ONLINE CHARGING SYSTEM MARKET KEY INSIGHTS:

The Online Charging System Market Size was valued at USD 7.72 Billion in 2023 and is expected to reach USD 20.08 Billion by 2032 and growing at a CAGR of 11.24% over the forecast period 2024-2032.

To get more information on Online Charging System Market - Request Free Sample Report

Demand for real-time billing has fuelled phenomenal growth in the Online Charging System market, specifically, in the telecom industries, Online Charging Systems have become a latest trend. Online Charging Systems are an imperative management tool for prepaid and postpaid telecom services, IoT apps, and so on with accurate and instantaneous billing. The system provides telecommunications operators with the capability to monitor and track user activities thereby ensuring that proper monetization of mobile data, voice services, and content occurs.

Government policies in all these regions promote the adoption of Online Charging Systems through transparency and consumer protection mandates. In Europe, France and Germany had consumer protection laws enforced by operators that comply with real-time billing. Asia is especially significant as China promotes Online Charging Systems in the context of 5G strategies; operators will have to go for scalable platforms, considering an exponential rise in connected devices.

Advanced technologies driving the development of Online Charging Systems include cloud-native platforms and AI-driven analytics. As these innovations begin to materialize, operators can manage increasingly complex billing models with dynamic pricing, personalized services, and flexible billing systems. For instance, among the largest and most prominent cloud-based legal technologies companies, Clio has introduced Clio Payments in Australia-a solution for law firms with flexible, compliant, and efficient payment options. Clio Payments is an introductory step toward the secure and streamlined billing options Australian law firms can offer clients with increasing living costs. It's expected that this platform will help smaller and mid-tier firms gain a competitive advantage by providing adaptable billing structures in line with modern legal practices. With the spotlight firmly on 5G monetization, telecom companies are now launching services that require complicated billing arrangements using these platforms.

Some of the recent technological breakthroughs include Whale Cloud's Elastic Charging Platform, ECP which was launched in 2023. It enables telecom operators to roll out next-gen 5G capabilities within the charging systems. Several opportunities lie ahead in the Online Charging Systems market: IoT billing, enterprise data monetization, and on-demand dynamic pricing are some of the models that will bolster revenue streams for operators.

MARKET DYNAMICS

KEY DRIVERS

- The growing consumption of real-time data is one major demand drive for Online Charging Systems adoption.

Telecom operators need very robust systems to track and monetize data usage efficiently across multiple sectors. As consumers demand more mobile data and on-demand services, real-time billing is becoming imperative for accurate bill payment. Real-time data usage tracking also supports personalized offerings, discounts, and data management. With continued growth in mobile usage globally, the need for systems that can provide real-time billing seamlessly has never been more pronounced.

Governments and regulatory organizations across the globe are increasingly imposing real-time billing for raising transparency and the confidence of the consumer, while further uptake of Online Charging Systems integration is expected to grow rapidly in this setting. By 2024, unprecedented growth in the application of real-time data in both telecom and IoT industries will greatly propel the demand for Online Charging Systems.

- Adoption of 5G networks across regions is positively influencing the Online Charging Systems market.

With 5G, the amount of device-to-device connection will increase which needs to be taken into hand by more complex billing systems dealing with such massive data volumes. Thus, with 5G promising greater speed along with increased capacity, operators realize that integration of Online Charging Systems is a must to effectively manage their services.

Platforms of Online Charging Systems support more detailed and granular service billing for services with heavy data intake such as video streaming and virtual reality applications. Such services require real-time charging. It would respond to enhanced data speeds and service offerings with accurate billing while trying to maximize revenues.

RESTRAIN

- High implementation costs and integration complexity feature as major inhibitors to Online Charging Systems adoption on a larger scale.

Despite the many advantages of Online Charging Systems, one significant restraint facing the market is the high implementation costs and complexity involved in integrating Online Charging Systems into existing telecom infrastructures. Telecom operators must invest heavily in upgrading their legacy billing systems to support Online Charging Systems, which may involve complex integration with existing network systems, CRM platforms, and payment gateways. Such upfront costs, along with the technical difficulties of ensuring interoperability across diverse systems and regions, often delay or prevent the adoption of Online Charging Systems, especially among smaller telecom operators.

In addition, the mandate for periodic software updates, scalability to handle 5G networks, and continuing regulatory compliance calls all add to the cost of ownership. Based on this, then, the long-term payoffs must be weighed against the capital outlay and overheads of operating. Similarly, governments of developing countries are finding it challenging to deploy the infrastructure needed for such a sophisticated system. And, therefore, this high cost coupled with complexity remains one of the major barriers to opening the door to full exploitation of Online Charging Systems solutions.

KEY SEGMENTATION ANALYSIS

BY ORGANISATION SIZE

Large enterprises segment dominated with the market share of over 62.49% in 2023. Large enterprises tend to have the capability and infrastructure that allows them to offer complex billing and require advanced online charging system platforms able to handle large amounts of data generated by the operations of such large organizations.

These organizations, including especially the telecommunication giants, have been adopting Online Charging Systems solutions for billing management across various services-whether mobile data, voice calls, IoT services, or content consumption. Large enterprises usually demand highly customizable and robust charging solutions that can handle a very wide array of service offerings and offer a consistent and accurate experience for consumers.

Small and Medium-sized Enterprises (SMEs) are likely to experience the maximum CAGR of 11.63% over the forecast period 2024-2032 as there is an increased requirement for sophisticated billing systems that keep pace with the digitalization of their services. Online Charging Systems solutions are also being used by SMEs, primarily in developing markets, to achieve operational efficiency, accurate billing, and better customer experience.

There is a gradual shifting of telecom operators from large-scale adaptation of customer base towards flexible pricing models; thus, SMEs came out as the largest adopter of cost-effective, cloud-based Online Charging Systems solutions. Most of this trend is seen in IoT-based services along with personalized mobile plans from smaller service providers. In total, there has been an increased adoption of Online Charging Systems by SMEs in the telecom sector.

BY DEPLOYMENT

On Cloud segment dominated at 74.17% in 2023, mainly because it scales to accommodate massive 5G deployments easily and can save the cost of investment. Cloud-based Online Charging Systems solutions help telecommunication companies to process a higher number of data transactions, to charge in real-time, and to support diverse service offerings such as mobile apps and IoT platforms without large on-site infrastructure. The adaptability of the cloud provides the opportunity for telecom companies to rapidly adapt to the evolving demand of the market, introduce new services, and scale up when needed.

Cloud solutions will expand at the highest CAGR of 11.43% over the forecast period 2024-2032 due to the greater acceptability of cloud technologies by telecom operators. The increasing adoption of 5G networks and the IoT ecosystem will further drive demand for cloud-based Online Charging Systems platforms with faster service deployment, lower operational costs, and more agile billing models.

Cloud deployments also support the enhanced security features, global regulations compliance, and the capability of introducing real-time analytics to achieve better service personalization. Since more companies are switching towards digital transformation, the cloud segment is to undergo significant growth in the near future years.

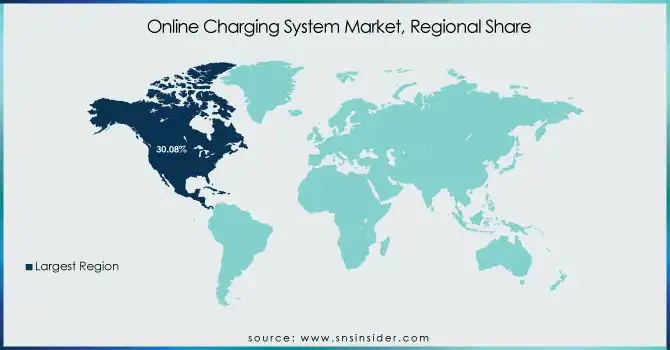

REGIONAL ANALYSIS

North America has dominated the Online Charging Systems market in 2023, contributing 30.08% of the market, due to the stronghold of telecom giants in the region enjoying a strong presence that allows them to take advantage of supportive regulatory frameworks and real-time billing practices. It has also experienced growth in demand for Online Charging Systems solutions as the widespread deployment of 5G technology and an influx of IoT devices in the ecosystem have demanded high-end charging systems. In the USA, FCC policies enforce real-time fair billing mainly on data usage with increased 5G penetration. For Instance, North America logged in an unprecedented rate of penetration in 5G at 40% while enjoying a growth rate of 25.5% for the first half of 2023. According to research, 5G connections in North America will have reached an incredible figure of 669 Million by 2028.

The regulatory environment in the U.S. ensures transparency in billing, which has eventually protected customers from various unfair practices; therefore, this particular factor has boosted the adoption of Online Charging Systems solutions by telecom operators.

Asia Pacific is the largest growing market with a CAGR of 11.96% for the period of 2024 to 2032. A huge increase in the deployment of 5G networks across China and India will drive the growth of the Online Charging Systems market while increasing demand for IoT-based services will also add momentum to this industry.

This shift by telecom operators in the region toward cloud-based Online Charging Systems solutions, which are aimed at managing the tremendous growth in data traffic, leaves an opportunity for the telecom provider to monetize 5G and IoT services better. Government policies favoring infrastructure and innovations in telecom led to the emergence of Asia Pacific as a hotbed for the adoption of Online Charging Systems.

Do You Need any Customization Research on Online Charging System Market - Inquire Now

KEY PLAYERS

Some of the major players in the Online Charging System (Online Charging Systems) Market are

-

AGNITY Inc. (AGNITY Online Charging Systems, Intelligent Network Services)

-

Alepo (Alepo Online Charging Systems, Alepo Charging Platform)

-

Amdocs (Amdocs Online Charging Systems, Amdocs Charging System)

-

Nexign (Nexign Online Charging Systems, Nexign BSS/OSS Solutions)

-

Cerillion Technologies Limited (Cerillion Online Charging Systems, Cerillion Charging System)

-

Huawei Technologies Co., Ltd. (Huawei Online Charging Systems, Huawei Cloud Solutions)

-

ZTE Corporation (ZTE Online Charging Systems, ZTE Telecom Solutions)

-

Comverse Inc. (Comverse Online Charging Systems, Comverse Billing Solutions)

-

Oracle Corporation (Oracle Online Charging Systems, Oracle Communications)

-

Ericsson AB (Ericsson Online Charging Systems, Ericsson Charging Solutions)

-

NetCracker Technology (NetCracker Online Charging Systems, NetCracker BSS/OSS Solutions)

-

Subex Limited (Subex Online Charging Systems, Subex Revenue Assurance Solutions)

-

Tech Mahindra Ltd. (Tech Mahindra Online Charging Systems, Tech Mahindra Telecom Solutions)

-

Cognizant Technology Solutions (Cognizant Online Charging Systems, Cognizant Telecom Solutions)

-

Infosys Ltd. (Infosys Online Charging Systems, Infosys Telecom Services)

-

Accenture plc (Accenture Online Charging Systems, Accenture Cloud Charging Solutions)

-

AireSpring Inc. (AireSpring Online Charging Systems, AireSpring Telecom Solutions)

-

Volaris Group (Volaris Online Charging Systems, Volaris Telecom Billing Solutions)

-

InnoPath Software Inc. (InnoPath Online Charging Systems, InnoPath Telecom Solutions)

-

Redknee Solutions Inc. (Redknee Online Charging Systems, Redknee Telecom Billing Solutions)

MAJOR SUPPLIERS (Components, Technologies)

-

Qualcomm Technologies, Inc.

-

Broadcom Inc.

-

Intel Corporation

-

Nokia Networks

-

IBM Corporation

-

Microsoft Corporation

-

Xilinx, Inc.

-

TSMC

-

Samsung Electronics

-

MediaTek Inc.

MAJOR CLIENTS

-

Verizon Communications Inc.

-

AT&T Inc.

-

Deutsche Telekom AG

-

China Mobile Communications Group Co., Ltd.

-

Vodafone Group plc

-

Orange S.A.

-

T-Mobile US, Inc.

-

Sprint Corporation

-

Telefónica S.A.

-

Reliance Jio Infocomm Limited

RECENT TRENDS

-

March 2024: The five-year deal was signed between Ericsson and Ooredoo Oman for the migration and consolidation of its online charging system onto the Ericsson Mediation and Ericsson Charging systems, thus providing Ooredoo Oman's customers with a next-level digital experience.

-

April 2023: Netcracker Technology has announced that, SLT-MOBITEL, a long-standing partner of the company, will use Netcracker's Digital BSS (Business Support System) and Professional Services. In such a partnership, improved billing system solutions will be handed over to the SLT-MOBITEL through integration with upgraded fixed, mobile, and Online Charging System.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.72 Billion |

| Market Size by 2032 | US$ 20.08 Billion |

| CAGR | CAGR of 11.24 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services), • By Deployment (On-Premises, Cloud) • By Organization Size (Large Enterprise, Small and medium-sized size Enterprise), • By Application (Prepaid, Post-paid) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGNITY Inc., Alepo, Amdocs, Nexign, Cerillion Technologies Limited, Huawei Technologies Co., Ltd., ZTE Corporation, Comverse Inc., Oracle Corporation, Ericsson AB, NetCracker Technology, Subex Limited, Tech Mahindra Ltd., Cognizant Technology Solutions, Infosys Ltd., Accenture plc, AireSpring Inc., Volaris Group, InnoPath Software Inc., Redknee Solutions Inc. |

| Key Drivers | • The growing consumption of real-time data is one major demand drive for OCS adoption. • Adoption of 5G networks across regions is positively influencing the OCS market. |

| Restraints | • High implementation costs and integration complexity feature as major inhibitors to OCS adoption on a larger scale. |