Medical Terminology Software Market Size Analysis:

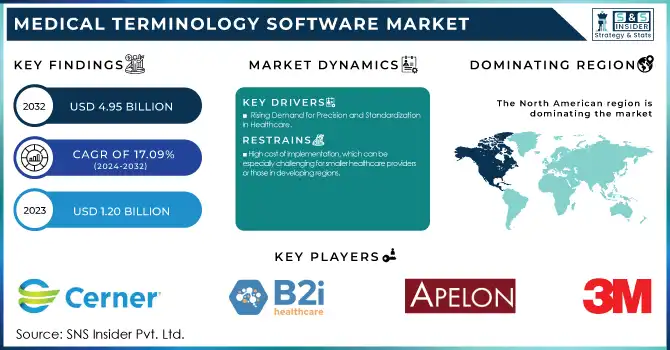

The Medical Terminology Software Market size was valued at USD 1.20 billion in 2023 and is expected to reach USD 4.95 billion by 2032 and grow at a CAGR of 17.09% over the forecast period 2024-2032.

Get more information on Medical Terminology Software Market - Request Sample Report

The medical terminology software market is witnessing rapid growth, driven by the increasing adoption of electronic health records and health information systems to enhance clinical documentation and data exchange. Studies reveal that approximately 89% of physicians in the U.S. use EHRs, underscoring the critical need for standardized terminology to improve interoperability and reduce documentation errors. Medical terminology software enables seamless communication by integrating coding systems such as ICD-10, SNOMED CT, and CPT, ensuring accuracy and compliance in clinical workflows. One example of its application is in telemedicine, where precise terminology is vital for remote consultations. Research highlights that telemedicine usage surged by over 154% during the COVID-19 pandemic, making uniform terminology essential for consistent diagnostics and treatment. For instance, platforms like Teladoc Health rely on standardized medical language to manage patient data across diverse healthcare ecosystems effectively.

Advancements in artificial intelligence and machine learning are further revolutionizing the market. AI-powered applications like Amazon HealthLake and Nuance’s Dragon Medical One leverage natural language processing to automate clinical note generation, saving physicians up to 2 hours per day on documentation tasks. This efficiency not only reduces burnout but also enhances patient-physician interaction. However, concerns over the accuracy of AI-generated notes remain, with some studies reporting error rates of 10-20%, emphasizing the need for rigorous validation processes.

The rising importance of multilingual support is another driving factor. Global healthcare systems demand software capable of translating medical terminology across languages to ensure equitable care. For instance, tools like SDL Trados streamline cross-linguistic communication, improving outcomes in regions with diverse patient populations.

Despite challenges such as implementation complexity and data privacy concerns, regulatory initiatives like the Health Level Seven (HL7) standards promote adoption by ensuring software compliance. For example, initiatives by the European Union's eHealth Network focus on harmonizing health data exchange, further boosting the market.

Medical Terminology Software Market Dynamics

Drivers

-

Rising Demand for Precision and Standardization in Healthcare

The increasing complexity of healthcare operations, including multidisciplinary treatments and personalized medicine, is driving the adoption of medical terminology software. These systems standardize terminologies like ICD, SNOMED CT, and CPT to ensure accuracy in clinical documentation and seamless communication across departments. Precision is particularly critical in specialized fields such as oncology and cardiology, where errors in coding can lead to misdiagnoses or delayed treatments. This demand is further amplified by the global shift toward value-based care models, which prioritize patient outcomes and cost-efficiency. By minimizing documentation errors and ensuring interoperability, medical terminology software supports healthcare providers in achieving these objectives, making it a cornerstone of modern healthcare systems.

-

Governments and regulatory bodies worldwide are enforcing stringent data standardization and interoperability regulations.

In the U.S., the ONC’s interoperability rules mandate seamless data exchange among healthcare entities, while Europe’s GDPR requires secure and compliant handling of health information. These regulations emphasize the need for robust software solutions to meet compliance standards. Medical terminology software facilitates compliance by ensuring consistent and accurate data exchange, reducing the risk of penalties associated with non-compliance. Additionally, international initiatives like the WHO’s ICD-11 revision are fostering global standardization, further driving adoption. These mandates highlight the critical role of terminology software in aligning healthcare systems with evolving legal and operational frameworks.

-

Innovations in artificial intelligence, machine learning, and cloud technology are significantly boosting the adoption of medical terminology software.

AI-driven tools like NLP-powered clinical note generators automate documentation, saving time and reducing physician burnout. Cloud-based solutions offer scalability, real-time updates, and cross-platform integration, making them ideal for healthcare providers seeking cost-effective deployments. For instance, cloud-enabled systems allow rural or resource-limited healthcare facilities to access standardized terminology tools, leveling the playing field in healthcare delivery. Additionally, technological advancements ensure compatibility with evolving electronic health record systems, enhancing overall efficiency and interoperability. These innovations not only address existing challenges but also position medical terminology software as a critical enabler of future-ready healthcare systems.

Restraints

-

High cost of implementation, which can be especially challenging for smaller healthcare providers or those in developing regions.

The expenses associated with purchasing, customizing, and training staff on these systems can be a significant financial burden. Additionally, integrating medical terminology software into existing healthcare infrastructures, such as Electronic Health Records or other clinical platforms, often leads to compatibility issues. Healthcare organizations relying on outdated systems may struggle with the seamless integration of newer terminology software, potentially causing operational disruptions. Moreover, the ongoing need to update these systems to comply with ever-changing regulatory requirements introduces further complexity and costs. As a result, healthcare institutions must carefully consider the balance between the benefits of adopting these technologies and the financial and technical challenges associated with their implementation and long-term maintenance.

Medical Terminology Software Market Segmentation Analysis

By Product & Service

In 2023, the Services segment dominated the medical terminology software market, holding a significant share of 60%. Services in this category include consulting, training, implementation, and maintenance, which are essential for the successful adoption and efficient functioning of medical terminology software in healthcare systems. The dominance of the Services segment is attributed to the growing complexity of integrating such software into healthcare IT infrastructure. Healthcare providers, particularly larger hospitals and clinics, require tailored services to ensure smooth integration with their existing systems, such as Electronic Health Records and Health Information Systems.

The platforms segment is growing rapidly as healthcare systems move toward more integrated, flexible, and scalable solutions. The demand for cloud-based platforms that can efficiently handle large volumes of medical terminology data and provide real-time updates is increasing. These platforms enable healthcare organizations to manage and standardize terminology like ICD, SNOMED CT, and CPT more effectively, improving the accuracy of clinical documentation and patient care. With the growing emphasis on interoperability and the need for robust, future-proof systems, healthcare providers are turning to platforms that can seamlessly integrate with other technologies and applications.

By Application

In 2023, data integration was the dominant application in the medical terminology software market. This segment accounted for a significant share of the market, primarily due to the critical need for healthcare systems to integrate disparate data sources seamlessly. Healthcare providers are increasingly relying on integrated systems to manage patient data efficiently, which is necessary for improving care coordination, reducing errors, and enhancing clinical outcomes.

The Clinical Trials segment is growing rapidly due to the increased need for precision, standardization, and regulatory compliance in clinical research. Medical terminology software plays a vital role in ensuring consistency across clinical trial data by standardizing the use of medical terms and codes, such as those from ICD, SNOMED CT, and MedDRA. As clinical trials become more complex, spanning multiple sites and involving diverse patient populations, the demand for robust systems that can ensure accurate and consistent data collection and reporting is rising. The growing focus on drug discovery, personalized medicine, and regulatory compliance is driving this trend.

Medical Terminology Software Market Regional Outlook

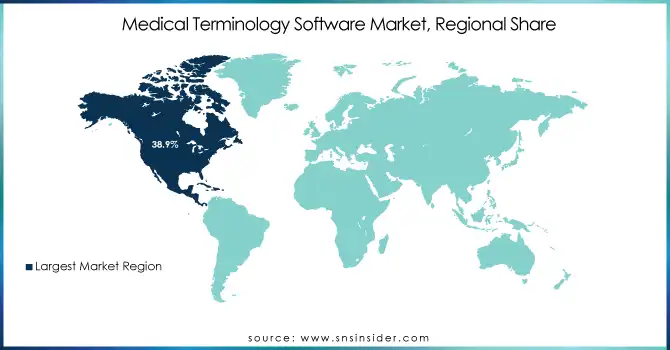

North America was the dominant region in the market, accounting for a 38.9% share in 2023. This is due to the advanced healthcare systems in the U.S. and Canada, where the adoption of Electronic Health Records and other healthcare technologies is widespread. Furthermore, the region's focus on regulatory compliance, such as the Health Insurance Portability and Accountability Act in the U.S., ensures a continuous need for standardized medical terminology systems. North America also leads in the integration of Artificial Intelligence and machine learning into healthcare systems, further driving the demand for advanced medical terminology solutions.

Europe followed closely, with countries like Germany, the UK, and France making substantial strides in adopting medical terminology software. The region is seeing growing investments in digital health technologies, with a particular focus on improving data interoperability and meeting EU regulations like the General Data Protection Regulation. These factors are propelling the demand for software that ensures data accuracy, consistency, and compliance.

Asia-Pacific is the fastest-growing region, driven by increasing investments in healthcare infrastructure and the growing adoption of digital health solutions in countries like China, India, and Japan. As healthcare systems in these regions modernize, there is a rising need for standardized data management, which is boosting the demand for medical terminology software. Government initiatives, coupled with increasing healthcare digitization, are expected to continue fueling the market growth in this region.

Need any customization research on Medical Terminology Software Market - Enquiry Now

Key Players

-

3M – 3M CodeFinder Software, 3M Medical Terminology Solutions

-

Apelon, Inc. – Apelon DTS (Distributed Terminology System), Apelon FHIR Terminology Services

-

B2i Healthcare – B2i Terminology Manager, B2i Healthcare Terminology Services

-

BiTAC – BiTAC Terminology Integration Suite

-

BT Clinical Computing – BT Terminology Management Software

-

CareCom – CareCom Terminology Solutions

-

Cerner Corporation – Cerner PowerChart, Cerner Millennium

-

Clinical Architecture, LLC – 3M Clinical Terminology Manager, Clinical Architecture Terminology Manager

-

HiveWorx – HiveWorx Terminology Services

-

Intelligent Medical Objects, Inc. – IMO Terminology Solutions, IMO Coding and Billing

-

Medicomp Systems – Medicomp Quippe, Medicomp Clinical Knowledge Engine

-

NextGen Healthcare – NextGen Healthcare Terminology Solutions

-

Spellex Technologies – Spellex Medical Dictionary, Spellex Medical Spell Checker

-

West Coast Informatics – West Coast Informatics Terminology Solutions

-

Wolters Kluwer N.V. – UpToDate, Lexicomp, ClinicalKey

Recent Developments

In March 2024, Google introduced Vertex AI Search for Healthcare, an AI-powered search and answer tool designed for medical professionals. This launch comes as the healthcare industry anticipates federal guidelines on the use of AI in healthcare.

In Jan 2024, A Penn Medicine resident launched an AI-powered dictation software aimed at alleviating administrative burdens for physicians. The software was designed to streamline documentation tasks, allowing healthcare professionals to focus more on patient care.

In Aug 2023, Vital launched a Doctor-to-Patient Translator powered by AI and LLMs, which simplifies complex medical jargon into easy-to-understand content at a 5th-grade reading level. This innovative tool translates doctor's notes, radiologist reports, discharge summaries, test results, and more, making medical information more accessible for patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.20 Billion |

| Market Size by 2032 | US$ 4.95 Billion |

| CAGR | CAGR of 17.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Services, Platform) • By Application (Data Aggregation, Reimbursement, Public Health Surveillance, Data Integration, Decision Support, Clinical Trials, Quality Reporting, Clinical Guidelines) • By End User (Healthcare Providers (Healthcare Information Exchanges, Healthcare Service Providers), Healthcare Payers (Public, Private), Healthcare IT Vendors, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | 3M, Apelon, B2i Healthcare, BiTAC, CareCom, Clinical Architecture, BT Clinical Computing, 3M, HiveWorx, Intelligent Medical Objects, Wolters Kluwer. |

| Drivers | • Rising Demand for Precision and Standardization in Healthcare • Governments and regulatory bodies worldwide are enforcing stringent data standardization and interoperability regulations. • Innovations in artificial intelligence, machine learning, and cloud technology are significantly boosting the adoption of medical terminology software. |

| Restraints | • High cost of implementation, which can be especially challenging for smaller healthcare providers or those in developing regions. |