Residential Solar Energy Storage Market Report Scope & Overview:

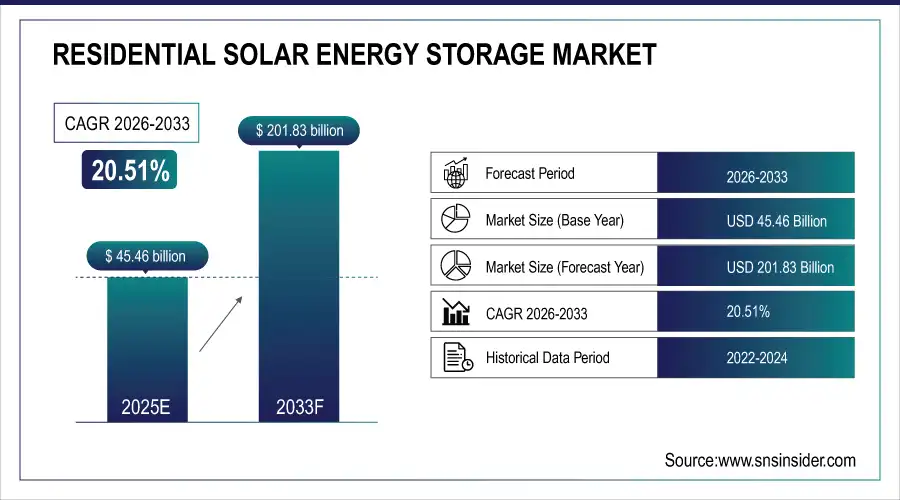

The Residential Solar Energy Storage Market size was valued at USD 45.46 Billion in 2025E and is projected to reach USD 201.83 Billion by 2033, growing at a CAGR of 20.51% during 2026-2033.

The Residential Solar Energy Storage Market analysis highlights the growing adoption of home-based battery systems driven by increasing solar installations and energy independence goals. Rising electricity costs and government incentives are further boosting demand for efficient energy storage. Technological advancements in lithium-ion batteries enhance performance and reduce costs, encouraging wider consumer adoption.

Solar + Storage Pairing: Over 40% of new residential solar installations in the U.S. and Germany in 2024 included battery storage, up from just 10% in 2020, reflecting strong consumer interest in energy autonomy.

Market Size and Forecast:

-

Market Size in 2025E: USD 45.46 Billion

-

Market Size by 2033: USD 201.83 Billion

-

CAGR: 20.51% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Residential Solar Energy Storage Market - Request Free Sample Report

Residential Solar Energy Storage Market Trends

-

Increasing integration of solar-plus-storage systems enables households to achieve greater energy independence and optimize power consumption efficiency.

-

Rapid decline in lithium-ion battery costs is driving widespread affordability and accelerating residential energy storage adoption globally.

-

Growing use of smart energy management systems allows real-time monitoring, predictive maintenance, and optimized battery performance for homeowners.

-

Rising demand for backup power solutions during grid outages boosts installations of home solar energy storage systems.

-

Expansion of government incentives and net-metering policies continues to encourage homeowners to invest in solar energy storage systems.

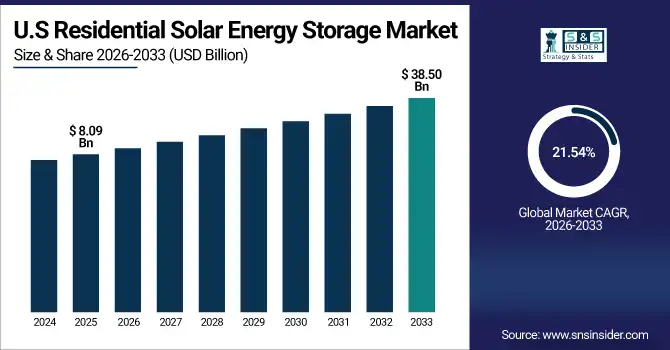

The U.S. Residential Solar Energy Storage Market size was valued at USD 8.09 Billion in 2025E and is projected to reach USD 38.50 Billion by 2033, growing at a CAGR of 21.54% during 2026-2033. Residential Solar Energy Storage Market growth is driven by rising solar panel adoption and increasing grid instability concerns. Supportive federal and state incentives are accelerating household investments in battery storage solutions. Declining lithium-ion battery costs make solar storage more affordable for consumers.

Residential Solar Energy Storage Market Growth Drivers:

-

Rising Adoption of Solar Panels and Home Battery Systems Enhancing Energy Independence

The Residential Solar Energy Storage Market Growth is primarily driven by the increasing adoption of solar panels and home battery systems. Homeowners seek energy independence, reduced electricity bills, and backup power during grid outages. Technological advancements in lithium-ion batteries have improved efficiency, lifespan, and affordability. Supportive government incentives, tax rebates, and net-metering policies further accelerate adoption. Additionally, the integration of storage systems with smart home technologies and electric vehicles encourages homeowners to optimize energy consumption while contributing to a more sustainable and resilient energy ecosystem.

Energy Independence Motivation: Over 70% of residential battery adopters cite energy independence and protection against power outages as primary reasons for investing in solar-plus-storage systems.

Residential Solar Energy Storage Market Restraints:

-

High Upfront Costs and Technical Limitations Hindering Residential Solar Energy Storage Adoption

Despite strong growth, the market faces several restraints. High upfront costs of battery storage systems can discourage potential consumers, especially in developing regions. Limitations in battery lifespan, degradation over time, and safety concerns such as overheating or fire risk affect adoption. Compatibility issues with existing solar panels or home electrical systems pose additional challenges. Lack of awareness and technical expertise among homeowners further slows implementation. These factors combined limit market penetration, particularly among cost-sensitive households, and may delay return on investment for residential solar storage systems.

Residential Solar Energy Storage Market Opportunities:

-

Expansion of Smart, Connected, and Sustainable Energy Storage Solutions for Homes

The market presents significant opportunities through smart, connected, and sustainable energy storage solutions. Increasing consumer interest in energy-efficient and eco-friendly technologies encourages the adoption of smart home-integrated storage systems. Growth in electric vehicle ownership creates demand for solar-plus-storage solutions. Manufacturers can innovate with longer-lasting, recyclable, or high-capacity batteries to meet consumer needs. Additionally, expanding government incentives, net-metering programs, and community solar initiatives provide opportunities for market expansion. Focus on sustainable and technologically advanced systems allows companies to capture emerging segments and differentiate their offerings.

Smart Home Integration: Over 60% of new residential energy storage systems sold in 2024 feature Wi-Fi connectivity and app-based control, enabling real-time monitoring and AI-driven energy optimization in smart homes.

Residential Solar Energy Storage Market Segment Analysis

-

By power rating, up to 6 kW led the market with a 65.23% share in 2025, while 6 kW to 10 kW is the fastest-growing segment, registering a CAGR of 12.40%.

-

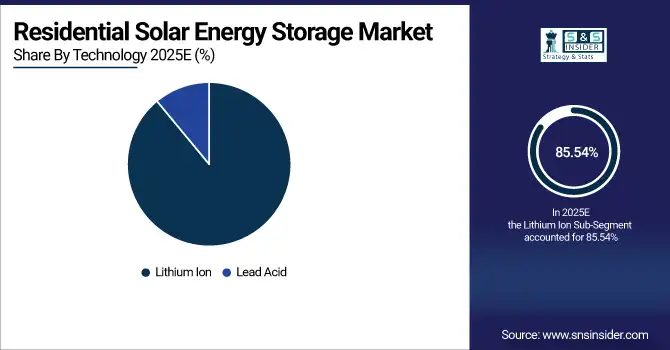

By technology, lithium-ion dominated with an 85.54% share in 2025 and is also the fastest-growing segment, growing at a CAGR of 14.46%.

-

By type, customer-owned systems led with a 65.15% share in 2025, while third-party-owned systems are the fastest-growing segment, with a CAGR of 15.34%.

-

By connectivity type, on-grid systems held 71.36% of the market in 2025, whereas off-grid systems are the fastest-growing segment, registering a CAGR of 13.25%.

By Power Rating, Up to 6 kW Leads Market While 6 kW to 10 kW Registers Fastest Growth

Up to 6 kW residential solar storage systems dominate the market due to their suitability for typical household energy needs and affordability. They are widely adopted for self-consumption, backup power, and integration with rooftop solar panels. Meanwhile, 6 kW to 10 kW systems are registering the fastest growth, driven by larger homes, electric vehicle charging requirements, and increasing consumer interest in high-capacity energy storage solutions.

By Technology, Lithium Ion Dominate and Shows Rapid Growth

In 2025, Lithium-ion technology leads the residential solar energy storage market due to its high energy density, long lifecycle, and low maintenance requirements. The technology supports efficient energy storage and delivery, making it ideal for self-consumption and backup applications. Lithium-ion continues to show rapid growth as advancements in battery chemistry, cost reduction, and performance improvements drive adoption. Increasing consumer awareness and supportive government policies further reinforce the preference for lithium-ion technology in homes.

By Type, Customer-Owned Lead While Third Party-Owned Registers Fastest Growth

Customer-owned residential storage systems remain the dominant segment as homeowners prefer direct control over energy generation, storage, and usage. These systems allow consumers to maximize savings and gain independence from the grid. However, third party-owned systems are registering the fastest growth, driven by lease programs, virtual power plant models, and subscription-based services. These models reduce upfront costs and make storage accessible to more households. Expanding financing options and partnerships between manufacturers and energy service providers accelerate adoption of third-party ownership.

By Connectivity Type, On-Grid Lead While Off-Grid Grow Fastest

In 2025, On-grid residential solar energy storage systems dominate the market due to widespread grid connectivity, net-metering benefits, and integration with existing utility infrastructure. These systems allow homeowners to store solar energy and feed excess power back to the grid. Meanwhile, off-grid systems are growing fastest as remote and rural areas adopt storage solutions where grid access is limited. Increasing demand for energy resilience, independent power supply, and microgrid-enabled homes further drives growth in the off-grid segment globally.

Residential Solar Energy Storage Market Regional Analysis:

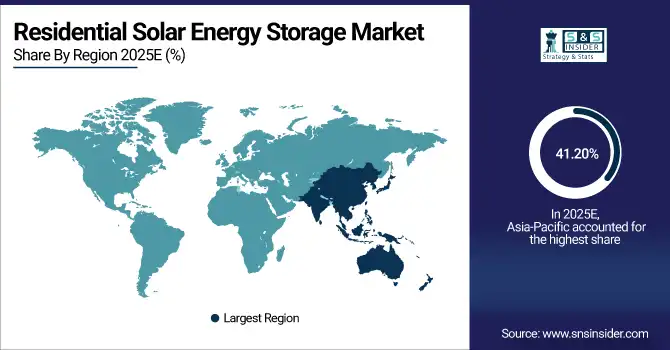

Asia-pacific Residential Solar Energy Storage Market Insights

In 2025 Asia-Pacific dominated the Residential Solar Energy Storage Market and accounted for 41.20% of revenue share, this leadership is due to the rapid urbanization, rising electricity demand, and supportive government policies. Countries such as Australia, Japan, South Korea, and India are seeing increasing adoption of rooftop solar systems integrated with energy storage units. Falling lithium-ion battery prices and strong renewable targets are further driving market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Residential Solar Energy Storage Market Insights

China dominates both the production and adoption sides of the residential solar energy storage industry. The nation’s strong manufacturing base for photovoltaic modules and batteries keeps system costs low. Government initiatives promoting distributed energy and smart home integration are encouraging households to install storage systems.

North America Residential Solar Energy Storage Market Insights

North America is expected to witness the fastest growth in the Residential Solar Energy Storage Market over 2026-2033, with a projected CAGR of 21.85% due to need for reliable power and rising solar adoption. Consumers in the region, particularly in areas prone to power outages, are increasingly turning to home batteries for resilience and cost control. Favorable incentives, including tax credits and state-level rebates, are stimulating demand. The integration of smart energy management systems with solar-plus-storage setups is also gaining momentum.

U.S. Residential Solar Energy Storage Market Insights

The U.S. leads North America’s market, supported by growing consumer awareness and strong incentive programs. California, Texas, and Florida are witnessing large-scale residential installations driven by high solar penetration and grid reliability concerns.

Europe Residential Solar Energy Storage Market Insights

Europe’s residential solar storage market is mature and diverse, characterized by widespread adoption in several key nations. Energy security concerns, high electricity prices, and incentives for self-consumption are boosting installations. Germany, Italy, and the Netherlands are among the front-runners in battery deployment. Technological innovation, grid services, and consumer awareness are driving stable demand across the region. While short-term fluctuations may occur due to policy shifts, Europe’s long-term outlook remains positive with steady market expansion.

Germany Residential Solar Energy Storage Market Insights

Germany remains the leading European country for residential solar energy storage systems. Strong renewable energy policies, high rooftop solar adoption, and attractive self-consumption economics have encouraged large-scale installations.

Latin America (LATAM) and Middle East & Africa (MEA) Residential Solar Energy Storage Market Insights

Latin America and the Middle East & Africa are emerging markets for residential solar energy storage, showing promising growth potential. In Latin America, countries like Brazil, Chile, and Mexico are promoting decentralized energy models to support rural electrification. Meanwhile, in the Middle East and Africa, solar-plus-storage is gaining traction due to high solar irradiation and unreliable grid networks. Falling battery costs are improving affordability across these regions. Despite limited infrastructure, growing investments and government initiatives are expected to accelerate adoption.

Residential Solar Energy Storage Market Competitive Landscape:

ABB plays a significant role in the residential solar energy storage market through its advanced inverter and energy management technologies. The company focuses on integrating solar-plus-storage systems that enhance grid stability and home energy efficiency. ABB’s digital platforms enable remote monitoring, smart charging, and optimized energy consumption for households. It collaborates with installers and utilities to expand smart home adoption.

-

In May 2025, ABB introduced its Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service) to help businesses adopt renewable energy with minimal upfront investment. The initiative simplifies energy transition for homeowners and communities through flexible, scalable battery options.

Eaton is strengthening its presence in the residential solar energy storage space by offering scalable and safe power management systems. The company provides hybrid inverters, battery management, and backup power solutions that enhance home energy resilience. Eaton’s focus lies in developing modular systems adaptable for both on-grid and off-grid applications. It emphasizes sustainability by promoting efficient energy use and supporting renewable integration.

-

In September 2024, Eaton introduced its new AbleEdge home energy management system for seamless solar and battery integration. The platform supports both new and existing homes, promoting smarter and more sustainable energy consumption.

Enphase Energy is one of the leading names in the global residential solar energy storage market. The company’s microinverter technology and IQ Battery systems offer homeowners reliable, intelligent, and modular energy storage options. Enphase focuses heavily on user-friendly designs and advanced monitoring via its Enlighten platform. Its integrated ecosystem allows seamless solar generation, storage, and energy management.

-

In October 2025, Enphase launched its IQ Battery with FlexPhase technology to support diverse home and business power configurations. The launch reinforces the company’s focus on scalability, adaptability, and smarter renewable energy solutions.

EnerSys contributes to the residential solar energy storage market with its deep expertise in advanced battery technology. The company offers high-performance lithium-ion and lead-acid batteries tailored for home and small-scale renewable systems. EnerSys focuses on enhancing battery efficiency, lifespan, and safety for residential applications. Through partnerships with solar equipment manufacturers, it provides integrated storage solutions.

-

In February 2025, EnerSys unveiled new energy storage and charging systems designed to optimize solar-plus-storage performance. These innovations support improved grid stability, energy management, and sustainable power delivery for homes and businesses.

Residential Solar Energy Storage Market Key Players:

Some of the Residential Solar Energy Storage Market Companies are:

-

ABB

-

Eaton

-

Enphase Energy

-

EnerSys

-

Fluence

-

Honeywell

-

Huawei

-

Johnson Controls

-

Leclanché

-

LG Electronics

-

Maxwell Technologies

-

Primus Power

-

Saft

-

Samsung SDI

-

Schneider Electric

-

Siemens Energy

-

SolarEdge Technologies

-

Tesla

-

Toshiba

-

Uniper

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 45.46 Billion |

| Market Size by 2033 | USD 201.83 Billion |

| CAGR | CAGR of 20.51% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Rating (Up to 6 kW and 6 kW to 10 kW), • By Technology (Lithium Ion and Lead Acid) • By Type (Customer-Owned, Utility-Owned, and Third Party-Owned) • By Connectivity Type (On-Grid and Off-Grid) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ABB, Eaton, Enphase Energy, EnerSys, Fluence, Honeywell, Huawei, Johnson Controls, Leclanche, LG Electronics, Maxwell Technologies, Primus Power, Saft, SAMSUNG SDI, Schneider Electric, Siemens Energy, SolarEdge Technologies, Tesla, Toshiba, Uniper |