2D Barcode Reader Market Size & Trends:

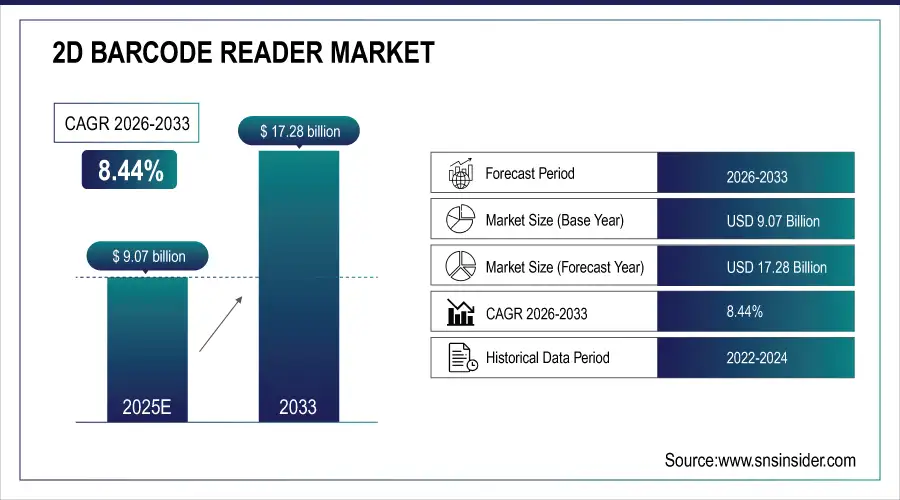

The 2D Barcode Reader Market size is estimated at USD 9.07 Billion in 2025E and is projected to reach USD 17.28 Billion by 2033, growing at a CAGR of 8.44% during 2026–2033.

The 2D barcode readers market is expanding rapidly due to the growing use of automated data capture technologies in the industrial, transportation, logistics, retail, and healthcare industries. The use of 2D barcode readers is expanding in both commercial and industrial settings due to growing demands for error-free inventory management, enhanced traceability, and fast scanning. Further promoting market expansion is the extensive usage of QR codes, Data Matrix codes, and PDF417 codes in supply chain tracking, digital payments, and product identification.

2D Barcode Reader Market Size and Growth Projection:

-

Market Size in 2025E: USD 9.07 Billion

-

Market Size by 2033: USD 17.28 Billion

-

CAGR: 8.44% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on 2D Barcode Reader Market - Request Free Sample Report

Key 2D Barcode Reader Market Trends:

-

Rapid growth in e-commerce and logistics is driving strong demand for high-speed 2D barcode readers to improve warehouse accuracy and throughput.

-

Expanding use of QR codes in payments, ticketing, and consumer engagement is accelerating large-scale deployment of 2D barcode readers in retail and hospitality.

-

Increasing track-and-trace regulations across pharmaceuticals, food, and healthcare are boosting adoption of 2D barcode readers for serialization and anti-counterfeiting.

-

Advances in imaging, CMOS sensors, and AI-based decoding are significantly improving scan performance on damaged or low-quality barcodes.

-

Miniaturized and rugged 2D barcode readers are seeing rapid adoption in industrial, manufacturing, and warehouse environments.

-

Integration of 2D barcode readers with mobile devices, cloud platforms, and IoT systems is enabling real-time data capture and analytics.

-

Growth of self-checkout and smart retail solutions is driving demand for embedded and presentation-based 2D barcode readers.

U.S. 2D Barcode Reader Market Analysis:

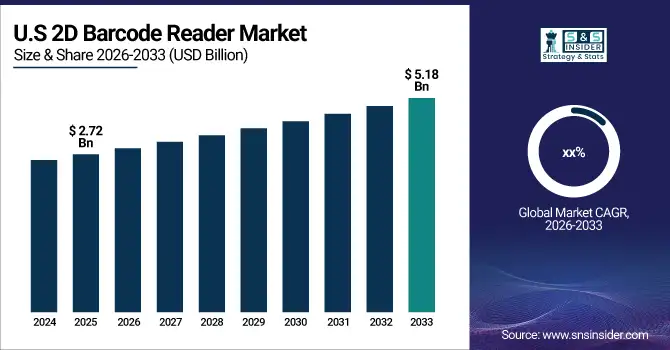

The U.S. 2D Barcode Reader Market size was estimated at USD 2.72 Billion in 2025E and is expected to reach USD 5.18 Billion by 2033. According to industry analysis, the U.S. leads global adoption of advanced barcode scanning solutions due to high penetration of e-commerce, automated warehousing, and omnichannel retail operations. Studies indicate that the deployment of high-performance 2D barcode readers can improve order picking accuracy by up to 40% and reduce inventory processing time by over 30%, significantly enhancing operational efficiency.

2D Barcode Reader Market Driver:

-

Rising Automation, E-commerce Growth, and Track-and-Trace Compliance Increase Demand for High-performance 2D Barcode Readers Across Retail, Logistics, and Healthcare

The rapid expansion of e-commerce, omnichannel retail, automated warehousing, and regulated supply chains is intensifying the need for fast, accurate, and reliable data capture, directly driving demand for advanced 2D barcode readers. This cause, growing order volumes, SKU complexity, and regulatory mandates for serialization and traceability, effects wider deployment of handheld, fixed-mount, and embedded 2D barcode readers capable of decoding QR, Data Matrix, and PDF417 codes in real time. As enterprises seek higher throughput, lower error rates, and end-to-end visibility, they increasingly specify imaging-based readers with omnidirectional scanning, high-resolution sensors, and AI-enhanced decoding, encouraging manufacturers to innovate in speed, ruggedness, and connectivity.

2D Barcode Reader Market Restraint:

-

Higher Upfront Costs, Integration Complexity, and Device Management Challenges Restrict Faster Adoption among Small and Price-sensitive Enterprises

While they have distinct functional advantages, advanced 2D barcode readers often come with a high price in terms of imaging sensors, processing capability, rugged enclosures and wireless connectivity, making them a tough sell for small retailers, SMEs and cost-sensitive operators. This leads to fragmented application environments and the requirement for seamless integration with POS systems, warehouse systems, and ERP systems, resulting in prolonged deployment cycles, increased IT setup, and continuous device operating cost. As the productivity gains are clear, the penetration will still be moderated in low-margin or low-volume use cases as organizations with limited budgets may struggle to shift from basic 1D scanners or smartphone-based solutions.

2D Barcode Reader Market Opportunity:

-

Integration of AI-enabled, Cloud-connected, and Mobile 2D Barcode Readers Opens New Value-added and Service-based Revenue Opportunities

The convergence of 2D barcode readers, AI-based image processing, cloud connectivity, and mobile computing platforms represent a key growth opportunity. This growth is driven by the increasing need for real-time visibility, analytics, and remote device management across distributed operations, leads to greater interest in smart barcode readers, ones which not only capture data but also analyzes scan performance, identify defects, and connect with the cloud dashboard. Matrix can also allow the bundling of hardware with software subscriptions, device management platforms and analytics services, extending the vendor balance sheet into recurring revenue models beyond a one-time sale of a scanner. These types of solutions also allow enterprises to help them optimize workflows, limit downtime, and adjust scanning performance on the fly, changing to different product mixes and operational conditions.

2D Barcode Reader Market Segmentation Analysis

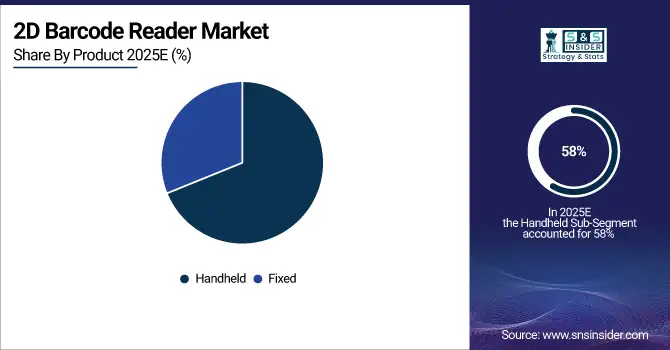

By Product, Handheld Barcode Readers Lead Market While Fixed Barcode Readers Register Fastest Growth

The Handheld 2D Barcode Reader segment dominated the market with the largest revenue share of around 58% in 2025E. Handheld scanners are widely adopted across retail stores, warehouses, healthcare facilities, and logistics hubs due to their flexibility, ease of use, and lower deployment cost. This cause, diverse scanning needs across dynamic environments and frequent product handling, effects strong preference for cordless and lightweight handheld readers capable of scanning damaged, poorly printed, or mobile-screen barcodes.

The Fixed 2D Barcode Reader segment is expected to grow at the fastest CAGR of approximately 9.4% during the forecast period. The segment’s expansion is driven by the rising automation in warehouses, distribution centers, and manufacturing lines is driving demand for fixed-mount scanners integrated into conveyors, sorting systems, and self-checkout kiosks.

By Application, E-commerce & Retail Lead Market While Factory Automation Registers Fastest Growth

The E-commerce & Retail segment had the highest revenue share of around 41% in 2025E due to major transaction volumes, omnichannel fulfillment strategies, and increasing proliferation of QR codes for payments, promotions and product information, resulting in large deployment of 2D barcode readers in both retail stores and online fulfillment centers. Due to this cause and the requirement for speedy checkout, true stock visibility, and diminished shrinkage, there may be strong demand for handheld and presentation-based 2D barcode readers throughout physical and digital retail touchpoints.

The Factory Automation segment is expected to grow with the highest CAGR of nearly 10.1% throughout the forecast period. Growing adoption of Industry 4.0 practices, smart manufacturing and real-time tracking of production contents is propelling the deployment of 2D barcode reader on assembly line and robotic workcells. This demand for accurate part, identification, traceability and quality assessment, results in the quick installation of stand-alone and embedded 2D barcode readers in automated inspection and material handling systems.

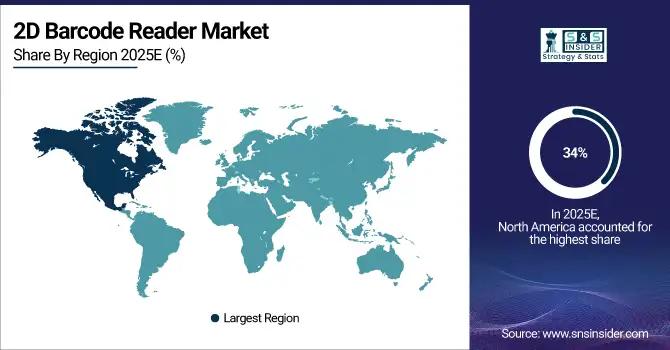

North America Dominates the 2D Barcode Reader Market in 2025E

The 2D Barcode Reader Market in North America is pegged to hold a share of around 34% in 2025E, driven by advanced retail infrastructure, high penetration of e-commerce and automation in warehousing and logistics. These causes, along with widespread acceptance of omnichannel retail models and the establishment of high-performance, wide-area fulfillment centers, drive ongoing demand for robust, high-performance handheld and fixed 2D barcode readers that can provide fast, accurate, and omnidirectional scanning. Presence of matured IT ecosystems, early adaptation of self-checkout systems and labor cost pressures will further strengthen the regional dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Leads the North American 2D Barcode Reader Market

High volumes of online orders, dense networks of distribution centers, and strict track-and-trace requirements in healthcare and pharmaceuticals concentrate demand for advanced scanning solutions. U.S.-based retailers and logistics providers increasingly deploy AI-enabled and cloud-connected 2D barcode readers, which studies show can improve inventory accuracy by over 35% and reduce fulfillment errors by up to 40%. Strong investment in automation and digital transformation ensures the U.S. remains the largest contributor to regional revenue and a key driver of global technology adoption.

Asia Pacific is the Fastest-Growing Region in the 2D Barcode Reader Market

Furthermore, the Asia Pacific is expected to record the highest growth with a CAGR of over 9.6% during the forecast period 2026–2033. The rapid growth of e-commerce, increasing warehouse automation, and rising adoption of digital payments through QR codes are accelerating the adoption of 2D Barcode Readers. This demand for low-cost hand-held readers, and high-speed fixed-mount scanners for retail, logistics and manufacturing applications is driven by the large consumer bases available in emerging economies and the rapid digitalization experienced in these regions.

China dominates the Asia Pacific 2D Barcode Reader Market in 2025

Massive e-commerce volumes, extensive use of QR codes for payments and services, and large-scale manufacturing activity generate high demand for 2D barcode readers across fulfillment centers, factories, and retail environments. Domestic OEMs integrate barcode readers into automated sorting systems and smart factories, while strong local manufacturing ecosystems and government-backed digital initiatives support continued market expansion. China’s scale and pricing influence significantly shape regional growth dynamics.

Europe 2D Barcode Reader Market Insights, 2025

Europe with well-developed retail networks, increasing demand for warehouse automation and food, pharmaceutical, and industrial goods traceability regulations attracts around 27% of the world 2D Barcode Reader Market in 2025E. Reasons for this include regulatory focus towards product serialization and consumer safety, implementation of more than 2D barcode reader for 2D barcode compliance, inventory control and quality control. Durability, with ergonomic and energy-efficient features, is crucial for the scanners in enterprise settings which acts as a major driver for steady demand across multiple end-use sectors in Europe.

Germany leads the European 2D Barcode Reader Market

Due to its strong manufacturing base, advanced logistics infrastructure, and leadership in Industry 4.0 initiatives. High adoption of factory automation and smart warehouses increases demand for fixed and embedded 2D barcode readers used in production tracking and material flow management. Germany’s focus on engineering precision, process efficiency, and compliance with strict quality standards sustains its leading role in regional market growth.

Middle East & Africa and Latin America 2D Barcode Reader Market Insights, 2025

Middle East & Africa and Latin America 2D barcode reader market would continue on their path to normal growth around 2025E fueled by the growing retail network development, rationalization of logistics infrastructure and services, and the expanding digital payment, and tracking solutions. With e-commerce expansion and warehouse automation boosting growth in Brazil, coupled with continued smart retail, logistics hubs, and digital transformation initiatives in the UAE and Saudi Arabia driving adoption, the overall growth of the market in Latin America and the Middle East & Africa is expected to continue to develop over the retail, warehousing, and transportation segments over the forecast period.

2D Barcode Reader Market Competitive Landscape:

Based in the U.S. Zebra Technologies Corporation, is one of the leading mobile computing and barcode printing/scanning companies globally. The company’s dominance is driven by its comprehensive portfolio, which ranges from enterprise-grade handheld scanners and mobile computers to advanced fixed industrial scanning and machine vision solutions. The company’s dominance also lies in its deep workflow optimization understanding for retail, manufacturing, and transportation & logistics, further offering highly integrated hardware, software, and services.

-

In September 2025, to increase first-pass scan rates by up to 30% in demanding retail and warehouse settings, Zebra introduced the next-generation DS9900 Series of rugged handheld imagers. These devices have improved AI-based decoding and all-day battery life.

A strong rival with a stellar record for durable, dependable, and high-performing scanning gear is Honeywell International Inc., a U.S.-based company. Honeywell offers a wide range of products, including robust industrial fixed-mount readers, wearable technology, and ergonomic handheld scanners. Its strong channel relationships and emphasis on productivity-boosting solutions for industries including parcel delivery, healthcare, and retail guarantee its place as a leading player.

-

In January 2025, targeting high-speed parcel and manufacturing sorting applications, Honeywell unveiled its new Honeywell Momentum 2D Fixed Mount Scanner series, which boasts ultra-high-speed reading and a proprietary optical design for enhanced performance on shiny and low-contrast surfaces.

Cognex Corporation, is a U.S.-based leading provider of machine vision, which dominates the vision software and high-end fixed industrial scanning segment in the country. Cognex is the preferred supplier for intricate applications in automotive, electronics, and logistics where exceptional speed, accuracy, and robotic integration are crucial. The company is well-known for its technologically advanced DataMan series of fixed-mount barcode readers and advanced vision software, such as In-Sight and VisionPro.

-

In November 2025, Cognex introduced the DataMan 470 series with Deep Learning 2.0, which largely improves the read rates on several highly degraded, distorted, or directly marked (DPM) codes that are common in electronic and automotive manufacturing, further decreasing line misreads and stoppages.

Leading 2D Barcode Reader Companies are:

-

Honeywell International Inc.

-

Denso Wave Inc.

-

SICK AG

-

Keyence Corporation

-

Datalogic S.p.A.

-

Panasonic Corporation

-

SATO Holdings Corporation

-

Toshiba TEC Corporation

-

Wasp Barcode Technologies

-

Omron Microscan Systems, Inc.

-

Code Corporation

-

Socket Mobile, Inc.

-

Unitech Electronics Co., Ltd.

-

Opticon Sensors Europe B.V.

-

Newland EMEA (Newland Digital Technology)

-

Casio Computer Co., Ltd.

-

JADAK – A Novanta Company

-

Scandit AG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 9.07 Billion |

| Market Size by 2033 | USD 17.28 Billion |

| CAGR | CAGR of 8.44 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Handheld, Fixed) • By Application (Warehousing, E-commerce & Retail, Logistics, Factory Automation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Zebra Technologies Corporation, Honeywell International Inc., Denso Wave Inc., Cognex Corporation, SICK AG, Keyence Corporation, Datalogic S.p.A., Panasonic Corporation, SATO Holdings Corporation, Toshiba TEC Corporation, Wasp Barcode Technologies, Omron Microscan Systems, Inc., Code Corporation, Socket Mobile, Inc., Unitech Electronics Co., Ltd., Opticon Sensors Europe B.V., Newland EMEA (Newland Digital Technology), Casio Computer Co., Ltd., JADAK – A Novanta Company, Scandit AG |