Containerboard Market Key Insights:

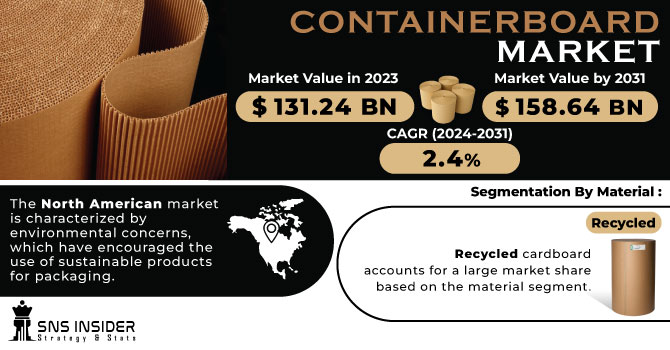

The Containerboard Market size was valued at US $ 131.24 billion in 2023 & is expected to reach USD 158.64 billion by 2031 at a CAGR of 2.4% over the forecast period of 2024-2031.

The most used packaging material is containerboards made of renewable resources, which are durable, lightweight and flexible. It's the most recycled material when it comes to packaging. In order to meet the growing demand for products, end-user industries of containerboard are chemical packaging, food & beverage packaging, consumer goods packaging, pharmaceutical packaging and electronic packaging as they require packaging solutions that offer sustainability, lightness and simplicity.

Get More Information on Containerboard Market - Request Sample Report

This market is driven by factors such as a growing youth preference for processed foods, a large population requiring safe and protective packaging for transportation, and increasing exports of agricultural products. However, factors such as the availability of alternative packaging solutions and rising raw material costs are expected to hinder market growth during the forecast period.

The ongoing technological advancements in the Digital Printing Packaging field are expected to create several potential opportunities in the market. In addition, the increasing adoption of advanced processes and increasing demand for high-volume liners and post-printing products is expected to create further new opportunities. In addition, manufacturers in the corrugated base paper market are expected to meet the high demands of their customers by offering customized requirements such as sustainable manufacturing, material design, and significant development of cost-effective manufacturing technology. increase.

Moreover, rising demand for advanced lightweight materials is expected to drive business growth in the coming years. This can be attributed to factors such as cost reduction, performance improvement and environmental friendliness. Distributors offer high-performance, lightweight corrugated and corrugated grades. Corrugated boxes are an environmentally friendly and sustainable form of packaging compared to other forms of packaging such as plastic and metal. Cardboard boxes are made from 46% recycled materials.

MARKET DYNAMICS

KEY DRIVERS:

-

Growing Packaging Industry of Food & Beverages

Corrugated boxes which are extensively used in the packaging of food and beverages are primarily made from containerboard. Demand is increasing worldwide due to the expansion of the food and beverage sector. The food & beverage industry has been driven by a shift in consumer behaviour, and an increase in the appetite for frozen foods, prepared meals, and packages, which is helping to drive market growth.

-

As a result of e-commerce, there has been an increase in demand for cardboard boxes and packaging materials

RESTRAIN:

-

Stringent legislation and sustainability requirements may arise as a consequence of environmental concerns about deforestation and greenhouse gas emissions, which could pose restrain the industry.

OPPORTUNITY:

-

Opportunities are available for container manufacturers due to increased awareness about sustainability and the environment.

In view of the increasing demand for eco-friendly packaging alternatives, containerboard made from recyclable materials and biomass sources is in a strong position to satisfy this need. Developing innovative sustainable packaging solutions, utilizing recycled fibers, and reducing carbon footprint can attract environmentally conscious consumers and businesses.

-

There are opportunities in this market for technological advances such as automation, digital printing and modern production methods.

CHALLENGES:

-

The challenge for containerboard manufacturers is that environmental regulations and sustainability requirements are becoming increasingly stringent.

IMPACT OF RUSSIAN UKRAINE WAR

About 1.5 million tons of paper and cardboard are produced in Ukraine annually. The country's largest producers include the Kyiv Paperboard and Paper Mill (KCPM), which accounts for about 35 % of the total Ukrainian paper and board production, and Lubezhansky Paperboard and Packaging, a joint venture of DS Smith.

As of February 2022, almost all P&B manufacturers have stopped production due to the ongoing conflict in Ukraine. The total capacity of his P&B plant in Ukraine is 1,240,0000 tons.

Stora Enso also stopped all production and sales in Russia because of the war. All imports and exports to the country have also been suspended.

Europe produces 2600 tons of containerboard, exporting 5% to Russia. The war and trade turmoil halted exports, impacting industry-wide earnings. Russia imports some 800,000- 950,000 tonnes of paper and board, mostly boxboard and painted newspaper graphics from the EU, this is likely to be affected due to the war. There might be a short term paper shortages in certain segments of the European market, kraftliner, when trade restrictions cut off papers and boards from coming to Europe. The war in Ukraine has put at risk a large part of the EU gas supply, given that Europe is currently importing 40% of its natural gas from Russia.

IMPACT OF ONGOING RECESSION

During the global recession, all sectors of the economy, such as manufacturing, services, retail, and construction are affected. According to the AF&PA, total boxboard production in the first quarter of 2023 went down to 5 % as compared to 2022, while the boxboard operating rate was 88 %, down 6.5 % from last year.

WestRock reported a loss of $1.8 billion that included 255,000 tons of economic-related downtime, and International Paper reported 425,000 tons worth of economic downtime. Shipments of boxes declined by 12.7% after covid in the first quarter, according to Packaging Corporation of America executives

Packaging Corp. was down almost 13% in its shipments during the first quarter of 2023.

KEY MARKET SEGMENTS

By Material

-

Virgin

-

Recycled

Recycled cardboard accounts for a large market share based on the material segment. Consumer goods manufacturers are increasingly favoring recyclable materials, increasing the demand for recycled materials. The market has been driven by high demand from the food and beverage sector. The recycled containerboards also align with the government regulations on environment.

By Type

-

Flutings

-

Kraftliners

-

Testliners

By End User

-

Food & Beverages

-

Personal Care

-

Industrial

-

Consumer Goods

-

Others

By end user segment, food and beverage hold major container board market. Corrugated boxes are required in foods and beverages for the purpose of storage and transportation. Corrugated boxes have properties such as toughness, and ability to resist crushing. Therefore, growth in food and beverage sector with give growth to the market of containerboards.

REGIONAL ANALYSIS

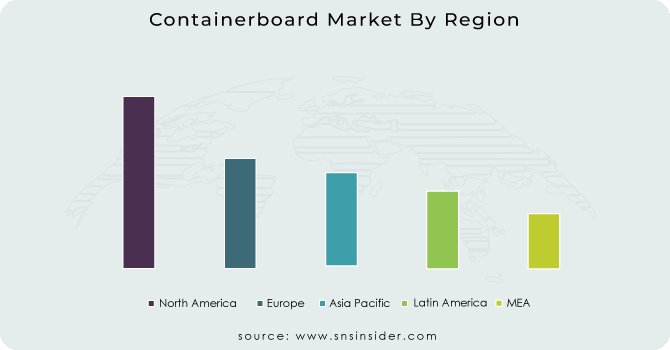

The Asia Pacific region, characterized by rapid industrialization activity coupled with increased consumer preference for ready-to-eat or drink products due to busy lifestyles, is the world's largest and fastest-growing market. In addition, China is the biggest contributor to the demand for products and will underpin market growth in this part of the world.

The North American market is characterized by environmental concerns, which have encouraged the use of sustainable products for packaging. For the products, containerboards provide a lighter and more durable form of packaging as well as attractive displays. In this part of the world, therefore, containerboard demand is high for end users.

Due to the growth of the Personal Care & Cosmetics Market, Europe has seen high demand. The personal care industry uses container boards to protect products against piracy and prevention of spillage, which will drive market growth.

During the forecast period, Latin America and the Middle East and Africa are expected to grow significantly. In these regions, market growth will be stimulated by growing agricultural and business-related businesses together with the development of retailers' distribution channels.

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some major key players in the Containerboard market are Smurfit Kappa, SCG Packaging Public Company Limited, DS Smith, Stora Enso, Georgia-Pacific LLC, Westrock Company, International Paper, Mondi Group, Hamburger Containerboard, Lee & Man Paper Manufacturing Limited and other players.

Westrock Company-Company Financial Analysis

RECENT DEVELOPMENTS

-

Valmet said that in order to improve its environmental footprint, it will be providing DS Smith Paper Italia SRL with a new containerboard machine.

-

Mondi is taking over Burgo's Duino mill and converting it into the manufacture of containerboard.

| Report Attributes | Details |

| Market Size in 2023 | US$ 131.24 Bn |

| Market Size by 2031 | US$ 158.64 Bn |

| CAGR | CAGR of 2.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Virgin, Recycled) • By Type (Flutings, Kraftliners, Testliners) • By End User (Food & Beverages, Personal Care, Industrial, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Smurfit Kappa, SCG Packaging Public Company Limited, DS Smith, Stora Enso, Georgia-Pacific LLC, Westrock Company, International Paper, Mondi Group, Hamburger Containerboard, Lee & Man Paper Manufacturing Limited |

| Key Drivers | • Growing Packaging Industry of Food & Beverages • As a result of e-commerce, there has been an increase in demand for cardboard boxes and packaging materials |

| Market Restraints | • Stringent legislation and sustainability requirements may arise as a consequence of environmental concerns about deforestation and greenhouse gas emissions, which could pose restrain the industry. |