenience Stores) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Carrier Global Corporation, Daikin Industries Ltd., Danfoss A/S, Haier Group Corporation, Hussmann Corporation (Panasonic Corporation), Epta S.p.A., Arneg S.p.A., Hoshizaki Corporation, Metalfrio Solutions S.A., AHT Cooling Systems GmbH, Verco Limited, Turbo Air Inc., Zero Zone Inc., Frigoglass S.A.I.C., Hill Phoenix Inc. (Dover Corporation), Fagor Professional (ONNERA Group), ISA S.p.A., Afinox S.r.l., Lennox International, Illinois Tool Works Inc. |