Radiotherapy Market Report Scope & Overview:

Get more information on Radiotherapy Market - Request Free Sample Report

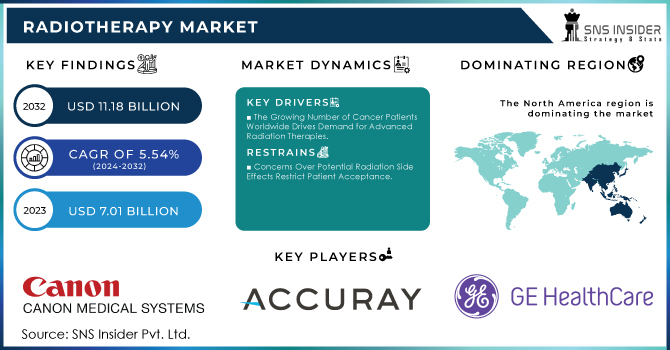

The Radiotherapy Market Size was valued at USD 7.01 Billion in 2023, and is expected to reach USD 11.18 Billion by 2032, and grow at a CAGR of 5.54%.

The global market of radiotherapy experiencing rapid growth due to the increasing rate of cancer all over the world. Thus, according to the statistics of the World Health Organization, cancer is the second biggest killer globally. Furthermore, in 2023, the U.S. National Cancer Institute reported a 7% rise in federal funding for cancer research and treatments. More specifically, over USD 8.4 billion has been allocated to support radiotherapy advancement. Moreover, in Europe, the European Commission has increased the Cancer Mission budget up to Euro 1.2 billion in the framework of the “Beating Cancer Plan”.

In response to that, healthcare systems globally have started to implement radiotherapy technologies at an increasingly high rate. However, the other triggers that propel the market forward include the rising awareness of radiotherapy efficiency and a growing number of cancer patients worldwide (more than 19.3 million new cases in 2023). Moreover, the technological advancements in the field, namely, intensity-modulated radiation therapy and stereotactic body radiotherapy, have made the treatments more accurate and relevant, leading to better patient outcomes as well.

MARKET DYNAMICS:

Key Drivers:

-

The Growing Number of Cancer Patients Worldwide Drives Demand for Advanced Radiation Therapies.

-

Increased Adoption of Personalized Radiation Therapy Enhances Treatment Outcomes and Opens New Market Avenues.

Restraints:

-

Expensive Equipment and Treatment Procedures Limit Access, Especially in Developing Regions.

-

Concerns Over Potential Radiation Side Effects Restrict Patient Acceptance.

Opportunity:

-

Expanding Healthcare Infrastructure in Asia-Pacific and Latin America Presents Growth Opportunities for Radiation Therapy.

-

Increasing Innovations in Radiation Therapy, Such as Image-Guided Techniques, are Improving Treatment Precision.

KEY MARKET SEGMENTATION:

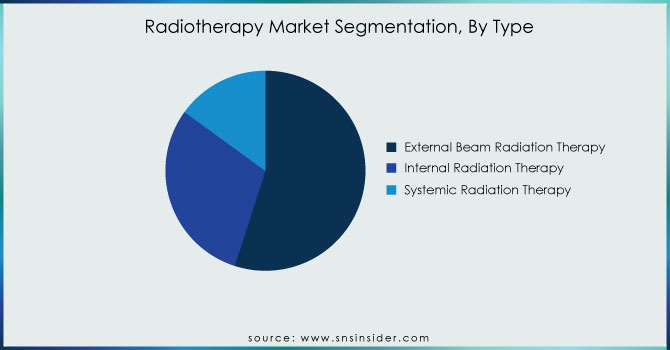

By Type

In 2023, EBRT dominated the radiotherapy market, with a 55% total share. The procedure’s share of the market was extensive due to its high use in several types of cancers. Breast, prostate, and lung cancers are the most common types of cancer aside from skin cancer. According to the CDC, breast cancer remains the most common among women, with the same applying to prostate cancer among men. The procedure continues to be the most used due to government investment. In 2023, the federal government spent approximately USD 1.1 billion on research into breast cancer. EBRT is used on breast cancer patients to reduce the need for surgical services. The treatment is non-invasive, irrespective of advancements in radiation, such as image-guided radiation therapy.

The procedure has become widely employed across Europe by the emergence of the HERA agreement on expanding healthcare technology investments by governmental entities. EBRT is used to provide the most significant standard of care over varying types of oncology. This conclusion was based on the fact that more incidences of cancer are being documented since more populations are now aware of the illness. These people are thus encouraged to own types of treatment that are simple and will target the exact affected area of the body. Additionally, the treatments remain profitable for healthcare providers, resulting in diseases becoming less fatal and ensuring patients survive longer.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-User

Hospitals as an end-user segment held the largest share in the radiotherapy market in 2023, accounting for over 60% of the market share. It is considered the largest market segment for radiotherapy because hospitals have considerable infrastructure, technology, and access to skilled health professionals. According to the U.S. National Cancer Institute, about 75% of all radiotherapy procedures are done in hospitals due to substantial facilities and availability of radiotherapy machines such as linear accelerators. Additionally, public hospital systems are heavily supported by their governments. For instance, the U.K. government, in 2023, provided an additional £5.4 billion to its National Health Service to improve cancer treatment, including radiotherapy centers.

The World Bank and World Health Organization launched initiatives to boost the hospital infrastructure and upgrade radiotherapy in low and middle-income countries. Research institutes and ambulatory therapy centers are the fastest-growing segments, but hospital centers currently have an advantage with newer machines and an established patient population and referral system.

REGIONAL ANALYSIS:

In the year 2023, North America was the leading region with 40% of the total market share in the global radiotherapy market. The comprise to the leadership of the region was attributed to its high cancer prevalence, good government support, and the availability of modern healthcare. In the U.S. where cancer spending care was expected to rise to USD 246 billion by the end of the year, The National Institutes of Health and the U.S. National Cancer Institute proceeded to expend their energy towards supporting the implementation of sophisticated technologies in the treatment of the disease. Consequently, the U.S. Food and Drug Administration in the same year promptly approved various innovative radiotherapy devices that accelerated the growth of the market.

Besides, Canada affected the leadership of the region through the allocation of more than CAD 500 million to the cause of health innovation. The amount was focused on facilitating the improvement of cancer treatment therapies such as radiotherapy under the country’s 2023 health budget. Furthermore, North America is focused on the adoption of leading technologies in the treatment of diseases such as proton therapy. The region asserted its earlier claim of being the leading geographical market for radiotherapy based on its well-set government support and a good country healthcare system. Other competing regions such as Europe and the Asia Pacific are rapidly taking the competitive nature in boosting the health systems, but it would be very difficult to overpower North America based on the availability of comprehensive treatment mechanisms.

KEY PLAYERS:

The key market players are Canon Medical Systems Corporation, Accuray Incorporated, Elekta, GE Healthcare, ViewRay Technologies, Inc., Isoray Inc., Mevion Medical Systems, Siemens Healthineers AG, Hitachi, Ltd., ALCEN (PMB) and other players.

RECENT DEVELOPMENTS

-

In May 2023: GE HealthCare invested in three radiotherapy machines comprising intelligent machines (IRT), auto segmentation in addition to an updated magnetic radiation suite referred to as AIR open coil suite.

-

In February 2023: RefelXion Medical was granted the United States Food and Drug Administration approval of SCINTIC biology-guided radiotherapy for early and late treatment of cancer.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 7.01 Billion |

|

Market Size by 2032 |

US$ 11.18 Billion |

|

CAGR |

CAGR of 5.54% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (External Beam Radiation Therapy, Internal Radiation Therapy and Systemic Radiation Therapy) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Canon Medical Systems Corporation, Accuray Incorporated, Elekta, GE Healthcare, ViewRay Technologies, Inc., Isoray Inc., Mevion Medical Systems, Siemens Healthineers AG, Hitachi, Ltd., ALCEN (PMB) and other players |

|

Key Drivers |

•The Growing Number of Cancer Patients Worldwide Drives Demand for Advanced Radiation Therapies. |

|

RESTRAINTS |

•Expensive Equipment and Treatment Procedures Limit Access, Especially in Developing Regions. |