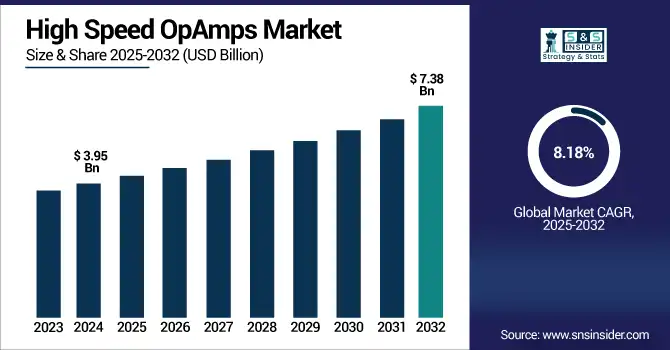

High Speed OpAmps Market Size & Growth:

The High Speed OpAmps Market Size was valued at USD 3.95 billion in 2024 and is expected to reach USD 7.38 billion by 2032 and grow at a CAGR of 8.18% over the forecast period 2025-2032.

To Get more information on High Speed OpAmps Market - Request Free Sample Report

The global market includes market segment analysis, strategic market insights per key region, and competition. High-speed operational amplifiers are being adopted due to the increasing need for high-frequency signal processing in industries such as telecommunications, instrumentation, and medical diagnostics. High Speed OpAmps Market analysis highlights emerging use-cases and innovation trends as miniaturization, increasing adoption in smart electronics, and a growing desire for faster and more efficient analog systems drive global use in both commercial and research applications.

For instance, over 4 billion medical imaging procedures are performed annually worldwide, many relying on high-speed signal amplification.

The U.S. High Speed OpAmps Market size was USD 1 billion in 2024 and is expected to reach USD 1.83 billion by 2032, growing at a CAGR of 7.83% over the forecast period of 2025–2032.

The U.S. market is largely propelled by fast-paced technological advancements in aerospace, defense, and precision instrumentation industries. Growth is driven by strong R&D ecosystem, early deployment of next-generation communication technologies and few of leading semiconductor companies. All of these contribute to an environment of innovation in the field of high speed analog design to improve performance, decreasing latency and improving signal integrity for modern electronic systems which will underpin the continued leadership of USA in high-speed OpAmp usage and technology.

For instance, over 70% of global high-frequency lab instrumentation systems are designed or prototyped in the U.S., due to its strong R&D backbone.

High-speed Operational Amplifier Market Dynamics:

Key Drivers:

-

Growing Demand for High-Speed Signal Processing in Telecommunication and 5G Infrastructure Globally

With the rapid development of 5G and high frequency telecom networks globally, the integration of high-speed OpAmps is experiencing a wide range of applications. These amplifiers provide a significant advantage in sending signals precisely and at lightning speed over routers, base stations and fiber-optic systems. With data center and satellite link data communications under increasing pressure to deliver non-blocking low-latency, high-bandwidth communications, manufacturers are extending their spectrum with OpAmps suitable for GHz-range operations that provide high levels of performance relevant to next-generation network infrastructures by aligning with growing interest in multi-channel data transmission at larger and larger signal levels.

For instance, over 70% of telecom system upgrades in 2024 included components operating above 1 GHz bandwidth.

Restraints:

-

High Cost of Design and Complex Integration in Advanced Systems

Designing high-speed Op Amps that will perform at GHz frequencies is a nontrivial and expensive endeavor. These devices typically have stringent layout, noise mitigation and thermal management needs. This high development cost makes entry difficult for many smaller or mid-sized manufacturers or integrators. In fact, while high-speed OpAmps allow great performance, they have a requirement of customization at the system level, hence it increases both the R&D time and the cost, making it difficult to deploy them in a cost-sensitive market segment.

Opportunities:

-

Integration with AI-Powered Edge Devices and Sensor Networks

High-speed analog front-ends are needed for AI-integrated edge devices for autonomous vehicles, smart cities, and industrial IoT applications. In sensor signal conditioning, where ultra-fast response times are required, high-speed OpAmps are indispensable. High Speed OpAmps Market trends reveal growing relevance in edge computing. Companies focusing on AI-enabled edge hardware can find plentiful opportunities by integrating OpAmps with a high slew rate, low latency, and low noise, as real-time data analysis gains momentum.

For instance, over 30 billion IoT-connected sensors are expected to be in use by 2025, many needing high-speed analog interfaces.

Challenges:

-

Thermal Management Issues in High-Frequency, High-Density Circuit Designs

Heat becomes one of the critical problems in high density and high-speed systems. With frequencies of operation increasing, the challenge of managing thermal loads without degrading performance or substantially increasing footprint becomes a serious engineering challenge. Insufficient thermal management can cause drift signals, shorten the life cycle, and break. With miniaturization continuing to push the envelope and demand high performance and high speed, power efficiency vs heat dissipation is now a key challenge in high speed and high performance OpAmp across the industries.

High Speed Op Amps Market Segmentation Analysis:

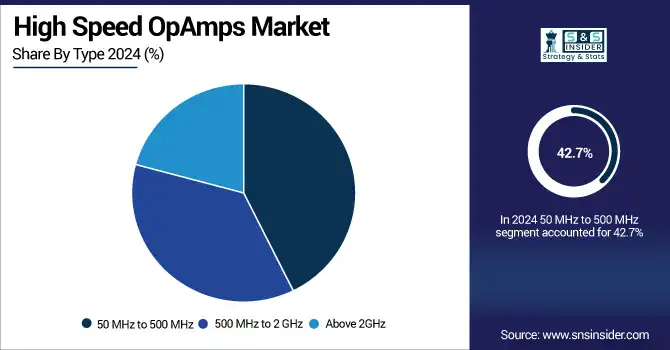

By Type

50 MHz to 500 MHz held the highest High Speed OpAmps Market share of around 42.7%. It is widely compatible with numbers of applications such as industrial control systems, consumer electronics, low-to-mid frequency communication devices, this is why this dominance. This is all supported in this space with broad portfolios such as provided by Analog Devices, Inc., which makes it possible for engineers to create flexible, low-power analog circuits at scale. These OpAmps are the perfect compromise between speed, cost, and stability for high volume applications.

The Above 2GHz segment is anticipated to achieve the highest CAGR, nearly at 9.06%. The burgeoning demand emerging 5G base stations, radar systems, RF instrumentation, and high-performance computing applications demanding high signal speeds and low latency is driving this growth. Texas Instruments, another key player in this segment, is broadening its product range for GHz-level requirements in aerospace, defense and of course communications applications. As this trend towards faster, more complex systems continues, the adoption of ultra-high frequency OpAmps will likely become ever more frequent.

By Application

The instrumentation segment accounted for the largest revenue share of approximately 33.2% in 2024. This dominance is due to the widespread adoption of industrial test equipment, signal analyzers, and control systems that require precision and reliability. Varying solutions are provided by various companies such as STMicroelectronics by providing customized OpAmp that enable complex high-speed, low-noise signal chains for various instruments The usage in military, scientific and automation industrial environments shows that for many high-performance systems, instrumentation-grade amplifiers are essential.

Telecommunication segment is anticipated to register fastest CAGR of around 9.29% over the forecast period 2024–2032. This is fueled by the global expansion of 5G, fiber-optic networks and low-latency services. To signal conditioning and optical transceivers, high-speed OpAmps are essential. Maxim Integrated have been designing amplifiers focused on high performance analog ICs for years optimized for communications infrastructure. A growing need for bandwidth — air data moving from 1G to real-time, fast data environments continues fueling High Speed OpAmps market growth.

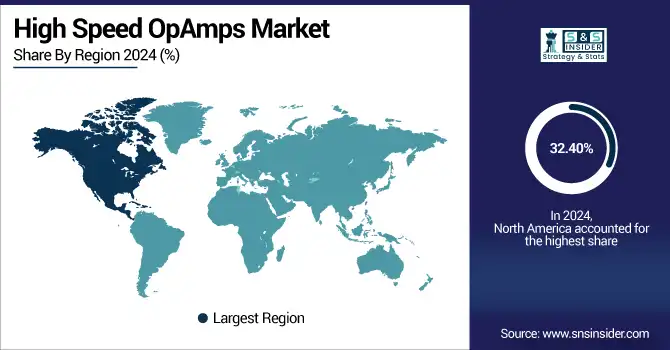

High Speed OpAmps Market Regional Overview:

North America dominated the High Speed OpAmps Market with the high revenue share of approximately 32.40% in 2024. The dominance of the region is backed by a well-established semiconductor ecosystem, healthy aerospace and defense investments, and focus of major plants on Analog ICs and mixed-signal IC development. High density instrumentation companies and the constantly evolving need of next-gen communication and medical electronics is keeping North America in the lead of demand for high-speed OpAmps.

-

The U.S. dominates the North American High Speed OpAmps industry due to its robust semiconductor industry, strong R&D ecosystem, and extensive defense and aerospace applications, supported by key players such as Texas Instruments and Analog Devices driving constant technological innovation.

The Asia Pacific segment is estimated to witness the highest CAGR of around 9.14% during the forecast years from 2024 to 2032. The expansion is primarily due to the quick construction of industries, the quick establishment of electronics fabrication centers in China, South Korea, and Taiwan, and the increasing consumer electronics and telecom infrastructure demand. The rapid growth rate of the high-speed analog semiconductor segment in the greater Asia-Pacific region continues to be propped up by government-led drives towards semiconductor self-reliance and rising R&D spending by Asian tech juggernauts.

-

China leads the Asia Pacific market owing to its massive electronics manufacturing base, rapid 5G rollout, and strong government backing for semiconductor self-sufficiency, with domestic giants such as HiSilicon and industry investments accelerating demand for high-speed analog components.

Europe holds a significant position in the High Speed OpAmps Market, attributed to increased demand in automotive electronics, automation, and precise medical devices. Germany and France are among the leading adopting nations, propelled by deep-rooted manufacturing infrastructure for smart technologies and governments favouring innovation. European businesses need more high-speed analog components to ensure signal accuracy at system level in smart mobility and healthcare applications.

-

Germany dominates the European High Speed OpAmps Market due to its advanced automotive and industrial sectors, strong R&D capabilities, and a high concentration of OEMs. Its focus on precision electronics and automation drives consistent demand for high-speed analog components.

UAE is leading the Middle East & Africa High Speed OpAmps Market due to the fastest digital transformation and developed telecom industry along with the adoption of smart infrastructure projects. Brazil continues to lead in Latin America and is likely to do so with a balanced combination of expanding electronics manufacturing, increasing telecom demand, and local government support for industrial and technological development throughout the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

High Speed OpAmps Companies are:

Key Players in High Speed OpAmps Market are Texas Instruments Incorporated, Analog Devices, Inc., STMicroelectronics N.V., Maxim Integrated (now part of Analog Devices), ON Semiconductor (onsemi), Renesas Electronics Corporation, Infineon Technologies AG, NXP Semiconductors N.V., Microchip Technology Inc. and Cirrus Logic, Inc and others.

Recent Developments:

-

In July 2024, ST introduced the TSB952, a 52 MHz dual op-amp with rail-to-rail input/output, designed for automotive and industrial-grade environments. The release addresses demand for high-speed, high-reliability analog components in compact form factors.

-

In March 2024, at Embedded World 2024, TI launched the OPA2891 and OPA2892, high-speed op-amps targeting communications and signal processing. With bandwidths of 180 MHz and up to 2 GHz, they support ultra-low distortion applications, marking TI’s strategic expansion in precision analog solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.95 Billion |

| Market Size by 2032 | USD 7.38 Billion |

| CAGR | CAGR of 8.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (50 MHz to 500 MHz, 500 MHz to 2 GHz and Above 2GHz) • By Application (Instrumentation, Telecommunication, Laboratory, Medical System and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Texas Instruments Incorporated, Analog Devices, Inc., STMicroelectronics N.V., Maxim Integrated (now part of Analog Devices), ON Semiconductor (onsemi), Renesas Electronics Corporation, Infineon Technologies AG, NXP Semiconductors N.V., Microchip Technology Inc. and Cirrus Logic, Inc. |