Smart Flooring Market Size & Trends:

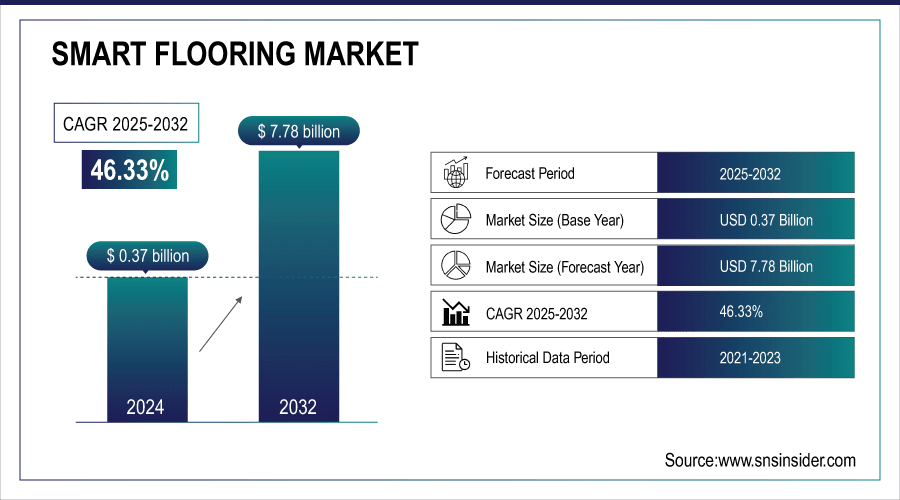

The Smart Flooring Market size was valued at USD 0.37 Billion in 2024 and is projected to reach USD 7.78 Billion by 2032, growing at a CAGR of 46.33% during 2025-2032.

The smart flooring market is rapidly advancing with innovations that combine kinetic and solar energy to maximize power generation and sustainability. Modern tiles capture footsteps while integrating solar cells, enabling continuous energy production, off-grid storage, and support for e-mobility solutions. These technologies provide valuable data for urban planning, enhance interactive and engaging experiences, and reduce carbon footprints through modular, resource-efficient designs. Growing adoption in smart cities, public spaces, and commercial developments is driving market expansion globally, highlighting energy-efficient, data-driven, and experiential flooring solutions.In Dec 2024, Pavegen’s Solar+ smart flooring combines kinetic energy from footsteps with solar power, generating up to 30x more energy than previous models. The modular, low-carbon tiles deliver continuous energy, actionable data, and interactive experiences, supporting smart city applications, off-grid power, and sustainable urban mobility.

To Get more information on smart flooring market - Request Free Sample Report

Key Smart Flooring Market Trends

-

Urban luxury residential projects are driving smart flooring adoption with interactive, sensor-enabled, and energy-efficient solutions enhancing comfort, aesthetics, and space utilization.

-

Premium developments demonstrate growing demand for advanced flooring in high-end homes with spacious layouts, high-quality finishes, and integrated amenities.

-

High installation and maintenance costs, complex integration, lack of standardization, privacy concerns, and durability issues limit smart flooring adoption.

-

Integration with smart building systems and IoT platforms creates multifunctional, data-driven, and energy-efficient environments.

-

Increasing interest in sustainable materials, customizable designs, and immersive, interactive experiences is fueling market growth globally.

-

Technological innovations in modular, low-carbon, and energy-harvesting flooring are expanding applications across residential, commercial, and public spaces.

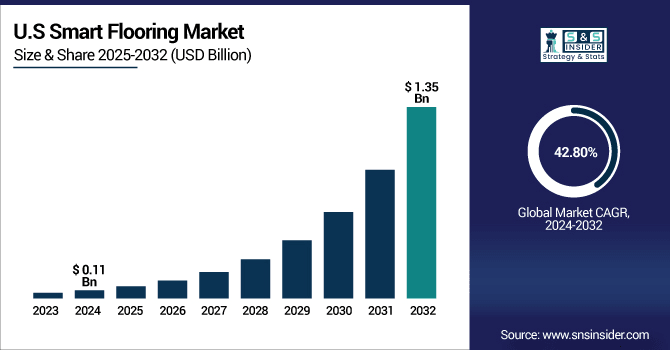

The U.S. Smart Flooring Market size was valued at USD 0.11 Billion in 2024 and is projected to reach USD 1.35 Billion by 2032, growing at a CAGR of 42.80% during 2025-2032. This growth is driven by increasing adoption of sensor-embedded and energy-efficient flooring solutions, rising demand for interactive and data-driven applications in smart homes, commercial spaces, and public infrastructure, and the integration of innovative technologies such as kinetic and solar-powered tiles for sustainable urban mobility and enhanced user experiences.

The Smart Flooring market trends include the integration of sensor-embedded and energy-harvesting technologies, adoption of interactive LED and visualization floors, focus on safety and elderly-care monitoring, increasing use in smart homes, commercial buildings, and public infrastructure, growth of data-driven space utilization and occupancy analytics, emphasis on sustainable and low-carbon materials, and rising deployment in gaming, retail, and e-mobility applications, reflecting a shift toward multifunctional, energy-efficient, and experiential flooring solutions across urban and residential environments.

Smart Flooring Market Growth Drivers:

-

Urban Luxury Residential Developments Driving Smart Flooring Adoption

The demand for smart flooring is being driven by the growth of high-end residential developments, where luxury, comfort, and advanced design are key priorities. In premium urban projects, such as full-floor apartments near central business districts, developers are integrating interactive, sensor-enabled, and energy-efficient flooring solutions to enhance occupant experience, improve space utilization, and support modern lifestyle needs. Rising interest in aesthetics, sustainability, and technologically advanced interiors in boutique and luxury housing is fueling adoption of smart flooring globally.

West Village Sydney offers eight luxury full-floor homes near Barangaroo, blending New York–inspired design with spacious layouts, high-end finishes, and serene interiors. The boutique development features two- and three-level apartments, premium materials, and communal amenities, providing an exclusive urban living experience in the heart of Sydney.

Smart Flooring Market Growth Restraints:

-

High costs, integration challenges, privacy concerns, and durability issues limit smart flooring adoption.

The smart flooring market include high installation and maintenance costs, which can discourage adoption in budget-sensitive residential and commercial projects. Integration with existing building systems is often complex, requiring specialized infrastructure. A lack of standardization and interoperability among smart flooring technologies creates compatibility challenges, while data privacy and security concerns may limit adoption. Additionally, limited awareness of benefits, along with potential durability and reliability issues under heavy use, further restrict market growth, collectively slowing large-scale implementation globally.

Smart Flooring Market Growth Opportunities:

-

Integration of Smart Flooring and Connected Home Devices Driving Market Opportunities

The integration of smart lighting and interactive flooring offers significant growth potential in smart homes and commercial spaces. Consumer demand is rising for multifunctional, connected solutions that combine illumination, audio, and IoT-enabled control. Smart flooring that captures data, improves energy efficiency, or provides interactive experiences can be seamlessly integrated into smart home ecosystems. Increasing adoption of Matter-compatible devices, interest in customizable environments, and growing focus on convenience, sustainability, and immersive experiences are driving opportunities for innovative, integrated smart flooring solutions worldwide.

Govee has launched the Floor Lamp 2 and Floor Lamp Pro, offering higher brightness, more LEDs, and RGBICWW color control, with the Floor Lamp Pro featuring a built-in speaker. Both models support Matter for seamless smart home integration, enhancing lighting and interactive experiences in any space.

Key Smart Flooring market Segment Analysis:

-

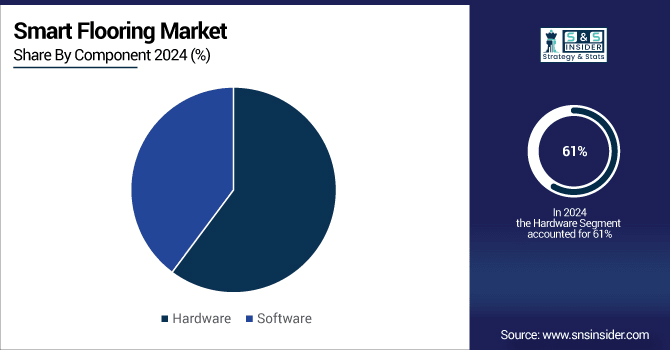

By Component, Hardware led with ~61% share in 2024; Software fastest growing (CAGR 47.20%).

-

By Technology, Sensor-Embedded Floor Tiles led with ~34% share in 2024; Energy-Harvesting Flooring fastest growing (CAGR 56.44%).

-

By End-User, Commercial led with ~35% share in 2024; Residential fastest growing (CAGR 51.55%).

-

By Application, Occupancy and Space-Utilisation Analytics led with ~30% share in 2024; Gaming and Interactive Entertainment fastest growing (CAGR 51.85%).

By Component, Hardware Dominance Market While Software Registers Fastest Growth

Hardware leads the Smart Flooring market due to its widespread adoption in residential, commercial, and industrial projects. Software is emerging as the fastest-growing segment, driven by rising demand for integrated, data-driven, and IoT-enabled smart flooring solutions. The combination of durable hardware and intelligent software is enhancing functionality, energy efficiency, and interactive experiences, creating significant opportunities for innovation and market expansion globally.

By Technology, Sensor-Embedded Floor Tile Dominate While Semiconductor Energy-Harvesting Flooring Rapid Growth

Sensor-Embedded Floor Tiles dominate the Smart Flooring market due to their widespread use in interactive, data-capturing, and energy-efficient applications. Meanwhile, Energy-Harvesting Flooring is experiencing rapid growth, driven by increasing demand for sustainable, self-powered solutions. Together, these technologies are reshaping flooring applications, enabling smarter, more interactive, and energy-conscious environments across residential, commercial, and public spaces worldwide.

By End-User, Commercial Lead While Residential Registers Fastest Growth

The commercial sector leads the Smart Flooring market, driven by demand from offices, retail spaces, and public infrastructure seeking enhanced functionality and analytics. Residential applications, however, are registering the fastest growth as homeowners increasingly adopt smart, sensor-enabled, and interactive flooring solutions. This trend reflects rising consumer interest in comfort, convenience, energy efficiency, and connected home experiences.

By Application, Occupancy and Space-Utilisation Analytics Lead Gaming and Interactive Entertainment Grow Fastest

Occupancy and Space-Utilisation Analytics lead the Smart Flooring market, helping businesses and facilities optimize space management, efficiency, and operational insights. Meanwhile, Gaming and Interactive Entertainment is the fastest-growing application, driven by rising demand for immersive, engaging, and interactive experiences in residential, commercial, and public environments, highlighting the versatility and innovation potential of smart flooring solutions.

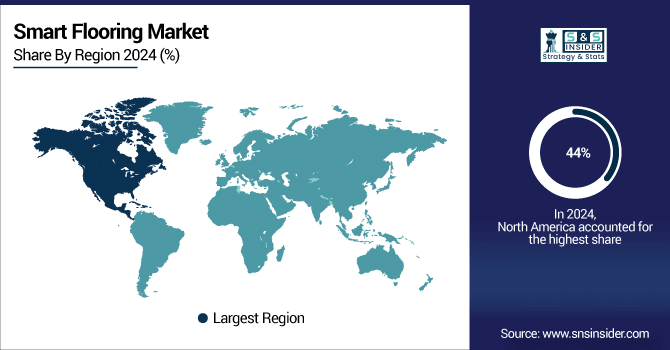

North America Smart Flooring Market Insights

In 2024 North America dominated the Smart Flooring Market and accounted for 44% of revenue share, driven by widespread adoption across commercial, residential, and public infrastructure sectors. Strong technological advancements, including sensor-embedded and energy-harvesting flooring, coupled with growing demand for interactive, connected, and energy-efficient solutions, are fueling market growth. The region’s focus on smart building initiatives, sustainable construction, and IoT integration further strengthens its position, making it a key hub for innovation and large-scale deployment of smart flooring technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Smart Flooring Market Insights

Asia-Pacific is expected to witness the fastest growth in the Smart Flooring Market over 2025-2032, with a projected CAGR of 48.61%, driven by rapid urbanization, increasing smart building projects, rising adoption of interactive and energy-efficient flooring, and growing investments in residential, commercial, and public infrastructure. The region’s focus on technological innovation, sustainability, and IoT-enabled smart environments is fueling strong demand, positioning Asia-Pacific as a key growth hub for smart flooring solutions globally.

Europe Smart Flooring Market Insights

In 2024, Europe emerged as a promising region in the Smart Flooring Market, supported by increasing adoption of sensor-enabled and energy-efficient flooring solutions, growing smart building initiatives, and rising demand in residential, commercial, and public infrastructure projects. Technological advancements, sustainability focus, and integration with connected home and IoT ecosystems are driving market potential, positioning Europe as a key region for innovation, investment, and expansion in smart flooring solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Flooring Market Insights

The Smart Flooring Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, driven by increasing adoption in commercial, residential, and public infrastructure projects, gradual technological advancements, and growing awareness of energy-efficient, sensor-enabled, and interactive flooring solutions. Investments in smart building initiatives, sustainability, and connected environments are supporting steady market expansion, positioning these regions as emerging markets with potential for future growth in smart flooring technologies.

Competitive Landscape for Smart Flooring Market:

Shaw Industries, established in 1946, is a prominent flooring company known for its innovative smart and resilient flooring solutions. The company emphasizes sustainability, combining durability with eco-friendly materials to deliver high-performance flooring for commercial and residential spaces. Through advanced technologies and intelligent design, Shaw Industries creates products that not only enhance aesthetics and functionality but also support environmental responsibility, reflecting its commitment to modern, intelligent, and sustainable flooring solutions worldwide.

-

In Nov 2024, Shaw Industries launched EcoWorx™ Resilient, a fully recyclable, PVC-free commercial flooring combining high performance, sustainability, and affordability, with low carbon impact and end-of-life recycling through the re[TURN]® program.

Shaw Industries, founded in 1946, is a leading flooring company offering innovative smart and resilient flooring solutions. The company focuses on sustainable, high-performance products integrating advanced technologies, catering to commercial and residential spaces with eco-friendly, durable, and intelligent flooring options.

-

In Dec 2024, flooring brands launched stylish, durable, and eco-friendly collections like Cali Mavericks, COREtec Wheat Oak, and i4F HerringB/ONE, offering modern design, resilience, and simplified installation for smart residential and commercial spaces.

Smart Flooring Companies are:

-

Pavegen

-

SensFloor

-

Future-Shape GmbH

-

Energy Floors

-

MariCare

-

Technis SA

-

Wixalia

-

American Pro Marketing (Smart Step)

-

Tarkett

-

Armstrong Flooring

-

Mohawk Industries

-

Forbo Flooring Systems

-

Interface Inc.

-

Gerflor

-

Mannington Mills

-

Balterio

-

LG Hausys

-

Samsung Electronics

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.37 Billion |

| Market Size by 2032 | USD 7.78 Billion |

| CAGR | CAGR of 46.33% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Hardware and Software) • By Technology(Sensor-Embedded Floor Tiles, Smart Heated Flooring (Electric and Hydronic), Energy-Harvesting Flooring, Static-Dissipative / ESD Smart Flooring, and Interactive LED / Visualisation Flooring) • By End-User(Residential, Commercial ,Industrial and Logistics, Sports and Fitness Facilities, Public Infrastructure / Smart-City Installations and Other End-Users) • By Application(Occupancy and Space-Utilisation Analytics, Fall Detection and Elderly-Care Monitoring, HVAC and Energy Management, Security and Access Control, Customer Engagement and Wayfinding, Gaming and Interactive Entertainment and Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Shaw Industries, Pavegen, SensFloor, Future-Shape GmbH, Scanalytics Inc., Energy Floors, MariCare, Technis SA, Wixalia, American Pro Marketing (Smart Step), Tarkett, Armstrong Flooring, Mohawk Industries, Forbo Flooring Systems, Interface Inc., Gerflor, Mannington Mills, Balterio, LG Hausys, Samsung Electronics. |