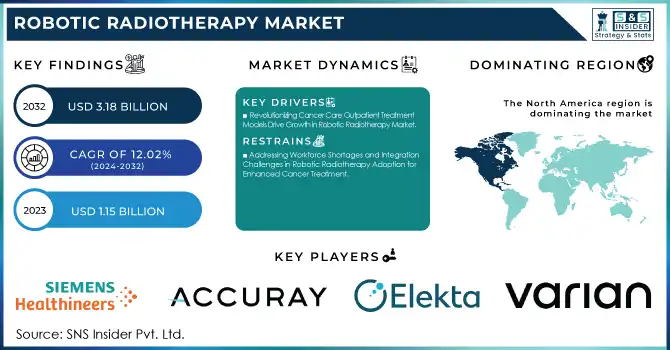

Robotic Radiotherapy Market Size:

The Robotic Radiotherapy Market Size was valued at USD 1.15 Billion in 2023 and is expected to reach USD 3.18 Billion by 2032 and grow at a CAGR of 12.02% over the forecast period 2024-2032.

To get more information on Robotic Radiotherapy Market - Request Free Sample Report

The Robotic Radiotherapy Market is increasing due to developments in technology providing more accuracy and efficacy of treatment against cancer for example, technical advances in image-guided radiotherapy (IGRT) and possibly even intensity-modulated radiation therapy (IMRT) have translated to improved treatment outcomes. With these technologies, clinicians can target high doses of radiation to tumors but lower the dose as much as possible to healthy tissues nearby. In addition, the worldwide rise in cancer cases is causing a sustained demand for efficient targeted treatments. IGRT technology can reduce radiation exposure to healthy tissue by 25% compared with conventional radiotherapy, resulting in improved patient quality of life. Delivery of robotic radiotherapy systems takes treatment a step further, further reducing toxicity, with outcomes such as a 45% reduction in the risk of severe xerostomia for head and neck cancer patients. Moreover, more than 50% of cancer patients worldwide require radiotherapy as part of their therapy at some stage, making an increasing demand for high-end robotic radiotherapy solutions a global market segment

With robotic systems, tailored treatment solutions can be developed for individual patients at the same time as providing general care and enhanced effectiveness. The use of AI and machine learning combined with robotic radiotherapy systems creates more robust treatment planning and improved workflow. AI-assisted radiotherapy planning in 2023 could cut treatment planning times by up to half, quickening the speed at which patients could be treated more precisely. Investigation of scanning images. Detailed imaging in real time allowed the image-guided robotic radiotherapy system to target tumors within 1-2 millimeters order, reducing radiation exposure on healthy tissue by 25%. Studies have shown that they reduce side effects such as fatigue and nausea by 25% because of precise dose delivery. Over 40% of major cancer centers worldwide have also implemented robotic radiotherapy, highlighting its continued impact in enhancing patient outcomes and workflows.

Robotic Radiotherapy Market Dynamics

Key Drivers:

-

Revolutionizing Cancer Care Outpatient Treatment Models Drive Growth in Robotic Radiotherapy Market

The Outpatient treatment model is fueling the growth of the Robotic Radiotherapy market. Outpatient radiotherapy is a feasible option as healthcare systems aim to improve patient convenience and reduce costs. Similar to excision for atypical nevi, treatment can be performed with no overnight hospitalization as they are done on an outpatient basis, thereby allowing higher patient satisfaction and quality of life. This trend is notable, especially because it looks to help healthcare providers optimize the operations of their facilities while also lessening the economic weight that accompanies inpatient care. In 2023, about 65% of radiotherapy procedures were outpatient, boosting patient satisfaction by 25% and reducing treatment costs by up to 40%. Outpatient robotic radiotherapy facilities reported a 30% increase in treatment capacity, allowing for more efficient patient care. As the demand for outpatient services increases, the requirement to develop and bring advanced robotic systems that can effectively treat patients in an efficient manner such as with safety within the premises of a hospital acts as a constraint on this paradigm shift, thus accelerating market growth.

-

Innovative Collaborations in R&D Propel Growth of Advanced Robotic Radiotherapy Solutions for Cancer Treatment

Additional factors that will fuel the market growth are increased investments towards R&D for advancement in radiotherapy procedures. As a result, pharmaceutical companies, medical device manufacturers, and research institutions are working together more to create new and more effective therapies. It aims to be a next-generation robotic system incorporating advanced robotics and quantitative imaging, with the goals of increased accuracy, speed, and patient outcomes compared to state-of-the-art treatments. about 60% of pharmaceutical companies collaborated with medical device manufacturers and academic institutions to develop next-generation robotic systems, accelerating innovation. This technology further augments the functionality by enabling real-time monitoring, adaptive radiation therapy, etc. which increases the applications in treatment. real-time monitoring capabilities were integrated into 45% of newly developed robotic radiotherapy technologies. This focus on research and development not only broadens functionality in robotic radiotherapy systems but also encourages competition among manufacturers, resulting in a more dynamic market structure. This advancement allowed for a 20% increase in the range of treatable conditions, enabling the effective management of more complex cases. Hence, the regular supply of new radiotherapy solutions in terms of R&D investments will contribute to the expansion robotic radiotherapy market benefiting patients with more effective and innovative cancer treatment options.

Restrain:

-

Addressing Workforce Shortages and Integration Challenges in Robotic Radiotherapy Adoption for Enhanced Cancer Treatment

In the Robotic Radiotherapy Market, one of the major limitations is a lack of professionals who can operate these sophisticated robotic systems. Such technologies are complex and need special training, which creates a mismatch between the increasing demand for robotic therapies and adequate manpower. Such a challenge can create obstacles in the widespread adoption of robotic radiotherapy, especially in areas that are less developed or smaller healthcare facilities due to their difficulty in attracting trained personnel. Another difficulty is in the integration of robotic systems into existing healthcare infrastructure. A lot of capabilities could contain aged machinery or legacy methods unable to run with new robotic technologies. It also creates logistical challenges and would require an overhaul of workflow and processes. If novel robotic solutions for fractionated radiation therapy are to be adopted into the clinic however, effective integration and interoperability with existing current practices in radiotherapy will need to occur; with the challenges associated with such requirements potentially limiting adoption and widespread implementation of new technologies.

Robotic Radiotherapy Market Segmentation Analysis

By Product

Software, which accounted for a 41% share in the Robotic Radiotherapy Market in 2023 due to its fundamental role in improving the efficiency and accuracy of radiotherapy therapies, is fueling growth in this sector. With software solutions enabling superior treatment planning, real-time monitoring, and data analysis, clinicians can tailor therapies on a patient-specific basis. Image processing, dose calculation, and workflow management features are necessary to optimize treatment efficiency while minimizing side effects. The need for advanced software solutions is expected to rise as healthcare providers focus on Personalized Medicine and Enhanced Patient Outcomes.

Radiotherapy systems are envisaged to witness the fastest CAGR between 2024 and 2032 owing to continuous technological developments and growing investment in robotic systems. Novel hardware improvements, particularly for robotic arms and imaging mechanisms, are also allowing radiotherapy systems to become more streamlined and effective. Healthcare facilities can apply these treatment capabilities as these systems become affordable and easily accessible. Furthermore, increasing incidence of cancer and increasing demand for efficient treatment methods are also supporting the need for better radiotherapy systems and this will drive the growth of this segment rapidly. All these factors bring about a new balance between software and hardware that is expected to drive the robotic radiotherapy market in the future.

By Technology

Linear accelerators led the market in 2023 with 49% share and are projected to grow at the fastest cagr during the period from 2024-2032. This dominance can be attributed to their successful track record in providing accurate and local treatment for different cancer patient cohorts. This has brought about the use of high-energy X-rays or electrons to treat the tumors using a linear accelerator and sparing adjacent healthy tissues as much as possible. Their broad-spectrum anti-tumor efficacy makes them a proposal of virtually all favored occupancy in oncology wards throughout the globe. Linear accelerators are expected to grow at a rapid pace, supported by continued technology advancements such as better imaging plans and treatment planning systems. These innovations not only improve treatment accuracy and efficiency but also make linear accelerators appealing to healthcare facilities that want to enhance patient care at their institutions. Combined with this, the growing incidence of cancer across the globe leads to more advanced radiation modalities in clinical practice therefore, linear accelerator has become an indispensable component of modern oncology. With more and more hospitals and clinics channeling their investments into upgrading better treatment capabilities, the linear accelerators will continue commanding a lead in the robotic radiotherapy landscape.

By Application

In 2023, Lung cancer held the largest share at 36% in the Robotic Radiotherapy market and is projected to rise Furthermore, it is expected that over the forecast period of 2024-2032. The reason for this is dominant because lung cancer is one of the most frequently diagnosed cancers all over the world every year. The high prevalence of the disease with a substantial demand for effective treatment is attributed to possible risk factors including smoking, environmental contaminants, and genetic characteristics. Robotic radiotherapy technologies capable of transmitting radiation more accurately are fueling this anticipated rapid growth of the market for lung cancer segmentation. Innovations provisioning stereotactic body radiation therapy let high dosages of radiation be given over fewer sessions, leading to enhanced results and fewer side effects. Moreover, rising awareness and screening programs are resulting in early diagnosis of lung cancer thus contributing positively to the market growth for targeted therapy. Given this, the lung cancer segment will witness considerable growth in the future, as treatment protocols become more targeted and efficacious from the perspective of healthcare providers.

By End Use

In 2023, hospitals dominated with a market share of 58% owing to their overall capabilities in advanced cancer care with access to sophisticated technology and multidisciplinary teams. As such, the existing infrastructure at most hospitals means that they can also provide a wider spectrum of radiotherapy services for various patient requirements. The capacity to embed robotic radiotherapy into an overall treatment paradigm, which may involve surgical and/or chemotherapeutic and supportive management options, together with their sound marketing position.

Independent Radiotherapy Centers will grow at the fastest CAGR during 2024-2032. This growth is driven by the increasing demand for convenient and accessible cancer treatment centers. This is a big draw for patients who find it appealing to have quick, customized care, since independent centers usually offer shorter wait times. Furthermore, technological development in conjunction with the increasing focus on outpatient settings has made it easier to set up and grow these centers. With the increase of independent radiotherapy centers adopting new and advanced robotic radiotherapy systems, they are expected to gain a larger patient market share leading to their swift growth in the market. This trend indicates a movement towards patient-driven care and a growing desire for outpatient treatment facilities compared to conventional hospital buildings.

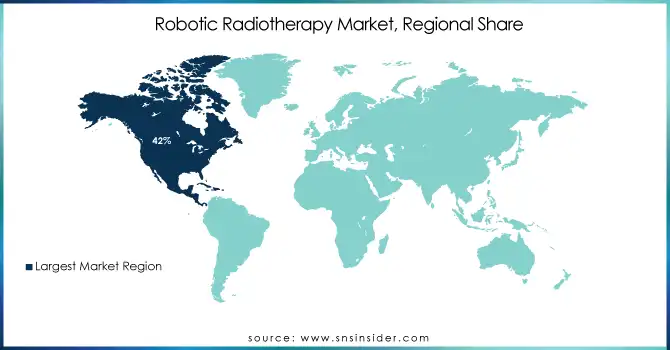

Robotic Radiotherapy Market Regional Outlook

North America held the largest share of 42% in terms of revenue in the Robotic Radiotherapy Market in 2023 and is expected to grow fastest during 2024-2032 at a higher CAGR. The dominance can be attributed to the well-established healthcare infrastructure in the region, high investments in medical technology as well as a large pool of cancer patients. Similarly, owing to its high incidence of lung and breast cancer, the United States has become a key robotic radiotherapy market due to rising demand for innovative treatment solutions. For illustration, in the U.S., such progress is being seen with recent uptakes of advanced linear accelerators and robotic systems through major cancer treatment centers. As an example, institutes like the MD Anderson Cancer Center in Houston and the Mayo Clinic in Rochester are globally known for their applications of advanced radiotherapy technologies such as robot-assisted systems that emphasize improving patient outcomes. In addition, continuous partnerships of technology provider companies and healthcare providers such as Varian Medical Systems along with key hospitals for clinical development and implementation of new robotic solutions are expected to drive market growth in North America. This provides the region with an advantage to become a leader in robotic radiotherapy, which will propel future growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Robotic Radiotherapy Market are:

-

Varian Medical Systems (TrueBeam, Halcyon)

-

Elekta (Flexitron, Versa HD)

-

Accuray Incorporated (CyberKnife, TomoTherapy)

-

Siemens Healthineers (ARTIS, Somatom)

-

Philips Healthcare (Azurion, Ingenia)

-

Hitachi Medical Systems (HTA, Proton Therapy System)

-

C-RAD (Catalyst, C-RAD Sentinel)

-

RaySearch Laboratories (RayStation, RayCare)

-

Brainlab (ExacTrac, Elements)

-

MediTech (Oncology Solutions, Radiotherapy Planning)

-

Bluebird Bio (LentiGlobin, Gene Therapy)

-

Panasonic Healthcare (Medi-Physics, Proton Therapy Solutions)

-

Ge Healthcare (Discovery, Centricity)

-

ViewRay (MRIdian, MLC)

-

Sordina I.P.S. (Sordina System, Radiotherapy Solutions)

-

United Imaging Healthcare (uMI, uCT)

-

Fujifilm Medical Systems (Fujifilm Synapse, Digital X-ray Systems)

-

CMS (CMS Radiotherapy System, Treatment Planning Software)

-

RayCare (RayCare Software, RayStation)

-

Civco Medical Solutions (Civco SRS, CIVCO Shield)

Some of the Raw Material Suppliers for Robotic Radiotherapy Companies:

-

Merck KGaA

-

BASF SE

-

3M Company

-

Dow Chemical Company

-

Huntsman Corporation

-

AkzoNobel N.V.

-

Nusil Technology LLC

-

Wacker Chemie AG

-

Eastman Chemical Company

-

Heraeus Holding GmbH

Recent Trends

-

In June 2024, Apollo Cancer Centres launched advanced robotic radiotherapy using Accuray's CyberKnife System, offering precise and non-invasive treatment options for cancer patients. This partnership aims to enhance patient outcomes through cutting-edge technology.

-

In June 2024, Researchers at King’s College Hospital used a custom robot to deliver targeted radiation for treating wet age-related macular degeneration, enhancing standard eye treatment.

-

In January 2024, Tampa General Hospital introduced the CyberKnife S7 robot, an AI-powered system offering cutting-edge radiosurgery for patients with tumors in the brain, spine, and other areas. The launch was celebrated with a ribbon-cutting event.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.15 Billion |

| Market Size by 2032 | USD 3.18 Billion |

| CAGR | CAGR of 12.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Radiotherapy system, Software, 3D cameras, other) • by Technology (Linear Accelerators, Stereotactic Radiation Therapy, Particle Therapy) • by Application (Prostate Cancer, breast cancer, Lung Cancer, Head & Neck Cancer, Colorectal Cancer, Other Cancer) • by End Use (Hospital, Independent Radiotherapy Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Varian Medical Systems, Elekta, Accuray Incorporated, Siemens Healthineers, Philips Healthcare, Hitachi Medical Systems, C-RAD, RaySearch Laboratories, Brainlab, MediTech, Bluebird Bio, Panasonic Healthcare, Ge Healthcare, ViewRay, Sordina I.P.S., United Imaging Healthcare, Fujifilm Medical Systems, CMS, RayCare, Civco Medical Solutions |

| Key Drivers | • Revolutionizing Cancer Care Outpatient Treatment Models Drive Growth in Robotic Radiotherapy Market • Innovative Collaborations in R&D Propel Growth of Advanced Robotic Radiotherapy Solutions for Cancer Treatment |

| Restraints | • Addressing Workforce Shortages and Integration Challenges in Robotic Radiotherapy Adoption for Enhanced Cancer Treatment |