Revenue Operations Market Report Scope & Overview:

Revenue Operations Market was valued at USD 6.16 billion in 2025E and is expected to reach USD 21.70 billion by 2032, growing at a CAGR of 17.16% from 2026-2033.

The Revenue Operations Market is growing rapidly due to increasing adoption of cloud-based and AI-driven solutions, rising demand for data-driven decision-making, and the need to streamline sales, marketing, and customer success operations. Organizations are focusing on improving revenue forecasting, operational efficiency, and cross-department collaboration, driving significant market expansion globally between 2026-2033.

Clari’s benchmark study across 10 million sales opportunities revealed that the top 10% of sellers generate 65% of total revenue, emphasizing significant opportunities for revenue operations to enhance sales performance and efficiency.

Revenue Operations Market Size and Forecast

-

Market Size in 2025: USD 6.16 Billion

-

Market Size by 2033: USD 21.70 Billion

-

CAGR: 17.16% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Revenue Operations Market - Request Free Sample Report

Revenue Operations Market Trends

-

The Revenue Operations (RevOps) Market is expanding rapidly due to increasing demand for unified business strategies that align sales, marketing, and customer success teams.

-

Growing adoption of data-driven decision-making and analytics platforms is enhancing operational transparency and performance tracking.

-

Integration of AI and automation tools in revenue management processes is optimizing forecasting accuracy and pipeline visibility.

-

Rising focus on customer retention, lifecycle value, and performance optimization is propelling market growth.

-

Cloud-based RevOps solutions are gaining traction due to their scalability, real-time collaboration, and cost-effectiveness.

-

Increasing investments by enterprises to break down departmental silos and improve go-to-market efficiency are fueling adoption.

-

Technological advancements and growing emphasis on end-to-end revenue accountability are strengthening the global Revenue Operations Market.

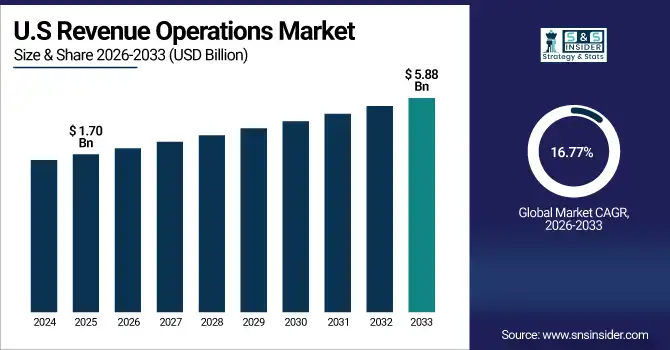

U.S. Revenue Operations Market was valued at USD 1.70 billion in 2025E and is expected to reach USD 5.88 billion by 2032, growing at a CAGR of 16.77% from 2026-2033.

The U.S. Revenue Operations Market growth is driven by widespread adoption of cloud and AI-based solutions, emphasis on data-driven decision-making, and the need to optimize sales, marketing, and revenue processes.

Revenue Operations Market Growth Drivers:

-

Adoption of Advanced Analytics and AI Tools Enhances Revenue Forecasting Accuracy and Operational Decision-Making Efficiency Globally

Advanced analytics and artificial intelligence integrated into revenue operations platforms provide actionable insights for accurate revenue forecasting and strategic planning. Predictive analytics identify high-value opportunities, reduce churn, and optimize pricing, boosting profitability. Real-time dashboards enable performance tracking and alignment of sales and marketing strategies. AI-powered automation streamlines repetitive tasks, enhances data quality, and improves cross-department collaboration. Organizations increasingly adopt these intelligent tools to gain competitive advantages, optimize revenue processes, and meet growing demand for data-driven, measurable outcomes, driving consistent market growth globally.

AI can increase leads by up to 50%, reduce call times by 60%, and cut overall costs by 60% for revenue teams.

AI-powered forecasting models have improved accuracy by up to 20%, enabling more agile decision-making and resource allocation.

Companies not adapting AI-driven approaches may face up to a 20% decrease in sales and a 30% increase in support costs.

|

Company/Platform |

Key Features & Benefits |

|

Oliv AI |

Deploys autonomous agents into workflows (CRM, email, Slack) for CRM hygiene, bottom-up forecasting, and coaching, solving tool fragmentation and enhancing efficiency |

|

Salesforce Einstein |

Integrates machine learning for predictive insights, lead scoring, and customer engagement analysis, consolidating revenue data for unified decision-making |

|

Invoca |

Applies AI to analyze customer interactions across channels, improving revenue attribution accuracy and optimizing marketing strategies |

|

ZoomInfo & Markaaz |

AI-enabled B2B data platform integrating sales and marketing datasets, delivering deeper cross-team insights and automating sales and marketing processes |

Revenue Operations Market Restraints:

-

High Implementation Costs and Complex Integration of Revenue Operations Solutions Restrict Adoption Among Small and Medium Enterprises

The deployment of revenue operations platforms involves significant investment in software, infrastructure, and employee training, which can be prohibitive for SMEs. Integration with existing CRM, ERP, and marketing systems often requires complex technical expertise and prolonged implementation timelines. Small enterprises may lack the resources or skilled personnel to manage such integrations efficiently, limiting widespread adoption. Additionally, costs associated with continuous software updates, maintenance, and system customization add to financial burdens. This financial constraint can slow market growth in cost-sensitive regions. Enterprises often weigh potential ROI against upfront expenses, restraining adoption despite clear operational benefits.

-

Revenue Orchestration platforms typically cost $200-400+ per user monthly when fully deployed, with implementation timelines often exceeding 6-12 months for enterprises.

-

67% of Revenue Operations implementations fail to meet initial ROI expectations due to complexity, training overhead, and slow adoption.

-

Training can require 40-80+ hours per user. Implementation fees for platforms like Gong or Chorus range from $10,000 to $50,000 plus ongoing support. Common issues include data inconsistencies, duplicates, tool compatibility problems, and difficulty with CRM integration, while poor user adoption leads to underutilized systems and lost business value.

Revenue Operations Market Opportunities:

-

Expansion of Cloud-Based Revenue Operations Platforms Offers Scalability and Reduced Infrastructure Costs Globally

Cloud deployment of revenue operations solutions enables enterprises to access scalable, flexible, and cost-effective platforms without heavy on-premises infrastructure. Organizations benefit from faster implementation, seamless updates, and global accessibility, which supports multi-location teams and remote operations. Cloud platforms also facilitate integration with other cloud-based tools, enhancing data centralization and operational efficiency. Growing cloud adoption across SMEs and large enterprises creates a significant opportunity for vendors to expand market presence. Subscription-based pricing models further lower the entry barrier, encouraging wider adoption. The increasing trend toward digital transformation positions cloud-based revenue operations as a high-growth opportunity globally.

Cloud adoption boosts revenue and profitability, with reported revenue increases up to 15% and profit growth of 4% on average after successful migration.

Small and medium businesses using cloud computing experienced 21% higher profits and grew 26% faster than those not on the cloud, highlighting scalability and cost efficiency.

Additionally, 65% of businesses report faster time to market, while 98% of enterprises with public cloud infrastructure adopt multi-cloud strategies to reduce costs, improve data governance, and enhance operational flexibility.

Revenue Operations Market Segment Highlights

-

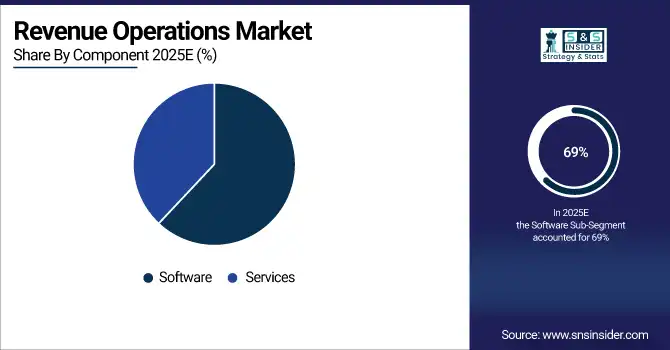

By Component, Software dominated with ~69% share in 2025; Services fastest growing (CAGR).

-

By Enterprise Size, Large Enterprises dominated with ~61% share in 2025; SMEs fastest growing (CAGR).

-

By Application, Sales Operations dominated with ~33% share in 2025; Marketing Operations fastest growing (CAGR).

-

By End Use, IT & Telecom dominated with ~25% share in 2025; Bio-BFSI fastest growing (CAGR).

-

By Deployment Mode, Cloud dominated with ~71% share in 2025; Cloud fastest growing (CAGR).

Revenue Operations Market Segment Analysis

By Component

Software segment dominated the Revenue Operations Market in 2025 due to its ability to automate workflows, centralize data, and provide actionable insights across sales, marketing, and customer success teams. Enterprises increasingly rely on software solutions for real-time analytics, forecasting, and process optimization, making it the primary choice for revenue efficiency.

Services segment is expected to grow at the fastest CAGR from 2026-2033 as organizations seek expert support for implementation, customization, training, and ongoing management of revenue operations platforms. The demand for consulting, integration, and managed services is rising, helping enterprises maximize platform adoption and optimize revenue processes efficiently.

By Enterprise Size

Large Enterprises segment dominated the Revenue Operations Market in 2025 due to their complex sales structures, higher budgets, and need for centralized revenue management. Large organizations benefit from integrated platforms to align multiple departments, improve forecasting, and enhance decision-making, making them the leading adopters of revenue operations solutions.

SMEs segment is expected to grow at the fastest CAGR from 2026-2033 as smaller organizations increasingly recognize the benefits of affordable, scalable, and cloud-based revenue operations solutions. Growing digital transformation and the need for data-driven decision-making encourage SMEs to adopt platforms to streamline sales and marketing processes effectively.

By Application

Sales Operations segment dominated the Revenue Operations Market in 2025 because it directly impacts revenue generation, performance tracking, and pipeline management. Organizations prioritize automating sales processes, enhancing forecasting accuracy, and improving team efficiency, making sales operations the core focus of revenue operations adoption.

Marketing Operations segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing demand for personalized campaigns, lead management, and alignment with sales. Enterprises are leveraging revenue operations platforms to optimize marketing strategies, improve ROI, and integrate data across multiple channels for targeted audience engagement.

By End Use

IT & Telecom segment dominated the Revenue Operations Market in 2025 due to its early adoption of digital platforms, large-scale sales operations, and emphasis on data-driven decision-making. Companies in this sector leverage advanced analytics and automation to optimize revenue streams and maintain competitive advantage in dynamic markets.

BFSI segment is expected to grow at the fastest CAGR from 2026-2033 as financial institutions increasingly adopt revenue operations platforms to enhance cross-department collaboration, improve forecasting, and manage complex customer journeys efficiently. Rising competition and regulatory pressures drive BFSI companies to invest in revenue optimization solutions.

By Deployment Mode

Cloud segment dominated the Revenue Operations Market in 2025 due to its scalability, flexibility, and ease of deployment across multiple departments. Enterprises prefer cloud solutions for real-time data access, seamless updates, and lower infrastructure costs. It is expected to grow at the fastest CAGR from 2026-2033 as organizations increasingly adopt cloud platforms for remote operations, enhanced collaboration, and integration with other digital tools, enabling faster implementation and optimized revenue management across diverse business environments.

Revenue Operations Market Regional Analysis

North America Revenue Operations Market Insights

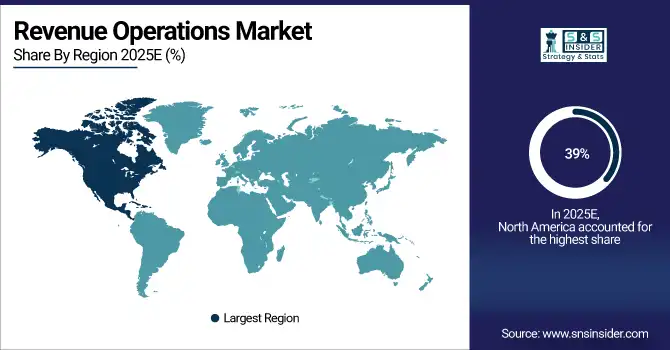

North America dominated the Revenue Operations Market in 2025 with the highest revenue share of about 39% due to early adoption of advanced technologies, high digital maturity, and presence of major revenue operations solution providers. Enterprises in the region focus on integrating sales, marketing, and customer success processes, leveraging cloud and AI-driven platforms to enhance operational efficiency, forecasting, and decision-making, making North America the leading market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Revenue Operations Market Insights

Asia Pacific segment is expected to grow at the fastest CAGR of about 19.10% from 2026-2033, driven by increasing digital transformation initiatives, rising adoption of cloud-based and AI-enabled revenue operations solutions, and expanding SME and large enterprise base. Growing awareness of revenue optimization benefits, coupled with rapid IT infrastructure development and favorable government policies, accelerates adoption, making Asia Pacific the fastest-growing region in the revenue operations market.

Europe Revenue Operations Market Insights

Europe holds a significant position in the Revenue Operations Market due to increasing adoption of cloud-based solutions, focus on data-driven decision-making, and presence of established enterprises. Organizations across the region are investing in revenue optimization platforms to streamline sales, marketing, and customer success operations. Growing digital transformation initiatives and regulatory support for technology adoption further contribute to steady market growth in Europe.

Middle East & Africa and Latin America Revenue Operations Market Insights

Middle East & Africa and Latin America are gradually adopting revenue operations solutions, driven by growing digital transformation and increasing enterprise focus on optimizing sales and marketing processes. Investments in cloud infrastructure, AI, and analytics are rising, enabling organizations to improve forecasting and revenue management. Expanding SME and corporate sectors in these regions create growth opportunities, making them emerging markets for revenue operations adoption.

Revenue Operations Market Competitive Landscape:

Salesforce, Inc.

Salesforce, Inc. is a global leader in CRM and enterprise software, offering cloud-based solutions to manage sales, marketing, service, and revenue operations. The company focuses on integrating AI, automation, and digital labor to streamline business processes, reduce friction across departments, and enable data-driven decision-making. Salesforce’s platforms support complex revenue operations, allowing organizations to unify sales, finance, and legal processes while enhancing forecasting, productivity, and overall revenue performance.

-

2025: Launched Revenue Cloud, a modular, composable RevOps platform with built-in Agentforce digital labor, reducing quote-to-cash friction and enabling unified revenue operations across sales, finance, and legal.

-

2024: Introduced Revenue Lifecycle Management capabilities on the Einstein 1 Platform, automating quote-to-cash across channels and revenue models to support complex RevOps needs.

Clari

Clari delivers AI-powered revenue operations and intelligence solutions, helping businesses analyze pipelines, optimize forecasting, and reduce revenue leakage. Its platform provides actionable insights to improve seller performance, identify process inefficiencies, and drive predictable growth. Clari focuses on leveraging automation, AI, and data analytics to maximize revenue capture and empower go-to-market teams across industries.

-

April 2024: Announced over US$4 trillion in customer revenue flows through its Revenue Platform, marking the first provider to reach this scale.

-

July 2024: Released inaugural “Revenue Leak Report,” finding companies lose up to 26% of revenue due to process breakdowns, prompting AI adoption and hiring to improve RevOps.

Gong.io Ltd.

Gong.io Ltd. specializes in AI-driven Revenue Intelligence, analyzing customer interactions to enhance sales performance, improve deal outcomes, and reduce churn. The platform consolidates CRM data, conversation analytics, and forecasting insights into actionable intelligence. Gong empowers sales and RevOps teams to identify key opportunities, optimize workflows, and increase revenue predictability through AI-powered automation and analytics.

-

November 2023: Announced AI-powered enhancements (e.g., “Deal Spotlight”) to unify deal history, interaction data, and forecasting for revenue teams.

-

July 2023: Reported over 4,000 global customers using its AI-powered Revenue Intelligence Platform to consolidate workflows, boost win-rates, and reduce churn.

Xactly Corporation

Xactly Corporation provides AI-driven Intelligent Revenue Platforms designed to automate and optimize revenue lifecycle processes. Its solutions enable go-to-market teams to manage commissions, incentives, and performance analytics, ensuring accurate compensation and operational efficiency. Xactly focuses on leveraging AI agents and cloud integrations to enhance revenue predictability and drive scalable growth across enterprise sales and RevOps operations.

-

August 2025: Launched the market’s first AI Agents on its Intelligent Revenue Platform, automating end-to-end revenue workflows for go-to-market teams.

-

May 2025: Joined the AWS Partner Network and launched solutions on AWS Marketplace (Asia-Pacific, Tokyo), accelerating revenue performance for AWS customers.

HubSpot, Inc.

HubSpot, Inc. offers an integrated CRM and marketing platform that empowers businesses to align marketing, sales, and customer service operations. Its focus on AI, automation, and analytics enhances RevOps efficiency and customer engagement. HubSpot continuously expands its tools for data management, CPQ, and workflow automation, enabling teams to drive revenue growth, reduce friction, and scale operations effectively across enterprise environments.

-

2025: At INBOUND 2025, revealed over 200 product updates for RevOps teams, including a rebranded Data Hub, Breeze AI Agents, and enhanced AI-driven CPQ tools.

Key Players

Some of the Revenue Operations Market Companies

-

Salesforce, Inc.

-

Clari

-

Gong.io Ltd.

-

HubSpot, Inc.

-

Aviso, Inc.

-

People.ai, Inc.

-

Xactly Corporation

-

InsightSquared

-

Revenue.io

-

LeanData

-

BoostUp.ai

-

Revenue Grid

-

Kluster

-

Fullcast.io

-

Freshworks

-

Zoho Corporation

-

Oracle Corporation

-

Microsoft Corporation

-

Altify (Upland Software)

-

Ambit Software Private Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.16 Billion |

| Market Size by 2033 | USD 21.70 Billion |

| CAGR | CAGR of 17.16% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment Mode (Cloud, On-Premises) • By Enterprise Size (Large Enterprises, SMEs) • By Application (Sales Operations, Marketing Operations, Customer Success Operations, Finance & Revenue Analytics, Forecasting & Planning) • By End Use (BFSI, IT & Telecom, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Salesforce, Inc., Clari, Gong.io Ltd., HubSpot, Inc., Aviso, Inc., People.ai, Inc., Xactly Corporation, InsightSquared, Revenue.io, LeanData, BoostUp.ai, Revenue Grid, Kluster, Fullcast.io, Freshworks, Zoho Corporation, Oracle Corporation, Microsoft Corporation, Altify (Upland Software), Ambit Software Private Ltd. |