Respiratory Care Device Market Report Scope & Overview:

Get more information on Respiratory Care Device Market - Request Sample Report

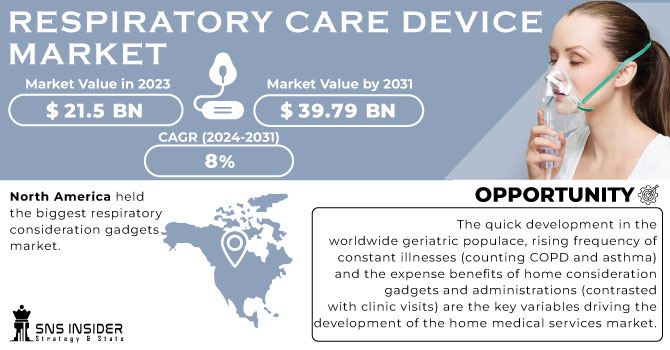

The Respiratory Care Devices Market Size was valued at USD 22.3 billion in 2023 and is expected to reach USD 43.35 billion by 2032, growing at a CAGR of 7.7% over the forecast period 2024-2032. This report provides a detailed analysis of key player's industry trends and current insights for the forecast period. This includes its volume and growth trends over the years, demonstrating the increasing demand for ventilators, oxygen concentrators, and CPAP/BiPAP machines. It also discusses the incidence and prevalence of respiratory diseases highlighting the fast-growing cases of chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea. The report also provides detailed statistics on trends in hospital versus home care usage, the economic impact on healthcare systems, and technological workflow and monitoring advancements such as AI-driven monitoring and wearable oxygen therapy. It also offers a detailed view of the regulatory framework, competitive structure with their strategies, and R&D investment outlook, offering a comprehensive market outlook for stakeholders.

Market Dynamics

Drivers

-

Innovations such as portable oxygen concentrators, smart inhalers, and advanced ventilators with monitoring capabilities are enhancing patient care and improving treatment outcomes.

The major factor boosting the growth of the respiratory care devices market is technological advances which are improving patient outcomes and the efficient delivery of health care. This includes one of the most exciting innovations a cheap ‘smart mask’ that can analyze breath and can diagnose diseases. This is a mask enabled with EBCare technology that collects breath biomarkers associated with respiratory and metabolic pathways and transmits data over Bluetooth to an app. By measuring substances such as alcohol, pH, and amounts of ammonium and nitrite, it can be used to detect disease and monitor conditions including lung disease, asthma, chronic obstructive pulmonary disease (COPD), and renal disease. The effectiveness and continuous real-time monitoring capacity have been validated by clinical tests.

Another key development is the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) into respiratory care devices. AE/AI algorithms have been able to predict exacerbations found in conditions like COPD to the ability of 78% accuracy, enabling on-time intervention which in return reduces hospitalizations. For lung sounds and imaging, machine learning models can now analyze their accuracy comparable to well-trained pulmonologists. For example, these diagnostic tools based on AI have demonstrated reductions in diagnostic time, enabling faster treatment initiation. The growth of telemedicine in respiratory care is another topic, where the usage of respiratory patient monitoring devices, such as portable spirometers and smart inhalers, enabling healthcare professionals to track patients' respiratory health in real-time. This trend represents the possible improvement of patient care and the lesser workload on healthcare systems.

Restraints

-

The significant expense associated with technologically advanced respiratory care devices can limit their adoption, especially in regions with constrained healthcare budgets.

Continuous Positive Airway Pressure (CPAP) machines, commonly used to treat obstructive sleep apnea, also present financial challenges. The expense of the CPAP unit, along with necessary accessories like filters, masks, and hoses, can be burdensome for patients lacking adequate insurance coverage. Additionally, these devices need timely maintenance, calibration, and servicing to function correctly and ensure patient safety, increasing the total expenditure. Regular maintenance and eventual replacement of parts add costs both to the health care provider and the patient. Therefore, the large capital investment needed for state-of-the-art respiratory care equipment, coupled with the inadequate maintenance capacity in healthcare facilities, is a tremendous impediment to the adoption of these technologies, particularly in low-resource settings.

Opportunities

-

Developing regions present significant opportunities due to improving healthcare infrastructure, increasing disposable income, and rising awareness about respiratory health.

This potential is largely fuelled by improved healthcare infrastructure and higher disposable incomes along with a greater sense of respiratory health. The market for respiratory care devices in India is growing at an notable growth rate. The increase can be attributed to factors such as the rising prevalence of respiratory diseases, escalating air pollution levels, and a growing geriatric population susceptible to respiratory illnesses.

Technological advancements are also playing a crucial role in these markets. For instance, the integration of telemedicine into respiratory care devices enables real-time monitoring and early detection of respiratory conditions, facilitating timely interventions and personalized care plans. This in-house approach is especially advantageous in areas with scarce healthcare facilities because patients can be treated at home. ResMed and other companies are seizing this opportunity with product innovation along with digital health. ResMed has reported strong financial performance, with a 10% increase in revenue to USD 1.3 billion and a 65% rise in net income to USD 344.6 million in a recent quarter. The company also believes this growth was driven by wearables sleep disorders detecting devices and higher engagement rates due to GLP-1 drugs. There are also product innovations in the pipeline and using its extensive sleep data to drive new sleep-related AI applications.

Challenges

-

Navigating complex regulatory landscapes can increase the time and cost of product development and market entry for respiratory care devices.

Regulatory compliance is one of the major challenges associated with the respiratory care devices market. From the issuing of authorizations to the maintaining of marketing approvals, manufacturers balance complex approval processes set forth by authorities such as the U.S. FDA (Food and Drug Administration) and the EMA (European Medicines Agency). While these formal regulations guarantee a device is safe and works, they may add to long timelines and higher costs to bring a product to market. As an example, it is the high standard that the FDA has put on medical devices, which require a significant amount of clinical trials and data to be collected, makes it difficult for companies to bring respiratory care devices to market; these regulatory criteria generally cause more delays and increases cost. The privatized system of medicine that fosters this regulatory environment can be especially challenging for smaller firms with fewer resources, thus stifling innovation and depriving patients of access to innovative respiratory care solutions.

Segment analysis

By Type

In 2023, the ICU ventilators segment held the largest share. This dominance is due to the need for these devices in the management of rapidly changing respiratory function in patients with severe respiratory comorbidities and the increasing rate of ICU admission worldwide. ICU ventilators are needed for patients with ARDS, COPD exacerbations, and other critical illnesses requiring lifesaving support. This sophistication has led to their widespread adoption in healthcare settings, with modern ICU ventilators capable of providing advanced modes of ventilation while maintaining a high degree of precision in the control of respiratory parameters.

The Society of Critical Care Medicine estimates that more than 5 million patients are admitted to ICUs each year within the United States with recent estimates that 40–50% of those patients require mechanical ventilation (MV). This rate of usage highlights the value of Ventilators in ICUs. In addition, government measures toward increasing the capacity of ICUs and providing refined critical care infrastructure have fuelled the demand for these devices across the globe. For example, the US Department of Health & Human Services estimates that there are 20.5 ventilator-equipped ICU beds per 100,000 population, indicating a considerable volume of these devices within healthcare networks.

By End User

The Hospitals segment held the largest market share 67% in 2023. This leadership position is primarily due to the comprehensive nature of hospital care and the high volume of patients requiring respiratory support in these settings. Respiratory care devices are used in hospitals for widespread usage like acute emergency or chronic treatment. The concentration of specialized medical professionals and advanced equipment in hospitals makes them the primary destination for patients with severe respiratory issues. The WHO states that around 80% of all ICU patients are limited to in-hospital care, making hospitals an essential part of providing critical respiratory care. Further, hospitals are generally better equipped with respiratory-related resources and specialties to provide new therapies and technology. Hospitals also have a high patient volume, most often enabling cost-efficient purchasing and use of respiratory care devices, further solidifying their market dominance.

By Disease Indication

The COPD segment accounted for a considerable revenue share in 2023. Due to the high prevalence of COPD worldwide and the nature of the condition, which is chronic and requires prolonged treatment with respiratory care devices, this segment registers a significant market share. COPD is a progressive lung disease that significantly impacts patients' quality of life and requires ongoing medical intervention.

According to the World Health Organization (WHO), COPD was the third leading cause of death globally, and it affects millions of people around the world. COPD conditions are chronic and many of the patients need extended oxygen therapy and non-invasive ventilation and other respiratory support devices, which globally contributes to an uninterrupted market demand. In addition, Earlier diagnosis and treatment and better awareness of COPD is also expected to increase the patient population base seeking respiratory care devices.

Regional analysis

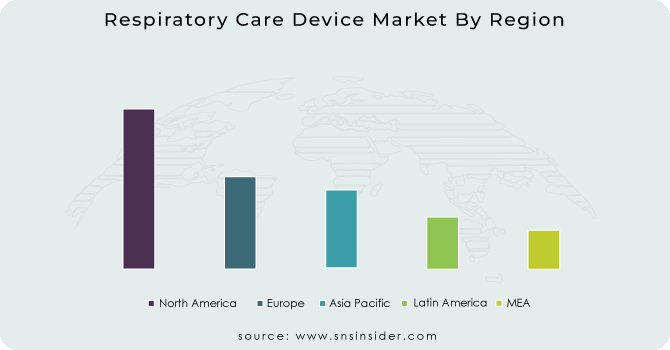

The North American region dominated the respiratory care devices market and held the highest market share 36% in 2023. The dominance is due to the advanced healthcare infrastructure, high healthcare expenses, and presence of key market players in the region. The United States especially helps to maintain its key position in the market owing to factors such as the high prevalence of respiratory diseases and favourable reimbursement policies for respiratory care devices. In the U.S., according to the Centers for Disease Control and Prevention (CDC), chronic lower respiratory diseases–which include COPD–were the fourth leading cause of death, indicating the high burden of respiratory conditions in the region.

During the forecast period, the Asia Pacific region is projected to grow at the fastest CAGR. This growth is largely attributed to factors like rising healthcare spending, rising prevalence of respiratory illnesses, and enhanced levels of access to the health system in developing nations. This growth is driven by countries with high populations like China and India where air pollution and smoking are frequent causes of respiratory diseases. According to the Indian Council of Medical Research, the prevalence of COPD in India is reportedly 4.2% which makes a core population of more than 53 million in India alone a huge potential market for respiratory care devices.

Need any customization research on Respiratory Care Device Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

Medtronic plc (Puritan Bennett™ 980 Ventilator, DAR™ Filters)

-

Philips Respironics (DreamStation CPAP, Trilogy Evo Ventilator)

-

ResMed Inc. (AirSense 10 CPAP, Astral 150 Ventilator)

-

Fisher & Paykel Healthcare (myAIRVO 2 Humidified Therapy, Optiflow Nasal High Flow)

-

Drägerwerk AG & Co. KGaA (Evita V600 Ventilator, Oxylog 3000 Plus)

-

Hamilton Medical AG (Hamilton-C6 Ventilator, HAMILTON-T1)

-

Vyaire Medical, Inc. (Bellavista™ Ventilator, AirLife™ Oxygen Masks)

-

Invacare Corporation (Platinum Mobile Oxygen Concentrator, Perfecto2 V Oxygen Concentrator)

-

GE Healthcare (Carescape R860 Ventilator, Airway Gas Monitors)

-

Masimo Corporation (Rad-97 Pulse CO-Oximeter, MightySat Rx Fingertip Pulse Oximeter)

Key Users

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Hospital

-

Mount Sinai Health System

-

Kaiser Permanente

-

Baylor Scott & White Health

-

HCA Healthcare

-

Apollo Hospitals

-

NHS (National Health Service, UK)

-

Fortis Healthcare

Recent developments

-

In February 2024, ResMed introduced the AirCurve 11 series in the U.S. These bilevel positive airway pressure devices provide two levels of support inspiratory and expiratory positive airway pressure to improve patient comfort and help with adherence to sleep apnea therapy.

-

In March 2023, Medtronic won FDA clearance for a new ventilator system for neonatal and pediatric patients that met the specific respiratory requirements of these populations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.3 Billion |

| Market Size by 2032 | USD 43.35 Billion |

| CAGR | CAGR of 7.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Therapeutic Devices, Monitoring Devices, Diagnostic Devices, Consumables and Accessories) • By Disease Indication (Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, Infectious Diseases, Asthma, Others) • By End User (Hospitals, Home Care) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic plc, Philips Respironics, ResMed Inc., Fisher & Paykel Healthcare, Drägerwerk AG & Co. KGaA, Hamilton Medical AG, Vyaire Medical, Inc., Invacare Corporation, GE Healthcare, Masimo Corporation |