Retinal Surgery Market Report Scope and Overview:

Get More Information on Retinal Surgery Market - Request Sample Report

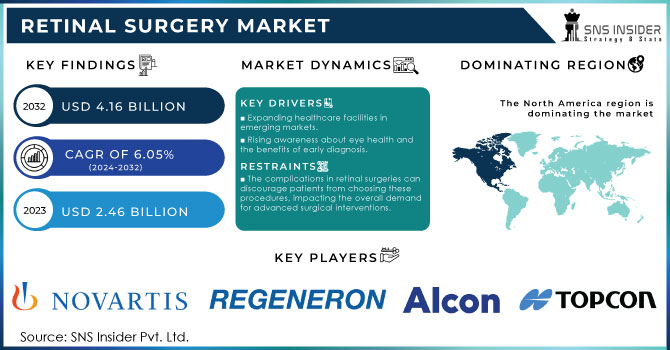

The Retinal Surgery Market Size was valued at USD 2.46 billion in 2023 and is expected to reach USD 4.16 billion by 2032 and grow at a CAGR of 6.05% over the forecast period of 2024 and 2032.

Retinal surgery devices are rapidly evolving to offer more effective treatments for a variety of retinal disorders. Minimally invasive surgical tools, for example, provide advantages such as less pain, minimal scarring, faster recovery times, and lower healthcare costs. The growth of the market is driven by increased awareness of eye health and improved access to advanced treatment options. As healthcare systems worldwide improve, access to retinal surgeries is expanding, leading to a growing demand for these devices.

These devices are primarily used to treat conditions like diabetic retinopathy, epiretinal membranes, retinal detachment, and macular holes. The market is also expanding due to an aging population that is more susceptible to eye problems and requires these treatments.

Diabetic retinopathy and retinal detachment are two significant eye conditions globally. As of 2023, diabetic retinopathy affects over 103 million people worldwide, a number that is expected to rise with increasing diabetes rates. In contrast, retinal detachment, while less common, impacts about 1 in 10,000 individuals annually. Both conditions play a major role in driving the demand for retinal surgical procedures, underscoring the critical need for innovative treatment solutions.

Retinal Surgery Market Dynamics

Drivers

-

Expanding healthcare facilities in emerging markets.

-

Rising awareness about eye health and the benefits of early diagnosis.

-

Rapid Innovations in retinal surgery devices, such as enhanced visualization systems, lasers, and micro-instruments.

Growing awareness of eye health and the advantages of early diagnosis is significantly influencing the retinal surgery market. As awareness of eye conditions such as diabetic retinopathy and macular degeneration increases, more individuals are recognizing the importance of regular eye checkups. Moreover, advancements in diagnostic technology facilitate quicker and more accurate identification of retinal disorders, which boosts the demand for surgical interventions. As individuals take a more proactive approach to managing their eye health, the frequency of routine screenings is expected to rise, further increasing the demand for retinal surgery devices.

Healthcare initiatives that emphasize the risks associated with untreated eye conditions are vital for raising public awareness. This focus on eye health is likely to result in more patients seeking treatment for retinal issues. The combination of heightened awareness and proactive healthcare practices is anticipated to drive growth in the retinal surgery market, making innovative treatment solutions essential to address the escalating demand.

Speedy innovations in retinal surgery devices are significantly advancing the field, with enhanced visualization systems, precision lasers, and refined micro-instruments leading the way. These technological advancements are improving surgical accuracy, making procedures less invasive, and enhancing patient outcomes. Surgeons now have better tools to address complex retinal conditions, reducing complications and recovery times. As these technologies continue to evolve, they are driving the growth and effectiveness of retinal surgery worldwide.

Restraints

-

The complications in retinal surgeries can discourage patients from choosing these procedures, impacting the overall demand for advanced surgical interventions.

-

A lack of trained ophthalmic surgeons can restrict market growth.

-

Expensive surgical devices and procedures, especially in developing regions, limit access to retinal surgeries.

In developing regions, retinal surgeries remain inaccessible owing to the high cost associated with surgical devices and procedures. The majority of low-and middle-income countries remain without access to advanced equipment, which means that the local healthcare facilities do not have the ability to provide the relevant treatment. Meanwhile, the absence of the necessary healthcare infrastructure combined with a shortage of trained healthcare professionals further creates a barrier towards timely and effective performance of these surgeries, which directly results in the preventable cases of people losing eyesight. Therefore, the major issue that needs to be focused on in order to address the given concern is the reduction of costs associated with surgical devices and the overall improvement of treatment affordability. Moreover, The challenge of high retinal surgery costs can be partially addressed by restricting foreign companies from importing their equipment until the local market is sufficiently saturated with similar domestic products. This approach could stimulate demand for local manufacturing and production, ultimately reducing costs and improving accessibility to essential treatments. Encouraging local production not only boosts the economy but also ensures that healthcare facilities can provide affordable solutions tailored to the needs of their communities. Additionally, the shortage of skilled ophthalmic surgeons hinders the growth of the retinal surgery market. Advanced procedures require specialized expertise that is not widely available, especially in developing regions. This lack of proficiency limits the number of surgeries that can be performed, constraining market expansion and leaving many patients without necessary eye care.

Additionally, the shortage of skilled ophthalmic surgeons hinders the growth of the retinal surgery market. Advanced procedures require specialized expertise that is not widely available, especially in developing regions. This lack of proficiency limits the number of surgeries that can be performed, constraining market expansion and leaving many patients without necessary eye care.

Retinal Surgery Market Segmentation Overview

By Product

In 2023, vitrectomy packs segment dominated the market and represented more than 30% of the total share. These packs enhance surgical efficiency by combining all necessary instruments into a single, convenient package, which minimizes preparation time and improves operational workflow during procedures.

Meanwhile, the retinal laser equipment segment is expected to grow at a compound annual growth rate (CAGR) of 5.8% in the forthcoming years. This growth is driven by the equipment's precision, effectiveness, and versatility, enabling surgeons to target specific retinal areas with accuracy. This targeted approach reduces damage to surrounding tissues and results in improved treatment outcomes. Retinal laser devices have shown significant success in treating various conditions, including diabetic retinopathy, retinal tears, and macular degeneration.

By Application

In 2023, diabetic retinopathy captured the largest revenue share at 29.9%, reinforcing its role as a critical component of the market. This condition, recognized as a leading cause of blindness worldwide, arises from damage to the retina's blood vessels and can result in significant vision loss. The global increase in diabetes cases has heightened the urgency surrounding diabetic retinopathy in the field of ophthalmology. As a result, the rising demand for early detection and effective treatments using specialized surgical devices is a key driver of market growth.

Meanwhile, the Epiretinal Membrane (ERM) segment is expected to see the fastest compound annual growth rate (CAGR) of 6.3% during the forecast period. ERM develops when fibrous tissue forms on the retina's surface, leading to visual impairment. The increasing prevalence of age-related macular degeneration and diabetic retinopathy-both of which significantly contribute to ERM-plays a major role in driving the growth of this market segment.

By End-use

In 2023, the Ophthalmology clinic segment emerged as the market leader, accounting for over 36.3% of total revenue, driven by factors such as cost-effectiveness, high patient volume, and specialized services. The rising public awareness of eye health significantly contributes to this growth. Ophthalmic clinics are increasingly recognized for their focus on eye care and the implementation of advanced technologies for targeted treatments of various retinal conditions. Concurrently, Ambulatory Surgery Centers (ASCs) are gaining popularity due to their efficiency and lower costs, offering outpatient surgical options.

Each segment plays a crucial role in providing retinal surgery services: hospitals lead in complexity and surgical volume, clinics focus on specialized care, and ASCs deliver high-quality yet affordable surgical solutions.

Hospital segment is projected to see substantial growth, with a compound annual growth rate (CAGR) expected to exceed 5.1% during the forecast period. This growth is largely attributed to the extensive infrastructure and specialized medical services available in hospitals, which support high adoption rates of retinal surgery devices. The consistent influx of patients, combined with advanced facilities and skilled specialists, results in a significant volume of retinal surgeries. Moreover, the increasing prevalence of eye disorders and the comprehensive care provided by hospitals further enhance the demand for retinal surgery devices in these settings.

Retinal Surgery Market Regional Analysis

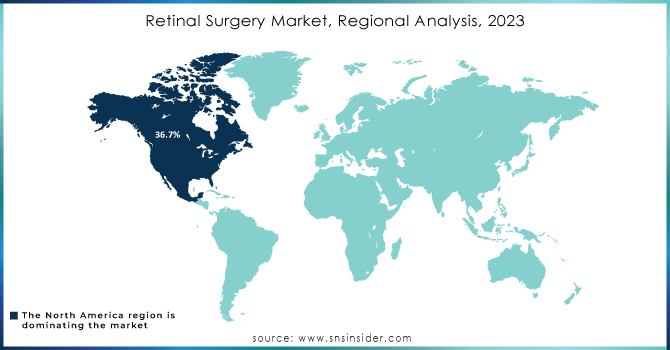

In 2023, the North American market for retinal surgery devices held a substantial share of 36.7%. The region benefits from a highly skilled workforce of ophthalmologists and healthcare professionals specializing in retinal surgeries. These qualifications, along with the capability to use advanced surgical devices, contribute to a high adoption rate of these technologies in North America. Additionally, the prevalence of diabetic retinopathy is significant in this region and is expected to rise as diabetes cases increase.

In the Asia Pacific region, the retinal surgery devices market is projected to grow the fastest during the forecast period. This growth is driven by increased investments in healthcare infrastructure in emerging countries like China and India, making treatments more accessible and affordable. Japan is also anticipated to experience notable growth due to its aging population, which results in a higher incidence of age-related eye diseases. In 2023, the European retinal surgery devices market was recognized as promising due to its advanced healthcare infrastructure and professional ophthalmic care facilities throughout the region.

Need Any Customization Research On Retinal Surgery Market - Inquiry Now

Key Players in Retinal Surgery Market

The major key players are

-

Novartis - (Lucentis, Beovu)

-

Regeneron Pharmaceuticals - (Eylea, Dexamethasone Injectable)

-

Bausch + Lomb - (ILUVIEN, Retisert)

-

Alcon - (Vitrectomy Packs, Retina Laser System)

-

Zeiss - (VisuMax, CIRRUS HD-OCT)

-

Topcon - (3D OCT-1 Maestro, retinal laser systems)

-

Abbott Laboratories - (Sutureless Vitrectomy, Retinal Prosthesis System)

-

Hoya - (i-Trace, Retina Imaging Systems)

-

EyePoint Pharmaceuticals - (YUTIQ, DEXYCU)

-

NIDEK - (Laser Systems, OCT Systems)

-

Optos -(Ultra-widefield Imaging, Optomap)

-

Friedrich Miescher Institute - (Imaging and diagnostic solutions, clinical trials)

-

Carl Zeiss AG - (OCT imaging devices, surgical microscopes)

-

Lumenis - (SLT Laser Systems, photocoagulation lasers)

-

Katalyst Surgical - (Retinal surgical instruments, custom surgical packs)

-

Merck - (Ocular drug delivery systems, clinical trials)

-

Santen Pharmaceutical - (Ophthalmic solutions, surgical devices)

-

Vysion Technologies - (Ophthalmic imaging software, diagnostic tools)

-

DGH Technology - (Ultrasound systems, diagnostic devices)

-

IRIDEX Corporation - (MicroPulse laser systems, ophthalmic lasers)

Recent Developments

-

In July 2024, Alcon Inc. announced its acquisition of Belkin Vision to enhance its glaucoma portfolio with the addition of direct selective laser trabeculoplasty (SLT).

-

In April 2024, Carl Zeiss Meditec AG announced that it completed the acquisition of the Dutch ophthalmic research center.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.46 Billion |

| Market Size by 2032 | USD 4.16 Billion |

| CAGR | CAGR of 6.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Vitrectomy Machines and Retinal Laser Equipment) • By Application (Diabetic Retinopathy, Retinal Detachment and Other) • By End-Use (Hospitals, Ophthalmology Clinics and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novartis, Regeneron Pharmaceuticals, Bausch + Lomb, Alcon, Zeiss, Topcon, Abbott Laboratories, Hoya, EyePoint Pharmaceuticals,NIDEK |

| Key Drivers | • Rising awareness about eye health and the benefits of early diagnosis. • Rapid Innovations in retinal surgery devices, such as enhanced visualization systems, lasers, and micro-instruments. |

| RESTRAINTS | • The complications in retinal surgeries can discourage patients from choosing these procedures, impacting the overall demand for advanced surgical interventions. • A lack of trained ophthalmic surgeons can restrict market growth. |