Residential Air Purifiers Market Report Scope & Overview:

To get more information on Residential Air Purifiers Market - Request Free Sample Report

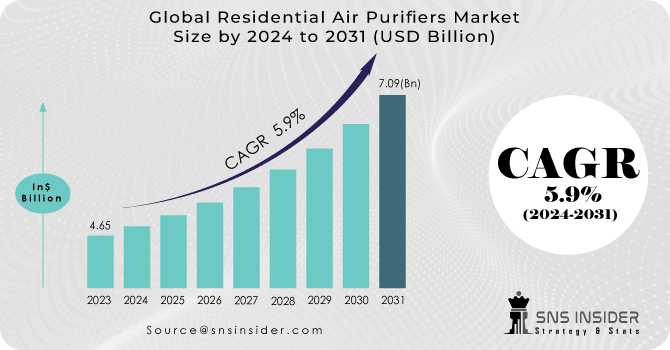

The Residential Air Purifiers Market Size was estimated at USD 11.16 billion in 2023 and is expected to arrive at USD 23.24 billion by 2032 with a growing CAGR of 8.49% over the forecast period 2024-2032. This report offers a unique perspective on the Residential Air Purifiers Market by analyzing production output trends, capacity utilization rates, and performance efficiency across key regions. It highlights significant technological advancements and material innovations, emphasizing how new filtration technologies and eco-friendly materials are shaping the industry. Additionally, the report delves into export/import data and trade flow, shedding light on global market dynamics and regional trade patterns. Key trends show a rise in smart, connected air purifiers and innovations in energy efficiency, which have been accelerating market growth.

Market Dynamics

Drivers

-

Rising air pollution, driven by urbanization, industrialization, and vehicular emissions, is fueling the demand for residential air purifiers, with advanced technologies and increasing health awareness driving market growth.

Rising air pollution levels, driven by rapid urbanization, industrial expansion, and increasing vehicular emissions, have significantly boosted the demand for residential air purifiers. Poor air quality primarily in densely populated cities has resulted in a rise in health conditions related to respiratory diseases and allergies, among others, which in turn has increased the demand for air purification systems for indoor spaces. Also, the governments across the globe are introducing more stringent air quality regulations fueling the adoption of residential air purifiers. The market is witnessing considerable growth; advanced filtration technologies like HEPA, activated carbon, and UV-based purification are also growing in popularity. Emerging trends also include smart air purifiers with IoT connectivity, real-time air quality monitoring, and energy-efficient designs. And this is such a strong movement that as more and more consumers become aware of their indoor air quality, such as through the various home-grade models of air purifiers available in e-commerce outlets, are expected to fuel immense growth of the air purifier market in the coming years, especially in the Asia-Pacific and other pollution-affected regions.

Restraint

-

The high initial cost and ongoing maintenance expenses of air purifiers, including filter replacements, can deter price-sensitive consumers despite growing health awareness.

The high initial cost and ongoing maintenance expenses of residential air purifiers pose a significant challenge for price-sensitive consumers. While the initial price of air purifiers can be variable, the best models with the appropriate type of filtration technologies such as HEPA filters or activated carbon filters are usually high-value. The maintenance cost of replacing filters regularly (this may vary between a few months to a year, based on the usage) can add up to a long term investment and put off consumers from the purchase. This ongoing maintenance burden can repel budget-conscious buyers, up in new markets where disposable income is tighter. However, dormant awareness about indoor air quality and health problems is driving the growth of air purifier market, despite the challenges of these parameters. The market and product trends reflect the rising demand for energy-efficient, longer-lasting filters and low-cost or smart models that give you good value for money. Consumer adoption is also growing due to the rise of online retail channels and increasing health consciousness, resulting in decreasing price sensitivity over time.

Opportunities

-

The rising demand for smart, energy-efficient air purifiers with advanced features like app control and voice integration presents a growing market opportunity as consumers prioritize convenience, sustainability, and enhanced functionality.

The rising adoption of smart and energy-efficient residential air purifiers presents a significant opportunity in the market. As consumers become more tech-savvy, they increasingly seek air purifiers that offer advanced features such as app-based monitoring, voice control integration, and real-time air quality tracking. These intelligent devices offer convenience by enabling users to remotely access and control air quality via a smartphone app or through voice assistants such as Amazon Alexa or Google Assistant. Also, energy-efficient models are on the rise as consumers are looking for sustainability and a reduction in their electricity bill. Adjusting to eco-friendly water purifiers, this hydrocyanic chart would consume lesser power, so it is attractive to eco-friendly people. Smart tech integration also enables more customized use of an air purifier, including features like auto-settings that change based on detected pollutants. As demand increases for connected, energy-smart appliances, makers are responding by offering even smarter air filters.

Challenges

-

The short product lifecycle and frequent filter replacements increase maintenance costs, discouraging long-term use of residential air purifiers.

One of the key challenges in the residential air purifiers market is the short product lifecycle and the frequent need for filter replacements. Most air purifiers work best with routine maintenance, and you’ll need to change the filter every several months, depending on usage and air quality. This increases the total operational costs for consumers, further reducing the attractiveness of long-term usage. Replacing filters can be pricey, and the ease and frequency of replacement vary according to things like the level of pollutants in the environment and the kind of filter used. Many popular filters, like HEPA filters and carbon filters, must be replaced on a scheduled basis to keep the purifier working optimally. These variable costs of ongoing maintenance are enough to dissuade some consumers from purchasing high-quality air purifiers at all, or to use the purifiers only periodically. As a result, the perceived cost of ownership may deter adoption among price-sensitive customers.

Segmentation Analysis

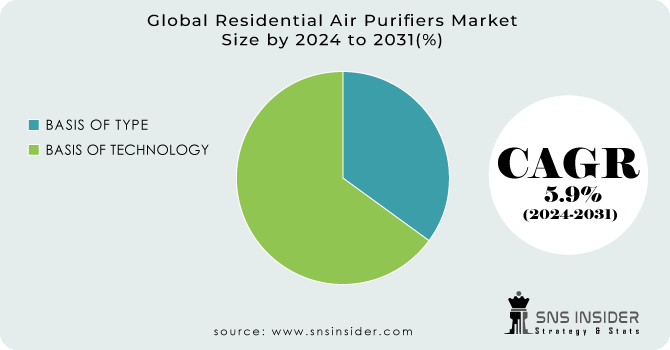

By Type

The Standalone/Portable segment dominated with a market share of over 68% in 2023, because of its practicality and adaptability to various living spaces. These models boast widespread consumer love for portability, as it can be easily moved from room to room or even across the house. Stand-alone units, as opposed to in-duct systems that require a permanent installation, allow users to move them where they are most needed, be it bedrooms, living rooms, or the office. These air purifiers are also easy to use, with straightforward setups and controls that are easy to navigate. Portable air purifiers are societal, they are gaining popularity because they can control their operation in different conditions, and awareness of indoor air quality is growing.

By Technology

The HEPA (High-Efficiency Particulate Air) technology segment dominated with a market share of over 42% in 2023, due to its exceptional filtration efficiency. HEPA filters are capable of trapping up to 99.97% of particles as small as 0.3 microns, including some common allergens like dust, pet dander, or pollen, along with some bacteria and viruses. The efficiency of these filters is what makes HEPA filters so effective at improving air quality indoors, especially for people with allergies and respiratory ailments like asthma. The HEPA-based air purifier market is steadily increasing due to growing awareness of air quality and health among consumers. The unrivaled performance and reliability of HEPA technology in delivering cleaner, healthier air makes it the gold standard in home air purification.

Need any customization research on Residential Air Purifiers Market - Enquiry Now

Key Regional Analysis

The Asia-Pacific region dominated with a market share of over 48% in 2023, due to a combination of factors. The growing urbanization and industrialization in China and India have led to increased levels of air pollution, which is driving demand for air purification solutions. Moreover, there is an increasing concern and awareness among consumers regarding the significance of clean indoor air to health and well-being. Moreover, availability of cost-effective yet efficient air purifiers offered by various top manufacturers in this region has further aided in propelling demand. These reasons have led to Asia-Pacific becoming the top region in the market, as consumers look for air purifiers to deal with pollution and enhance indoor air quality.

North America stands as the fastest-growing region, due to presence of will established bio-pharmaceutical industry along with increasing laboratory automation adoption here. As air quality becoming a smoking gun for health issues like pollution, allergens, and respiratory problems, consumers have been looking for effective air purification solutions. Moreover, growing trend towards smart home technologies, with many of new air purifiers come with app connectivity, remote monitoring, and integration with other smart devices making them more attractive for tech-savvy consumers. As a result, the need for high-end air purifiers, those equipped with HEPA filter-based, energy-efficient, and noise-reduction functions, is also increasing, especially in the U.S. and Canada, where health awareness and spending power are considerably high.

Some of the major key players in the Residential Air Purifiers Market

-

DAIKIN INDUSTRIES, Ltd. (Streamer Air Purifier, MCK55W)

-

Sharp Home (Sharp Corporation) (Plasmacluster Ion Air Purifier, KC-G50)

-

Honeywell International Inc (HPA300, HPA200)

-

Panasonic Corporation (F-VXR70, F-PXJ30)

-

LG Electronics (PuriCare 360, AS60GDWV0)

-

Koninklijke Philips, N.V. (Series 2000, AC1215/20)

-

Dyson (Dyson Pure Cool, Dyson Pure Hot + Cool)

-

SAMSUNG (AX60, Cube Air Purifier)

-

Whirlpool (Whirlpool AP51030K, Whispure)

-

Blueair (Unilever) (Blue Pure 411, Classic 605)

-

Xiaomi (Mi Air Purifier 3H, Mi Air Purifier Pro)

-

Levoit (Core 300, LV-H132)

-

Coway (AP-1512HH, Airmega 400)

-

Airthings (Wave Plus, Airthings View Plus)

-

GermGuardian (Guardian Technologies) (AC4825, GG1000)

-

Austin Air (HealthMate Plus, Bedroom Machine)

-

Winix (AM90, C535)

-

Vornado (Vornado PCO400, Vornado EVDC300)

-

Medify Air (MA-40, MA-112)

-

Bissell (Air220, MYair)

Suppliers for (for advanced air filtration technology, including HEPA filters, and user-friendly smart features for home air quality monitoring) on Residential Air Purifiers Market

-

Honeywell International Inc.

-

Blueair

-

Philips Electronics

-

Sharp Corporation

-

Panasonic Corporation

-

Coway

-

Xiaomi Corporation

-

Levoit

-

Austin Air Systems

-

Winix

LG Electronics-Company Financial Analysis

RECENT DEVELOPMENT

In July 2023: The Panasonic Kurashi Visionary Fund invested SAKA NO TOCHU, a company focused on advancing environmentally sustainable agriculture.

In August 2023: Honeywell and Recipharm have partnered to fast-track the development of inhalers using propellants with near-zero global warming potential.

| Report Attributes | Details |

| Market Size in 2023 | USD 11.16 Billion |

| Market Size by 2032 | USD 23.24 Billion |

| CAGR | CAGR of 8.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Standalone/Portable, In-Duct) • By Technology (HEPA, Activated Carbon, Ionic Filters, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DAIKIN INDUSTRIES, Ltd., Sharp Home (Sharp Corporation), Honeywell International Inc., Panasonic Corporation, LG Electronics, Koninklijke Philips, N.V., Dyson, SAMSUNG, Whirlpool, Blueair (Unilever), Xiaomi, Levoit, Coway, Airthings, GermGuardian (Guardian Technologies), Austin Air, Winix, Vornado, Medify Air, Bissell. |