Consumer Packaged Goods Market Report Scope & Overview:

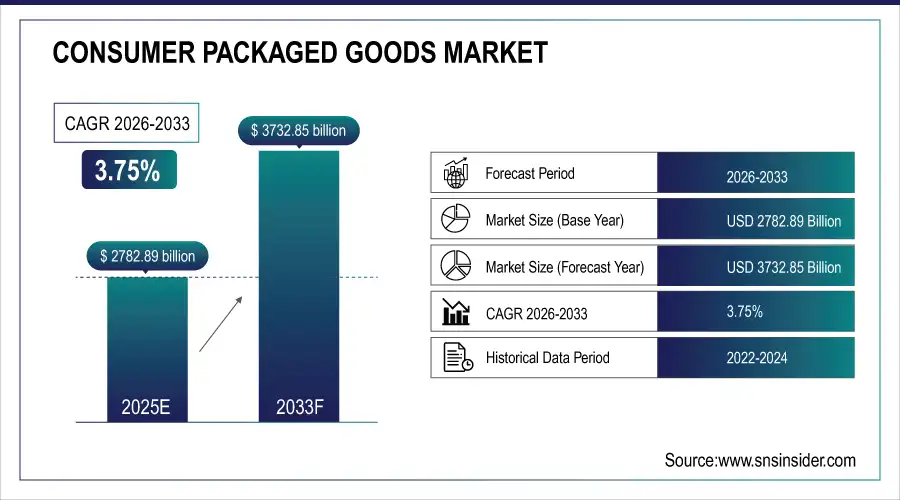

The Consumer Packaged Goods Market size was valued at USD 2782.89 Billion in 2025E and is projected to reach USD 3732.85 Billion by 2033, growing at a CAGR of 3.75% during 2026-2033.

The Consumer Packaged Goods Market analysis highlights the growing consumer demand in food & beverages, personal care and home products. Growing e-commerce sales, brand introductions and sustainable packaging use propel growth. Leading players concentrate on developing distribution, improving product quality and adopting digital marketing techniques. Emerging markets and e-commerce penetration are big long term expansion opportunities globally.

By 2025, over 60% of CPG brands globally will use recyclable or compostable packaging, driven by consumer pressure and regulations like the EU’s Single-Use Plastics Directive. E-commerce is projected to account for 25% of total CPG sales worldwide by 2025, up from 15% in 2022, fueled by mobile shopping and direct-to-consumer models.

Market Size and Forecast:

-

Market Size in 2025E: USD 2782.89 Billion

-

Market Size by 2033: USD 3732.85 Billion

-

CAGR: 3.75% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Consumer Packaged Goods Market - Request Free Sample Report

Consumer Packaged Goods Market Trends

-

Rising e-commerce adoption drives online sales growth, changing consumer purchasing habits and accelerating demand for fast, convenient delivery options globally.

-

Sustainable and eco-friendly packaging gains popularity as consumers increasingly prefer recyclable, biodegradable, and reduced-plastic products, influencing brand strategies worldwide.

-

Personalization and premium products are trending, with companies offering tailored formulations, flavors, and packaging to meet diverse consumer preferences.

-

Health-conscious and wellness-oriented products grow rapidly, fueled by demand for organic, low-sugar, and functional food and beverage options.

-

Digital marketing and social media campaigns drive brand engagement, awareness, and sales, transforming consumer interactions and purchase decisions significantly.

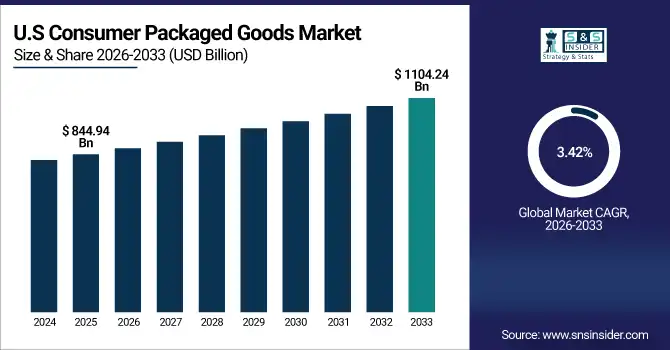

The U.S. Consumer Packaged Goods Market size was valued at USD 844.94 Billion in 2025E and is projected to reach USD 1104.24 Billion by 2033, growing at a CAGR of 3.42%during 2026-2033. Consumer Packaged Goods Market growth is driven by growing e-commerce adoption, health-conscious and premium product demand and brand loyalty patterns. The advancement in online sales and increasing demand of eco-friendly products in personal care, food and home create additional pace for market expansion by established as well as new manufacturers.

Consumer Packaged Goods Market Growth Drivers:

-

Rising consumer demand for convenience, health-focused, and sustainable products accelerates CPG market growth globally.

Consumer Packaged Goods Market growth is driven by rising consumer inclination towards convenient ready to eat products and health and wellness-based product offerings. There is high demand for health conscious, natural and functional food as well as wellness personal care. E-com push, digital marketing opens up audiences for brands. Furthermore, increasing demand for sustainable and eco-friendly packaging is pushing companies to come up with newer products, leading to product launches and thereby promoting the overall market growth in various regions globally.

By 2025, over 70% of new food and beverage launches globally will feature functional or wellness claims such as immunity support, gut health, or plant-based ingredients.

Consumer Packaged Goods Market Restraints:

-

High production costs, regulatory compliance, and raw material price volatility limit CPG market growth potential.

The Consumer Packaged Goods Market faces several restraints that may hinder its growth potential. increased raw material and packaging costs has an impact on profitability. Compliance with FDA, ISO and environmental standards complicates operation. Mature markets are also characterized by intense competition and price sensitivity, which will continue to restrict expansion. Supply chain disruptions and logistical hiccups, particularly with perishable items, could limit the availability of products. Cumulatively, these force a more restrictive expansion through cost-cutting activities and rigorous plans.

Consumer Packaged Goods Market Opportunities:

-

Expansion of online channels, emerging markets, and sustainable products creates growth opportunities in CPG market.

The Consumer Packaged Goods Market is witnessing strong opportunities in urbanization and increasing disposable incomes in emerging markets drive the sale of packaged foods, personal care and household items. Growing focus on environmentally friendly packaging drives development of green packaging and biodegradable products. Through the adoption of tech-enabled solutions, customized products and partnerships, businesses can reach out to untapped consumer segments, diversify their product offerings as well as penetrate markets across the world.

By 2025, e-commerce will account for over 35% of CPG sales in Asia-Pacific’s urban centers, driven by smartphone penetration and on-demand delivery platforms like GrabMart and JioMart. Urban consumers in emerging markets are projected to spend 40% more on premium packaged goods by 2025 compared to 2022, fueled by rising disposable incomes and lifestyle upgrades.

Consumer Packaged Goods Market Segment Analysis

-

By product, food & beverages led the Consumer Packaged Goods Market with a 30.54% share in 2025, while cosmetics & personal care products emerged as the fastest-growing segment, registering a CAGR of 5.50%.

-

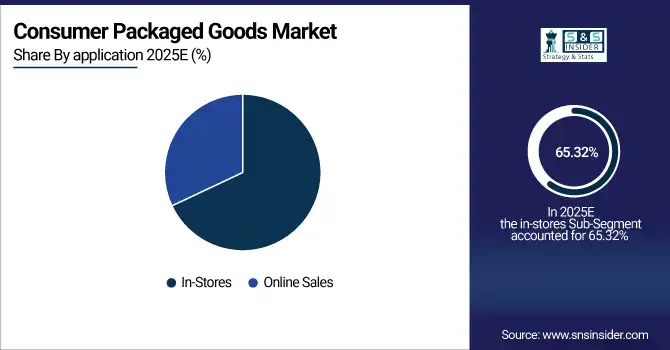

By application, in-stores dominated with 65.32% share in 2025, whereas online sales showed the fastest growth with a CAGR of 8.60%.

-

By packaging type, rigid packaging accounted for the leading 55.29% market share in 2025, while flexible packaging registered the fastest growth at a CAGR of 5.20%.

-

By material, plastic held the highest share of 40.58% in 2025, while paperboard emerged as the fastest-growing material with a CAGR of 6.80%.

By Product, Food & Beverages Leads Market While Cosmetics & Personal Care Products Registers Fastest Growth

Food & Beverages segment leads the Market as a result of consistent demand, mass consumption and product designing. There is key distinction between staple food, snack and beverage product sub-segments between developed (value) vs emerging markets in this category. Cosmetics & Personal Care Products are growing fast due to the sales of Cosmetics & personal care is expected to grow as more and more consumers become aware regarding their personal Hygiene, wellbeing and beauty standards. Online availability, product innovation, and premiumization…are other factors that are driving the growth of this segment worldwide.

By Application, In-Stores Dominate While Online Sales Shows Rapid Growth

By application in-store segment dominate Consumer Packaged Goods Market due to tradition retail remains the major channel for product sale. The convenience, assortment and availability at the point of purchase for the products bring the physical store in a good position with consumers. While, Online Sales is the fastest-growing application segment, driven by rising e-commerce penetration, digital marketing and consumer demand for contactless shopping. Their ramped-up efforts to use mobile apps, online deals and subscription services are helping the brews extend their reach — and sales — increasingly in urban and tech-savvy markets around the world.

By Packaging Type, Rigid Lead While Flexible Registers Fastest Growth

By packaging Rigid segment is leading the market because of its long-life structures, protective elements as well in the food and beverage industry for daily household needs. Glass bottles, metal cans and other hard plastics help protect food and beverages from thermal decomposition. Conversely, Flexible Packaging is the fastest growing category, driven by lightweight, cost-effectiveness and convenience factors. The demand for pouches, sachets and films that support single-use or on-the-go consumption has continued to grow with fast adoption in several product categories across the globe.

By Material, Plastic Lead While Paperboard Grow Fastest

Plastic is leading the consumer packaged goods market by material, due to its flexibility as well as for being low-cost and long-lasting in food, beverage, health and beauty sectors. It takes years before widespread adoption for high levels of market share. Paperboard, is the fastest-growing material segment, due to sustainability trends associated with recycling products and consumer preference for eco-friendly packaging. Paperboard cartons, boxes and eco-friendly packaging solutions have gained popularity among manufacturers to comply with regulations and attract environment conscious consumers across the world.

Consumer Packaged Goods Market Regional Analysis:

North America Consumer Packaged Goods Market Insights

In 2025 North America dominated the consumer packaged goods market and accounted for 41.62% of revenue share, this leadership is due to the presence of large electronics and semiconductor manufacturing hubs including China, Japan, South Korea, and Taiwan. In addition to this increasing demand for innovative PCBs, as well as government support for technology advancement due to rapid industrialization are fueling the market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Consumer Packaged Goods Market Insights

Consumer demand is strong in the U.S., with well-established retail routes to market, meaning that it accounts for North America’s market. Health-focused and convenience products dominate. Online sales growth speeds up, with help from digital marketing.

Asia-pacific Consumer Packaged Goods Market Insights

Asia-pacific is expected to witness the fastest growth in the Consumer Packaged Goods Market over 2026-2033, with a projected CAGR of 4.41% due to growing population and rising disposable incomes. Growing urban population drives the demand for convenience foods and personal care products. Sales are helped along in many categories by e-commerce adoption and digital marketing. India, Japan and South Korea play a major role. Robust retail structure is aiding the growth of CPG consumption led by the visible influx in modern retail stores.

China Consumer Packaged Goods Market Insights

China dominating the regional landscape due to healthful and upscale products gain strong acceptance. E-commerce penetration and mobile commerce to grow rapidly. Small brands intensify their products to cater to changing tastes.

Europe Consumer Packaged Goods Market Insights

In 2025, Europe emerged as a promising region in the Consumer Packaged Goods Market, due to a customers tend to pick up premium, health and ecofriendly items. Regulatory requirements of product safety and environmental sustainability. There is a slow rise in e-commerce. Packaging and formulation innovation continues to drive growth in all categories.

Germany Consumer Packaged Goods Market Insights

Germany is the elephant in portrait the largest CPG market in Europe with a healthy economy and advanced retail industry. Health, personal care and premium food items are selling well. Regulation is a good thing for safe, quality products. E-commerce expansion is strong, expanding reach.

Latin America (LATAM) and Middle East & Africa (MEA) Consumer Packaged Goods Market Insights

The Consumer Packaged Goods Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing urbanization and disposable income levels. Demand driven by Brazil, Mexico, UAE and South Africa. Online retail penetration is much lower but growing. Today, customers demand convenience and quality. International brands also have the chance to get further across these amalgamated regions.

Consumer Packaged Goods Market Competitive Landscape:

Procter & Gamble is one of the world's largest consumer products companies that provides personal care, household and hygiene products. It’s stable of household brands includes Gillette, Pampers and Tide. P&G puts an emphasis on innovation, sustainable packaging and digital marketing approaches. Powerful distribution and presence globally, ensuring deep market penetration and consumer stickiness.

-

In August 2025, Procter & Gamble partnered with Trimble to launch the Freight Marketplace in North America, enhancing supply chain efficiency and digital logistics capabilities. This initiative aims to reduce delivery times and optimize freight costs.

Unilever makes a variety of food, personal and household products. Its brands, which range from Dove to Lipton and Surf, lead the way in a number of markets across the globe. The focus of the company is on sustainability, nature-friendly containers and health-conscious product to name a few. Unilever’s leadership is enhanced across the regions with its global footprint, digital and innovative offerings.

-

In June 2025, Unilever acquired Dr. Squatch, a U.S.-based men's grooming brand, for $1.5 billion, expanding its premium personal care portfolio. The acquisition strengthens Unilever’s presence in the fast-growing men’s grooming market segment globally.

L’Oréal SA is among global beauty and personal care products covering skincare, haircare and color cosmetics. Revenue is driven by premium and mass-market brands, like Lancôme, Garnier and L’Oréal Paris. The business utilizes digital marketing, e-commerce outlets, and environmental concerns to grow list of growing market. Global growth continues to be primarily driven by innovation and product customization.

-

In June 2025, L’Oréal signed an agreement to acquire Color Wow, a professional haircare brand, enhancing its high-performance haircare portfolio. This move enables L’Oréal to diversify its premium offerings and target younger, trend-focused consumers.

Colgate-Palmolive manufactures oral care, personal care and home hygiene products, such as Colgate toothpaste and Palmolive soaps. The company is committed to product innovation, hygiene awareness campaigns, and sustainability efforts. The CPG giant maintains a powerful presence in both developed and developing markets, as well as dependable distribution networks that engender customer loyalty and market share.

-

In September 2025, Colgate-Palmolive partnered with Erthos to utilize its AI-powered platform, Zya, for sustainable biomaterial development in packaging. The collaboration aims to reduce plastic usage and improve environmental sustainability in CPG packaging.

Consumer Packaged Goods Market Key Players:

Some of the Consumer Packaged Goods Market Companies are:

-

Procter & Gamble

-

Unilever

-

L’Oréal SA

-

Colgate-Palmolive

-

The Kraft Heinz Co.

-

Kellogg Company

-

Nestlé S.A.

-

PepsiCo

-

Coca-Cola

-

Carlsberg A/S

-

Diageo

-

Heineken

-

AB InBev

-

Kweichow Moutai

-

Keurig Dr Pepper

-

Campbell Soup Company

-

Mondelez International

-

General Mills

-

Reckitt Benckiser Group

-

Danone

| Report Attributes | Details |

| Market Size in 2025E | USD 2782.89 Billion |

| Market Size by 2033 | USD 3732.85 Billion |

| CAGR | CAGR of 3.75% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Food & Beverages, Cosmetics & Personal Care Products, Household Care Products and Healthcare Products), • By Application (In-Stores and Online Sales) • By Packaging Type (Rigid and Flexible) • By Material (Plastic, Metal, Paperboard and Glass) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Procter & Gamble, Unilever, L’Oréal SA, Colgate-Palmolive, The Kraft Heinz Co., Kellogg Company, Nestlé S.A., PepsiCo, Coca-Cola, Carlsberg A/S, Diageo, Heineken, AB InBev, Kweichow Moutai, Keurig Dr Pepper, Campbell Soup Company, Mondelez International, General Mills, Reckitt Benckiser Group, Danone |