RFID Market Report Scope & Overview:

The RFID Market size was valued at USD 14.87 Billion in 2025E and is projected to reach USD 33.38 Billion by 2033, growing at a CAGR of 10.66% during 2026-2033.

The RFID Market is expanding due to the increasing demand for real-time asset tracking and inventory management across industries such as retail, healthcare, and logistics. Rapid adoption of IoT and smart supply chain solutions is driving the need for advanced RFID technologies. Growing focus on operational efficiency and cost reduction encourages businesses to deploy RFID systems. Technological advancements, including UHF and high-frequency tags, improve accuracy and range, boosting market adoption.

In 2024, the global RFID market surpassed $15.2 billion, with retail and logistics accounting for over 55% of deployments UHF RFID alone grew 19% YoY, enabling real-time inventory accuracy of 99%+ in smart supply chains.

To Get More Information On RFID Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 14.87 Billion

-

Market Size by 2033: USD 33.38 Billion

-

CAGR: 10.66% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

RFID Market Trends

-

Increasing integration of RFID with IoT devices enables real-time data capture, smarter supply chains, predictive analytics, and enhanced operational efficiency across industries globally.

-

Adoption of RFID in automated warehouses and inventory systems improves accuracy, reduces human error, streamlines logistics, and enables faster inventory reconciliation and tracking.

-

Development of Ultra-High Frequency (UHF) and High-Frequency (HF) RFID tags enhances read range, durability, and reliability, expanding applications in retail, healthcare, and industrial sectors.

-

Retailers increasingly use RFID for inventory management, anti-theft solutions, and omnichannel fulfillment, enhancing customer experience and reducing stockouts or overstock situations.

-

Governments and healthcare providers adopt RFID for asset tracking, patient monitoring, and supply chain transparency, driving regulatory support and widespread market deployment.

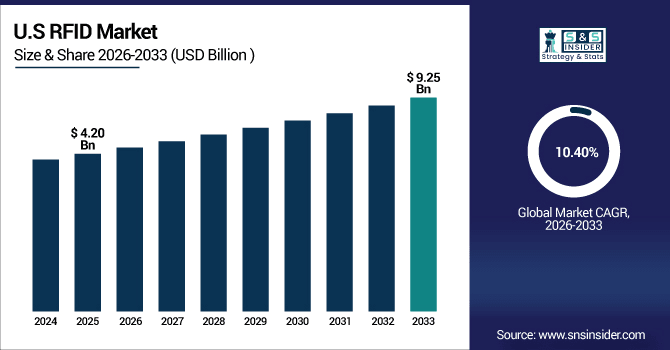

The U.S. RFID Market size was valued at USD 4.20 Billion in 2025E and is projected to reach USD 9.25 Billion by 2033, growing at a CAGR of 10.40% during 2026-2033. RFID Market growth is driven by widespread adoption in retail, healthcare, and logistics for inventory and asset tracking. Increasing implementation of IoT-enabled supply chain solutions enhances operational efficiency. Rising demand for automated warehouses and smart inventory systems accelerates market expansion. Technological advancements in UHF and HF RFID tags improve accuracy, range, and reliability.

RFID Market Growth Drivers:

-

Increasing Adoption of RFID for Smart Supply Chain and Asset Management Solutions.

The RFID market is driven by the growing need for real-time asset tracking, inventory management, and supply chain optimization. Businesses across retail, healthcare, logistics, and manufacturing are adopting RFID solutions to enhance operational efficiency, reduce human error, and minimize losses. Integration with IoT and cloud-based analytics enables smarter decision-making. Technological advancements in UHF and HF tags further improve accuracy, range, and durability, fueling widespread deployment.

In 2024, global RFID adoption surged with the market valued at $15.8 billion — UHF tags dominated 61% of deployments, enabling 98%+ inventory accuracy for retailers and logistics firms, reducing shrinkage by up to 30% and human error by 45%.

RFID Market Restraints:

-

High Implementation Costs and Complex Integration Hindering RFID Adoption

The RFID market faces restraints due to the high cost of RFID tags, readers, and associated software. Small and medium enterprises often find large-scale implementation expensive. Additionally, integrating RFID systems with existing enterprise resource planning (ERP) or warehouse management systems can be complex. Technical challenges like signal interference, environmental conditions, and data management also limit adoption, slowing down growth in cost-sensitive industries and regions.

RFID Market Opportunities:

-

Expansion of RFID Applications in Emerging Industries and IoT Integration

The RFID market offers opportunities through expansion into emerging sectors such as smart healthcare, automotive, and industrial automation. Increased adoption of IoT, AI, and blockchain technologies enhances RFID capabilities for real-time monitoring, predictive analytics, and supply chain transparency. Growing demand for smart warehouses, e-commerce inventory tracking, and regulatory compliance solutions further opens new revenue streams. Companies investing in innovative RFID solutions can capitalize on rising demand globally.

In 2024, smart healthcare and industrial automation drove 28% of new RFID deployments — AI-powered RFID systems enabled predictive asset maintenance in 40% of smart factories, while blockchain-integrated tags ensured end-to-end supply chain compliance for 25% of Fortune 500 logistics providers.

RFID Market Segment Analysis

-

By Product: Tags led the market with a 54.67% share in 2025E. Readers are the fastest-growing segment, with a CAGR of 12.30%.

-

By Application: Readers dominated the market with a 46.82% share in 2025E. Healthcare is the fastest-growing application, registering a CAGR of 11.67%.

-

By Frequency: Ultra-High Frequency (UHF) led the market with a 59.10% share in 2025E and is also the fastest-growing segment, with a CAGR of 12.34%.

-

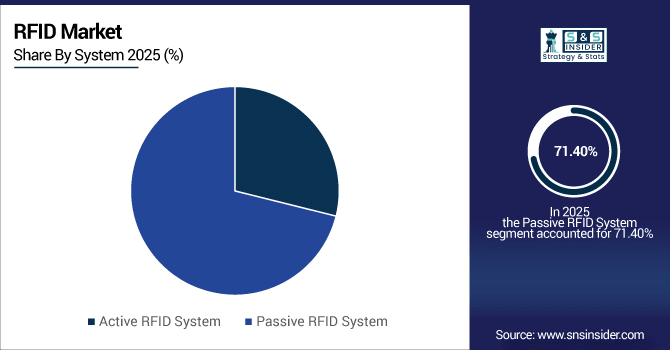

By System: Passive RFID systems held the largest share at 71.40% in 2025E. Active RFID systems are the fastest-growing, with a CAGR of 9.72%.

By System, Passive RFID System Lead While Active RFID System Grow Fastest

In the RFID market, passive RFID systems hold the largest share due to their lower cost, ease of deployment, and extensive adoption in retail, supply chain, and asset tracking. Passive systems are preferred for mass inventory and low-power applications. Conversely, active RFID systems are growing the fastest, fueled by increasing demand for real-time location tracking, long-range communication, and critical asset monitoring in logistics, healthcare, and industrial environments. Advancements in battery-powered tags and IoT-enabled active systems support rapid adoption, enhancing operational efficiency and visibility across industries.

By Product, Tags Leads Market While Readers Registers Fastest Growth

In the RFID market, tags hold the largest market share due to their extensive use in inventory management, asset tracking, and retail operations. They are cost-effective and available in various frequencies, making them versatile across industries. Tags enable accurate data collection and seamless integration with existing systems. Readers, on the other hand, are experiencing the fastest growth, driven by technological advancements and increasing deployment in automated warehouses, logistics, and healthcare applications. Rising demand for smart supply chains and IoT-enabled monitoring also accelerates reader adoption globally.

By Application, Readers Dominate While Healthcare Shows Rapid Growth

Among RFID applications, readers dominate the market as they are essential for scanning and capturing data from tags. Retail, logistics, and industrial sectors rely heavily on readers for real-time tracking, inventory management, and supply chain optimization. Healthcare is emerging as the fastest-growing application, driven by the need for patient tracking, asset management, and medical equipment monitoring. Increasing focus on patient safety, regulatory compliance, and efficiency in hospitals fuels healthcare adoption. IoT integration and digital transformation strategies further support growth in this sector.

By Frequency, Ultra-High Frequency Lead as well as Registers Fastest Growth

Ultra-High Frequency (UHF) leads the RFID market due to its long read range, high speed, and suitability for large-scale applications. UHF tags and readers are widely adopted in retail, logistics, and industrial sectors for fast and accurate data collection. Additionally, UHF is witnessing the fastest growth as organizations increasingly require real-time asset visibility and automated processes. High-frequency (HF) and low-frequency (LF) technologies maintain steady adoption but are limited to niche applications. Continuous technological improvements enhance UHF reliability, durability, and integration with IoT systems, driving overall market expansion.

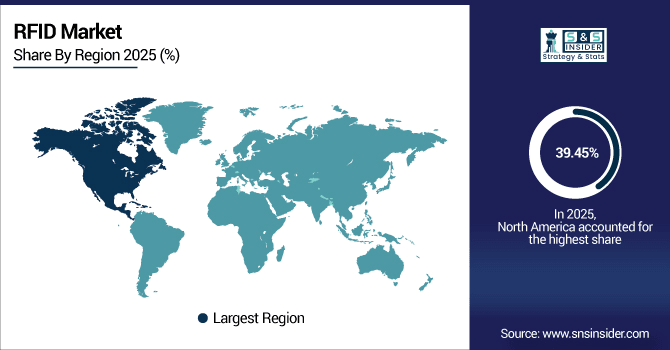

RFID Market Regional Analysis:

North America RFID Market Insights

In 2025E North America dominated the RFID Market and accounted for 39.45% of revenue share, this leadership is due to the high adoption in retail, healthcare, and logistics. The U.S. is the largest contributor, with investments in smart warehouses and IoT-enabled tracking solutions. Technological advancements in HF and UHF systems drive market expansion. Government and regulatory support for asset tracking and inventory transparency further promote adoption.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. RFID Market Insights

The U.S. RFID market is the largest in North America, driven by retail, healthcare, and logistics sectors adopting advanced tracking solutions. E-commerce growth and smart warehouse initiatives increase demand for UHF and HF tags.

Asia-pacific RFID Market Insights

Asia-pacific is expected to witness the fastest growth in the RFID Market over 2026-2033, with a projected CAGR of 11.33% due to growing adoption in retail, logistics, and industrial automation. China leads the region with large-scale deployment of tags and readers across supply chains. Rising e-commerce growth and smart warehouse initiatives fuel demand for RFID solutions.

China RFID Market Insights

China is the largest RFID market in Asia-Pacific, driven by strong retail, manufacturing, and logistics sectors. The government’s push for smart cities and Industry 4.0 adoption accelerates deployment. Major retailers and e-commerce players invest heavily in UHF tags and automated inventory systems.

Europe RFID Market Insights

Europe shows steady RFID market growth, led by Germany’s manufacturing and automotive sectors. Adoption in retail, healthcare, and logistics is increasing, supported by Industry 4.0 initiatives. Germany focuses on UHF and active RFID systems for smart factories and automated warehouses. Regional standardization and government incentives promote large-scale deployment.

Germany RFID Market Insights

Germany is a key contributor to Europe’s RFID market, driven by the automotive, manufacturing, and logistics sectors. UHF and active RFID systems are increasingly deployed for smart factories and automated warehouses. Retail and healthcare industries are adopting RFID for inventory accuracy and asset management.

Latin America (LATAM) and Middle East & Africa (MEA) RFID Market Insights

The RFID Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to growing in healthcare, transportation, and government asset tracking. Limited local manufacturing creates reliance on imports, but demand for smart supply chain solutions is increasing. Government initiatives and infrastructure modernization support growth.

RFID Market Competitive Landscape:

Zebra Technologies Corporation, is a leading provider of RFID solutions, offering a comprehensive range of products including handheld readers, printers, and software. The company serves various industries such as retail, healthcare, and manufacturing, focusing on improving asset tracking and inventory management.

-

In 2025, Zebra expanded its portfolio by acquiring Elo Touch Solutions, enhancing its presence in retail and self-service kiosks. The company continues to invest in research and development to strengthen its market position in the RFID industry.

Impinj, Inc. specializes in RAIN RFID solutions, providing high-performance readers, tags, and platforms that enable real-time inventory tracking and operational efficiency. The company's technology connects billions of everyday items, such as apparel, automobile parts, and shipments, to the Internet, facilitating data-driven decision-making.

-

In 2024, Impinj settled a patent dispute with NXP Semiconductors, strengthening its position in the RFID market. The company continues to innovate and expand its offerings to meet the growing demand for RFID solutions.

HID Global Corporation, is a prominent player in the RFID market, focusing on secure identity and access management solutions. The company offers a wide range of RFID products, including industrial tags and visual tag solutions, designed to operate in harsh environments. HID's technology serves various sectors such as banking, education, and healthcare, providing secure and efficient operations.

-

In 2024, HID Global expanded its RFID portfolio through acquisitions, enhancing its capabilities in secure identity solutions. The company continues to innovate and adapt to the evolving needs of its customers in the RFID industry.

Avery Dennison Corporation, is a global leader in RFID technology, specializing in passive RFID tags and labeling solutions. The company's products are widely used in retail, logistics, and supply chain management to improve inventory accuracy and operational efficiency. Avery Dennison's RFID solutions enable businesses to automate processes and enhance visibility across their operations.

-

In 2024, the company was recognized as the overall market leader in Digital Product Passport solutions, highlighting its innovation in RFID technology. Avery Dennison continues to drive growth in the RFID market through strategic investments and partnerships.

RFID Market Key Players:

Some of the RFID Market Companies are:

-

Zebra Technologies Corporation

-

Impinj, Inc.

-

HID Global Corporation

-

Avery Dennison Corporation

-

NXP Semiconductors

-

Honeywell International Inc.

-

Alien Technology LLC

-

Datalogic S.p.A.

-

GAO Group

-

Dipole RFID

-

Laird Technologies

-

Allflex

-

Invengo Information Technology Co., Ltd.

-

Nedap

-

Unitech Electronics Co., Ltd.

-

RFID Global Solution

-

SATO Holdings Corporation

-

FEIG ELECTRONIC GmbH

-

Siemens AG

-

TIBCO Software Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 14.87 Billion |

| Market Size by 2033 | USD 33.38 Billion |

| CAGR | CAGR of 10.66% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Tags, Readers, Software & Services) • By Application (Retail, Financial Services, Healthcare, Industrial, Government and Others) • By Frequency (Low Frequency (LF), High Frequency (HF) and Ultra-High Frequency (UHF)) • By System (Active RFID System and Passive RFID System) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Zebra Technologies Corporation, Impinj, Inc., HID Global Corporation, Avery Dennison Corporation, NXP Semiconductors, Honeywell International Inc., Alien Technology LLC, Datalogic S.p.A., GAO Group, Dipole RFID, Laird Technologies, Allflex, Invengo Information Technology Co., Ltd., Nedap, Unitech Electronics Co., Ltd., RFID Global Solution, SATO Holdings Corporation, FEIG ELECTRONIC GmbH, Siemens AG, TIBCO Software Inc. |