Robotic Arm Market Report Scope & Overview:

Get More Information on Robotic Arm Market - Request Sample Report

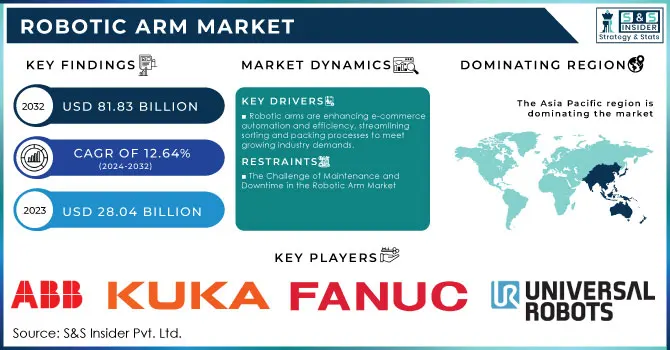

The Robotic Arm Market size was valued at USD 28.04 Billion in 2023 and is expected to reach USD 81.83 Billion by 2032 and grow at a CAGR of 12.64% over the forecast period 2024-2032.

The robotic arm market is set for considerable expansion, fueled by advancements in Industry 4.0 and the growing integration of Internet of Things (IoT) technologies within manufacturing. Notably, the number of active industrial robots worldwide is increasing at an impressive rate of approximately 14% per year. The GermX Initiative is at the forefront of this industrial transformation, promoting the creation of "data spaces" that enhance collaboration throughout the manufacturing sector. This initiative underscores the critical role of interoperability in unlocking the full potential of Industry 4.0. VDMA, the largest industrial association in Europe, is focused on establishing standardized machine communication via the OPC UA framework, which has already been adopted by over 700 companies globally. Robotic arms are particularly impactful in sectors such as automotive and electronics, where they are deployed for a variety of tasks, including assembly, welding, quality inspection, and precision surgery. Collaborative robots, or cobots, which are designed to work alongside human operators, are gaining popularity for their enhanced flexibility and efficiency, especially among small and medium-sized enterprises.

Moreover, the logistics and warehousing industries are undergoing a significant transformation, as robotic arms play a crucial role in sorting, packing, and transporting goods, thereby enabling businesses to efficiently meet the rising demands of e-commerce. Additionally, advancements in artificial intelligence and machine learning are further augmenting the capabilities of robotic arms, making them smarter and more adaptable, which solidifies their importance in the future of manufacturing. In summary, the robotic arm market is on the cusp of substantial growth, driven by Industry 4.0, and is establishing automation as a vital component of modern manufacturing strategies. The key statistics and trends highlight the necessity for businesses to embrace these technologies to maintain competitiveness in an ever-evolving industrial landscape.

Robotic Arm Market Dynamics

Drivers

-

Robotic arms are enhancing e-commerce automation and efficiency, streamlining sorting and packing processes to meet growing industry demands.

The increasing demand for automation is one of the primary market drivers for the robotic arm industry, especially in sectors like e-commerce and logistics. As businesses seek to enhance operational efficiency and productivity, robotic arms are becoming essential tools for streamlining various processes, including sorting, packing, and inventory management. E-commerce companies, particularly those facing economic pressures, are increasingly adopting robotic solutions to automate resource-intensive tasks, which helps reduce labor costs and minimize human error. The rise of smart warehouses facilitated by the integration of advanced technologies such as artificial intelligence further amplifies the capabilities of robotic arms, positioning them as indispensable assets for meeting the challenges of high-volume order fulfillment. This trend toward automation not only optimizes supply chains but also significantly improves customer experiences. Additionally, technological advancements are making robotic arms more accessible and affordable for small and medium-sized enterprises, thus broadening their market reach.

Restraints

-

The Challenge of Maintenance and Downtime in the Robotic Arm Market

A major constraint on the robotic arm market is the challenge posed by maintenance and downtime, which can significantly disrupt operations and incur additional costs. Although robotic systems are engineered for high efficiency, they require consistent maintenance to maintain optimal functionality and extend their lifespan. This maintenance typically involves routine inspections, part replacements, and software updates, all of which demand dedicated personnel and resources. For instance, in surgical robotics utilized for procedures like colorectal cancer surgery, any downtime can hinder crucial operations, negatively affecting patient care and hospital efficiency. Companies such as Universal Robots are actively seeking partnerships to bolster the capabilities and reliability of their robotic arms, indicating that even cutting-edge systems face operational hurdles. When robotic arms malfunction or need servicing, it can lead to considerable interruptions in production lines, especially in manufacturing and logistics, where rapid task handling—like sorting, packing, and assembly—is essential. The financial repercussions of lost productivity during these downtimes can be significant, particularly for businesses striving to stay competitive. This risk is heightened in sectors like e-commerce, where prompt order fulfillment is vital for customer satisfaction. Thus, maintenance needs and potential downtime present notable challenges to widespread robotic arm adoption, particularly for smaller enterprises.

Robotic Arm Market Segmentation Overview

By Type

In 2023, articulated robotic arms became the leading segment in the robotic arm market, accounting for around 35% of total revenue. This significant market share is largely due to their versatility and applicability across diverse industries. Articulated robots feature multi-jointed structures that provide a wide range of motion, making them ideal for complex tasks such as welding, painting, assembly, and packaging. Their design allows them to replicate human arm movements, enabling operation in confined spaces and execution of intricate maneuvers, which is invaluable in manufacturing settings.The demand for articulated robotic arms is particularly strong in the automotive, electronics, and consumer goods sectors. For example, in automotive manufacturing, these robots play a crucial role in assembly lines for material handling and precision welding. Furthermore, ongoing advancements in technology, especially in AI and machine learning, have improved the precision and efficiency of articulated robots, facilitating their integration into existing workflows with enhanced programming interfaces. Increased investments from major industry players in automation solutions have also fueled their growth. As the push for automation continues globally, along with the rise of smart manufacturing and Industry 4.0 initiatives, the articulated robot segment is poised for sustained demand and market leadership.

By Application

In 2023, materials handling emerged as the leading application segment in the robotic arm market, accounting for around 47% of total revenue. This substantial share highlights the crucial role of robotic arms in enhancing logistics and supply chain efficiency across various industries. Robotic arms are particularly effective in automating repetitive and labor-intensive tasks such as picking, packing, sorting, and palletizing. Their capability to operate quickly and accurately significantly improves overall productivity, allowing businesses to manage larger volumes of goods more efficiently. By automating these processes, companies can lower labor costs associated with manual handling, a vital consideration for sectors like e-commerce and manufacturing, where operational expenses can be high. Furthermore, the integration of robotic arms with advanced technologies, including AI, machine learning, and IoT, enhances their effectiveness in materials handling, enabling real-time monitoring and predictive maintenance. Their flexibility and scalability allow for easy adaptation to various tasks and quick adjustments to changing market demands. The adoption of robotic arms in materials handling spans numerous sectors, including retail and logistics

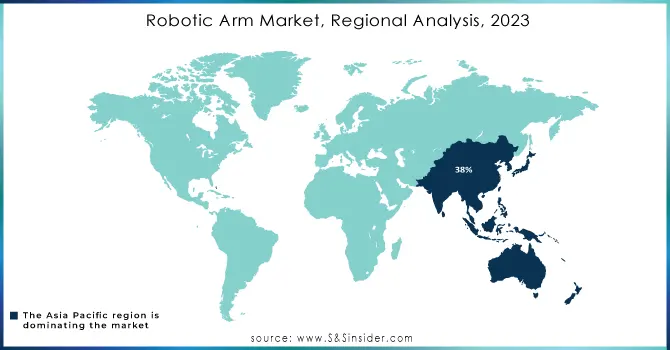

Robotic Arm Market Regional Analysis

In 2023, the Asia Pacific region led the robotic arm market, securing around 38% of total revenue due to its strong manufacturing capabilities and rapid technological progress. This region hosts major manufacturing economies, including China, Japan, and South Korea. China, as the largest manufacturing hub, has significantly invested in automation, driving demand for robotic arms across diverse industries. Japan is renowned for its advanced robotics research, with companies like Fanuc and Yaskawa Electric at the forefront of innovation. Additionally, South Korea is enhancing its automation efforts, increasingly utilizing robotic arms for assembly and welding tasks.

Technological advancements, particularly in artificial intelligence and machine learning, have further propelled the region's robotics sector. For example, SoftBank Robotics' Pepper robot exemplifies how AI enhances robotic functionality, appealing to manufacturers. Government initiatives also play a crucial role; China’s “Made in China 2025” and South Korea’s “Manufacturing Innovation 3.0” strategies promote robotics adoption. Rising labor costs in China compel manufacturers to seek automation to maintain profitability, while e-commerce growth in countries like China and India drives investments in robotic solutions for efficient order fulfillment. Overall, these factors position the Asia Pacific region as a powerhouse in the global robotic arm market.

In 2023, North America distinguished itself as the fastest-growing region in the robotic arm market, propelled by technological advancements, significant investments in automation, and an escalating demand for robotics across multiple sectors. The United States plays a pivotal role in this landscape, witnessing remarkable progress in automation technology, particularly in manufacturing, healthcare, and logistics. Leading companies such as ABB, KUKA, and Universal Robots are innovating robotic solutions that significantly improve operational efficiency and productivity. This growth aligns with the increasing adoption of Industry 4.0 principles, which emphasize the integration of smart technologies and data analytics into manufacturing workflows. Additionally, the surge in e-commerce has heightened the need for robotic arms to enhance order fulfillment processes, including sorting and packing. The growing emphasis on automation as a means to tackle labor shortages and rising operational costs further accelerates the region’s development. Supportive government initiatives and increased funding for robotics research and development have fostered an environment conducive to innovation. Consequently, North America is well-positioned for continued robust growth in the robotic arm market, showcasing its dedication to advancing automation technologies across various industries.

Need Any Customization Research On Robotic Arm market - Inquiry Now

Key Players in Robotic Arm Market

Some of the major key players in Robotic Arm market with product:

-

ABB Ltd. (IRB Series Robots)

-

KUKA AG (LBR iiwa Collaborative Robots)

-

FANUC Corporation (M-20iA Series)

-

Yaskawa Electric Corporation (MOTOMAN Series)

-

Universal Robots (UR3, UR5, UR10)

-

NACHI-FUJIKOSHI Corp. (MC Series Robots)

-

Siemens AG (Simatic Robot)

-

Omron Corporation (LD Series Autonomous Mobile Robots)

-

Mitsubishi Electric Corporation (RV Series Robots)

-

Epson Robots (Epson C4 Series)

-

Denso Corporation (VS-Series Robots)

-

Rethink Robotics (Baxter and Sawyer Robots)

-

Kawasaki Heavy Industries (K-Series Robots)

-

Robot System Products AB (RSX and RSP Robotic Arms)

-

Schunk GmbH & Co. KG (PGS and PGS Plus Grippers)

-

Stäubli Robotics (TX Series Robots)

-

Cyberdyne Inc. (HAL Exoskeleton)

-

Festo AG & Co. KG (BionicSoftHand)

-

Adept Technology (Adept Viper Series)

-

Kinova Robotics (J2 Robot Arm)

List key raw material suppliers for robotic arms, which provide essential components and materials used in manufacturing robotic systems:

-

BASF SE

-

DuPont de Nemours, Inc.

-

Aluminum Corporation of China Limited (CHALCO)

-

Thyssenkrupp AG

-

3M Company

-

Hitachi Metals, Ltd.

-

CeramTec GmbH

-

Mitsubishi Materials Corporation

-

Ferro Corporation

-

Siemens AG (Digital Industries)

-

Parker Hannifin Corporation

-

SKF Group

-

SABIC (Saudi Basic Industries Corporation)

-

Toray Industries, Inc.

-

Eaton Corporation

-

Emerson Electric Co.

-

Nippon Steel Corporation

-

Kukdong Industrial Co., Ltd.

-

Huntsman Corporation

-

Northrop Grumman Corporation

Recent Development

-

On October 24, 2024, [FABRI Creator] unveiled a tutorial for building a mini robotic arm, enabling enthusiasts to automate small, repeatable tasks at a low cost. This DIY project is designed for beginners, making robotics more accessible without the need for expensive industrial systems.

-

On October 24, 2024, GITAI USA Inc. announced that its Inchworm-type Robotic Arm achieved Technology Readiness Level 6 (TRL6) after successfully completing tests in a thermal vacuum chamber simulating lunar conditions. This advancement underscores GITAI's commitment to reducing space operation costs through innovative robotic technologies, including lunar rovers and robotic satellites.

-

On October 24, 2024, McMaster University researcher Andrew Gadsden announced a collaboration with the developer of the Canadarm to enhance the reliability and accuracy of robotic arms used in space. Gadsden plans to build a highly complex robotic arm in the lab to predict and address malfunctions during space missions.

-

On October 9, 2024, Amazon showcased its latest robotics innovations at its new fulfillment center in Shreveport, Louisiana, highlighting the integration of over 750,000 robots into its operations. This initiative aims to enhance employee safety and productivity while accelerating package delivery times for customers.

-

On October 19, 2024, engineering students at the Four Rivers Career Center received a robotic arm donated by Parker Hannifin - Sporlan Division, aimed at enhancing their robotics skills. The donation will enable students to integrate the technology into projects focused on developing independent robotic systems for HVAC and refrigeration manufacturing.

-

On October 12, 2024, Indian Creek High School introduced FANUC robotic arms into its curriculum, providing students with advanced tools for hands-on training. This initiative aims to better prepare students for future careers in robotics and automation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 28.04 Billion |

| Market Size by 2032 | USD81.83 Billion |

| CAGR | CAGR of 12.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Articulated, Cartesian, SCARA, Spherical or Polar, Cylindrical, Others), • By Application (Materials Handling, Cutting and Processing, Soldering and Welding, Assembling and Disassembling, Others), • By End User (Automotive, Electrical and Electronics, Metals and Machinery, Plastics and Chemicals, Food and Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots, NACHI-FUJIKOSHI Corp., Siemens AG, Omron Corporation, Mitsubishi Electric Corporation, Epson Robots, Denso Corporation, Rethink Robotics, Kawasaki Heavy Industries, Robot System Products AB, Schunk GmbH & Co. KG, Stäubli Robotics, Cyberdyne Inc., Festo AG & Co. KG, Adept Technology, and Kinova Robotics. |

| Key Drivers | • Robotic arms are enhancing e-commerce automation and efficiency, streamlining sorting and packing processes to meet growing industry demands. |

| RESTRAINTS | • The Challenge of Maintenance and Downtime in the Robotic Arm Market |