Vertical Software Market Report Scope & Overview:

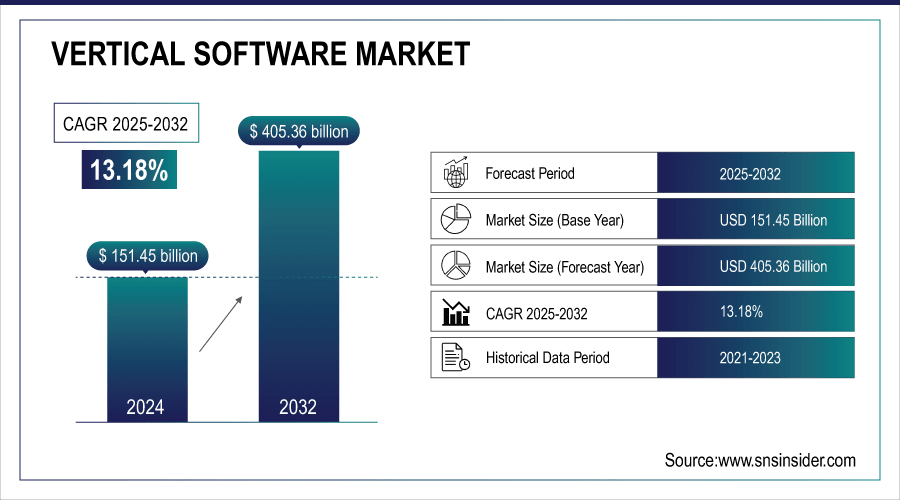

Vertical Software Market was valued at USD 151.45 billion in 2024 and is expected to reach USD 405.36 billion by 2032, growing at a CAGR of 13.18% from 2025-2032.

The Vertical Software Market is growing due to increasing digital transformation across industries, rising demand for industry-specific solutions, and the need for operational efficiency. Adoption of cloud-based platforms, AI, and analytics enhances decision-making and scalability. Businesses seek tailored software for sectors like healthcare, retail, BFSI, and manufacturing to improve productivity, customer engagement, and compliance. Additionally, remote work trends and automation requirements further accelerate market expansion globally. For example, in August 2025, Microsoft Corporation highlighted its manufacturing cloud modernization, BMW improved IoT data delivery and analysis tenfold using Azure AI, Azure Data Explorer, and generative AI–powered Power BI, enabling more accessible insights for decision-makers.

To Get more information on Vertical Software Market - Request Free Sample Report

Key Vertical Software Market Trends

-

Growing demand for industry-specific solutions tailored to healthcare, retail, manufacturing, and finance.

-

Cloud-based deployment is enabling scalable, flexible, and cost-efficient software adoption.

-

Integration of AI, analytics, and automation is enhancing operational efficiency and decision-making.

-

Rising need for regulatory compliance drives adoption of specialized vertical software solutions.

-

Mobile and SaaS platforms are facilitating real-time access and collaboration across enterprises.

-

Increasing investments in digital transformation and workflow optimization are accelerating market growth.

-

Collaboration with fintech, IoT, and cybersecurity providers is creating more connected industry ecosystems.

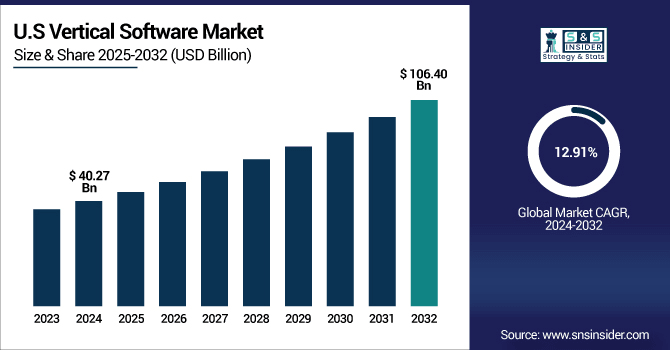

U.S. Vertical Software Market was valued at USD 40.27 billion in 2024 and is expected to reach USD 106.40 billion by 2032, growing at a CAGR of 12.91% from 2025-2032.

The U.S. Vertical Software Market is expanding due to rising digital transformation, demand for industry-specific solutions, and cloud adoption. Businesses increasingly leverage AI, analytics, and automation to enhance efficiency, compliance, and customer engagement, driving robust growth.

Vertical Software Market Growth Drivers:

-

Increasing digital transformation initiatives are fueling adoption of vertical software to streamline workflows and enable sector-specific operational efficiency

Increasing investments in digital transformation are driving the adoption of vertical software, as businesses shift toward automation and technology integration. Companies across sectors prioritize operational efficiency, real-time analytics, and improved customer experiences, which specialized vertical solutions deliver. For instance, cloud-based solutions enhance scalability in retail, while advanced analytics optimize patient care in healthcare. In manufacturing, digital platforms integrate IoT and supply chain visibility, boosting productivity. These tailored solutions help reduce costs, enhance accuracy, and accelerate innovation. As enterprises embrace modernization, vertical software adoption strengthens, ensuring long-term reliance on technology tailored to meet sector-specific requirements effectively and efficiently.

Vertical Software Market Restraints:

-

Data security and compliance complexities create obstacles for vertical software adoption in regulated industries like healthcare, banking, and government sectors

Stringent regulations around data protection and compliance create challenges for vertical software adoption in industries like healthcare, finance, and government. These sectors deal with sensitive personal, financial, and operational data, requiring robust security frameworks. Software providers must ensure compliance with strict standards such as HIPAA, GDPR, and PCI DSS, which significantly increases complexity and costs. Any breach or non-compliance risks severe financial penalties and reputational damage. As cyber threats grow, businesses hesitate to fully adopt digital solutions without strong assurances of security. These concerns slow adoption, limit flexibility, and increase resistance to implementing vertical software in heavily regulated environments.

Vertical Software Market Opportunities:

-

Rising demand for AI and advanced analytics in vertical software creates new opportunities for predictive insights and data-driven decision-making across industries

Rising integration of artificial intelligence (AI) and advanced analytics in vertical software offers immense growth potential, enabling predictive capabilities and smarter decision-making. Industries increasingly rely on real-time insights to optimize operations, enhance customer experiences, and improve forecasting accuracy. For example, AI-powered analytics in retail helps predict consumer demand, while in healthcare it supports personalized treatment. Manufacturing leverages predictive maintenance to avoid downtime, and finance benefits from fraud detection and risk modeling. These technologies enhance the value proposition of vertical solutions, making them essential for businesses seeking competitive advantage, efficiency gains, and innovation across specialized industry sectors globally.

Key Vertical Software Market Segment Analysis

-

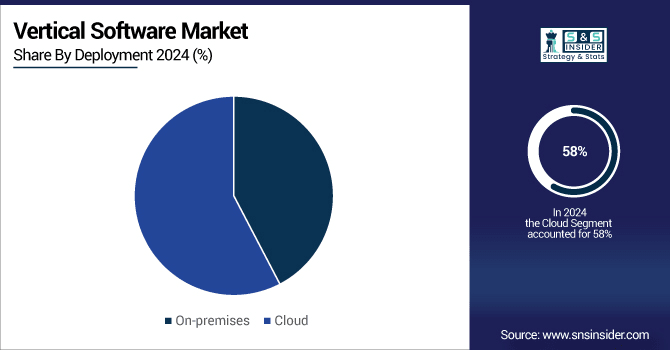

By Deployment, Cloud dominated with ~58% share in 2024; Cloud fastest growing (CAGR 14.10%).

-

By End-use, BFSI dominated with ~27% share in 2024; Healthcare fastest growing (CAGR 15.64%).

-

By Organization Size, Large Enterprises dominated with ~61% share in 2024; SMEs fastest growing (CAGR 14.43%).

-

By Application, Enterprise Resource Planning (ERP) dominated with ~28% share in 2024; Supply Chain Management (SCM) fastest growing (CAGR 15.74%).

By Deployment Cloud dominated and is expected to grow fastest

Cloud segment dominated the Vertical Software Market in 2024 and is expected to grow at the fastest CAGR from 2025 to 2032 due to its scalability, flexibility, and cost-effectiveness. Organizations increasingly prefer cloud deployment for easier integration, real-time collaboration, and reduced infrastructure costs. Enhanced data security, remote accessibility, and subscription-based pricing models further drive widespread adoption, making cloud the most dominant and rapidly expanding deployment model across industries.

By End Use BFSI dominated while Healthcare is expected to grow fastest

BFSI segment dominated the Vertical Software Market in 2024 due to its heavy reliance on advanced compliance, risk management, fraud detection, and secure digital transaction platforms. Increasing regulatory demands and rapid digitization across banking and financial institutions significantly drove large-scale adoption of industry-specific vertical solutions during the period.

Healthcare segment is expected to grow at the fastest CAGR from 2025 to 2032 owing to rising digital health initiatives, adoption of electronic health records, telemedicine expansion, and demand for AI-driven diagnostics. Increasing regulatory compliance and the shift toward patient-centric care are further accelerating the adoption of vertical software solutions.

By Organization Size Large Enterprises led while SMEs are projected to grow rapidly

Large Enterprises segment dominated the Vertical Software Market in 2024 due to their greater financial capacity, advanced IT infrastructure, and higher adoption of digital transformation strategies. These organizations implement customized, large-scale vertical solutions to improve operational efficiency, compliance, and competitiveness across diverse global business operations.

SMEs segment is expected to grow at the fastest CAGR from 2025 to 2032 driven by increasing affordability of cloud-based solutions, growing awareness of digital efficiency, and demand for cost-effective tools. Flexible subscription models and industry-specific scalability make vertical software increasingly accessible for small and medium-sized enterprises globally.

By Application Enterprise Resource Planning held the largest share while Supply Chain Management is expected to expand fastest

Enterprise Resource Planning segment dominated the Vertical Software Market in 2024 because of its role in centralizing operations, streamlining workflows, and improving efficiency across industries. Businesses heavily rely on ERP for financial management, human resources, and compliance, making it the most widely adopted vertical solution during the year.

Supply Chain Management segment is expected to grow at the fastest CAGR from 2025 to 2032 due to rising global trade complexities, demand for real-time visibility, and integration with IoT and AI. Industries increasingly adopt SCM software to optimize logistics, reduce costs, and ensure resilience in supply chain networks.

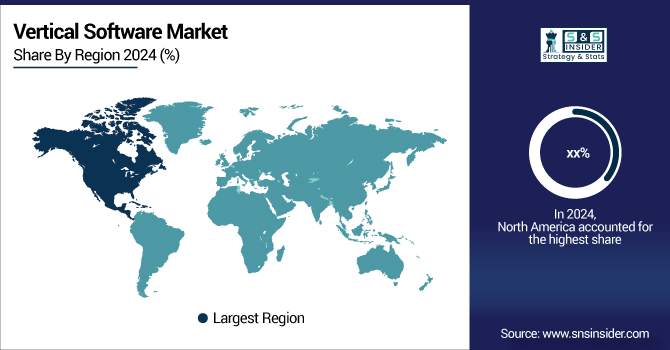

North America Vertical Software Market Insights

North America dominated the Vertical Software Market in 2024 due to strong technological infrastructure, high digital transformation investments, and the presence of leading software providers. Industries such as BFSI, healthcare, and retail adopted advanced solutions for compliance, analytics, and operational efficiency. Supportive regulatory frameworks, strong cybersecurity practices, and early adoption of cloud-based platforms further strengthened the region’s leadership, ensuring consistent demand and large-scale deployment of vertical software solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Vertical Software Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2032 driven by rapid industrialization, rising digital adoption, and increasing investments in IT infrastructure. Expanding SMEs, government-backed digitization programs, and widespread adoption of cloud solutions contribute significantly to growth. Rising demand for healthcare, retail, and manufacturing software solutions further accelerates expansion, making Asia Pacific the most dynamic region for vertical software adoption in the forecast period.

Europe Vertical Software Market Insights

Europe in the Vertical Software Market is experiencing steady growth driven by stringent regulatory compliance, strong adoption of cloud-based solutions, and increasing demand across healthcare, BFSI, and manufacturing sectors. Rising investments in digital transformation, emphasis on data security, and support for industry-specific innovation foster market expansion, positioning Europe as a key contributor to global vertical software adoption and development.

Middle East & Africa and Latin America Vertical Software Market Insights

Middle East & Africa in the Vertical Software Market is growing steadily due to rising digital transformation initiatives, expanding BFSI and healthcare sectors, and government-led smart city projects. Latin America is witnessing increased adoption driven by growing SME investments, cloud-based affordability, and sectoral demand in retail and manufacturing, positioning both regions as emerging contributors to vertical software adoption and market expansion.

Vertical Software Market Competitive Landscape:

Microsoft Corporation, founded in 1975, is a key player in the Vertical Software Market, offering industry-specific solutions across healthcare, finance, manufacturing, and retail. Its cloud-based platforms, including Microsoft Dynamics 365, integrate AI, analytics, and automation to enhance operational efficiency, compliance, and customer engagement. Microsoft’s continuous innovation, strong enterprise presence, and global reach position it as a dominant provider of scalable, tailored software solutions, driving adoption across diverse industries.

-

In 2025, Microsoft introduced Copilot Tuning for Microsoft 365 enabling sector-specific AI agents. Industries like aviation or legal can train domain-expert Copilots using internal documents securely.

Veeva Systems, founded in 2007, is a leading provider in the Vertical Software Market, specializing in cloud-based solutions for the life sciences and healthcare sectors. Its platforms, including Veeva CRM and Veeva Vault, streamline regulatory compliance, data management, and customer engagement. With a focus on innovation, scalability, and industry-specific functionality, Veeva enables organizations to enhance operational efficiency, accelerate product development, and maintain compliance, solidifying its position as a trusted vertical software provider.

-

In 2024, Veeva Systems Released Vault CRM Campaign Manager, advancing its life-sciences software by uniting sales, marketing, and medical teams in one CRM ecosystem, enabling coordinated omnichannel campaign execution and stronger industry collaboration.

-

In 2023, Veeva Systems Announced first Vault CRM customer, with field medical teams going live in Q4 2023; general availability rolled out in April 2024, marking a next-gen milestone for life-sciences CRM platforms.

Key Players

Some of the Vertical Software Market Companies

-

Microsoft Corporation

-

SAP SE

-

Salesforce, Inc.

-

Adobe Inc.

-

IBM Corporation

-

Intuit Inc.

-

Epic Systems Corporation

-

Infor Inc.

-

McKesson Corporation

-

Autodesk Inc.

-

Cerner Corporation

-

Tyler Technologies Inc.

-

Paychex Inc.

-

Sage Group plc

-

Veeva Systems

-

Procore Technologies

-

Toast

-

Clio

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 151.45 Billion |

| Market Size by 2032 | USD 405.36 Billion |

| CAGR | CAGR of 13.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Organization Size (SMEs, Large Enterprises) • By Application (Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Supply Chain Management (SCM), Human Resource Management (HRM), Other) • By Deployment (On-premises, Cloud) • By End-use (BFSI, Media & Entertainment, Healthcare, IT & Telecom, Retail & E-commerce, Government & Public Sectors, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft Corporation, Oracle Corporation, SAP SE, Salesforce, Inc., Adobe Inc., IBM Corporation, Intuit Inc., Epic Systems Corporation, Infor Inc., Constellation Software Inc., McKesson Corporation, Autodesk Inc., Cerner Corporation, Tyler Technologies Inc., Paychex Inc., Sage Group plc, Veeva Systems, Procore Technologies, Toast, Clio |