Steel Market Report Scope & Overview:

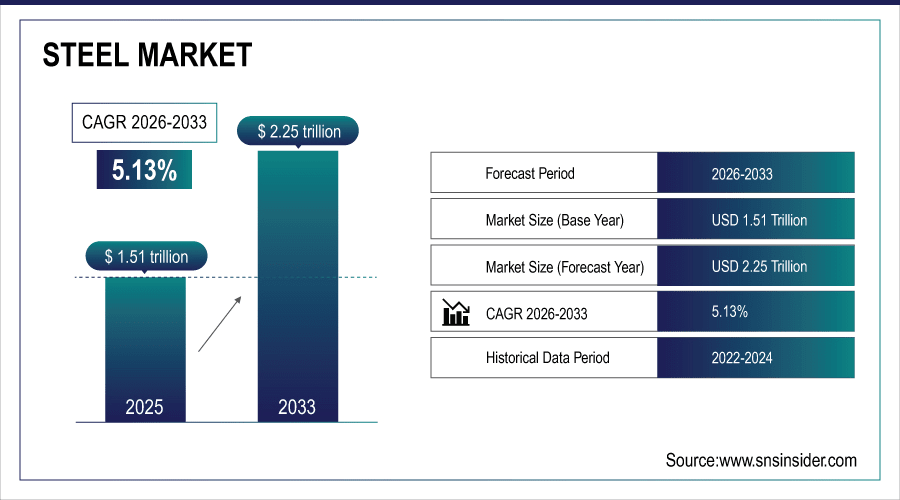

The Steel Market size was valued at USD 1.51 Trillion in 2025E and is projected to reach USD 2.25 Trillion by 2033, growing at a CAGR of 5.13% during 2026-2033.

The Steel market expansion will jump up as a result the increasing urbanization, infrastructure, automotive and construction sectors. Growth is influenced by higher industrialization, a rise in renewable energy projects and ongoing manufacturing activities all around the world. Advanced manufacturing practices and strength steel products are helping in achieving efficiency and sustainability, which also drive demand from various applications including construction, automotive, energy as well as machinery over regions worldwide.

In February 2025, ArcelorMittal inaugurated a $150 million advanced steel production plant in Ghent, Belgium, equipped with high-strength steel manufacturing lines and energy-efficient technologies to meet growing automotive, construction, and renewable energy demands while reducing carbon emissions.

To Get More Information On Steel Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 1.51 Trillion

-

Market Size by 2033: USD 2.25 Trillion

-

CAGR: 5.13% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Steel Market Trends

-

Growing use of high strength steels and specialty steels to bring innovation in automotive, construction and machinery application.

-

Digitalization and Industry 4.0 initiatives at steel plants are helping to improve productivity while minimizing downtime in the production process.

-

As more and more investment is directed into sustainable and energy-efficient steel plants, an eco-friendly production approach on worldwide scale is taking place.

-

Increasing demand for lightweight and high corrosion resistant steel products in automotive & aerospace sector.

-

Smart technologies like IoT and real-time monitoring are being integrated into manufacturing systems, which is facilitating better quality control and predictive maintenance.

-

Developing infrastructure and renewable energy projects are rising to promote the utilization of steel in heavy construction work as well as in power.

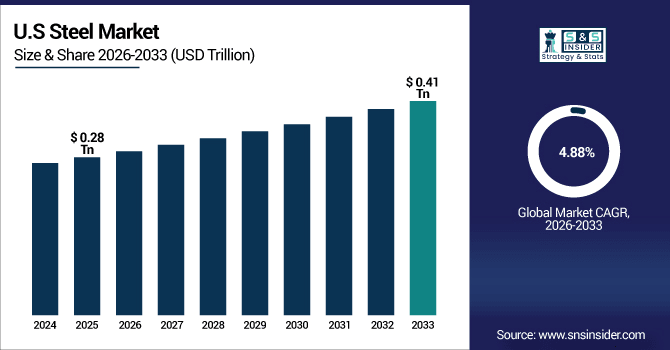

The U.S. Steel Market size was valued at USD 0.28 Trillion in 2025E and is projected to reach USD 0.41 Trillion by 2033, growing at a CAGR of 4.88% during 2026-2033. Demand for high strength, specialty and sustainability steel solutions is rising in construction, automotive and machinery. Growing awareness for energy-efficient production, the demand for lightweight and corrosion-resistant Steel are driving this segment to be a major driver of manufacturers, infrastructure projects and global market growth.

Steel Market Growth Drivers:

-

Rapid Urbanization and Expanding Infrastructure Projects Drive Steel Demand Globally

Urbanization & Infrastructure Development are the major traction of steel market. Fast pace of urbanization, growth in commercial facilities and infrastructure projects are generating huge demand for steel. Construction of building for residential, commercial and industrial purpose needs transition from mild steel to higher strength steel. This tendency also promotes the development of other industries such as transportation, energy and manufacturing, making infrastructure construction a major driving force for global steel consumption and market expansion.

In August 2025, the global steel market grew steadily, driven by infrastructure development, urbanization, and industrial expansion. The construction sector remains the largest end-use segment, supporting overall market growth worldwide.

Steel Market Restraints:

-

Volatile Raw Material Prices and Fluctuating Input Costs Challenge Steel Market Stability

Steel market is also facing the challenge of volatility in Raw Material Prices. Iron ore, coal and scrap steel used to make new steel are all critical inputs whose costs can vary significantly based on global supply-demand imbalances as well as geopolitical tensions and trade curbs. These fluctuating prices have significant impacts on the price of production, profit margins, and bring about uncertainty to manufacturers, which can hinder long-term investment planning as well as stable pricing for end-use industry.

Steel Market Opportunities:

-

Rapid Urbanization and Smart City Developments Create Significant Opportunities for Steel Market Expansion

Rising Infrastructure and Smart Cities Projects is a prime opportunity for steel market. Booming urbanization, massive housing and infrastructure construction projects by the government is creating a substantial demand for steel materials. The development of smart cities, such as transport systems, renewable energy plants or public services also increases the demand. This growing scale is providing manufacturers with the ability to increase production sizes, implement new technologies and serve a broad range of industries – underpinning sustained growth of world markets.

In September 2025, China’s steel exports are projected to reach a record high despite global trade barriers. Rising exports are driven by weakened domestic demand and the urgency to enter international markets. Major recipients include countries in the Middle East, Central Asia, and North Africa.

Steel Market Segment Analysis

-

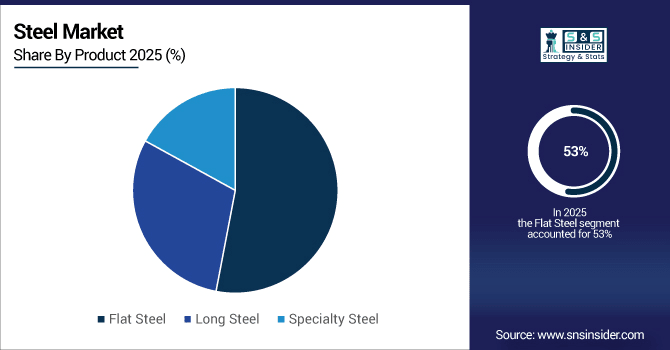

By Product, Flat Steel dominated the market, accounting for 53% share in 2025E, while Specialty Steel is the fastest-growing segment, projected to expand at a CAGR of 5.0% from 2026 to 2033.

-

By Raw Material, Iron Ore-Based Steel dominated the market, accounting for 62% share in 2025E, while Direct Reduced Iron (DRI) Steel is the fastest-growing segment, projected to expand at a CAGR of 5.2% from 2026 to 2033.

-

By Industry, Construction & Infrastructure dominated the market, accounting for 45% share in 2025E, while Automotive is the fastest-growing segment, projected to expand at a CAGR of 4.8% from 2026 to 2033.

-

By Manufacturing Process, Basic Oxygen Furnace (BOF) dominated the market, accounting for 57% share in 2025E, while Electric Arc Furnace (EAF) is the fastest-growing segment, projected to expand at a CAGR of 5.1% from 2026 to 2033.

By Product, Flat Steel leads market share, while Specialty Steel grows fastest

Flat steel is widely used in construction, automotive panels, appliances, and for packaging applications. Due to its durability and price point, it is ideal for large projects. Specialty Steel is by Contrast, the fastest growing industry as industries require its high strength, corrosion resistant & light steel for their automotive/aerospace and advanced engineering applications respectively that are responsible for driving a higher CAGR.

By Raw Material, Iron Ore-Based Steel dominates, while DRI Steel rises fastest

Iron Ore-Based Steel dominates the market and is a conventional & readily material used to produce steel for construction of infrastructure and other product applications. Direct Reduced Iron (DRI) Steel is fast emerging due to its energy efficiency, reduced carbon-foot print and electric arc furnaces suitability, which adds to the attractiveness of this type in sustainable and eco-friendly steel production regions further promoting higher industry growth.

By Industry, Construction & Infrastructure drive demand, while Automotive grows fastest

Construction & Infrastructure is also one of the primary consumers of steel due to significant urbanization, public infrastructure projects, and commercial construction demand enormous volumes of structural steel. But automotive is the most rapidly growing segment as increased vehicle production, as well as electric vehicle (EV) production, requires lightweight high-strength and specialty steels. Higher CAGR of this segment is a result of advancements in automotive construction and international extension of manufacturing units.

By Manufacturing Process, BOF holds majority share, while EAF expands fastest

Basic Oxygen Furnace is one of the most common, effective technologies for the production of large amounts of steel which use flat and long product routes. Electric Arc Furnace is the fastest growing segment on account of using steel scrap, being energy efficient, eco-friendly and versatile for production of specialty steels. Here are the following reasons why it has a faster CAGR at a worldwide level Over the past several years there has been increasing focus placed upon sustainability, and all sorts of flexible production.

Steel Market Regional Analysis:

North America Steel Market Insights:

North America is being led by high demand for steel from construction, automotive and energy industries along with robust manufacturing industry supported by developed supply chain. The area is befitted from massive infrastructure modernization, renewable energy initiatives and automotive manufacturing investments. In addition, leading steel producers and adopting sustainable technologies have continued to enhance North America’s position as the largest market in terms of consumption and innovation across sectors.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Steel Market Insights:

The U.S. rules the steel market with auto, infrastructure and construction industries providing strong demand. Sustained spending on smart manufacturing, electric vehicle manufacturing and renewable energy projects boosts steel usage. Its leadership is supplemented by the advanced technological prowess, stringent quality control and sustainable oriented measures. Additionally, the established distribution network and growing capacity of US domestic steel ensures that the US stays competitive in the world market.

Asia-Pacific Steel Market Insights:

Asia-Pacific dominates the global steel market, accounting for over 50% share in 2025E and projected to grow at a CAGR of 5.59% from 2026–2033, to become the fastest growing and largest region. The market is dominated by (rapid) urbanization, steady infrastructure developments and stronger demand from automotive & industrial sectors. Production and consumption are dominated by China and India, driven by State-based programs, technology uptake and increasing investment in green & sustainable steel options. Increasing construction, renewable energy and expanding export opportunities are all bolstering the Asia-Pacific’ position as leader in the global steel market.

China Steel Market Insights:

China is the world leader in steel production due to rapid urbanization, infrastructure expansion and industrial development. Steel consumption is underpinned by robust government initiatives, rapid expansion within real estate and a wave of investment in transport and energy infrastructure. China has the world’s largest steel production base and is endowed with integrated value chains that allow it to manipulate supply and demand dynamics.

Europe Steel Market Insights:

Europe plays a pivotal role in the global steel market because of advanced car manufacturing, aerospace and energy projects. Strict environmental legislation drives green steel uptake and stimulates innovation throughout the plant. Leading steelmakers of world being available along with research-based initiatives, technology evolves. In addition, the increasing demand from renewable energy and sustainable construction industries also contributes to the domination of Europe and its influence on global steel trends.

Germany Steel Market Insights:

Germany is the dominant player in Europe’s steel market, thanks to its large automotive, machinery and engineering sectors. It has advanced R.&D., precision manufacturing and a skilled work force. Significant investment in renewable power generation projects and green infrastructure underpin demand for steel. The policy focus on sustainability and low-carbon steel production pushes Germany’s market positioning even higher.

Middle East & Africa (MEA) and Latin America Steel Market Insights:

Middle East and Africa steel industry is growing due to high infrastructure projects, burgeoning urbanization and robust demand from the oil & gas industry. Gulf states are driving growth with government-backed construction megaprojects and economic diversification programmed that include spending on renewable energy projects and transport networks. Latin America sees its demand increase, supported by infrastructure renewal, construction and automotive production.

Steel Market Competitive Landscape:

ArcelorMittal is a global steel company based out of Luxembourg and is the largest corporate steel producer in the world, with an annual crude output of more than 97 million tons as of 2018. The company supports construction, automotive, energy and machinery industries globally. It focuses on sustainable steel production using the electric arc furnace and work as part of a circular economy where steel is used for 330 million tonnes assisting animal protection in Europe, South America, North America Asia and Africa.

-

In April 2025, ArcelorMittal expanded its partnership with carbon capture and reuse specialist LanzaTech through a $30 million investment via its XCarb™ innovation fund. This collaboration focuses on reducing carbon emissions in steel production.

Nippon Steel Corporation, headquartered in Japan, is one of the world's leading steel companies with interstate-faceted solutions including those for advanced high-tensile strength steel and stainless-steel products. It is also vital in automotive, infrastructure, ship building and power. The business has made significant R&D investments in special and high-grade steel solutions and green technologies and is a renowned name in sustainable steel production technology across the Asian circuit.

-

In May 2025, Nippon Steel decided to invest in the construction and expansion of electric arc furnaces at its Kyushu, Setouchi, and Yamaguchi Works. This move aligns with Japan's Green Transformation Promotion Act.

China Baowu Steel Group, based in Shanghai, is the world’s largest steel company by production. It controls China’s steel industry and has a growing worldwide presence. The company produces flat, long and special steels used for industries including construction, energy, automotive and machinery. Baowu is promoting digital transformation and low-carbon technologies to reinforce efficiency, competitiveness and sustainability in steel production.

-

In June 2025, China Baowu Steel Group partnered with BHP to accelerate the development of green steel technologies, focusing on decarbonization and sustainable production practices.

Steel Market Key Players:

Some of the Steel Market Companies are:

-

ArcelorMittal

-

Nippon Steel Corporation

-

China Baowu Steel Group

-

POSCO (Pohang Iron & Steel Company)

-

JFE Steel Corporation

-

Tata Steel Limited

-

Nucor Corporation

-

United States Steel Corporation (U.S. Steel)

-

Ansteel Group Corporation

-

Shougang Group

-

Severstal

-

Hyundai Steel Company

-

Steel Authority of India Limited (SAIL)

-

JSW Steel Limited

-

Gerdau S.A.

-

Tenaris S.A.

-

Evraz Group

-

Voestalpine AG

-

SSAB AB

-

AK Steel Holding Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.51 Trillion |

| Market Size by 2033 | USD 2.25 Trillion |

| CAGR | CAGR of 5.13 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Flat Steel, Long Steel and Specialty Steel) •By Raw Material (Iron Ore-Based Steel, Scrap-Based Steel and Direct Reduced Iron Steel) •By Industry (Construction & Infrastructure, Automotive, Energy & Power and Machinery & Equipment) •By Manufacturing Process (Basic Oxygen Furnace, Electric Arc Furnace, Open Hearth Furnace and Continuous Casting & Rolling) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ArcelorMittal, Nippon Steel Corporation, China Baowu Steel Group, POSCO (Pohang Iron & Steel Company), JFE Steel Corporation, Tata Steel Limited, Nucor Corporation, United States Steel Corporation (U.S. Steel), Ansteel Group Corporation, Shougang Group, Severstal, Hyundai Steel Company, Steel Authority of India Limited (SAIL), JSW Steel Limited, Gerdau S.A., Tenaris S.A., Evraz Group, Voestalpine AG, SSAB AB, AK Steel Holding Corporation. |