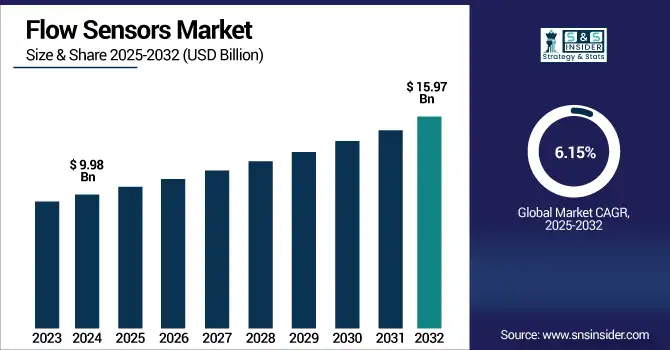

Flow Sensors Market Size & Growth:

The Flow Sensors Market Size was valued at USD 9.98 billion in 2024 and is expected to reach USD 15.97 billion by 2032 and grow at a CAGR of 6.15 % over the forecast period 2025-2032.

The global market is experiencing robust growth, with rising industrial automation, growing energy efficiency, and increasing expansion across multiple process industries. In addition, large investments in infrastructure development around the globe continue to boost the overall growth trend. The opportunity of benefiting from the fast and easy integration of IoT and smart technologies in the process flow monitoring creates favorable conditions for the extensive market growth in numerous sectors in the future. This enables real-time data analytics, providing the possibility to tailored the operations to requirements.

To Get more information on Flow Sensors Market - Request Free Sample Report

The U.S. Flow Sensors Market size was USD 2.36 billion in 2024 and is expected to reach USD 3.28 billion by 2032, growing at a CAGR of 4.30 % over the forecast period of 2025–2032.

The US flow sensors market growth is expanding and emboldened by rising demand for more sophisticated flow measurement solutions in water management, oil & gas, and chemical industries. Additionally, the U.S. government is focusing on increasing industrial efficiency and smart sensor integration enabled by the internet of things is also playing a critical role in expanding the market. The advancements and an increasing emphasis on sustainable business methods are among the reasons.

Flow Sensors Market Dynamics

Key Drivers:

-

Industrial automation and smart factory trends are driving the adoption of advanced flow sensors across multiple industries globally.

Automation and smart manufacturing are becoming more widely adopted across industrial sectors to improve their operational efficiency and minimize time losses. Flow sensors are used to monitor and regulate fluid flow and are a necessary element for achieving peak process performance. The integration of flow sensors with IoT platforms allows real-time data collection and remote monitoring, further enhancing their value in smart factory ecosystems, fostering predictive maintenance and resource optimization. Growing demand for precision in process industries such as oil & gas, chemicals, and pharmaceuticals is fostering greater adoption of technologically advanced flow sensors worldwide.

According to research, over 65% of large manufacturing firms worldwide have integrated IoT-enabled sensors into their operations as of 2024.

Restrain:

-

Calibration and maintenance challenges can affect sensor accuracy and long-term operational reliability.

Regular calibration and maintenance are needed due to the technical limitations of the flow sensors. The factors that can affect the sensors over time and must be controlled to ensure the assess the flow accuracy are the nature of the fluid, temperature variation, and the buildup of contaminants. Maintenance of the flow sensor can be time-consuming and include various complexities, especially in industries with harsh systems. Moreover, incorrect calibration can lead to large measurement errors, which may result in complications like product quality lack, non-compliant products, and inefficiencies. Both of the factors, the need for maintenance and human error, deter industry players from implementing flow sensor systems long-term.

Opportunities:

-

Emergence of Industry 4.0 and digital twin technologies is boosting demand for advanced, data-driven flow sensing solutions.

The rise of Industry 4.0 has revolutionized industrial operations by placing a renewed focus on data-driven decision-making and actionable real-time intelligence. Connected via digital platforms and powered by sophisticated sensing and analytics technology, flow sensors can integrate easily into a digital twin. This virtual model can predictively analyze, maintain, and monitor flow processes, as well as optimize them. Industries are implementing digitalisation at an accelerating pace to boost operating efficiency, reduce downtime, and raise product quality, driving simultaneous growth. This has created attractive markets for sensor makers to develop high-performance, digitally linked flow-sensing offerings to fuel broader smart factory environments.

According to research, Companies using digital twins report up to 30% improvement in process efficiency and up to 25% reduction in downtime.

Challenges:

-

Data security concerns and lack of standardization hinder the integration of flow sensors in IoT-driven industrial environments.

As flow sensors get more connected and integrated into industrial IoT platforms, data security becomes a major concern. Connected devices and unsecured communication links are vulnerable. The absence of standardized protocols to facilitate the smooth incorporation of different systems, along with unified data formats, additionally hinder the development of scalable, interoperable solutions. To alleviate the cybersecurity and standardization issue, rigorous encryption measures and widely-accepted industrial communication protocols are required for secure, safe implementation of flow sensor solutions in modern connected industrial environments.

Flow Sensors Market Segment Analysis:

By Type

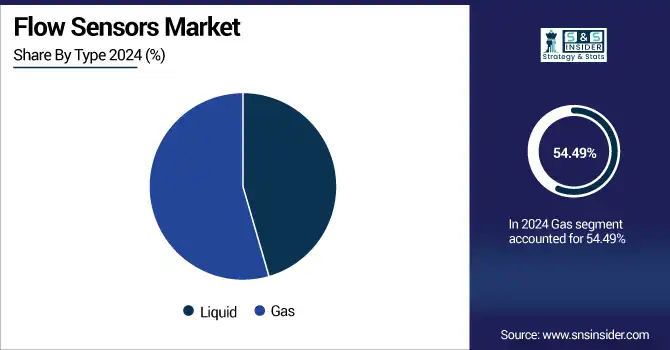

The Gas segment dominated the highest Flow Sensors Market share of approximately 54.49% in 2024. This position has been primarily driven by the vast use of gas flow sensors on key business fronts such as oil and gas, power generation sector, and chemical processing, among others. Key market players such as Honeywell International Inc. play a significant role in the provision of robust gas flow sensing alternatives. The hefty market share of this segment is also enhanced by the expansive use of natural gas as an energy source and the development in the global gas infrastructure, which is facilitated by gas being an efficient and low-emission option.

The Liquid segment is expected to grow at the fastest CAGR of approximately 7.04% from 2025-2032.This high growth is the result of the increasing need for precise liquid flow measurement in multiple industries, such as water and wastewater management, pharmaceuticals, food and beverage, and medical devices. Siemens AG is one of the leading companies offering high-tech liquid flow sensor technologies. Urbanization and industrialization are triggering the requirement for effective water resource management and treatment. Moreover, the high advances in liquid-based diagnostic devices and growing automation in manufacturing processes significantly increase the adoption of liquid flow sensors, ensuring precise fluid handling and quality control.

By Application

The Process Industries segment dominated the Flow Sensors Market with the highest revenue share of approximately 29.73% in 2024. This dominance of the segment is ascribed to the critical need for continuous and precise flow measurement in extensive industrial processes within the oil and gas, chemicals, power generation, and manufacturing sectors. Leading providers in this space are Emerson Electric Co. In complex environments like these, flow sensors are the only choice to control processes, ensure safety, quality assurance, and optimize the utilization of resources. The complexity and scale of these operations are such that strong, dependable flow sensing solutions are required; thus, process industries would be the largest application area.

The Environmental segment is expected to grow at the fastest CAGR of approximately 7.49% from 2025-2032. This rapid growth is mainly attributed to the growing global awareness towards the environmental monitoring and pollution control. Flow meters are essential to overseeing waste water run-off, air quality, smoke stack emissions, and optimal utilization of water resources. Flow Sensors Companies such as Sensirion AG, on the other hand, are involved in sensor-specific efforts for environmental purposes. Moreover, the adoption of sustainable solutions, the initiation of climate change schemes, and the continuous assistance of precise data for environmental compliance cases boost the demand for flow sensing equipment in various environmental settings such as green technologies and smart cities.

By Technology

The Differential Flow segment dominated the Flow Sensors Market with the highest revenue share of approximately 32.17% in 2024.Differential pressure flow meters like orifice plates, venturi tubes, and nozzles are highly established, low-cost, and dependable for a variety of industrial uses and hence have seen this dominance. One of the leading companies providing differential flow sensing technologies is ABB Ltd. Their ruggedness, simplicity, and versatility to deal with different types of fluids and conditions make them a choice in oil and gas, chemical, and power generation industries where established, mature technologies are paramount due to their reliability.

The Ultrasonic segment is expected to grow at the fastest CAGR of approximately 7.50% from 2025-2032. This rapid growth is fueled by the non-invasive nature of ultrasonic flow sensors, which offers advantages like no pressure drop, no moving parts, and suitability for corrosive or abrasive fluids. Endress+Hauser is one of the companies that have developed advanced ultrasonic flow meters, and the overall market growth is facilitated due to the rising demand for highly-accurate and low-maintenance, as well as hygienic flow measurement in industries such as water and wastewater, food and beverage, and pharmaceuticals. Sensor technology is also developing, and recent designs from that group include the clamp-on and multi-path sensors. This ensures that flow measurement using ultrasonic sensors grows further due to the favorable and versatile sensor-environment capabilities.

Flow Sensors Market Regional Overview:

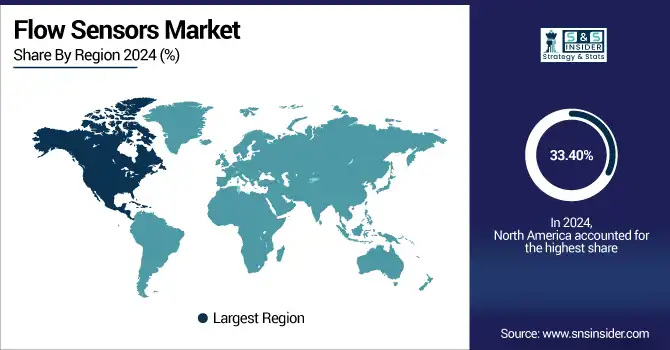

North America had the largest revenue share of about 33.40% in 2024 in the Flow Sensors Market. It owes this dominance to the advanced industrial base of the region, especially in the oil and gas, chemical processing, and power generation industries. Hefty spending in research and development, as well as a very high rate of adoption of industrial automation and smart manufacturing techniques, has further tightened its grip on the market. The existence of leading flow sensor manufacturers and robust regulatory systems promoting efficiency as well as safety is also responsible for the market leadership in North America.

-

The U.S. leads the North American market for flow sensors for the same reasons as mentioned earlier. The country has a strong industrial base especially oil & gas and manufacturing. Added to that are robust technological capabilities, high R&D expenditure, and quick uptake of cutting-edge automation and IoT solutions. These also drive demand for accurate flow measurement.

The Asia Pacific segment is anticipated to experience the highest CAGR of around 7.51% throughout the period of 2025-2032. This rapid growth is due to the fact that this region is experiencing fast-paced industrialization, urbanization, and increased government initiatives and policies toward energy efficiency and sustainable water management. Countries like China and India have seen huge investments into manufacturing, infrastructure development, and smart city projects, hence increasing the demand for such advanced flow sensors considerably. The growing adoption of Industry 4.0 and IoT technologies in Asian industries further accelerates this growth, creating lucrative opportunities for market players.

-

China is leading the Asia Pacific flow sensors market with its high-speed industrialization, massive manufacturing industry, and widespread smart factory programs such as "Made in China 2025." Heavy government incentives and investments in digital technologies, including 5G and IoT, are propelling mass-scale adoption of advanced flow sensing solutions by various industrial verticals.

Europe has a vast flow sensors industry due to stringent environmental regulations, high industrial automation, and extensive use of industry 4.0. Germany and the UK are leading the charge in investing in innovative manufacturing and green practices. It implies that the use of accurate flow measurement in water management, chemicals, and energy industries needs to increase to maintain compliance and optimal operational practices.

-

Germany has been the primary country of the Flow Sensors Market throughout Europe. This is characterized to its strong industrial base, especially in advanced manufacturing and automotive/chemical industries. With the German government’s extreme focus on Industry 4.0 and heavy investment in state-of-the-art research and development activities, the nation is suitable for the implementation of complex flow sensing solutions. This technological leadership and a widespread demand for precision in industrial processes solidify Germany's top position in the European market.

The Middle East & Africa and Latin America flow sensors markets are experiencing strong growth. MEA’s expanding market is fueled by high investments in the oil & gas industry and diverse diversification plans and Latin America’s by industrialization and urbanization. Moreover, both regions enjoy the rise of automation and IoT industries that stimulate accurate fluid management across a wide range of industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Flow Sensors Companies are:

Major Key Players in Flow Sensors Market are Rechner Sensors, Proxitron GmbH, Siemens AG, Sika AG, First Sensor AG, Emerson Electric Co., SICK AG, OMEGA Engineering, Christian Bürkert GmbH & Co. KG, TSI and others.

Recent Development:

-

In May 2025, ION SENSE (part of TE Connectivity, which acquired First Sensor) unveiled revolutionary new PID Sensors for gas detection. While not purely flow, these highly sensitive sensors are crucial for broader air quality monitoring, which often involves flow measurement.

-

April 2025, Bürkert announced that their Type 8098 FLOWave S flowmeter is now available with an optional IO-link option. This enhances its digital connectivity and integration into smart systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.98 Billion |

| Market Size by 2032 | USD 15.97 Billion |

| CAGR | CAGR of 6.15% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Liquid, Gas) • By Application (Automotive, Consumer Electronics, Environmental, Healthcare/Medical, Process Industries, Other Applications) • By Technology (Coriolis, Differential Flow, Ultrasonic, Vortex, Other Technologies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rechner Sensors, Proxitron GmbH, Siemens AG, Sika AG, First SensorAG, EmersonElectric Co., SICK AG, OMEGA Engineering, Christian Bürkert GmbH & Co. KG, TSI. |